Pennsylvania Commercial Partnership Agreement in the Form of a Bill of Sale

Description

How to fill out Commercial Partnership Agreement In The Form Of A Bill Of Sale?

If you intend to be thorough, retrieve, or print sanctioned document templates, utilize US Legal Forms, the premier collection of legal forms, accessible online.

Take advantage of the website’s straightforward and convenient search to find the documents you need.

A variety of templates for business and individual purposes are organized by categories and states, or keywords.

Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other types of the legal form template.

Step 4. Once you have found the form you need, select the Get now button. Choose the subscription plan you want and provide your details to register for an account.

- Utilize US Legal Forms to locate the Pennsylvania Commercial Partnership Agreement in the Form of a Bill of Sale in just a few clicks.

- If you are currently a US Legal Forms user, sign in to your account and click the Download button to obtain the Pennsylvania Commercial Partnership Agreement in the Form of a Bill of Sale.

- You can also access forms you have previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

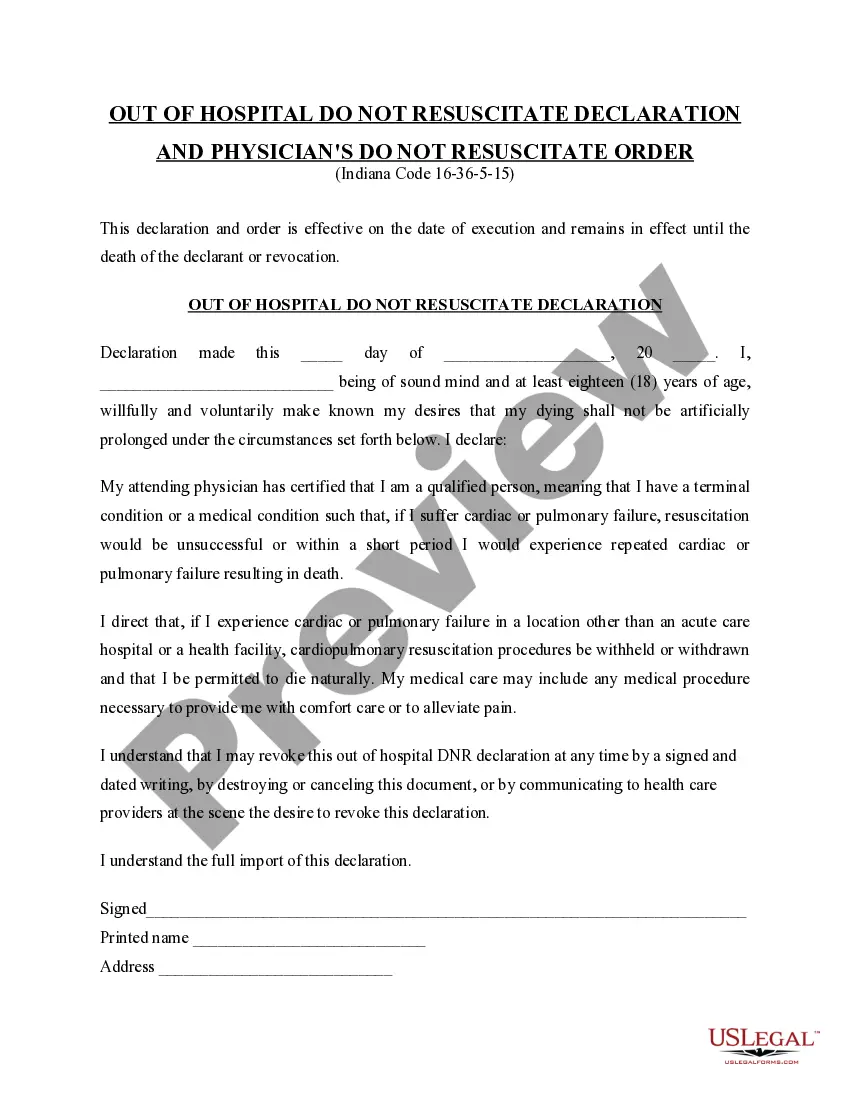

- Step 2. Use the Preview option to review the content of the form. Don't forget to read the details.

Form popularity

FAQ

In Pennsylvania, a bill of sale does not typically need to be notarized unless it involves a vehicle transfer. However, notarization can add an extra layer of protection for both parties involved. When drafting a Pennsylvania Commercial Partnership Agreement in the Form of a Bill of Sale, consider having it notarized to enhance its credibility and enforceability, particularly if the transaction involves substantial assets.

Limited partnerships can have several disadvantages, such as the potential for less control for limited partners compared to general partners. Also, general partners face unlimited liability for business debts. It is often useful to draft a clear Pennsylvania Commercial Partnership Agreement in the Form of a Bill of Sale to address these issues and clarify each partner's obligations.

To form a limited partnership in Pennsylvania, start by selecting a unique name for your business and ensuring it complies with state regulations. Next, complete and file the Certificate of Limited Partnership with the Department of State. Finally, consider drafting a Pennsylvania Commercial Partnership Agreement in the Form of a Bill of Sale, which will help articulate the relationship between partners and lay out the terms of your partnership.

To form a limited partnership in Pennsylvania, you need at least one general partner and one limited partner. It is essential to file a Certificate of Limited Partnership with the Pennsylvania Department of State. Additionally, drafting a Pennsylvania Commercial Partnership Agreement in the Form of a Bill of Sale can clearly outline the roles and responsibilities of each partner, ensuring smooth operations.

In Pennsylvania, partnerships typically do not need to file formation documents with the state. However, if you choose to form a limited liability partnership or register a fictitious name, you would need to file specific forms with the Department of State. Always consider drafting a Pennsylvania Commercial Partnership Agreement in the Form of a Bill of Sale to address essential terms and conditions.

Yes, a bill of sale is legally binding in Pennsylvania when it meets certain requirements. Essentially, it serves as a written document that transfers ownership of personal property from one party to another. To strengthen its validity, creating a Pennsylvania Commercial Partnership Agreement in the Form of a Bill of Sale can add clarity and legal assurance to the transaction.

To form a partnership in Pennsylvania, you should first choose a partnership type that suits your business needs. Next, it is advisable to draft a Pennsylvania Commercial Partnership Agreement in the Form of a Bill of Sale, outlining the roles and responsibilities of each partner. Register your partnership with the state if required, and obtain any necessary permits or licenses.

Forming a partnership in Pennsylvania involves drafting a partnership agreement that details each partner's contributions, duties, and profit shares. It’s also advisable to register the partnership with the state if you will be using a trade name. A Pennsylvania Commercial Partnership Agreement in the Form of a Bill of Sale is an excellent way to formalize your partnership and ensure all legal aspects are covered.

To form a partnership, you typically need at least two individuals who agree to conduct business together. A clear partnership agreement should be established to define roles, profit sharing, and procedures for resolving disputes. Using a well-structured Pennsylvania Commercial Partnership Agreement in the Form of a Bill of Sale helps ensure that these details are properly addressed.

One significant disadvantage of a partnership is the shared liability among partners. If one partner incurs debt or faces legal issues, the other partners may also be held responsible, which can jeopardize personal assets. Therefore, it's crucial to draft a solid Pennsylvania Commercial Partnership Agreement in the Form of a Bill of Sale that clearly outlines each partner's obligations and limits liability.