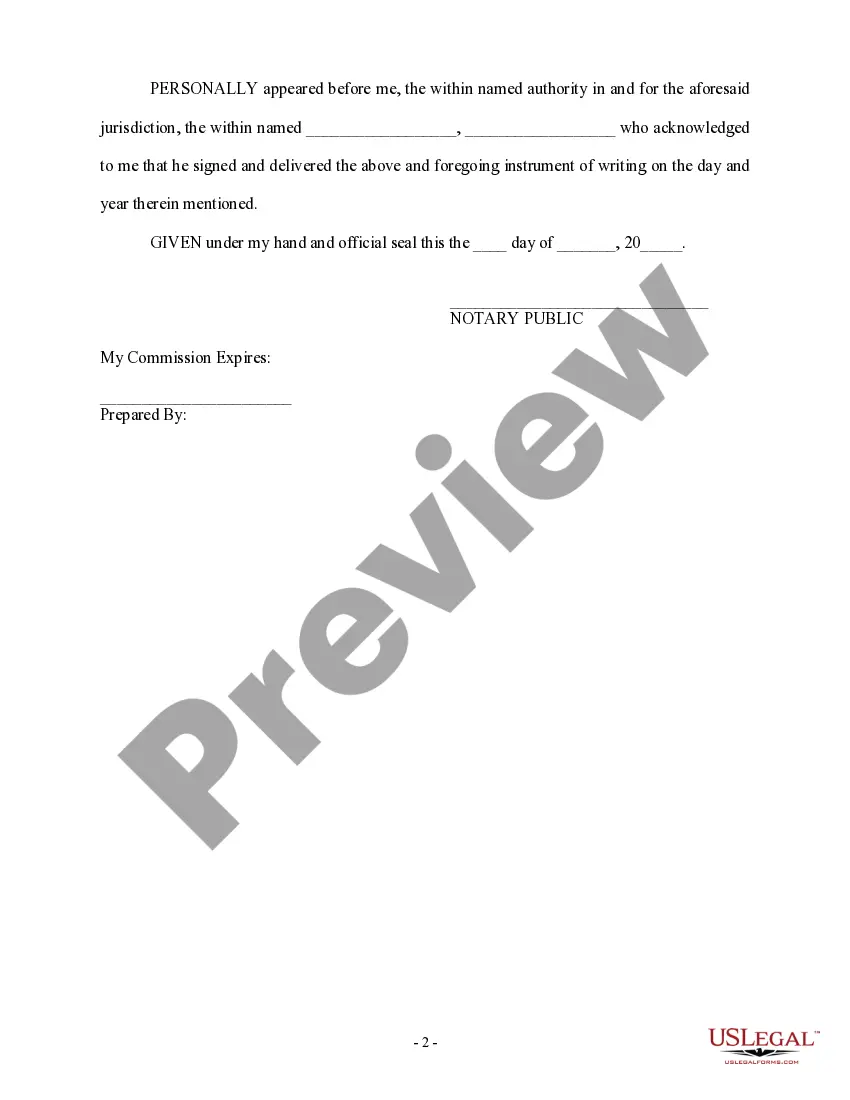

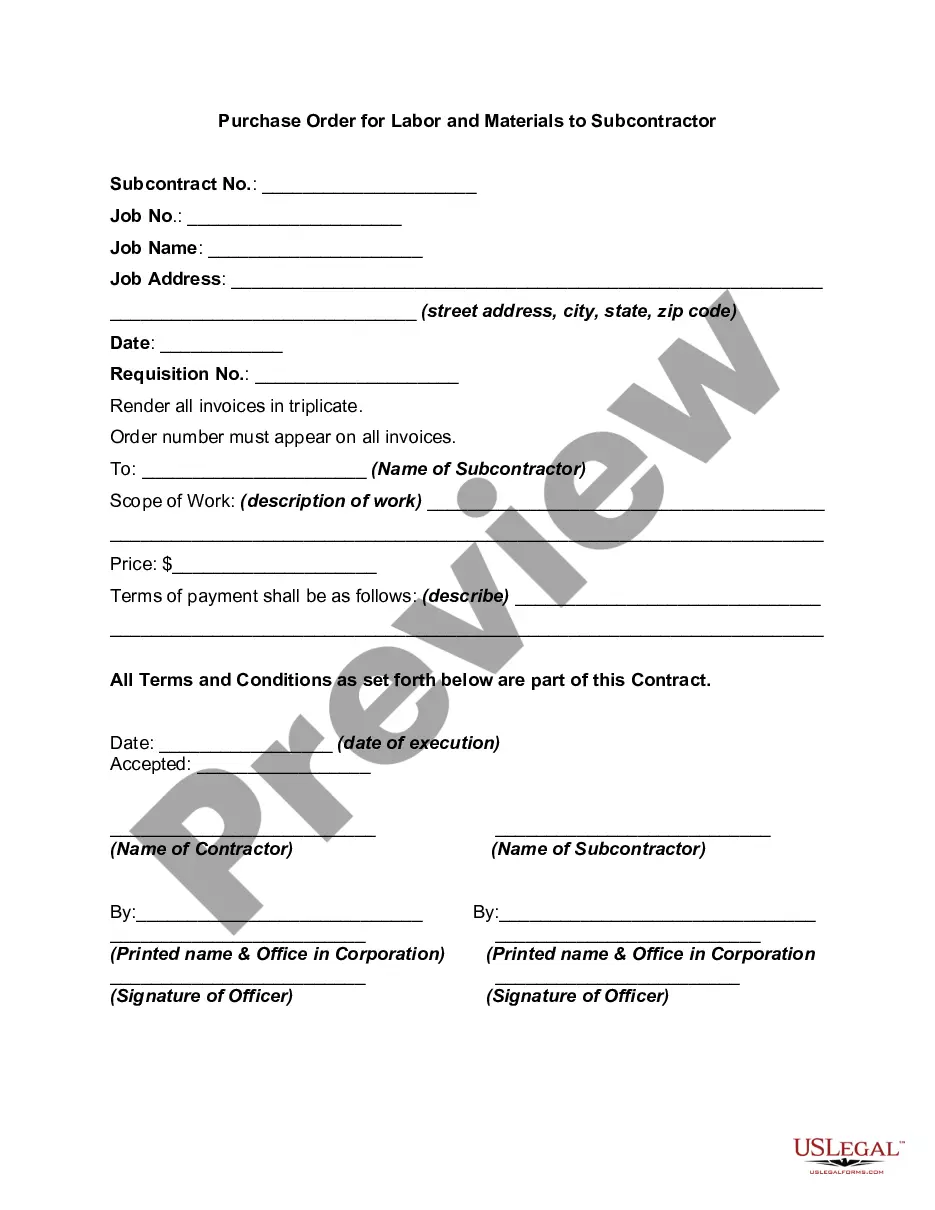

This form is an Authority to Release. The county clerk is authorized and requested to release from a deed of trust a parcel of land to the executor of the estate. The form must be signed in the presence of a notary public.

Pennsylvania Authority to Release of Deed of Trust

Description

How to fill out Authority To Release Of Deed Of Trust?

Choosing the right authorized record format could be a battle. Obviously, there are plenty of web templates available online, but how will you find the authorized kind you need? Take advantage of the US Legal Forms site. The services gives a large number of web templates, for example the Pennsylvania Authority to Release of Deed of Trust, which can be used for enterprise and private requires. Each of the types are checked out by pros and meet federal and state requirements.

If you are presently listed, log in to the account and click the Down load key to have the Pennsylvania Authority to Release of Deed of Trust. Make use of your account to check with the authorized types you have ordered formerly. Visit the My Forms tab of your respective account and obtain another backup in the record you need.

If you are a new user of US Legal Forms, here are basic recommendations that you can comply with:

- Initially, ensure you have chosen the appropriate kind for your personal city/area. You are able to look through the form utilizing the Preview key and look at the form description to make certain this is basically the right one for you.

- If the kind does not meet your requirements, utilize the Seach field to get the proper kind.

- When you are certain the form is suitable, select the Purchase now key to have the kind.

- Select the rates plan you desire and type in the required information. Build your account and pay money for an order using your PayPal account or Visa or Mastercard.

- Choose the document formatting and acquire the authorized record format to the gadget.

- Complete, modify and print and sign the acquired Pennsylvania Authority to Release of Deed of Trust.

US Legal Forms is the greatest library of authorized types in which you can see different record web templates. Take advantage of the service to acquire appropriately-made papers that comply with express requirements.

Form popularity

FAQ

The PEF code 7725 refers to a specific Pennsylvania tax code related to the transfer of property and may include regulations surrounding deeds and trust releases. Understanding this code is important for anyone involved in real estate transactions in Pennsylvania. If you need clarity on how this applies to your situation, the Pennsylvania Authority to Release of Deed of Trust can offer valuable guidance. You might also find useful information through platforms like US Legal Forms.

In a trust, the trustee holds the legal authority to manage the trust assets, while the beneficiaries hold the beneficial interest in those assets. This division of power is fundamental to trust law and is essential for understanding your rights and responsibilities. If you're dealing with a deed of trust in Pennsylvania, knowing the roles of trustee and beneficiary can clarify your situation. Resources from the Pennsylvania Authority to Release of Deed of Trust can provide additional insights.

To remove someone from a deed of trust, you generally need their consent to execute a new deed. This process can involve a quitclaim deed or a similar document that legally transfers their interest in the property. In Pennsylvania, it’s essential to follow the proper legal procedures to ensure the changes are recognized. Utilizing the Pennsylvania Authority to Release of Deed of Trust can help streamline this process efficiently.

To remove a name from a deed in Pennsylvania, you must file a new deed that reflects the change. This process often requires the involvement of a lawyer to ensure compliance with Pennsylvania's laws. Once the new deed is executed, it must be recorded at the county recorder's office. This process is crucial for maintaining accurate property records and is linked to the Pennsylvania Authority to Release of Deed of Trust.

A Deed to Trust form used to transfer the grantor's title and interest in real property in Pennsylvania to a trustee of a trust for the grantor's benefit. This standard document allows the drafter to choose between warranty and quitclaim deed language.

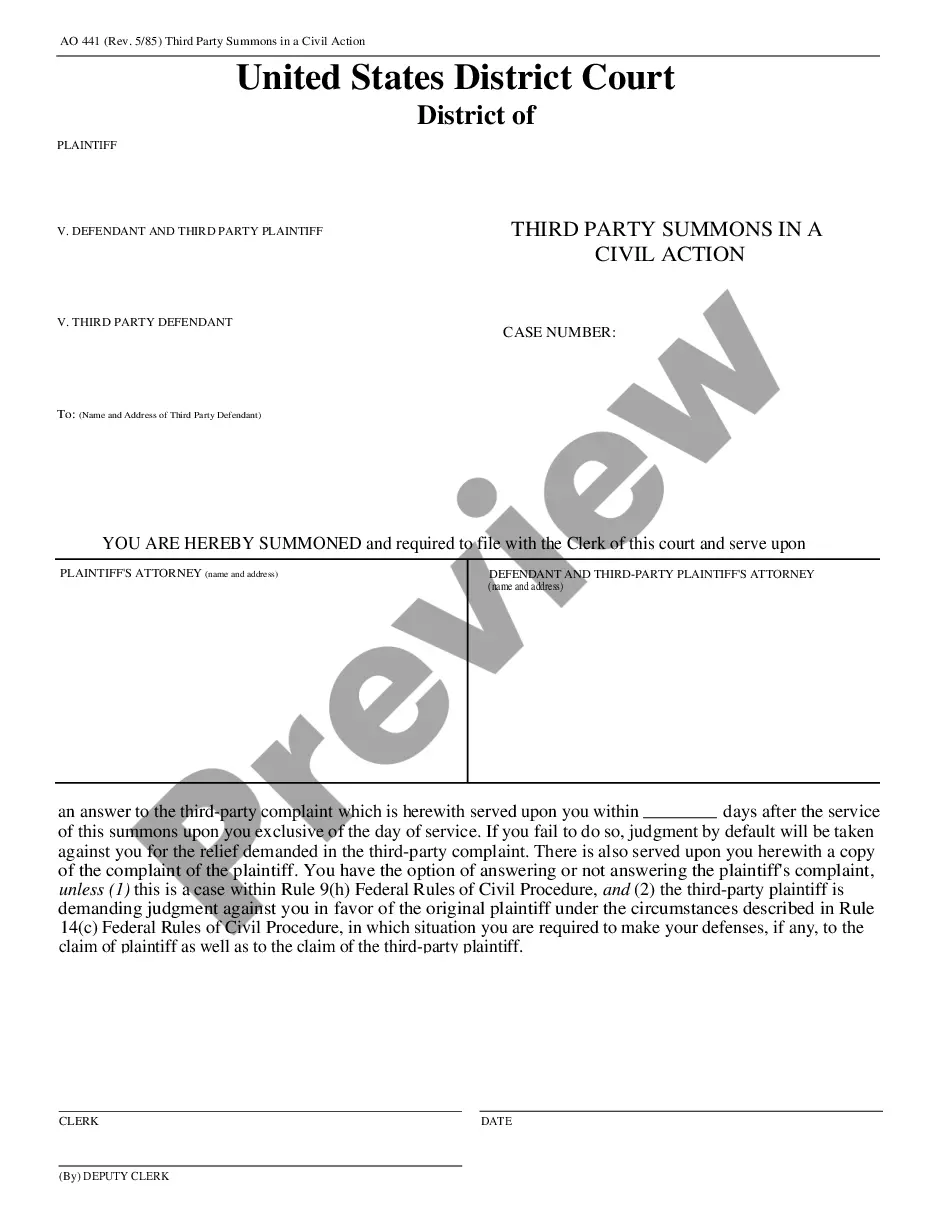

Mortgage States and Deed of Trust States StateMortgage StateDeed of Trust StateOregonYPennsylvaniaYRhode IslandYSouth CarolinaY47 more rows

The instant Certificate is filed pursuant to Pa. C.S.A. §925, which permits the filing of a Certificate where an original death certificate cannot be obtained and it is not necessary to administer an estate but a public record of death is necessary.

While the General Warranty deed is the most general, the Special Warranty deed is the most common type of property deed in Pennsylvania. It doesn't put all the responsibility for title issues post-sale on the grantor or grantee.

In Pennsylvania, a living trust is a legal agreement in which the testator's assets, including bank accounts, home, securities, etc., can be transferred and handled by an individual, including the testator, or corporation, such as a trust or bank.

A Deed of Trust is not a typical deed. It does not transfer the ownership of real property in the usual sense. Instead, a Deed of Trust creates a lien on real property as security or collateral for a loan. If the loan is not repaid on time, the lender can foreclose on and sell the property in order to pay off the loan.