Pennsylvania Special or Limited Power of Attorney for Real Estate Sales Transaction By Seller

Description

How to fill out Pennsylvania Special Or Limited Power Of Attorney For Real Estate Sales Transaction By Seller?

The work with documents isn't the most straightforward job, especially for those who rarely work with legal paperwork. That's why we recommend using accurate Pennsylvania Special or Limited Power of Attorney for Real Estate Sales Transaction By Seller samples created by professional lawyers. It gives you the ability to prevent troubles when in court or dealing with official organizations. Find the documents you need on our website for top-quality forms and accurate explanations.

If you’re a user having a US Legal Forms subscription, simply log in your account. As soon as you are in, the Download button will automatically appear on the file web page. Right after downloading the sample, it will be stored in the My Forms menu.

Customers with no a subscription can quickly get an account. Follow this simple step-by-step help guide to get your Pennsylvania Special or Limited Power of Attorney for Real Estate Sales Transaction By Seller:

- Ensure that the document you found is eligible for use in the state it is needed in.

- Confirm the file. Make use of the Preview option or read its description (if readily available).

- Buy Now if this template is the thing you need or go back to the Search field to get a different one.

- Choose a suitable subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your document in a required format.

After completing these simple actions, it is possible to complete the sample in a preferred editor. Double-check filled in data and consider asking a legal professional to review your Pennsylvania Special or Limited Power of Attorney for Real Estate Sales Transaction By Seller for correctness. With US Legal Forms, everything becomes much easier. Try it now!

Form popularity

FAQ

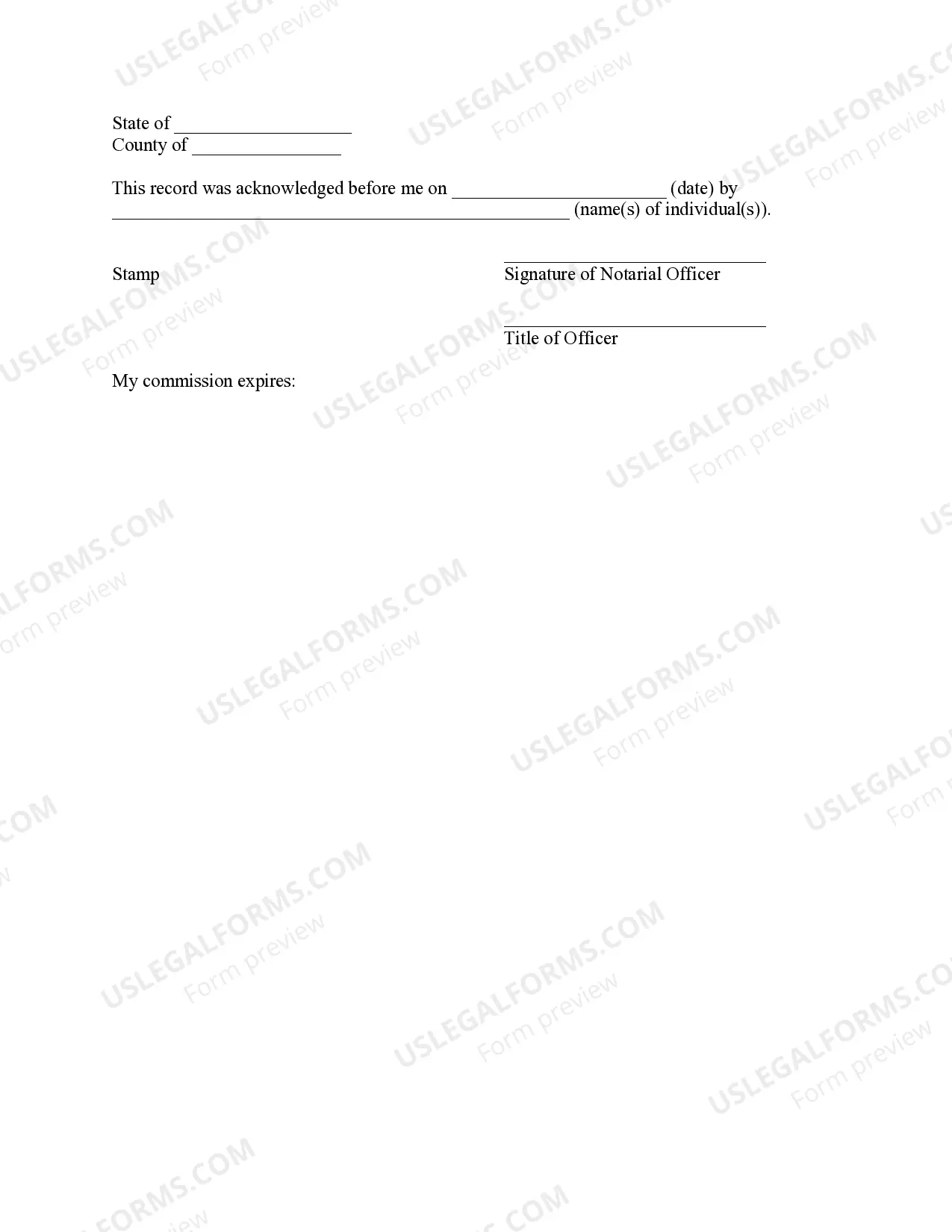

Pennsylvania law requires that POAs must be signed by the principal and witnessed by two people who are ages 18 or older. The document must also be dated and notarized. If the principal cannot write, he or she is allowed to sign the document by using a mark or by asking someone else to sign the POA for him or her.

In Pennsylvania, a Power of Attorney does not need to be witnessed or notarized to be effective. However, if you own real estate, you should have it notarized so it can be recorded. Also, you can only record an original Power of Attorney. Copies cannot be used to record a Deed.

Property and Financial Affairs Provided there are no restrictions within the lasting power of attorney (LPA) or enduring power of attorney (EPA) you can usually do the following: Sell property (at market value) Buy property. Maintain and repair their home.

The Supreme Court has ruled that sale transactions carried through general power of attorney will have no legal sanctity. "A transfer of immovable property by way of sale can only be by a deed of conveyance (sale deed).

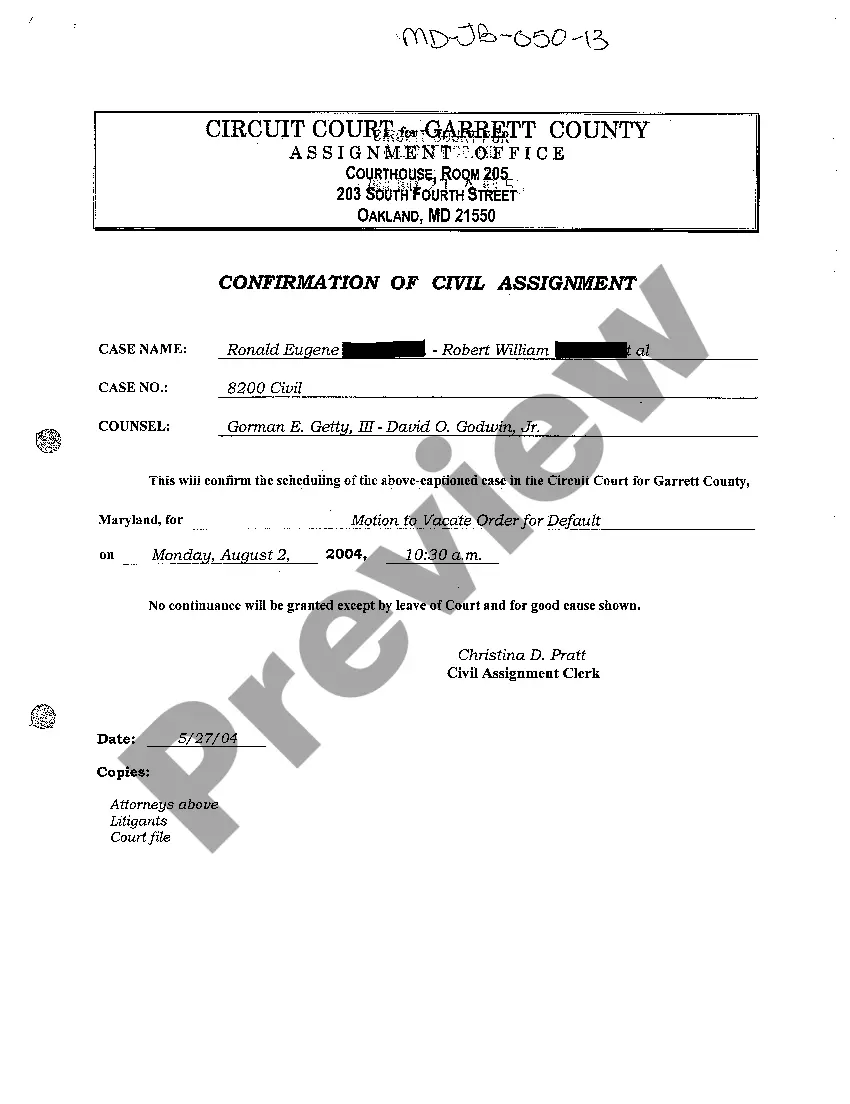

Remember that all of the authorized agents under the power of attorney or representatives in an estate must sign the listing agreement, disclosure documents, etc. For example, when there are two executors in an estate, then they both must sign the Listing Contract.

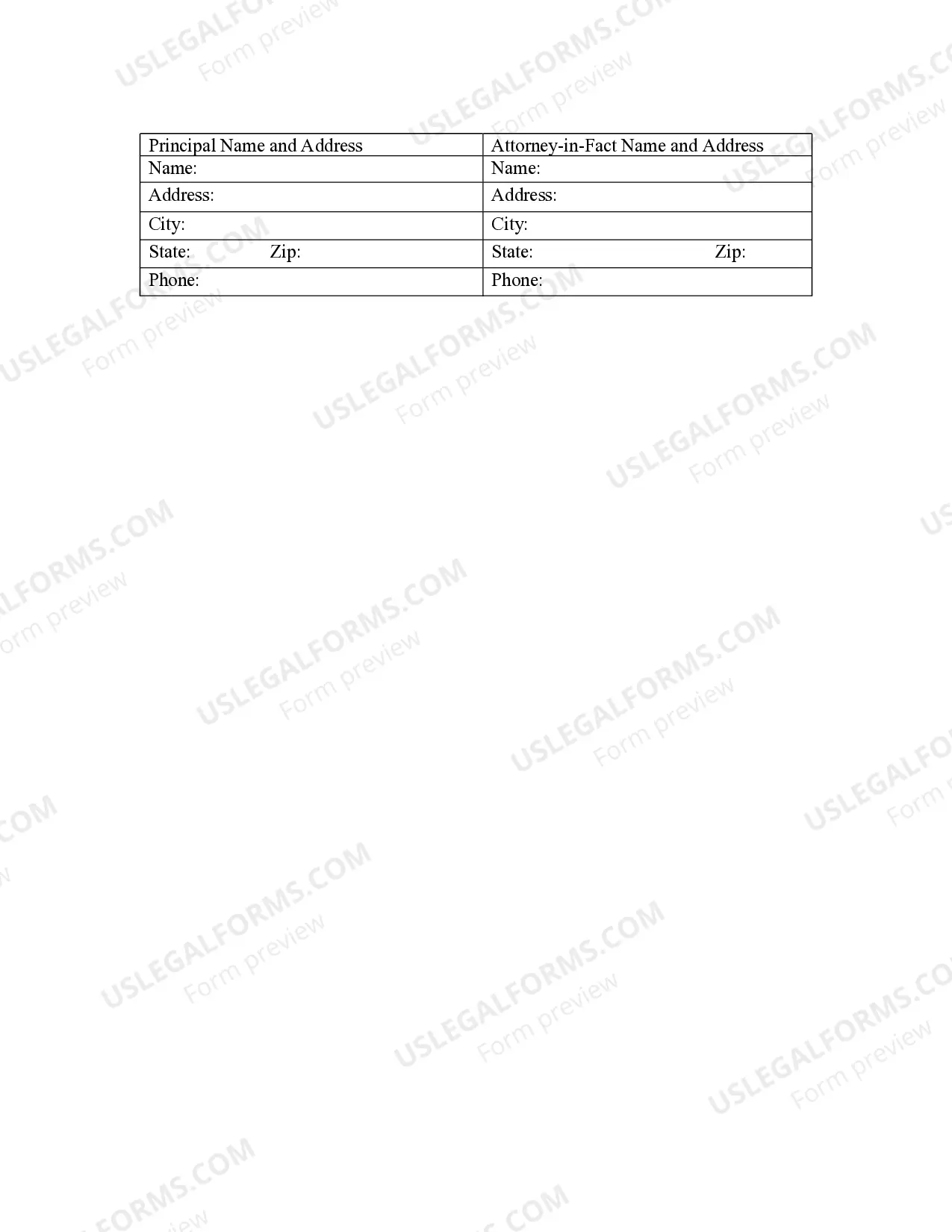

Name, signature, and address of the principal. Name, signature, and address of the agent. Properties and activities under the authority of the agent. Date of effect and termination of authority. Compensation to services of the agent.

Before death, a person doesn't have an executor (although the person may have granted the power of attorney to someone to act on his behalf).An ill, elderly parent who plans to sell or give away his or her principal residence would be well advised to consult with a lawyer who does Medicaid planning.

Powers of attorney are often used to transfer real estate.The person named as agent (usually a spouse or other family member) can use the power of attorney to sign the real estate documentsincluding the deedwithout opening a guardianship or conservatorship or otherwise obtaining court permission.

Is property sale through power of attorney legal? In 2011, the Supreme Court ruled that property sale through power of attorney (PoA) is illegal and only registered sale deeds provide any legal holding to property transactions.