Pennsylvania Warranty Deed from Individual to LLC

Description

How to fill out Pennsylvania Warranty Deed From Individual To LLC?

Creating papers isn't the most uncomplicated process, especially for people who rarely work with legal papers. That's why we recommend using correct Pennsylvania Warranty Deed from Individual to LLC templates made by skilled lawyers. It gives you the ability to avoid troubles when in court or working with formal organizations. Find the samples you want on our site for high-quality forms and correct explanations.

If you’re a user with a US Legal Forms subscription, just log in your account. Once you’re in, the Download button will automatically appear on the file page. Right after accessing the sample, it’ll be saved in the My Forms menu.

Users without an active subscription can quickly get an account. Use this simple step-by-step help guide to get your Pennsylvania Warranty Deed from Individual to LLC:

- Be sure that the sample you found is eligible for use in the state it’s required in.

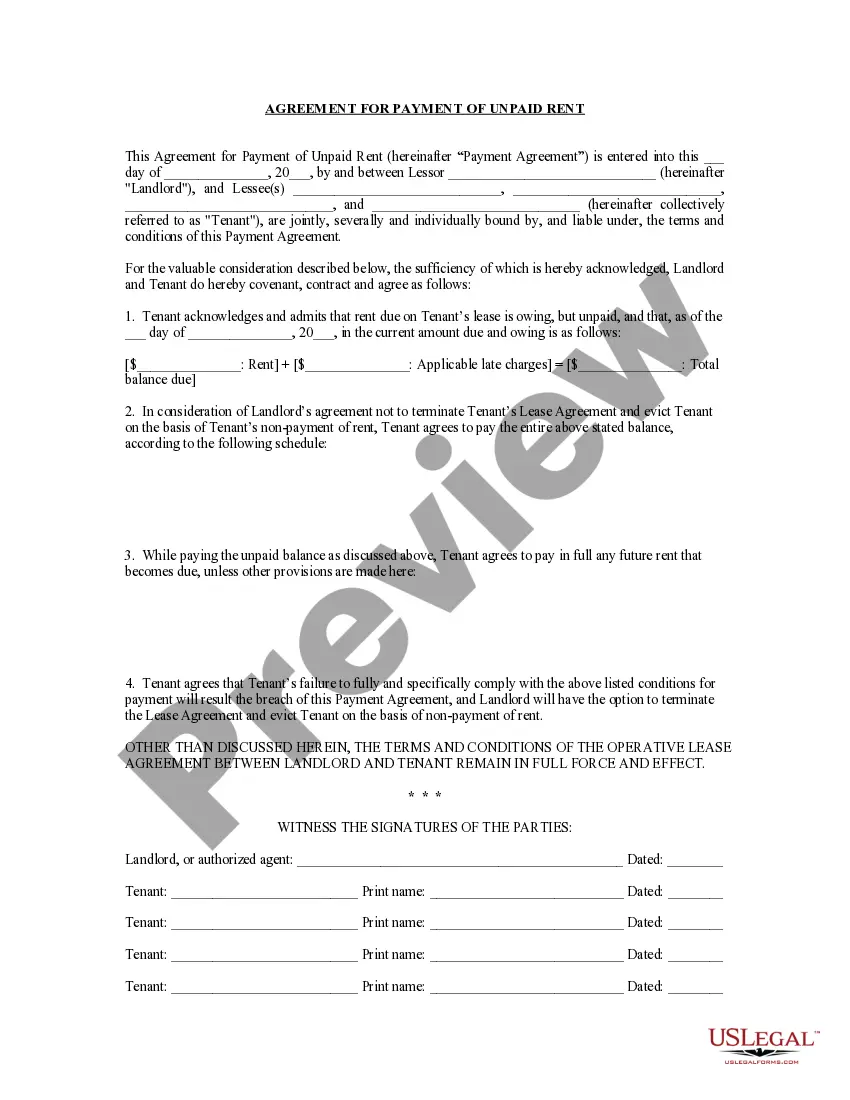

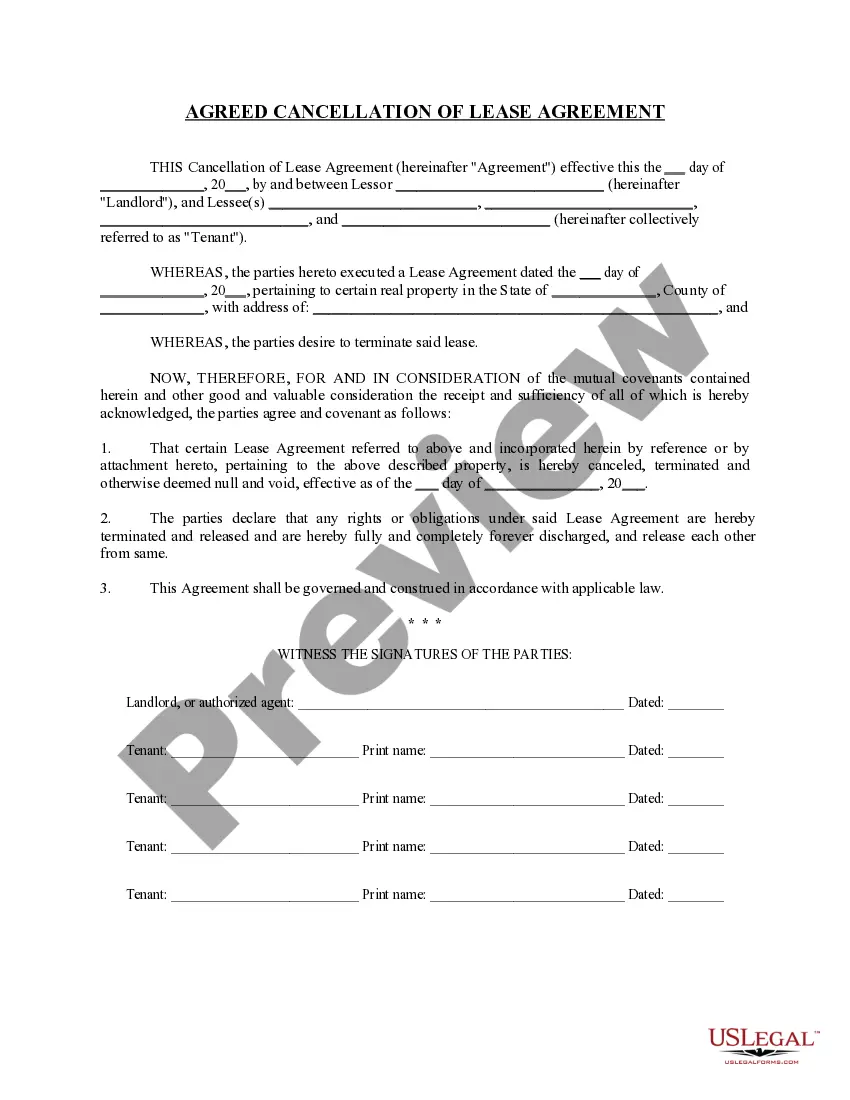

- Verify the document. Utilize the Preview feature or read its description (if available).

- Buy Now if this sample is what you need or utilize the Search field to get another one.

- Select a suitable subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your document in a wanted format.

Right after completing these easy actions, you are able to fill out the form in your favorite editor. Recheck completed details and consider asking a lawyer to examine your Pennsylvania Warranty Deed from Individual to LLC for correctness. With US Legal Forms, everything gets easier. Give it a try now!

Form popularity

FAQ

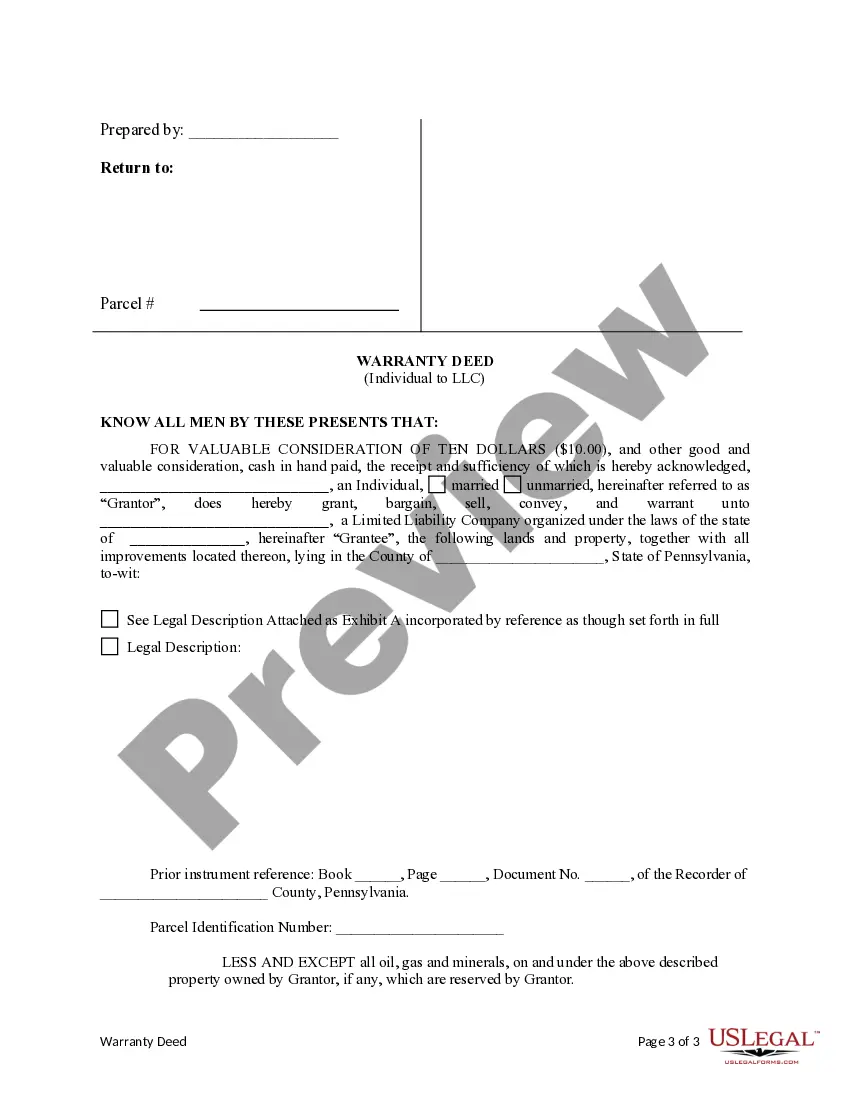

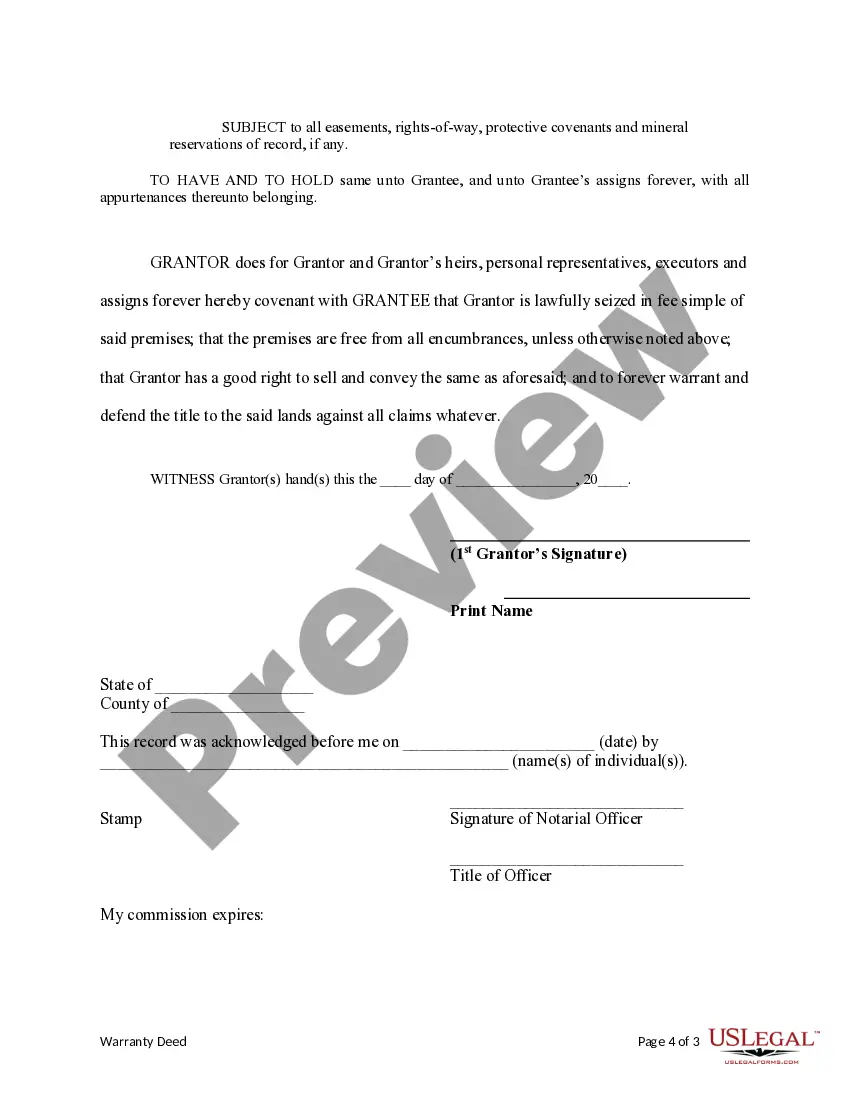

To transfer property in Pennsylvania, you'll need to prepare and execute a deed and record it in the county where the property is located. If the transfer was in exchange for money, you'll have to pay transfer tax.

If you give your house to your children, the tax basis will be $150,000.PA INHERITANCE TAX ISSUES: In Pennsylvania, there is no gift tax. However, to avoid PA Inheritance Taxes (the rate is 4.5% for assets passed to children or grandchildren), you must live at least one year from the time the gift was made.

Retrieve your original deed. Get the appropriate deed form. Draft the deed. Sign the deed before a notary. Record the deed with the county recorder. Obtain the new original deed.

A: A "special warranty" deed is the type of deed used most frequently in Pennsylvania real estate sales. It essentially represents that the seller did nothing to weaken the status of title from the time that he/she received it.A "quit-claim" deed is a deed that contains no warranties at all.

The only way to forcibly change the ownership status is through a legal action and the resultant court order. However, if an owner chooses to be removed from the deed, it is simply a matter of preparing a new deed transferring that owner's interest in the property.

The State of Pennsylvania charges 1% of the sales price and the municipality and school district USUALLY charge 1% between them for a total of 2% (i.e. 2% X 100,000 = $2,000). By custom, the buyer and seller split the cost. 1% to buyer, 1% to seller; however payment is dictated by the sales contract.

However, there are substantial downsides associated with transferring your primary home into an LLC.If you are using your personal residence for estate planning purposes, a qualified personal residence trust (QPRT) may be more effective than transferring your property to a limited liability company.

Does LLC ownership count as time used as a primary residence? For a single-member LLC, the answer is typically yes. For example, if the house is owned by an LLC. The Treasury Regulations allow for the capital gains exclusion when title is held by a single-member disregarded entity.