Pennsylvania REV-1502 -- Schedule A — Real Estate is a form used for filing real estate taxes in the state of Pennsylvania. This form is used to report and pay the taxes due on any real property owned in the state. There are two types of Pennsylvania REV-1502 -- Schedule A — Real Estate: Residential and Non-Residential. The Residential form is used to report and pay taxes on residential real estate such as single-family homes, condominiums, and townhouses. The Non-Residential form is used to report and pay taxes on commercial properties such as office buildings, retail stores, and warehouses.

Pennsylvania REV-1502 -- Schedule A - Real Estate

Description

How to fill out Pennsylvania REV-1502 -- Schedule A - Real Estate?

Preparing official paperwork can be a real stress unless you have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be confident in the blanks you obtain, as all of them comply with federal and state laws and are examined by our specialists. So if you need to fill out Pennsylvania REV-1502 -- Schedule A - Real Estate, our service is the best place to download it.

Obtaining your Pennsylvania REV-1502 -- Schedule A - Real Estate from our library is as simple as ABC. Previously authorized users with a valid subscription need only sign in and click the Download button once they find the proper template. Afterwards, if they need to, users can take the same blank from the My Forms tab of their profile. However, even if you are new to our service, registering with a valid subscription will take only a few minutes. Here’s a brief instruction for you:

- Document compliance check. You should carefully examine the content of the form you want and ensure whether it satisfies your needs and meets your state law regulations. Previewing your document and reviewing its general description will help you do just that.

- Alternative search (optional). If you find any inconsistencies, browse the library through the Search tab on the top of the page until you find an appropriate template, and click Buy Now when you see the one you need.

- Account creation and form purchase. Register for an account with US Legal Forms. After account verification, log in and select your preferred subscription plan. Make a payment to proceed (PayPal and credit card options are available).

- Template download and further usage. Select the file format for your Pennsylvania REV-1502 -- Schedule A - Real Estate and click Download to save it on your device. Print it to fill out your papers manually, or use a multi-featured online editor to prepare an electronic copy faster and more effectively.

Haven’t you tried US Legal Forms yet? Subscribe to our service today to get any formal document quickly and easily every time you need to, and keep your paperwork in order!

Form popularity

FAQ

PA DEPARTMENT OF REVENUE BUREAU OF INDIVIDUAL TAXES INHERITANCE TAX DIVISION-REF PO BOX 280601 HARRISBURG PA 17128-0601 The application for refund period is three years.

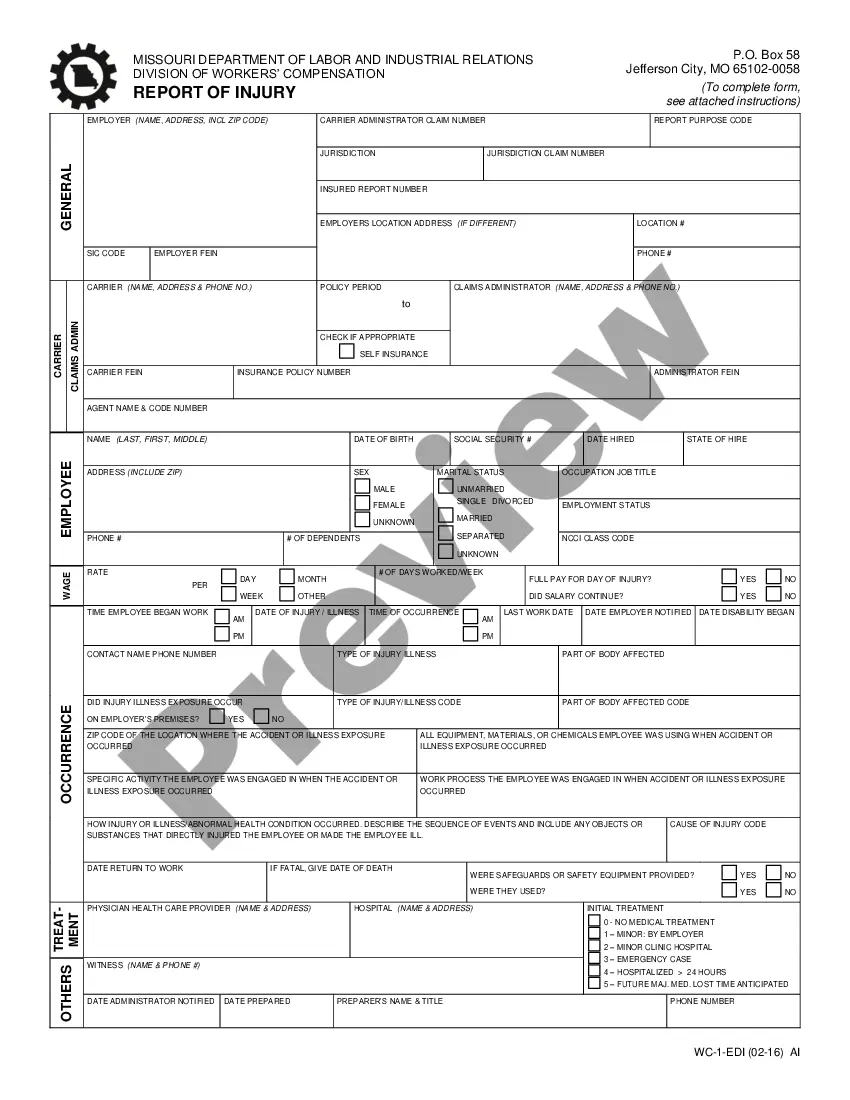

REV-1313 -- Application for Refund of Pennsylvania Inheritance/Estate Tax. REV-1381 -- Stocks/Bonds Inventory. REV-1500 -- Inheritance Tax Return - Resident Decedent. REV-1502 -- Schedule A - Real Estate.

Give your assets away If you give assets away and you survive for at least 7 years then all gifts are free and avoid inheritance tax. If you die within 7 years then inheritance tax will be paid on a reducing scale.

The most important exemption is for property that is owned jointly by a husband and wife. Therefore, if you and your spouse own all of your property jointly, upon death of the first spouse there will be no Pennsylvania inheritance tax.

The tax rate for Pennsylvania Inheritance Tax is 4.5% for transfers to direct descendants (lineal heirs), 12% for transfers to siblings, and 15% for transfers to other heirs (except charitable organizations, exempt institutions, and government entities that are exempt from tax).

Properties that are eligible for inheritance tax in Pennsylvania. All the decedent's tangible property, including but not limited to cash, furniture, automobiles, jewelry, antiques and more that are located within the state of Pennsylvania at the time of the decedent's passing, are eligible for inheritance tax.

Cash, investments or property held in a trust sit outside of your estate for inheritance tax purposes, and can therefore help you avoid an inheritance tax bill. You may want to set up a trust for your children, grandchildren, or other family members.

One way to avoid inheritance tax in PA is to make an asset joint. For example, if you have $30,000 in your name alone, and through your will, you give it to a friend of yours, it would be taxed at 15% or they would owe $4,500 in taxes.