Oregon Letter for Account Paid in Full

Description

How to fill out Letter For Account Paid In Full?

Have you ever been in a situation where you need to have documents for either professional or personal purposes almost every day.

There are numerous legal document templates available online, but finding ones you can rely on isn't easy.

US Legal Forms offers a wide array of form templates, such as the Oregon Letter for Account Paid in Full, which can be completed to comply with federal and state regulations.

Once you find the appropriate form, click on Acquire now.

Select the pricing plan you want, fill in the necessary information to create your account, and pay for your order using your PayPal or credit card. Choose a suitable document format and download your copy. You can find all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Oregon Letter for Account Paid in Full at any time if needed. Just select the required form to download or print the document template. Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors. The service provides well-crafted legal document templates that can be utilized for various purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms site and have an account, simply Log In.

- Then, you can download the Oregon Letter for Account Paid in Full template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

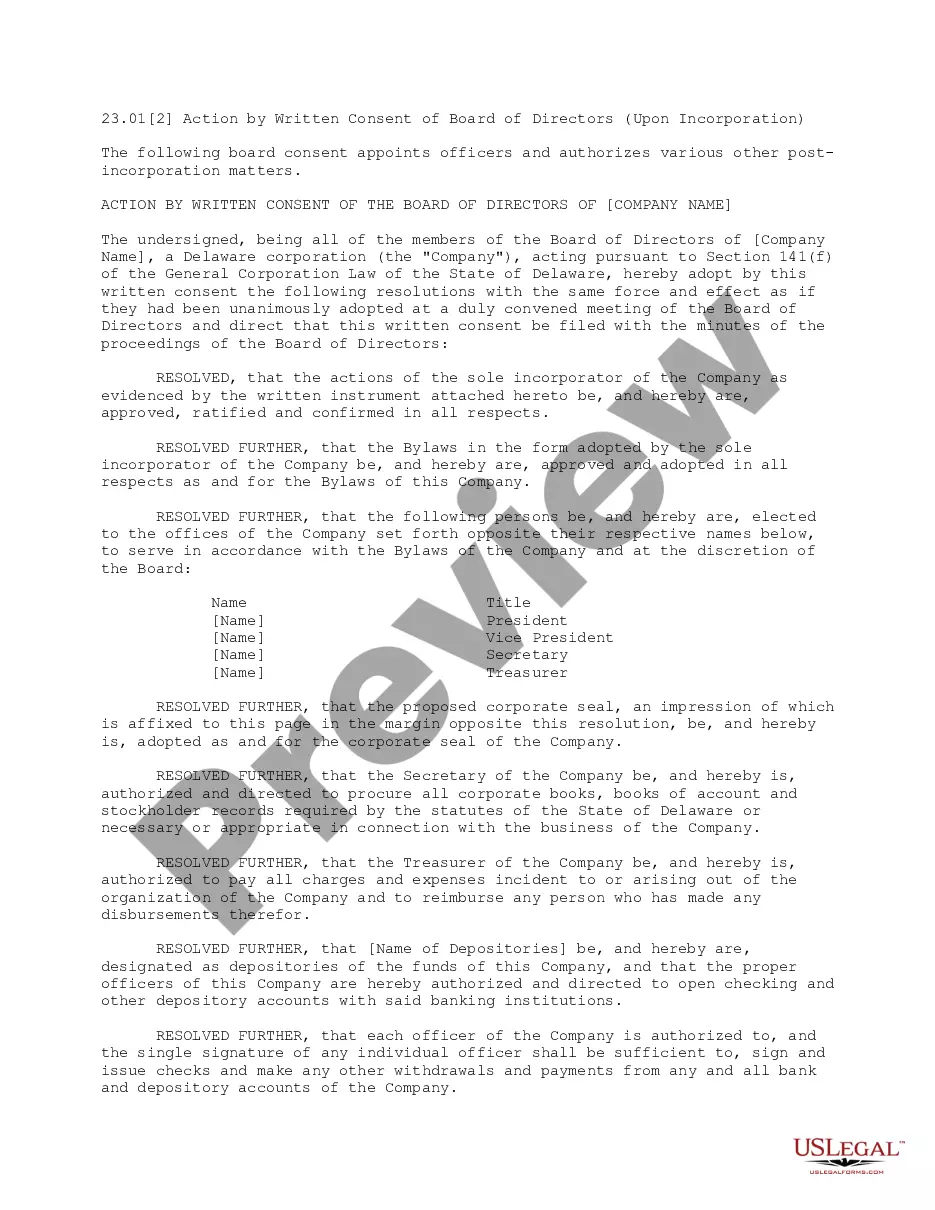

- Use the Review option to look over the form.

- Read the information to confirm that you have selected the right form.

- If the form isn’t what you’re looking for, use the Search field to find the form that meets your needs.

Form popularity

FAQ

A letter from the Department of Revenue typically conveys important information regarding your tax status or obligations. It may inform you of an account update, a payment confirmation, or a request for action regarding a debt. Understanding the content of the letter is crucial for managing your finances. If you receive an Oregon Letter for Account Paid in Full, it signifies a positive resolution to your debt.

To respond to a letter in Oregon Revenue Online, log into your account and locate the communication in your inbox. You can follow the prompts to provide any necessary information or clarification. Be clear and concise in your response to address the matter effectively. If you need additional guidance, uslegalforms can offer resources to assist with your reply.

Responding to a letter from the Oregon Department of Revenue requires careful attention. Start by reading the letter thoroughly to understand the issue at hand. If it concerns an Oregon Letter for Account Paid in Full, ensure that you have all relevant payment information ready. If you're uncertain how to proceed, using a platform like uslegalforms can streamline your response process.

You can contact the Oregon Department of Revenue by visiting their official website or calling their customer service number. They provide various resources and support to assist you with your inquiries. Additionally, you can find information on your account status and any letters you may have received. If you need help with a specific letter, consider using uslegalforms for the right documentation.

In Oregon, a debt generally becomes uncollectible after six years, following the statute of limitations. This period may vary depending on the type of debt and the circumstances surrounding it. Understanding this timeline can help you manage your financial obligations effectively. If you have questions about a specific debt, consider seeking advice on how an Oregon Letter for Account Paid in Full can impact your situation.

The Oregon Department of Revenue may send a certified letter to ensure you receive important information regarding your tax situation. This type of correspondence often pertains to urgent matters, such as outstanding debts or required actions. Receiving a certified letter means that the department requires your immediate attention. It is wise to read the letter carefully and respond promptly.

You might receive an Oregon Letter for Account Paid in Full from the Oregon Department of Revenue to inform you that your tax obligations are settled. This letter serves as proof of payment and can be important for your records. If you have recently paid off a debt, this communication is a positive confirmation of your status. It is essential to keep this letter for future reference.

To find an Oregon letter ID, you can start by checking the official documents associated with your account or reaching out to the creditor directly. The letter ID may be included in the correspondence you received regarding your payment. If you need assistance, platforms like uslegalforms offer resources and templates that can guide you in locating or creating an Oregon Letter for Account Paid in Full, making the process simpler.

A paid in full letter is an official statement from a creditor indicating that a debtor has fulfilled their financial obligation. It typically includes details such as the account number and the date the payment was received. This letter is essential for individuals to have as it protects them from any further collection attempts on the same debt. Utilizing an Oregon Letter for Account Paid in Full can help you ensure your records are clear and accurate.

A paid in full letter for collections is a document that confirms a debtor has settled their account completely. This letter serves as proof to both the debtor and creditor that the outstanding balance has been paid. Importantly, it helps prevent any future claims regarding the debt. For those in Oregon, obtaining an Oregon Letter for Account Paid in Full can streamline this process.