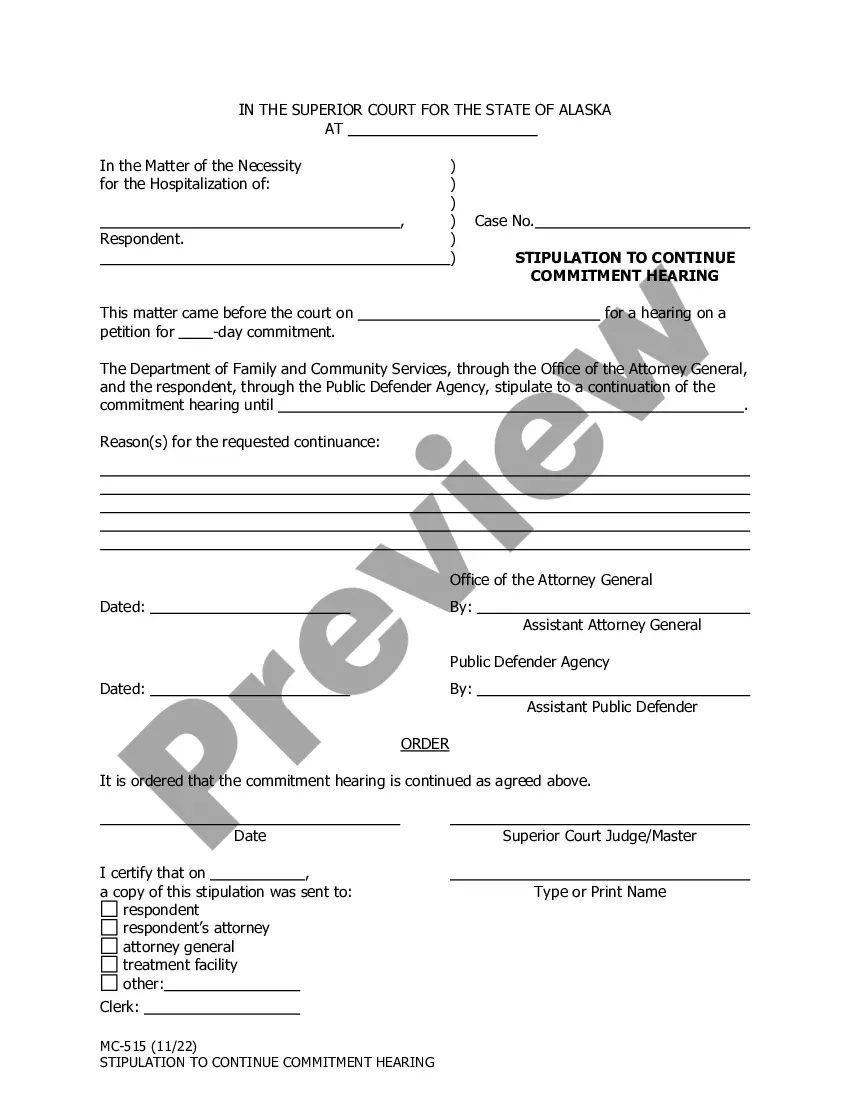

Pennsylvania Exemplification of the Record in State (Form 11) is a legal document issued by the Commonwealth of Pennsylvania that certifies the authenticity and accuracy of a document that is officially recorded in the state's public records. It is a type of notarized certification that verifies the accuracy of a document's contents and can act as evidence of its authenticity in a court of law. The Exemplification of the Record in State contains the signature of the (recorder) of deeds in the county wherein the document was recorded, the signature of the Secretary of the Commonwealth, and the seal of the Commonwealth of Pennsylvania. There are two types of Pennsylvania Exemplification of the Record in State (Form 11): 1) General Exemplifications, which certify the accuracy of a publicly recorded document, and 2) UCC Exemplifications, which certify the accuracy of a Uniform Commercial Code filing.

Pennsylvania Exemplification of the Record in State (Form 11)

Description

How to fill out Pennsylvania Exemplification Of The Record In State (Form 11)?

Preparing official paperwork can be a real stress if you don’t have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be certain in the blanks you find, as all of them correspond with federal and state laws and are checked by our specialists. So if you need to fill out Pennsylvania Exemplification of the Record in State (Form 11), our service is the best place to download it.

Obtaining your Pennsylvania Exemplification of the Record in State (Form 11) from our library is as simple as ABC. Previously authorized users with a valid subscription need only sign in and click the Download button after they find the proper template. Afterwards, if they need to, users can pick the same blank from the My Forms tab of their profile. However, even if you are unfamiliar with our service, registering with a valid subscription will take only a few minutes. Here’s a brief guideline for you:

- Document compliance verification. You should carefully examine the content of the form you want and check whether it suits your needs and meets your state law regulations. Previewing your document and looking through its general description will help you do just that.

- Alternative search (optional). If you find any inconsistencies, browse the library through the Search tab on the top of the page until you find an appropriate template, and click Buy Now once you see the one you want.

- Account registration and form purchase. Create an account with US Legal Forms. After account verification, log in and select your most suitable subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your Pennsylvania Exemplification of the Record in State (Form 11) and click Download to save it on your device. Print it to complete your papers manually, or use a multi-featured online editor to prepare an electronic version faster and more effectively.

Haven’t you tried US Legal Forms yet? Subscribe to our service now to obtain any formal document quickly and easily whenever you need to, and keep your paperwork in order!

Form popularity

FAQ

Assets that typically require probate include: Solely-owned real estate. Bank accounts held solely in the deceased's name. Stocks, bonds, or other investments held in the deceased's name only. Personal property, such as vehicles, furniture, and jewelry, owned solely by the deceased.

In Pennsylvania, when a person passes away, it is necessary for the executor or next of kin to analyze the assets that were owned by the decedent in order to determine whether it is necessary to probate and open an estate. It is not always necessary to open an estate.

6 types of non probate assets Property. Most personal property, such as real estate, jewelry, or furniture will become probate assets by default.Bank accounts.Retirement benefits.Life insurance policies.Any other assets that are owned jointly with others.Any other assets that have post-death designation in place.

Minors Can Contest a Will Minors cannot challenge a will until they have reached the age of majority (typically age 18). This is because minors are not legally able to initiate legal proceedings. A parent or guardian may initiate a lawsuit on their behalf.

In Pennsylvania, you can make a living trust to avoid probate for virtually any asset you own?real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

Pennsylvania offers a simplified probate process for small estates, which state law defines as estates that contain no more than $50,000 in assets.

Section 3392 states that all creditor claims shall be paid in the following order: (1) the costs of administering the decedent's estate, which includes any probate fees, attorneys' fees, or personal representative commissions; (2) the family exemption, which is $3,500.00 for each family member who resided with the

In Pennsylvania, it is only necessary to probate if the decedent owned assets, whether financial or real estate holdings, solely in their name which did not already have a beneficiary designated. Such assets are called probate assets, and in order to convey ownership of them it is necessary to probate.