This form is a Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage. Adapt to your specific circumstances. Don't reinvent the wheel, save time and money.

Pennsylvania Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage

Description

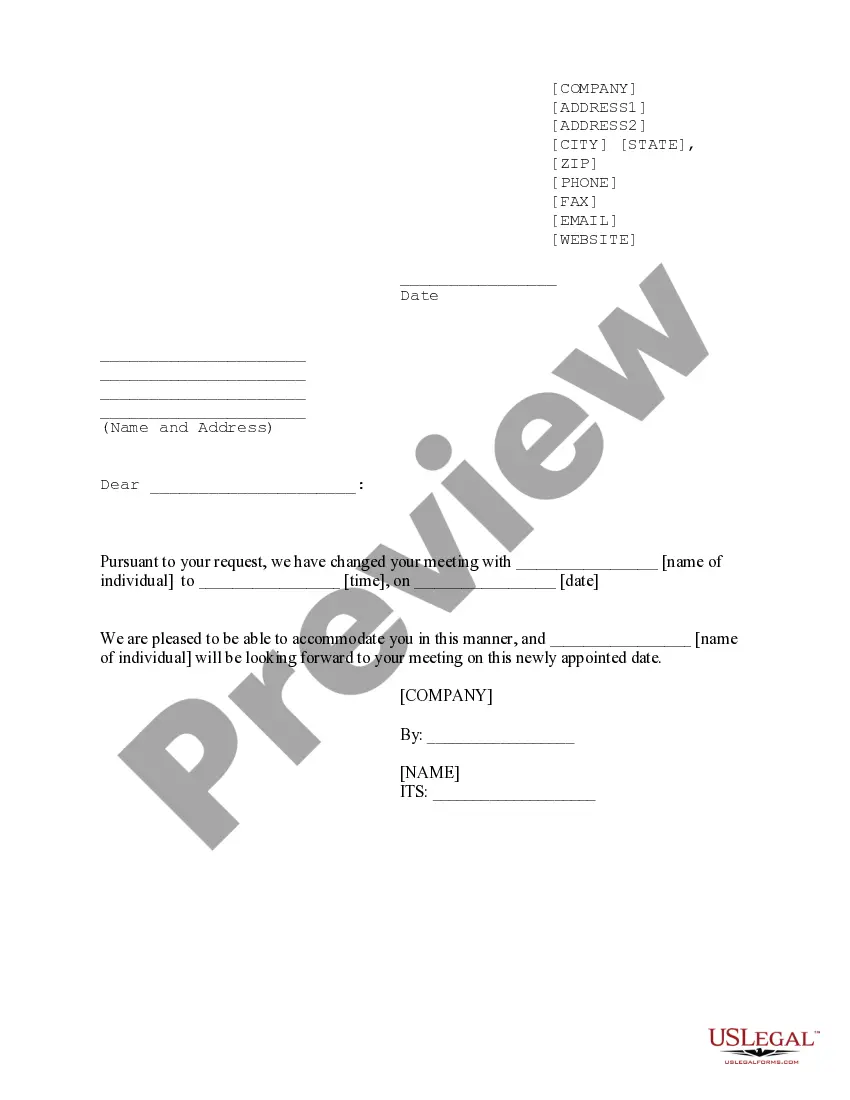

How to fill out Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage?

Are you presently in a position where you require documents for both business or personal purposes nearly every day.

There are numerous legitimate document templates available online, but finding reliable ones is not easy.

US Legal Forms provides a vast array of form templates, such as the Pennsylvania Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage, which are designed to comply with state and federal regulations.

If you discover the correct form, click Purchase now.

Choose the pricing plan you prefer, fill in the required information to create your account, and complete the purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms site and have an account, simply Log In.

- Then, you can download the Pennsylvania Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

- Use the Review button to inspect the form.

- Read the summary to confirm you have selected the right form.

- If the form is not what you are looking for, use the Search field to locate the form that fits your needs.

Form popularity

FAQ

The purpose of a declaratory judgment is to provide a definitive ruling on a legal matter, helping to clarify the legal rights and duties of the parties involved. This type of judgment is especially beneficial in insurance disputes, such as those surrounding a Pennsylvania Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage. By offering clarity, it can prevent future conflicts and promote fair resolutions. Ultimately, it serves to bring peace of mind to all parties involved.

Responding to a credit card judgment in Pennsylvania involves several steps. You can file a response with the court, contest the judgment, or negotiate a payment plan with the creditor. If the judgment relates to insurance matters, such as a Pennsylvania Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage, consider consulting legal resources or platforms like USLegalForms for guidance on your rights and options. This approach helps you navigate the process effectively.

While a declaratory judgment can provide clarity, it may also have disadvantages. For instance, the judgment may not provide the same level of enforcement as a traditional court ruling. Additionally, it could lead to further legal disputes if the parties disagree on the interpretation of the judgment, especially in cases like a Pennsylvania Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage. It's important to weigh these factors before pursuing this legal option.

A declaratory judgment in insurance is a court ruling that clarifies the rights and obligations of parties under an insurance policy. It often arises in disputes involving coverage, such as those related to a Pennsylvania Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage. This legal tool helps policyholders understand their entitlements and assists insurers in defining their responsibilities. By obtaining a declaratory judgment, you can potentially avoid lengthy litigation.

The disclosure rule in insurance requires insurers to provide clear and accurate information regarding the terms of a policy, including coverage limits and exclusions. This rule aims to protect consumers by ensuring they have the necessary information to make informed choices. If you are facing issues with your coverage, filing a Pennsylvania Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage can be an effective way to seek resolution and enforce your rights.

Yes, policy limits are generally considered discoverable information in legal proceedings. This means that the parties involved may obtain this information through discovery processes. If you are navigating a Pennsylvania Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage, understanding the discoverability of policy limits can help you build a stronger case.

To file a complaint with the Pennsylvania Insurance Commissioner, you need to visit the Pennsylvania Department of Insurance website and complete the online complaint form. Provide all relevant details about your issue, including your policy information and the nature of your complaint. If you are dealing with a dispute related to a Pennsylvania Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage, ensure you include this in your submission for a thorough review.

In Pennsylvania, insurance companies are generally required to disclose policy limits upon request. This transparency helps policyholders understand their coverage and make informed decisions. If you find yourself needing clarity on your coverage, you can consider filing a Pennsylvania Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage to address any disputes regarding policy limits.

Yes, you can pursue a lawsuit against an insurance company for amounts exceeding the policy limits under certain circumstances. If you believe the insurer acted in bad faith or violated the terms of the policy, you may have grounds to seek additional compensation. In the context of a Pennsylvania Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage, it is essential to evaluate your case with a legal professional who understands these complexities.