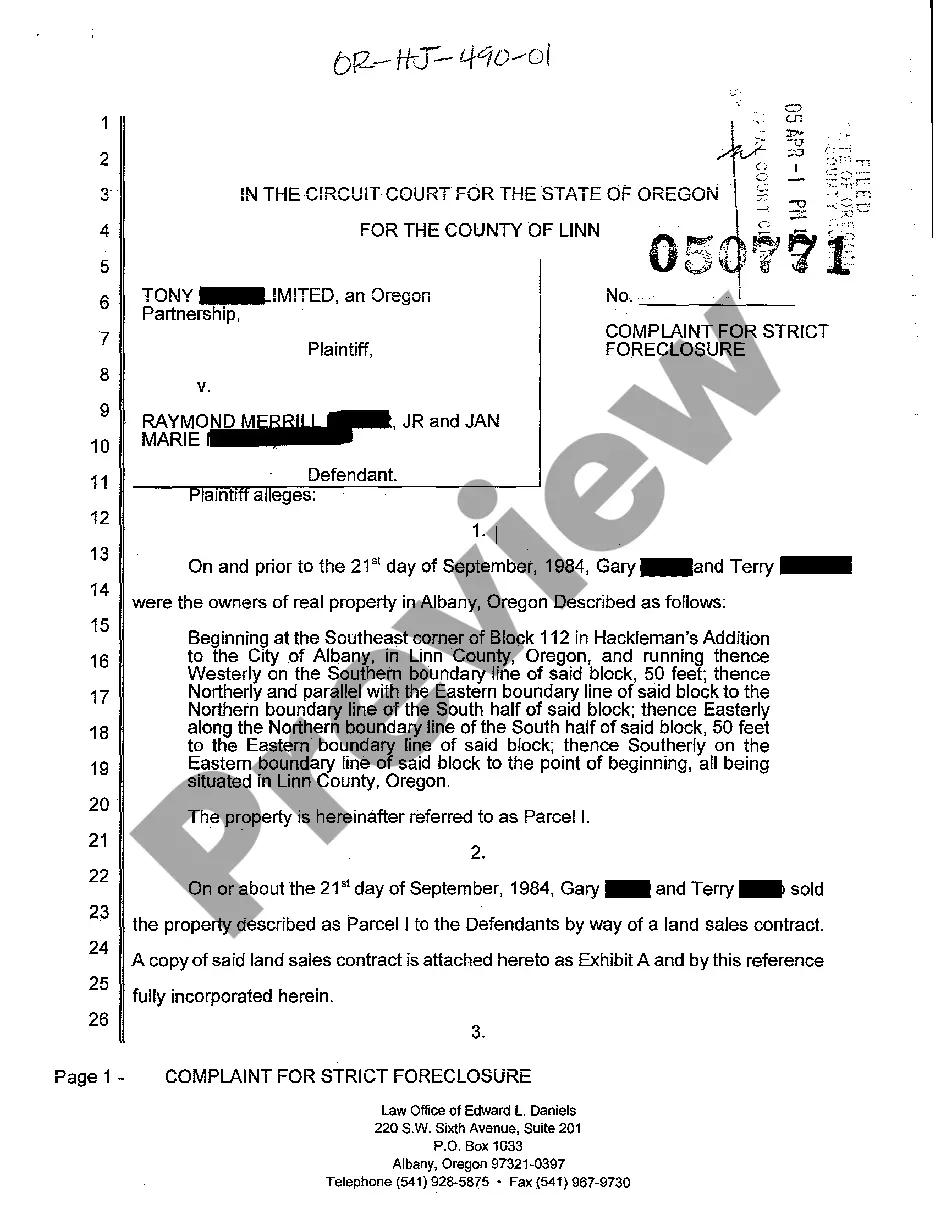

Oregon Complaint for Foreclosure of Security Interest

Description

How to fill out Oregon Complaint For Foreclosure Of Security Interest?

In terms of filling out Oregon Complaint for Foreclosure of Security Interest, you probably think about a long process that consists of getting a suitable sample among countless very similar ones and after that being forced to pay out a lawyer to fill it out for you. In general, that’s a sluggish and expensive option. Use US Legal Forms and select the state-specific form within clicks.

In case you have a subscription, just log in and click on Download button to get the Oregon Complaint for Foreclosure of Security Interest form.

In the event you don’t have an account yet but want one, keep to the point-by-point guideline below:

- Make sure the document you’re getting is valid in your state (or the state it’s needed in).

- Do it by reading the form’s description and through clicking the Preview function (if offered) to find out the form’s information.

- Click Buy Now.

- Select the proper plan for your budget.

- Join an account and select how you want to pay: by PayPal or by card.

- Download the document in .pdf or .docx format.

- Get the document on the device or in your My Forms folder.

Skilled legal professionals draw up our templates to ensure after saving, you don't need to worry about modifying content material outside of your individual info or your business’s information. Be a part of US Legal Forms and receive your Oregon Complaint for Foreclosure of Security Interest sample now.

Form popularity

FAQ

There are two types of foreclosure processes in Oregon: Judicial foreclosure: The process of taking the house by filing a lawsuit against the homeowner. If you receive a Notice of Hearing or any notice to appear in court regarding the sale of your house, contact an attorney as soon as possible.

Judicial foreclosure involves filing a lawsuit to get a court order to sell the home (foreclose). It is used when there is no power-of-sale clause in the mortgage or deed of trust. Generally, after the court orders the sale of your home, it will be auctioned off to the highest bidder.

After foreclosure, you might still owe your bank some money (the deficiency), but the security (your house) is gone. So, the deficiency is now an unsecured debt.

In Oregon, lenders may foreclose on deeds of trusts or mortgages in default using either a judicial or non-judicial foreclosure process. The judicial process of foreclosure, which involves filing a lawsuit to obtain a court order to foreclose, is used when no power of sale is present in the mortgage or deed of trust.

Banks and other lenders typically use a trust deed. A trust deed can be foreclosed by a lawsuit in the circuit court of the county where the property is located. This type of foreclosure is referred to as a judicial foreclosure and is now common for residential loans in Oregon.

Call your local real estate agent. If you do not have a real estate agent, then contact your local real estate company of choice and speak with the agent on call. Tell the agent you are interested in buying bank-owned properties. Often banks list foreclosed properties with agents to help them sell.

Oregon borrowers can expect that the foreclosure process will take approximately six months to complete if everything goes smoothly during the foreclosure. Court delays, borrower objects or a borrower's filing for bankruptcy can delay the process.