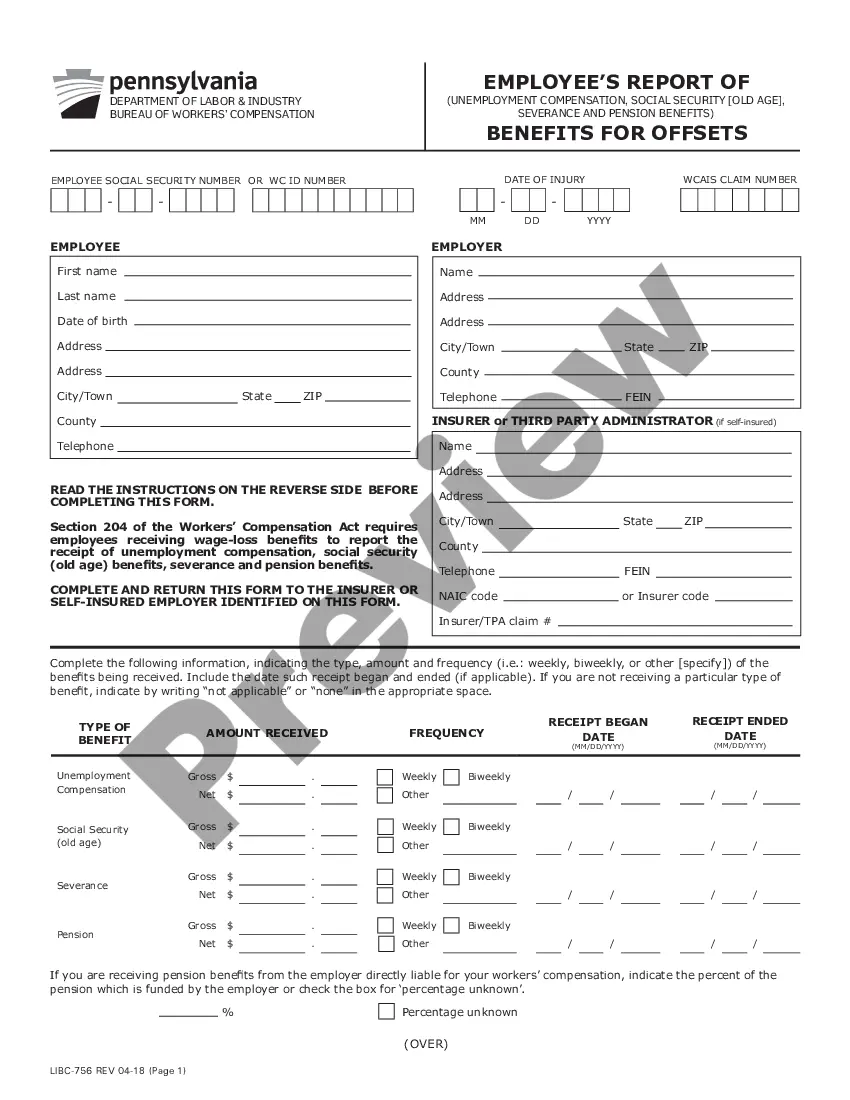

The Pennsylvania Employee's Report of Benefits for Offsets is a form that employers must provide to employees who may be eligible for certain types of offsets. Offsets are payments that employees may be eligible for when they are unemployed due to a reduction in work hours, an involuntary leave of absence, or a voluntary leave of absence. The Pennsylvania Employee's Report of Benefits for Offsets includes two types of forms: the Employer's Report of Benefits for Offsets and the Employee's Report of Benefits for Offsets. The Employer's Report of Benefits for Offsets is used to report the employee's wages and other benefits that were affected by the offsets. This form must be completed and signed by the employee and their employer before the offsets can be paid. The Employee's Report of Benefits for Offsets is used to report the amount of offsets that the employee is eligible for and must also be completed and signed by the employee and their employer. Both the Employer's Report of Benefits for Offsets and the Employee's Report of Benefits for Offsets must be submitted to the Pennsylvania Department of Labor and Industry in order for the employee to receive the offsets. The Pennsylvania Employee's Report of Benefits for Offsets is an important document that provides eligible employees with the financial assistance they need during times of reduced wages and other benefits.

Pennsylvania Employee's Report of Benefits for Offsets

Description

How to fill out Pennsylvania Employee's Report Of Benefits For Offsets?

If you’re searching for a way to properly complete the Pennsylvania Employee's Report of Benefits for Offsets without hiring a lawyer, then you’re just in the right place. US Legal Forms has proven itself as the most extensive and reputable library of formal templates for every private and business situation. Every piece of paperwork you find on our online service is created in accordance with federal and state laws, so you can be sure that your documents are in order.

Adhere to these straightforward instructions on how to obtain the ready-to-use Pennsylvania Employee's Report of Benefits for Offsets:

- Ensure the document you see on the page meets your legal situation and state laws by examining its text description or looking through the Preview mode.

- Type in the document name in the Search tab on the top of the page and choose your state from the list to locate an alternative template if there are any inconsistencies.

- Repeat with the content verification and click Buy now when you are confident with the paperwork compliance with all the requirements.

- Log in to your account and click Download. Create an account with the service and opt for the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to purchase your US Legal Forms subscription. The document will be available to download right after.

- Choose in what format you want to get your Pennsylvania Employee's Report of Benefits for Offsets and download it by clicking the appropriate button.

- Import your template to an online editor to fill out and sign it rapidly or print it out to prepare your paper copy manually.

Another great advantage of US Legal Forms is that you never lose the paperwork you purchased - you can find any of your downloaded blanks in the My Forms tab of your profile any time you need it.

Form popularity

FAQ

Compensation Rate Tiers Average Weekly WageCompensation RateAbove $1,695Flat Rate of $1,130$1,695 ? $847.51? of Average Weekly Wage$847.50 ? $627.78Flat Rate of $565Below $627.7890% of Average Weekly Wage

The maximum compensation rate is based on the statewide average weekly wage (AWW), which is $1,807.50 for 2022. It is ? of the AWW, and since the AWW typically increases each year along with inflation, the maximum rate does as well.

Most business owners are required to buy workers' comp in Pennsylvania if they have any employees at all. Business entities that operate with no employee are generally able to exclude coverage on themselves. Sole-Proprietors and Partners are automatically excluded from coverage on a policy.

The proposed employer assessment factor is 0.0318. This factor, in concert with the proposed employer assessment procedure, is subject to approval by the Insurance Commissioner.

Pursuant to the Workers' Compensation Act, Section 105.1, the Department of Labor & Industry has determined the statewide average weekly wage for injuries occurring on and after Jan. 1, 2023, shall be $1,273.00 per week.

Examples. If you generally worked five days per week, your AWW will be set by dividing your total salary by the total number of days paid, then multiplying the result by 260, and dividing that total by 52.

Pennsylvania's maximum workers' compensation rate for 2022 is $1,205. To receive compensation as close to this maximum rate as possible, it is important to properly calculate your AWW. An experienced workers' compensation attorney can help ensure you receive the wage loss benefits you are entitled to.

In Pennsylvania, the 90-day rule states that injured workers must initially see "panel physicians??a list of pre-approved doctors posted by the employer?within 90 days of their workplace injury to receive compensation. If they see a different doctor, workers' compensation won't necessarily have to cover the cost.