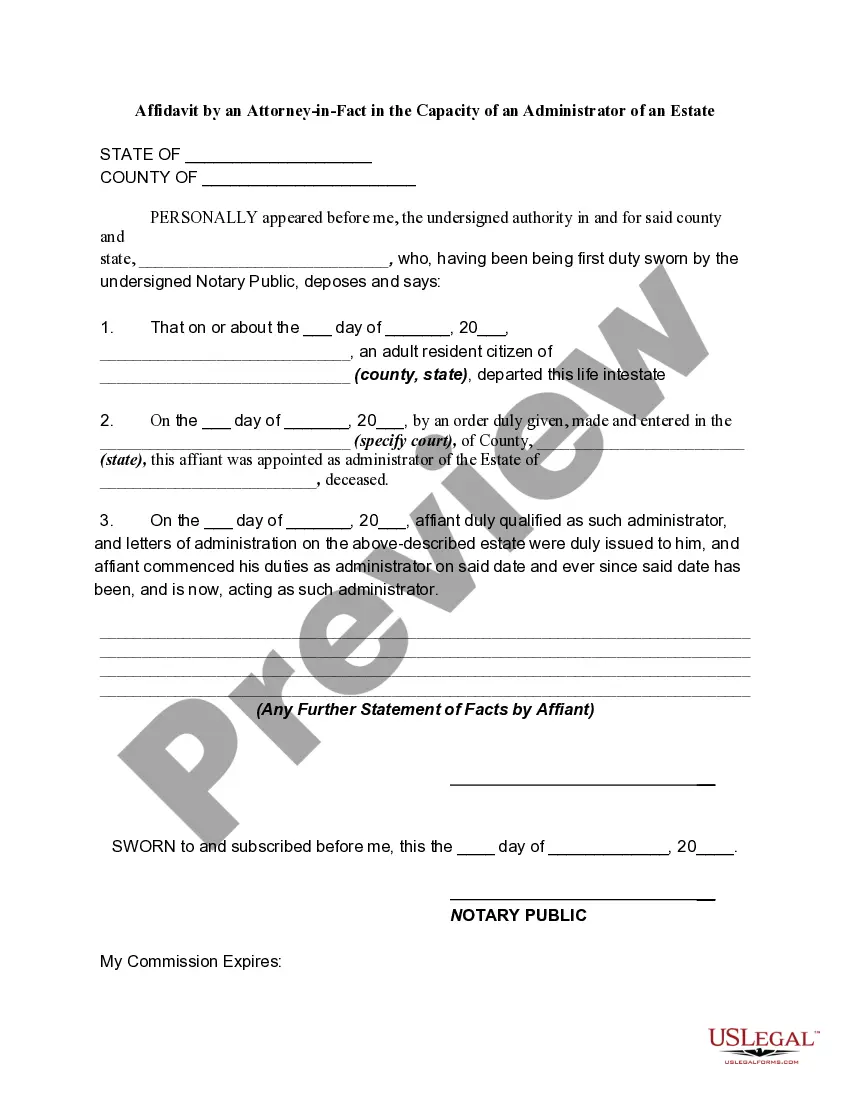

Pennsylvania Affidavit by an Attorney-in-Fact in the Capacity of an Administrator of an Estate

Description

How to fill out Affidavit By An Attorney-in-Fact In The Capacity Of An Administrator Of An Estate?

Selecting the appropriate legal document template can be challenging. Clearly, there are numerous templates accessible online, but how can you locate the legal form you require? Utilize the US Legal Forms website. The platform offers thousands of templates, such as the Pennsylvania Affidavit by an Attorney-in-Fact in the Role of an Estate Administrator, which can be utilized for both business and personal needs. All the forms are reviewed by professionals and comply with federal and state regulations.

If you are already a registered user, Log In to your account and click the Download button to retrieve the Pennsylvania Affidavit by an Attorney-in-Fact in the Role of an Estate Administrator. Use your account to browse through the legal forms you have purchased previously. Visit the My documents section of your account to obtain another copy of the document you need.

If you are a new user of US Legal Forms, here are straightforward steps to follow: First, ensure you have selected the correct form for your locality/state. You can review the document using the Review button and examine the form description to make sure it is suitable for you. If the form does not fulfill your requirements, use the Search box to find the correct document. Once you are confident that the form is appropriate, click the Get now button to acquire the form. Choose the pricing plan you prefer and enter the required information. Create your account and complete your purchase using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, modify, print, and sign the received Pennsylvania Affidavit by an Attorney-in-Fact in the Role of an Estate Administrator.

Make the most of US Legal Forms to find the legal documents you need quickly and effectively.

- US Legal Forms is the largest collection of legal documents where you can find various document templates.

- Utilize the service to download well-crafted papers that adhere to state requirements.

- Access thousands of templates for diverse legal needs.

- Ensure compliance with federal and state laws with professionally reviewed forms.

- Streamline your document preparation process with easy navigation.

Form popularity

FAQ

In Pennsylvania, the estate executor is known as a "personal representative". In determining executor fees, the state of Pennsylvania uses the commonly accepted principle of "reasonable and just" compensation, and explicitly states that compensation may be based on a graduated percentage of the estate value.

There are two very basic requirements for executors in Pennsylvania. They must be at least 18 years old, and they must be of sound mind. Pennsylvania's requirements for executors differ slightly from other states. The law has no general statute preventing someone from naming a convicted felon as executor.

To be recognized as the estate administrator, you must file the petition for grant of letters of administration with the Register of Wills. You'll also need to pay the estate administration fees.

--Any employer of a person dying domiciled in this Commonwealth at any time after the death of the employee, whether or not a personal representative has been appointed, may pay wages, salary or any employee benefits due the deceased in an amount not exceeding $10,000 to the spouse, any child, the father or mother, or ...

§ 3102. Settlement of small estates on petition. The authority of the court to award distribution of personal property under this section shall not be restricted because of the decedent's ownership of real estate, regardless of its value.

Under Pennsylvania law, executors have a duty to provide an accounting to beneficiaries. An accounting is a detailed report that outlines the assets, liabilities, income, and expenses associated with the estate, as well as the executor's actions in managing and distributing the estate.

In Pennsylvania, the Administrator of an estate may be, ing to preference: (1) the decedent's surviving spouse, (2) the decedent's issue (including children and grandchildren), (3) the decedent's parents, (4) the decedent's siblings, (5) the decedent's grandparents, and (6) other individuals are described in the ...