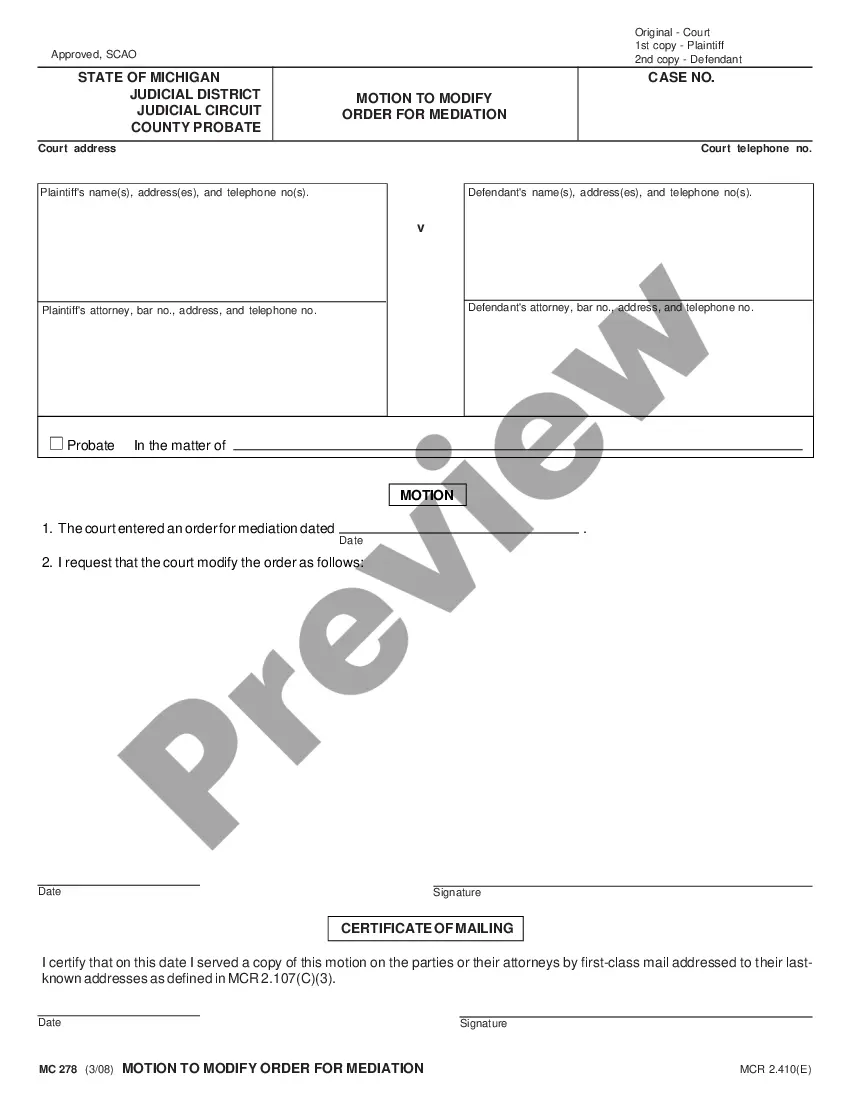

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Pennsylvania Online Return and Exchange Policy for Purchases and Gifts

Description

How to fill out Online Return And Exchange Policy For Purchases And Gifts?

US Legal Forms - one of the most important collections of legal documents in the United States - provides a diverse selection of legal template documents you can download or create.

By using the site, you can access numerous forms for both business and personal needs, categorized by types, states, or keywords.

You can find the latest versions of forms such as the Pennsylvania Online Return and Exchange Policy for Purchases and Gifts in just moments.

Read the form description to confirm you have picked the right form.

If the form does not meet your requirements, use the Search area at the top of the screen to find the one that does.

- If you already have a membership, Log In and retrieve the Pennsylvania Online Return and Exchange Policy for Purchases and Gifts from the US Legal Forms library.

- The Download button will be available on every form you view.

- You can access all previously saved forms from the My documents section of your account.

- If you are new to US Legal Forms, here are some simple steps to help you get started.

- Ensure you have selected the correct form for the city/state.

- Select the Preview button to view the form's details.

Form popularity

FAQ

To successfully file a Pennsylvania tax return, you will need to include specific attachments such as your W-2s and 1099s. Additionally, if you are claiming certain deductions, be sure to attach supporting documentation. Ensuring that you have all required attachments is essential for a quick and efficient filing process. Refer to the Pennsylvania Online Return and Exchange Policy for Purchases and Gifts for further details on attachment requirements.

In Pennsylvania, you can gift up to $15,000 to an individual without incurring federal gift tax. However, it’s important to note that gifts above this threshold may affect your estate tax obligations. Familiarizing yourself with the Pennsylvania Online Return and Exchange Policy for Purchases and Gifts can provide insights into how these gift limits work and how to manage your tax responsibilities efficiently.

When preparing your tax return for Pennsylvania, you often need to complete either the PA-40 for residents or the PA-40 NR for non-residents. Additionally, you may need to fill out supplemental forms if you have income from multiple sources or are claiming certain credits. The process can seem daunting, but the Pennsylvania Online Return and Exchange Policy for Purchases and Gifts provides clarity on the necessary paperwork and forms.

For a Pennsylvania tax return, attach various forms depending on your financial situation. Commonly required forms include your W-2, 1099s, and any forms related to deductions or credits you are claiming. It's crucial to ensure that all relevant forms are included to comply with state regulations. Check the Pennsylvania Online Return and Exchange Policy for Purchases and Gifts for guidance on additional attachments you might need.

Yes, you must attach your W-2 forms to your Pennsylvania state tax return. This form provides proof of your earnings and the taxes already withheld. Submitting your W-2s helps the state verify your income and avoid delays in processing your return. Make sure to review the Pennsylvania Online Return and Exchange Policy for Purchases and Gifts to understand the full requirements.

When filing your tax return in Pennsylvania, you need to attach several important documents. Typically, you should include your W-2 forms, 1099 forms, and any other relevant income statements. Additionally, if you are claiming deductions or credits, attach supporting documents for those as well. Understanding the Pennsylvania Online Return and Exchange Policy for Purchases and Gifts can help ensure you include all necessary paperwork.

Returning an online order in person is allowed at various retailers, which makes the process easier for you. You’ll need to provide your order details and ensure that the item is in good condition. Check the specific store’s return policy, and remember that the Pennsylvania Online Return and Exchange Policy for Purchases and Gifts can guide you in these transactions.

Certainly, you can return items in person that you purchased online at many retailers. This option is typically available, but it varies between stores. Always verify their guidelines beforehand, and consult the Pennsylvania Online Return and Exchange Policy for Purchases and Gifts to ensure you follow their processes correctly.

Yes, you can return items that you bought online, but it depends on the specific retailer’s return policy. Each store will have its own guidelines, so make sure to check their procedures. Understanding the Pennsylvania Online Return and Exchange Policy for Purchases and Gifts will help you know your rights in these situations.

Yes, you can return items purchased online at Walmart in-store. This is convenient if you prefer to handle your return in person. Remember to bring your order confirmation and the item in its original packaging. Familiarize yourself with the Pennsylvania Online Return and Exchange Policy for Purchases and Gifts for a smoother process.