Oregon Self-Employed Tailor Services Contract

Description

How to fill out Self-Employed Tailor Services Contract?

Are you currently in a location where you require documents for both business or personal purposes all the time.

There are many legal document templates available online, but finding versions you can rely on is not easy.

US Legal Forms provides a vast array of form templates, such as the Oregon Self-Employed Tailor Services Contract, designed to comply with federal and state requirements.

Choose the pricing plan you want, fill in the necessary information to create your account, and pay for the transaction using your PayPal or credit card.

Select a preferred file format and download your copy. Access all the document templates you have purchased in the My documents section. You can obtain another copy of the Oregon Self-Employed Tailor Services Contract at any time if needed. Just click the required form to download or print the document template. Use US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors. The service offers professionally crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Oregon Self-Employed Tailor Services Contract template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/county.

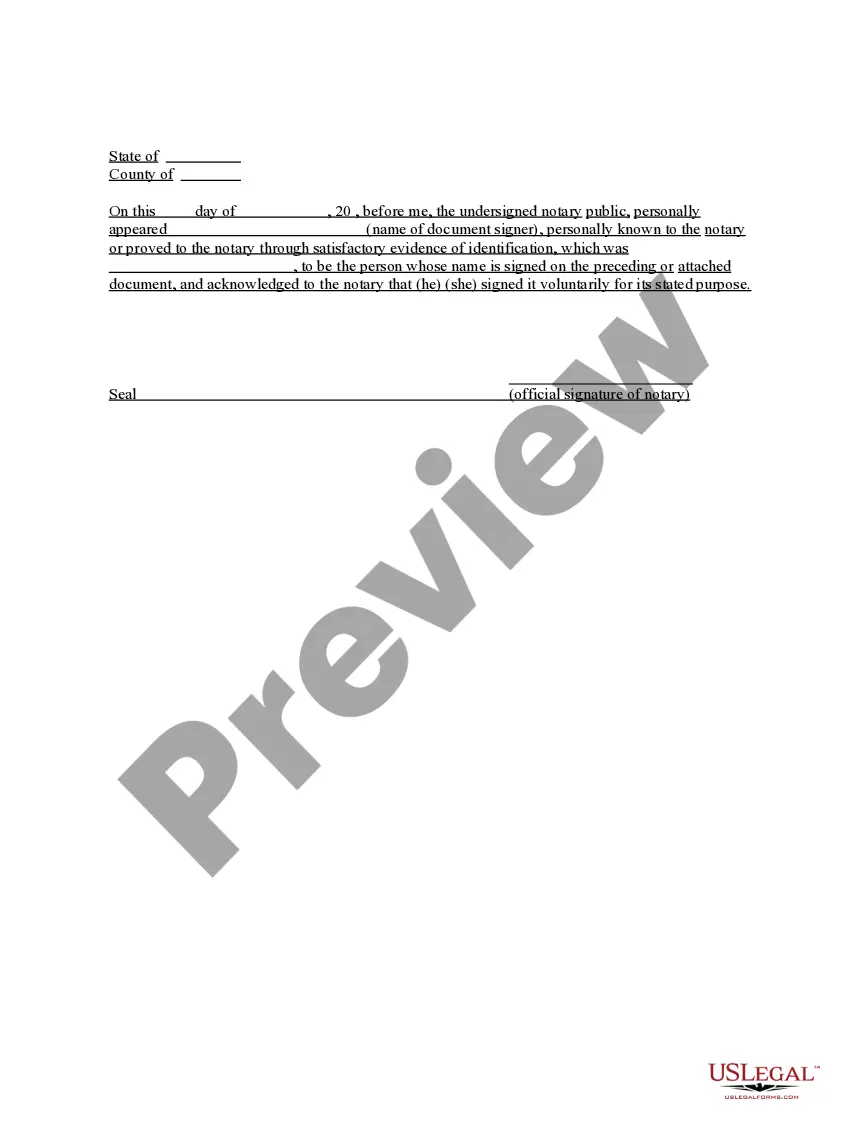

- Utilize the Review button to evaluate the document.

- Read the description to confirm you have selected the right form.

- If the form is not what you're looking for, use the Search field to find the form that suits your needs and requirements.

- When you find the appropriate form, simply click Purchase now.

Form popularity

FAQ

Absolutely, a self-employed person can have a contract. An Oregon Self-Employed Tailor Services Contract provides a formal agreement between you and your client, ensuring that both parties understand their roles and responsibilities. This contract serves as a vital tool for managing expectations and protecting your interests.

Yes, labor laws do apply to 1099 independent workers in Oregon, but the protections may differ from those of traditional employees. As a self-employed tailor with an Oregon Self-Employed Tailor Services Contract, you should be aware of your rights and responsibilities under these laws. Understanding these regulations can help you navigate your business effectively.

Self-employed individuals must comply with several legal requirements, including registering their business, paying taxes, and obtaining necessary licenses. An Oregon Self-Employed Tailor Services Contract can help ensure you meet client expectations and legal obligations. Additionally, keeping thorough records is essential for tax reporting.

While an operating agreement is not legally required in Oregon, it is highly recommended for LLCs. This document outlines the management structure and operational procedures, helping to prevent disputes. If you're self-employed as a tailor and considering forming an LLC, including this agreement can provide clarity and legal protection.

Yes, contract work is considered a form of self-employment. When you have an Oregon Self-Employed Tailor Services Contract, you essentially work for yourself while fulfilling obligations to a client. This arrangement affords you greater flexibility and control over your business operations.

In Oregon, an independent contractor is someone who performs services for a client but retains control over how those services are delivered. You might qualify as an independent contractor if you have an Oregon Self-Employed Tailor Services Contract that defines your work terms and allows you to operate independently. This classification affects tax obligations and rights.

Self-employed individuals work for themselves, while contracted workers often provide services for a specific client under a contract. In the case of an Oregon Self-Employed Tailor Services Contract, you operate as a self-employed tailor who has entered into an agreement with a client. This distinction is important for tax and legal purposes.

Yes, you can absolutely have a contract when you're self-employed. An Oregon Self-Employed Tailor Services Contract outlines the terms and conditions of your work, protecting both you and your clients. This document helps clarify expectations, payment terms, and project details, ensuring a smooth working relationship.

To write a self-employment contract, start by clearly describing the work to be performed and how compensation will be handled. Include terms for termination and any confidentiality requirements. For streamlined support, consider using the Oregon Self-Employed Tailor Services Contract template from the USLegalForms platform.

Writing a self-employed contract means outlining the services to be provided, payment terms, and any deadlines. It is important to clearly define both parties' responsibilities to avoid misunderstandings. You can use the Oregon Self-Employed Tailor Services Contract as a solid foundation for your agreement.