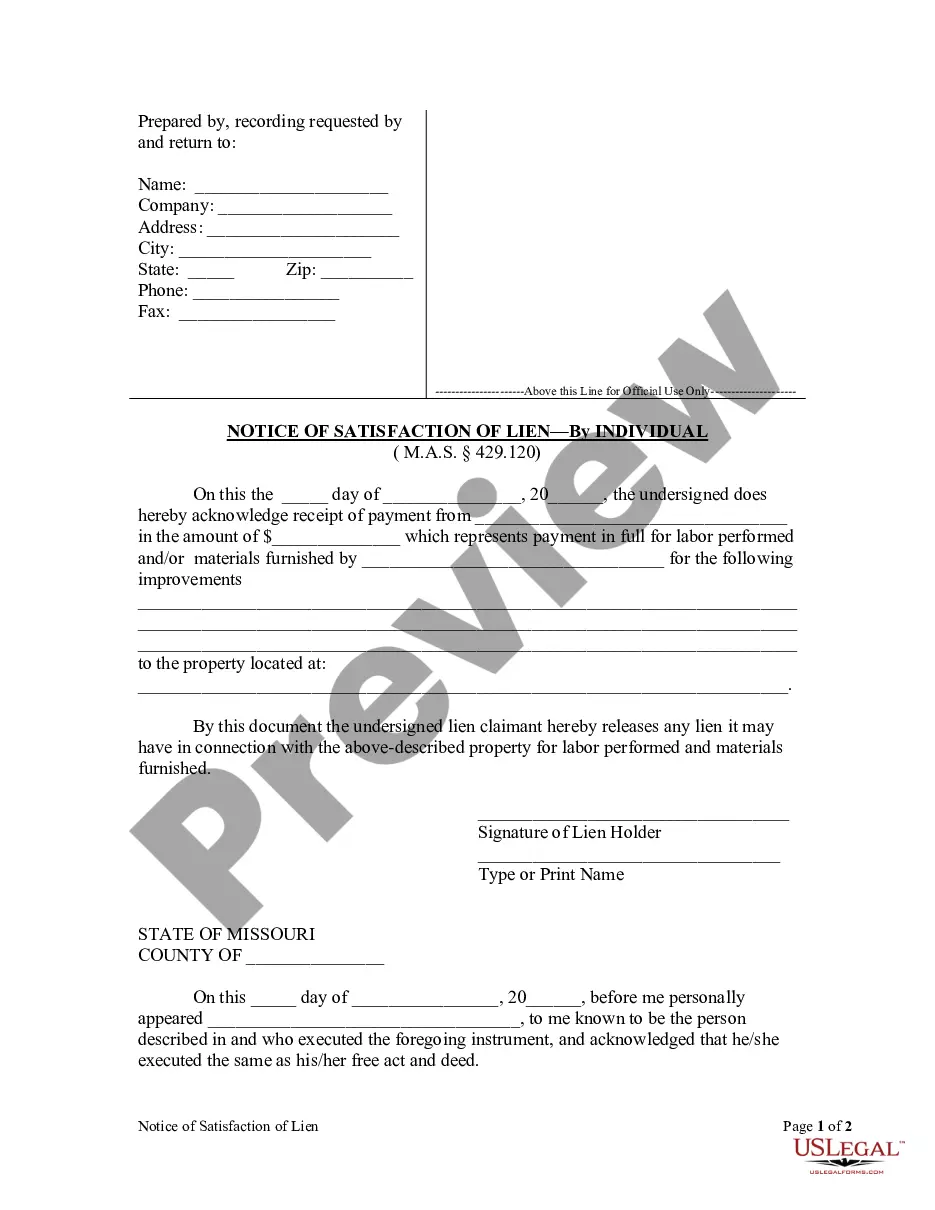

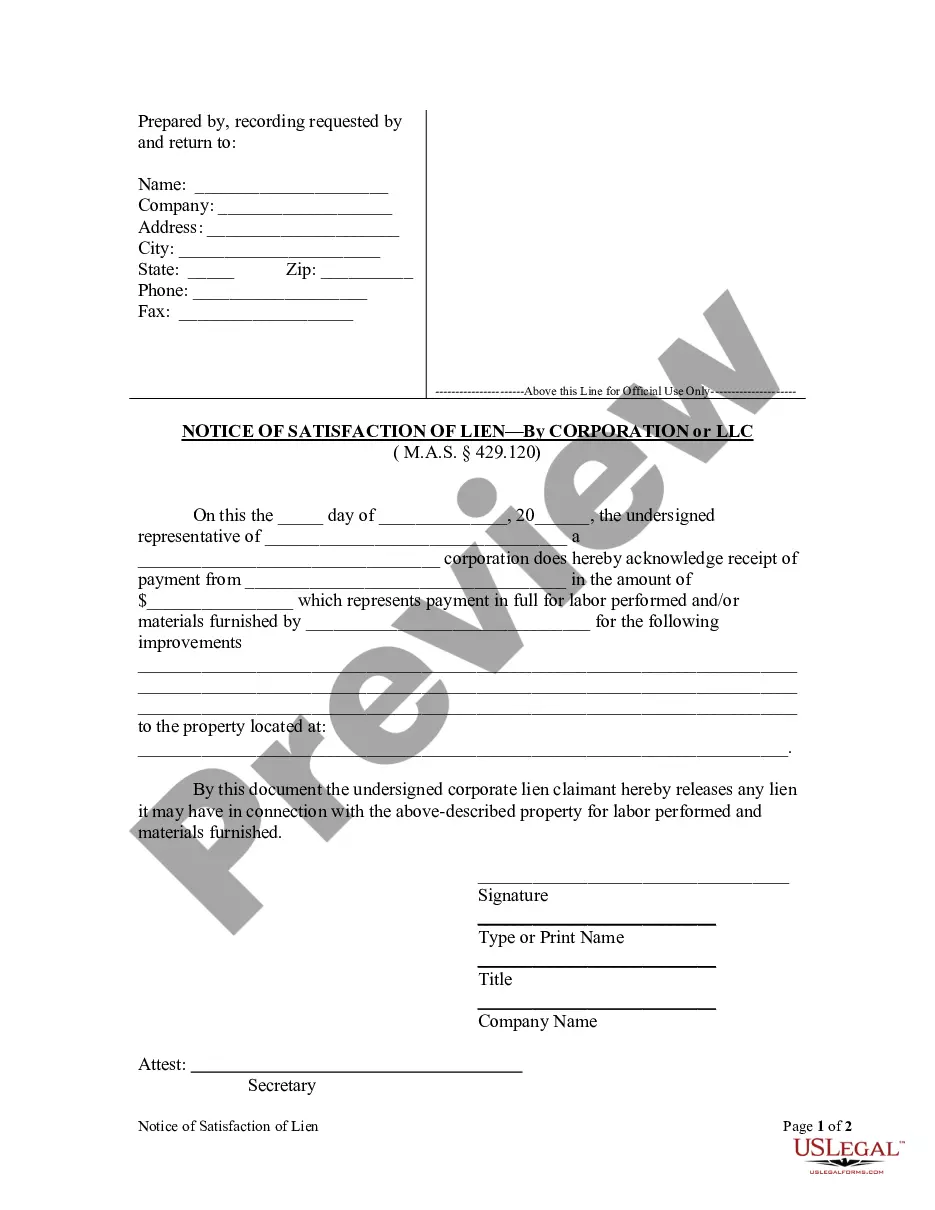

In the event that a lien has been satisfied by payment in full, this form allows a lien claimant to certify that the lien has been satisfied.

Missouri Notice of Satisfaction - Individual

Description

How to fill out Missouri Notice Of Satisfaction - Individual?

Obtain any template from 85,000 legal documents including Missouri Notice of Satisfaction - Individual online with US Legal Forms. Every template is composed and refreshed by state-certified attorneys.

If you possess a subscription, Log In. Once you’re on the form’s page, click on the Download button and navigate to My documents to access it.

If you haven’t subscribed yet, follow the guidelines below: Check the state-specific criteria for the Missouri Notice of Satisfaction - Individual you intend to utilize. Browse through the description and preview the template. Once you are confident that the template meets your needs, click Buy Now. Select a subscription plan that truly fits your budget. Create a personal account. Remit payment in one of two convenient methods: by credit card or via PayPal. Choose a format to download the document in; two alternatives are available (PDF or Word). Download the document to the My documents tab. After your reusable form is prepared, print it out or save it to your device.

- With US Legal Forms, you’ll consistently have swift access to the appropriate downloadable template.

- The service will provide you with access to forms and categorizes them into groups to ease your search.

- Utilize US Legal Forms to obtain your Missouri Notice of Satisfaction - Individual quickly and efficiently.

Form popularity

FAQ

To fill out a Missouri W-4 form, begin by entering your personal details such as your name and address. Next, select your filing status and claim the appropriate number of allowances based on your situation. If you need additional help, consider looking into resources regarding Missouri Notice of Satisfaction - Individual, which can provide step-by-step guidance.

Filling out a 53/1 form in Missouri requires you to provide specific information about your transaction and the parties involved. Carefully follow the instructions provided on the form, ensuring all sections are completed accurately. For those unfamiliar with the process, seeking assistance related to Missouri Notice of Satisfaction - Individual can make this task easier.

To fill out your W4 accurately, start by entering your personal information, including your name, address, and Social Security number. Next, determine your filing status and any additional adjustments you may need to make based on your financial situation. If you need further guidance, resources related to Missouri Notice of Satisfaction - Individual can provide you with the necessary insight.

To submit a notice of sale in Missouri, you must file the appropriate paperwork with the local court or government office. This includes providing details about the sale, such as the property description and the seller's information. Utilizing platforms that specialize in Missouri Notice of Satisfaction - Individual can streamline this process and help ensure you meet all legal requirements.

In Missouri, the standard withholding rate for state taxes is typically around 5.4% of your income. However, this percentage can vary based on your individual circumstances and any specific deductions or credits you may qualify for. To ensure you are withholding the correct amount, it's wise to consult guidelines or a professional familiar with Missouri Notice of Satisfaction - Individual.

When deciding whether to put 0 or 1 on your W4 form, consider your financial situation. If you claim 0, more taxes will be withheld, which may result in a larger refund. Conversely, claiming 1 means less tax withholding, which can result in a smaller refund or possibly owe taxes. For personalized assistance in navigating these decisions, consider using resources related to Missouri Notice of Satisfaction - Individual.

Your Missouri tax refund may be intercepted due to various reasons, such as unpaid debts or tax obligations. One common factor could be a pending Missouri Notice of Satisfaction - Individual that has not been processed. If you believe this interception is in error, you should contact the Missouri Department of Revenue for clarification. Additionally, USLegalForms can provide resources to assist you in resolving these issues efficiently.

Receiving a letter from the Missouri Department of Revenue often indicates that they are communicating important information regarding your tax status. This could relate to outstanding taxes, confirmations of payment, or updates on your Missouri Notice of Satisfaction - Individual. It's crucial to review the letter carefully and address any requests promptly. If needed, USLegalForms can help you understand and respond to these communications effectively.

The Missouri Department of Revenue offers several forms, including the Missouri Notice of Satisfaction - Individual. This form is essential for individuals to confirm that a tax obligation has been fulfilled. You can access these forms online or through local offices. Utilizing platforms like USLegalForms can streamline this process, ensuring you have the correct documentation.