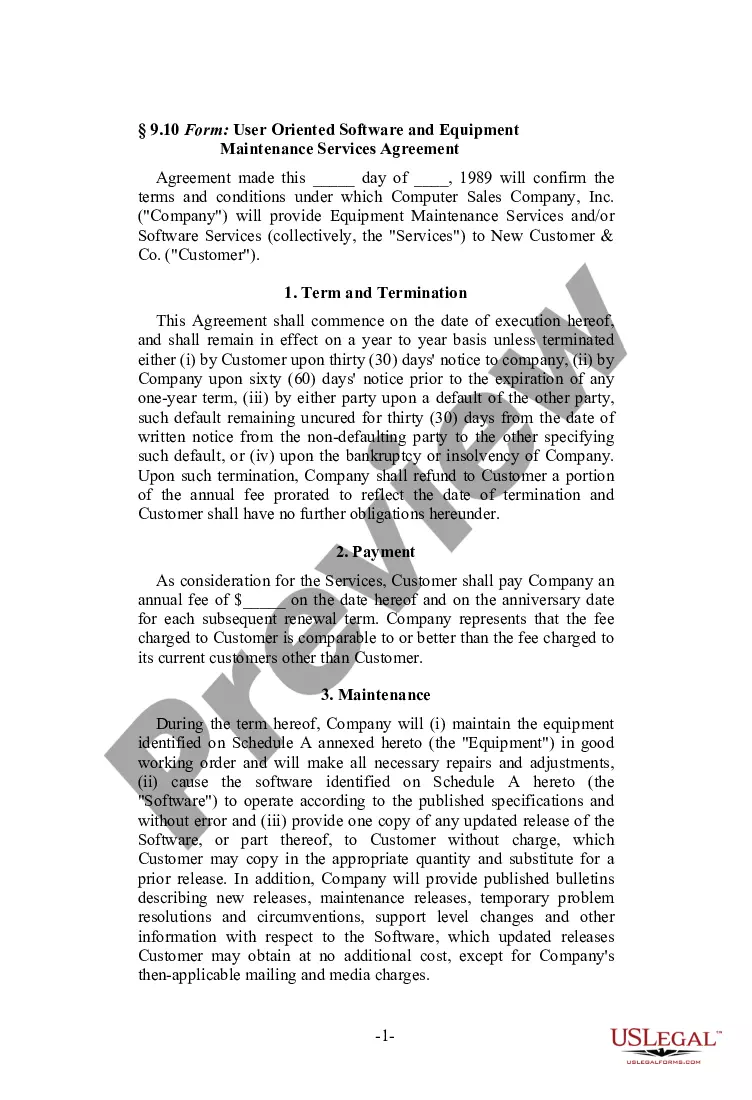

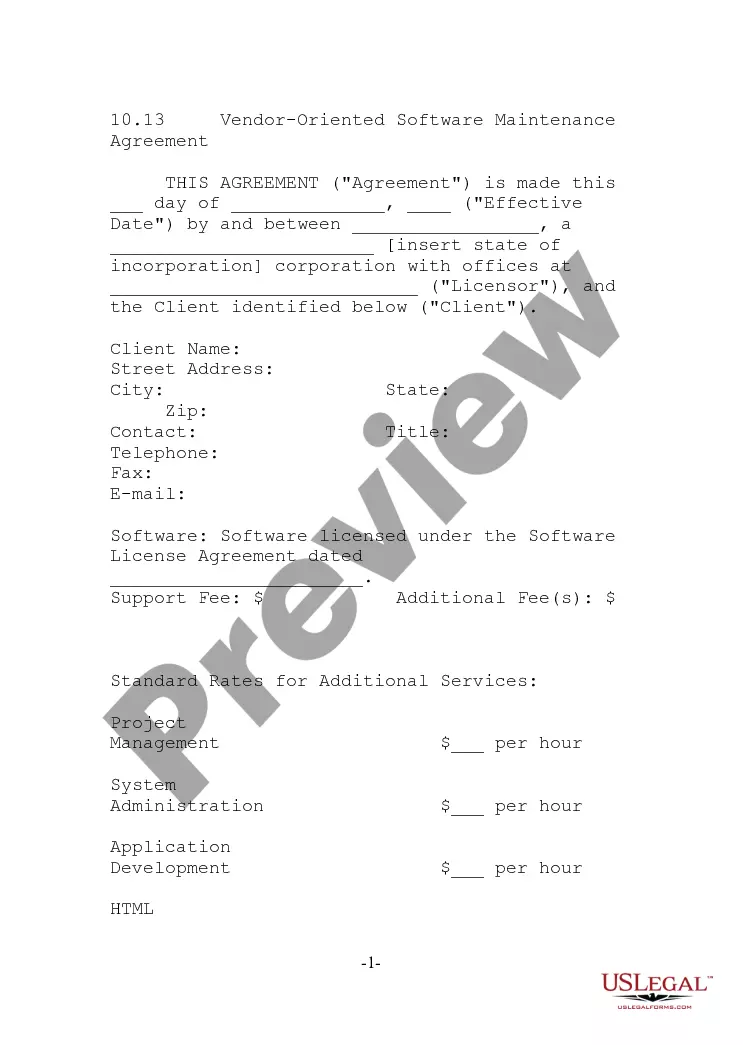

South Carolina User Oriented Software and Equipment Maintenance Services Agreement

Description

How to fill out User Oriented Software And Equipment Maintenance Services Agreement?

Selecting the optimal legitimate document template can be challenging.

Of course, there are countless designs accessible online, but how can you find the authentic version you require.

Utilize the US Legal Forms website. The platform provides numerous templates, including the South Carolina User Oriented Software and Equipment Maintenance Services Agreement, suitable for business and personal uses.

If the document does not fulfill your requirements, use the Search field to find the right form. Once you are confident the form is correct, click on the Purchase now button to acquire the document. Choose your desired pricing plan and input the necessary information. Create an account and complete your order using your PayPal account or credit card. Select the file format and download the legal document template to your device. Finally, complete, revise, print, and sign the downloaded South Carolina User Oriented Software and Equipment Maintenance Services Agreement. US Legal Forms is the largest collection of legal documents where you can find numerous paper templates. Utilize the service to obtain professionally created documents that meet state requirements.

- All forms are reviewed by experts and comply with federal and state regulations.

- If you are already registered, sign in to your account and click the Download button to obtain the South Carolina User Oriented Software and Equipment Maintenance Services Agreement.

- Use your account to search for the legal documents you have purchased in the past.

- Navigate to the My documents section of your account to retrieve another copy of the forms you need.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

- First, ensure you have selected the correct document for your city/state. You can preview the form by clicking the Review button and check the document details to confirm it is suitable for you.

Form popularity

FAQ

Maintenance, updating, and costs for adding to a website are treated as normal business expenses and are deductible when incurred if these costs are truly maintenance-type costs.

While software is not physical or tangible in the traditional sense, accounting rules allow businesses to capitalize software as if it were a tangible asset. Software that is purchased by a firm that meets certain criteria can be treated as if it were property, plant, & equipment (PP&E).

The majority of states which have addressed the issue and have concluded that software (at least unbundled software) is not tangible personal property for ad valorem tax purposes and therefore is generally not taxable.

In a recent private letter ruling, the South Carolina Department of Revenue held that software subscription services are tangible personal property subject to sales and use taxes.

California: SaaS is not a taxable service. However, software or information that is delivered electronically is exempt. The ability to access software from a remote network or location is exempt. Under California sales and use tax law, there must be a transfer of TPP, in order to have a taxable event.

Prescription medicines, groceries, and gasoline are all tax-exempt. Some services in South Carolina are subject to sales tax.

Yes. Charges for maintenance agreements (whether optional or mandatory) that are made in conjunction with, or as part of the sale of, computer software sold and delivered by tangible means are includable in "gross proceeds of sales" or "sales price", and, therefore, subject to the tax.

Traditional Goods or Services Goods that are subject to sales tax in South Carolina include physical property, like furniture, home appliances, and motor vehicles. Prescription medicines, groceries, and gasoline are all tax-exempt. Some services in South Carolina are subject to sales tax.

Except as provided in ? 1.199-3(j)(5)(ii) and 1.199-3(k)(2)(i), computer software, sound recordings, and qualified films are not treated as tangible personal property regardless of whether they are affixed to a tangible medium.

Computer software delivered electronically is not a sale of tangible personal property and therefore is not subject to sales and use tax.