The Pennsylvania Assessor's Office Definitions (55.2 KiB) is a document that outlines the definitions of key terms used by the Assessor's Office in Pennsylvania. It covers a wide range of property tax related topics, including assessment standards, taxation and valuation methods, assessment appeals, and more. The document is divided into two main sections: definitions of terms commonly used by the Assessor's Office, and examples of how these terms are applied in practice. The definitions cover concepts such as real estate, agricultural land, improvements, market value, taxation, exemptions, abatement, and more. The examples provide further explanation of the terms and how they are applied to different scenarios. The document is an important reference for assessors and other professionals who work with property taxes in the state of Pennsylvania.

Pennsylvania Assessor's Office Definitions (55.2 KiB)

Description

How to fill out Pennsylvania Assessor's Office Definitions (55.2 KiB)?

Working with legal documentation requires attention, accuracy, and using well-drafted templates. US Legal Forms has been helping people across the country do just that for 25 years, so when you pick your Pennsylvania Assessor's Office Definitions (55.2 KiB) template from our service, you can be certain it complies with federal and state regulations.

Working with our service is simple and quick. To get the necessary paperwork, all you’ll need is an account with a valid subscription. Here’s a brief guideline for you to get your Pennsylvania Assessor's Office Definitions (55.2 KiB) within minutes:

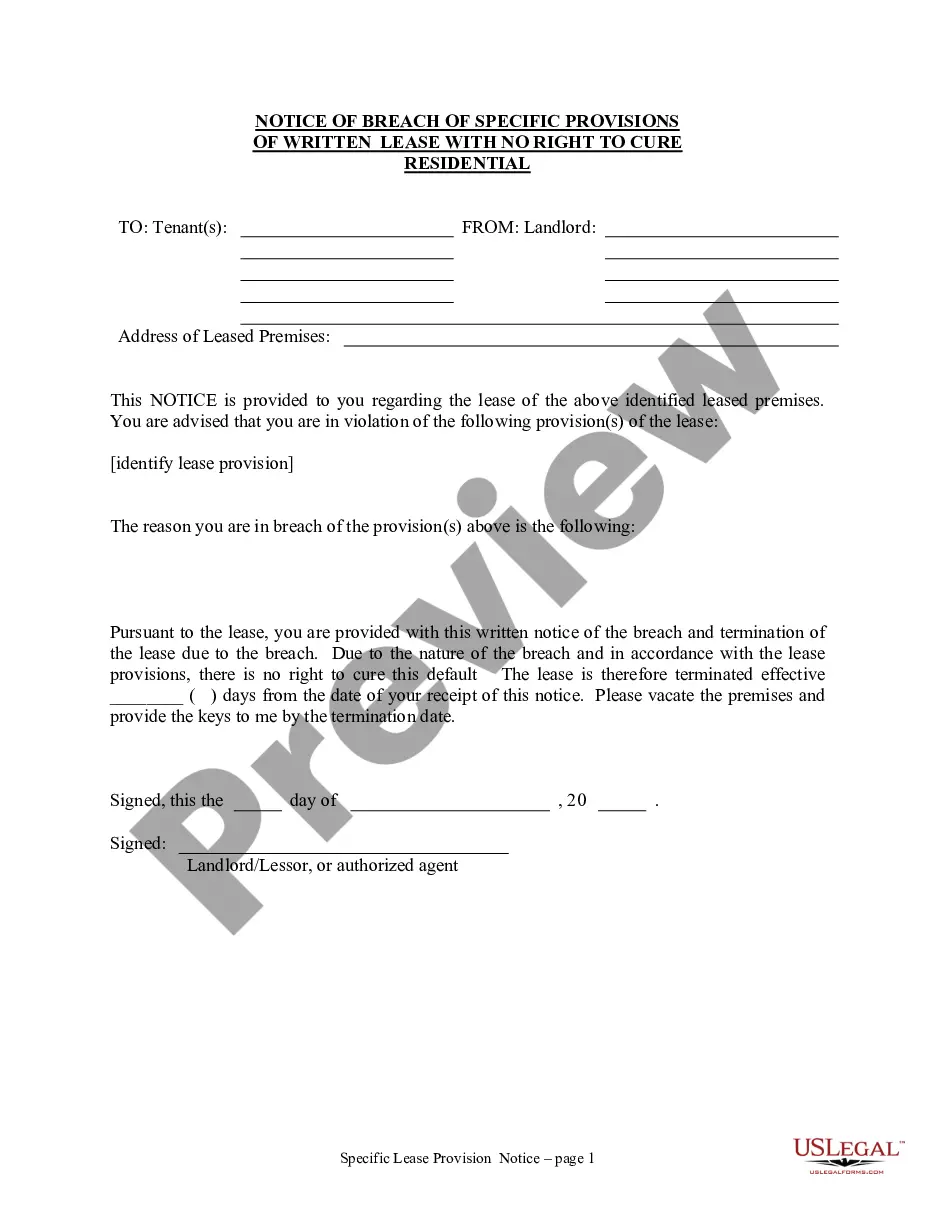

- Remember to carefully look through the form content and its correspondence with general and law requirements by previewing it or reading its description.

- Look for an alternative formal blank if the previously opened one doesn’t suit your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the Pennsylvania Assessor's Office Definitions (55.2 KiB) in the format you prefer. If it’s your first experience with our website, click Buy now to proceed.

- Register for an account, select your subscription plan, and pay with your credit card or PayPal account.

- Choose in what format you want to obtain your form and click Download. Print the blank or add it to a professional PDF editor to prepare it paper-free.

All documents are drafted for multi-usage, like the Pennsylvania Assessor's Office Definitions (55.2 KiB) you see on this page. If you need them one more time, you can fill them out without re-payment - simply open the My Forms tab in your profile and complete your document any time you need it. Try US Legal Forms and accomplish your business and personal paperwork quickly and in total legal compliance!

Form popularity

FAQ

Why Enroll in Clean and Green? Enrolling farmland or forest land in the Clean and Green program is an effective way to save property taxes in Pennsylvania. The primary goal of the Clean and Green program is to encourage landowners to preserve agricultural and forest land by providing tax savings for preservation.

In every county, the sum of local tax rates (school taxes, municipal taxes and county taxes) is applied to the assessed value of each property. However, each county has its own system for determining assessed value. In some counties, assessed value is (or should be) equal to the current market value of property.

When a county embraces an Act 319 program, it is required by state law to place two values on each parcel of land that is ten acres or more in size. These values are known as the Fair Market Value and the Agricultural-Use Value, better known as the Clean and Green Value.

The owner may always build a residential building on Clean and Green land. Also, buildings that are necessary for agricultural production may be built on lands enrolled in Clean and Green.

5% of the lesser of the sale price or fair market value of the agricultural asset, up to a maximum of $32,000; or. 10% of the gross rental income of the first, second, and third year of the rental agreement, up to a maximum of $7,000 per year.

The State Department of Agriculture has provided this document to give you a general overview of the Program . Enrolled land is taxed at its use value rather than fair market value, and can result in an average reduction of 50% in its assessment. The Clean and Green Use Value Page can provide greater detail.

Tax Millage Rates Property tax rates in Pennsylvania are referred to as millage rates, and they are figured in mills. One mill is equal to 1/1,000 of a dollar. To calculate your tax bill: Convert the millage rate to its decimal equivalent to make the calculation easier.

Greene County had the lowest in the country at 0.04%, while Blair County's was third at 0.09%. Susquehanna County boasted a tax rate of just 0.13% in 2021, making it the fifth lowest.