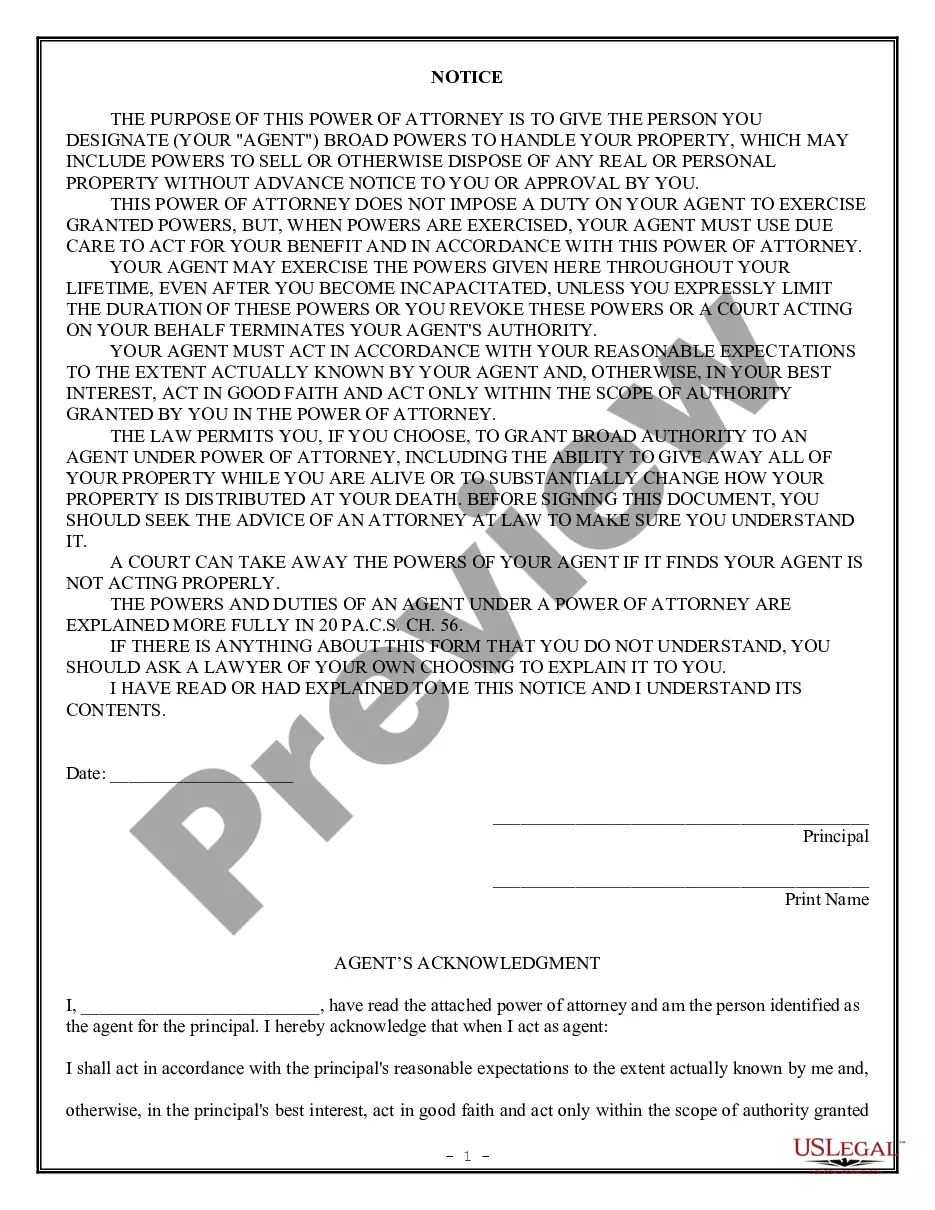

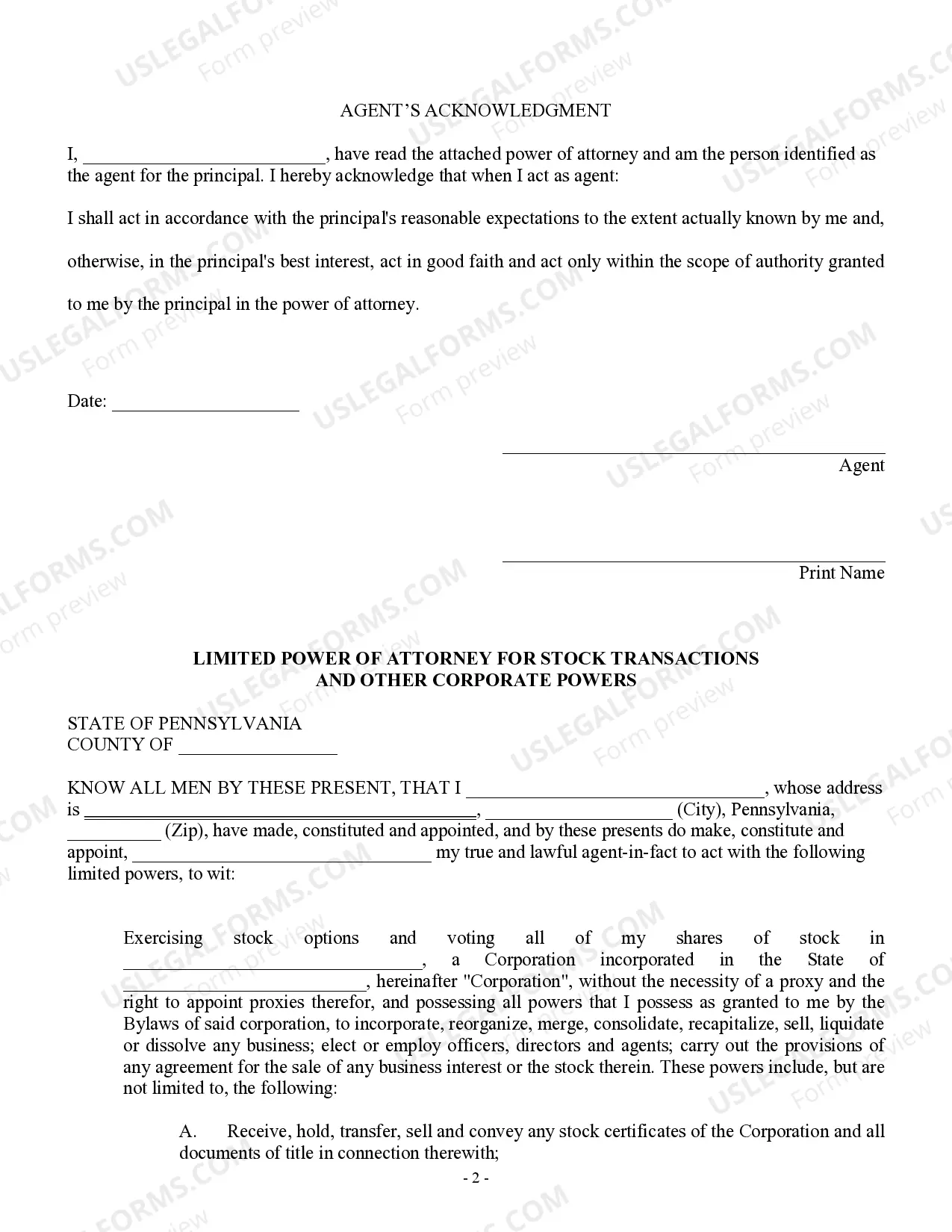

Pennsylvania Limited Power of Attorney for Stock Transactions and Corporate Powers

Description

How to fill out Pennsylvania Limited Power Of Attorney For Stock Transactions And Corporate Powers?

Creating documents isn't the most simple job, especially for those who rarely deal with legal papers. That's why we recommend making use of correct Pennsylvania Limited Power of Attorney for Stock Transactions and Corporate Powers samples created by skilled attorneys. It gives you the ability to eliminate difficulties when in court or working with formal institutions. Find the documents you require on our website for high-quality forms and accurate explanations.

If you’re a user having a US Legal Forms subscription, just log in your account. Once you’re in, the Download button will automatically appear on the template webpage. After downloading the sample, it will be stored in the My Forms menu.

Customers without an activated subscription can quickly create an account. Make use of this simple step-by-step help guide to get the Pennsylvania Limited Power of Attorney for Stock Transactions and Corporate Powers:

- Ensure that file you found is eligible for use in the state it is needed in.

- Verify the document. Make use of the Preview feature or read its description (if available).

- Click Buy Now if this form is what you need or return to the Search field to find a different one.

- Select a suitable subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your file in a wanted format.

After completing these easy actions, you are able to fill out the sample in your favorite editor. Recheck completed info and consider requesting a legal representative to review your Pennsylvania Limited Power of Attorney for Stock Transactions and Corporate Powers for correctness. With US Legal Forms, everything gets easier. Try it now!

Form popularity

FAQ

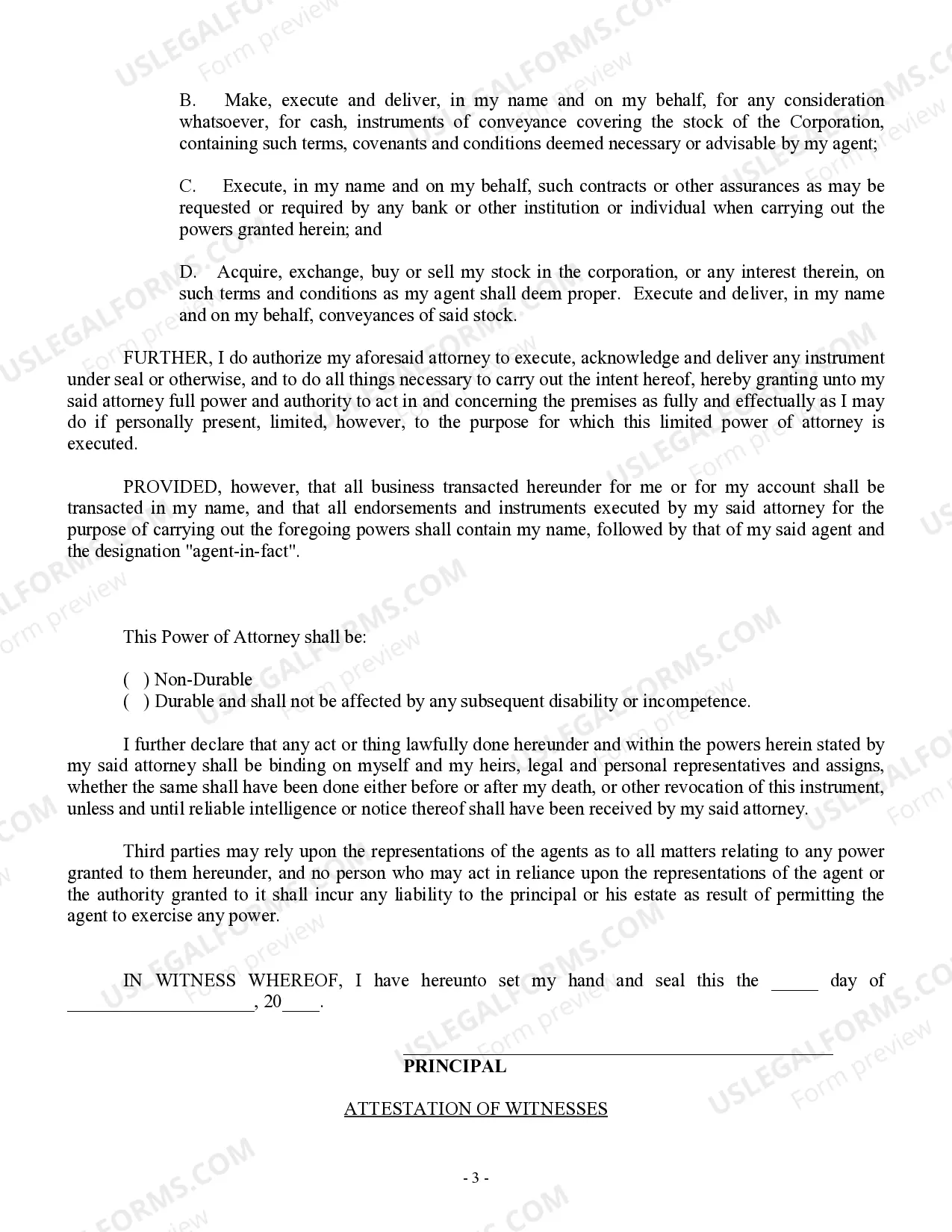

When you give someone the POA, there are important limitations to the power the agent has. First, your agent must make decisions within the terms of the legal document and can't make decisions that break the agreement, and the agent can be held liable for any fraud or negligence.

Limited powers of attorney are valid for no more than 90 days, except those used by lessors, which are good for periods up to one year.

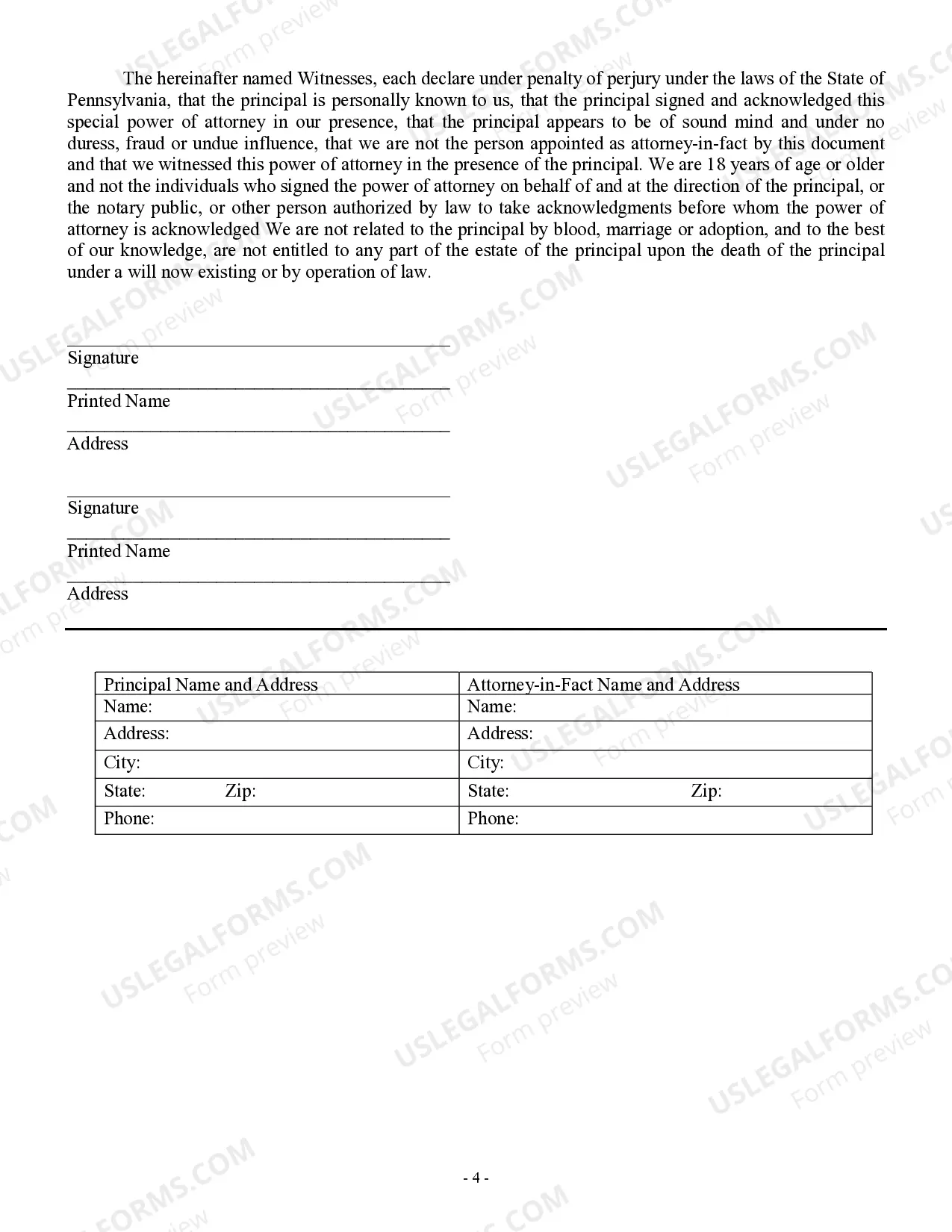

If the agent is acting improperly, family members can file a petition in court challenging the agent. If the court finds the agent is not acting in the principal's best interest, the court can revoke the power of attorney and appoint a guardian. The power of attorney ends at death.

Limited Power of Attorney (LPOA) is an authorization that permits a portfolio manager to perform specific functions on behalf of the account owner. In general, the LPOA allows the manager to execute an agreed-upon investment strategy and take care of routine related business without contacting the account holder.

Limited Power of Attorney (LPOA) is an authorization that permits a portfolio manager to perform specific functions on behalf of the account owner. In general, the LPOA allows the manager to execute an agreed-upon investment strategy and take care of routine related business without contacting the account holder.

A limited power of attorney grants the representative that you choose (the agent or attorney-in-fact) the power to act on your behalf under limited circumstances.Under a general power of attorney, the agent or attorney-in-fact can do anything that you can do.

Can the Power of Attorney be used by the agent to take my money or property without my permission? Unfortunately, you can run the risk that the agent you choose to give your Power of Attorney could abuse the power by spending your money or taking your money without your knowledge or worse without your permission.

General Power of Attorney. Durable Power of Attorney. Special or Limited Power of Attorney. Springing Durable Power of Attorney.