Oregon Self-Employed Seamstress Services Contract

Description

How to fill out Self-Employed Seamstress Services Contract?

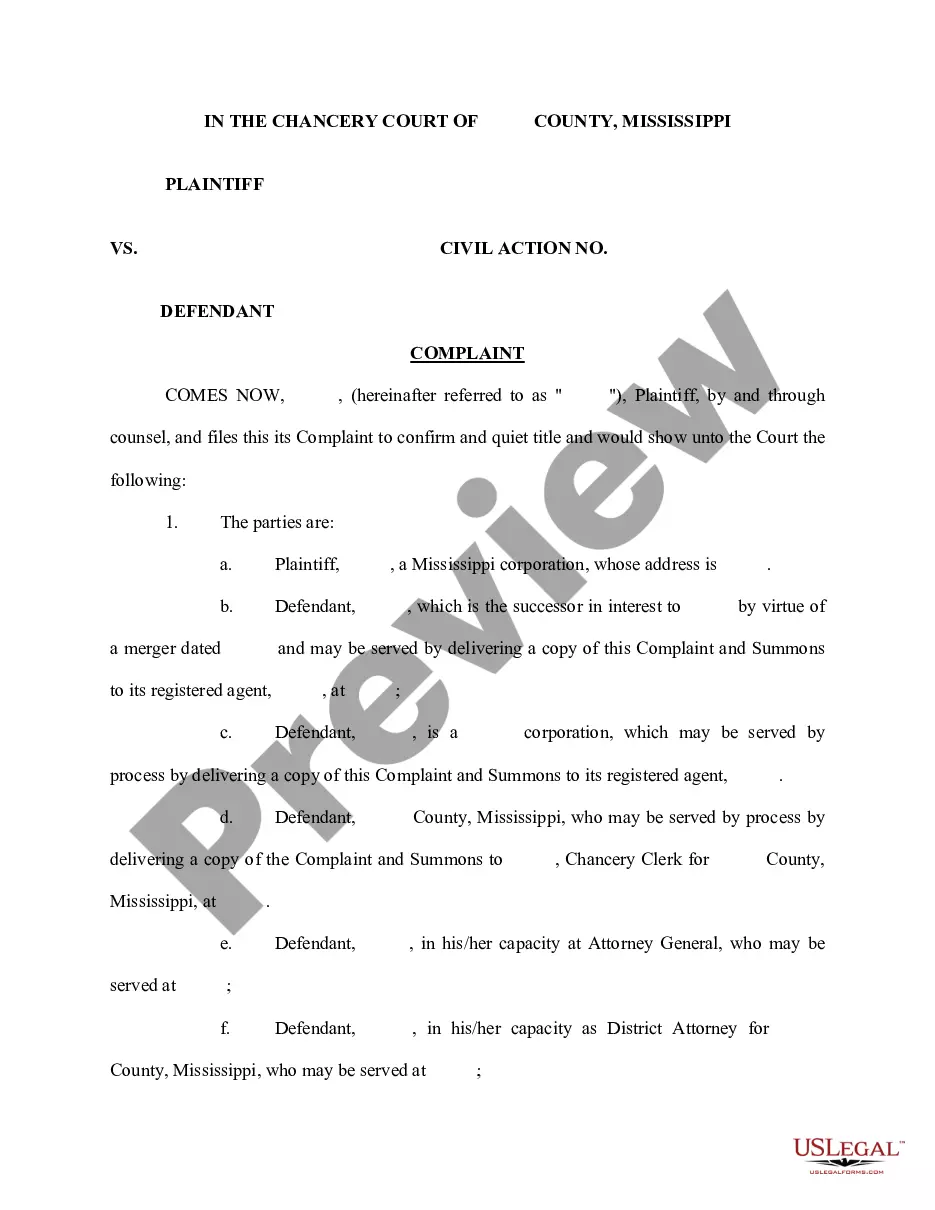

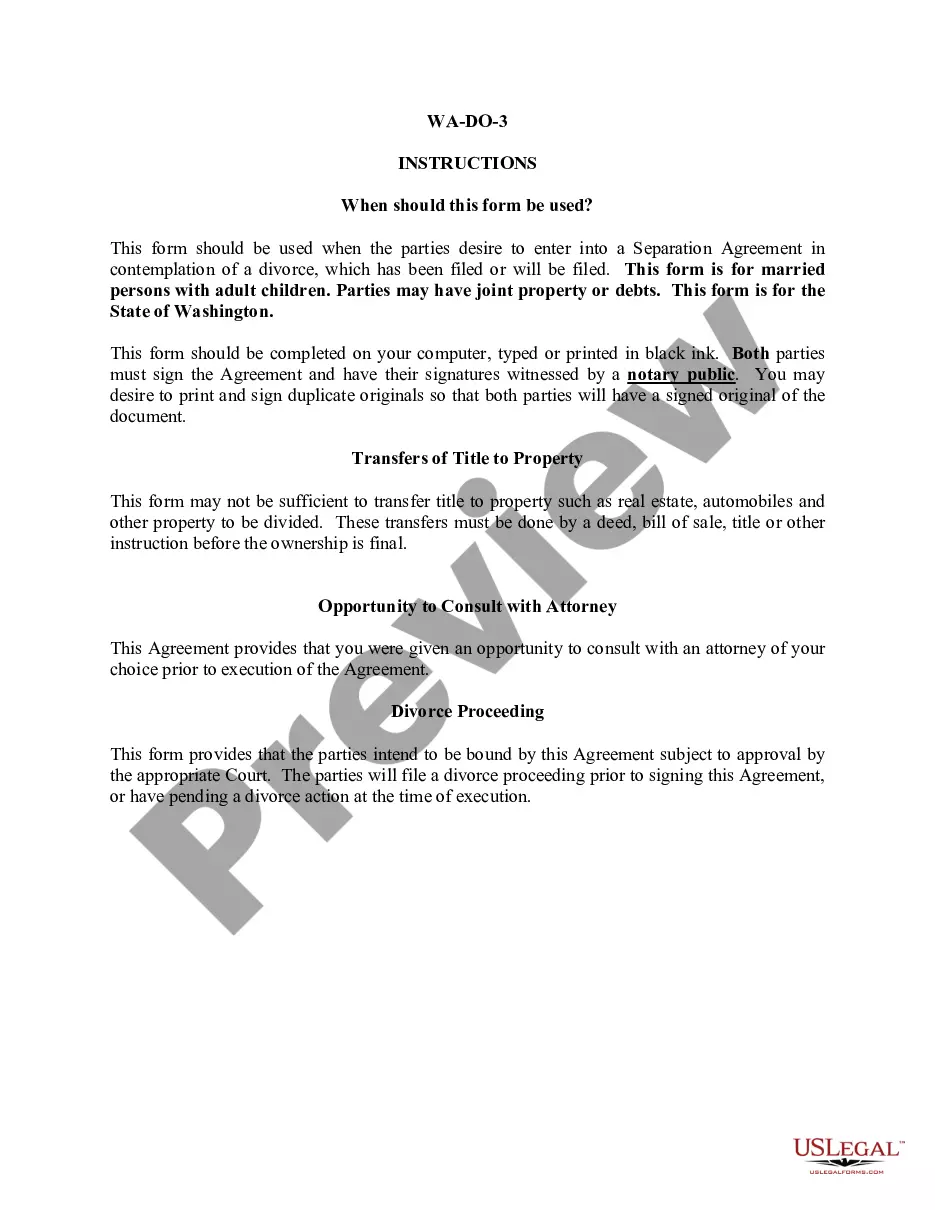

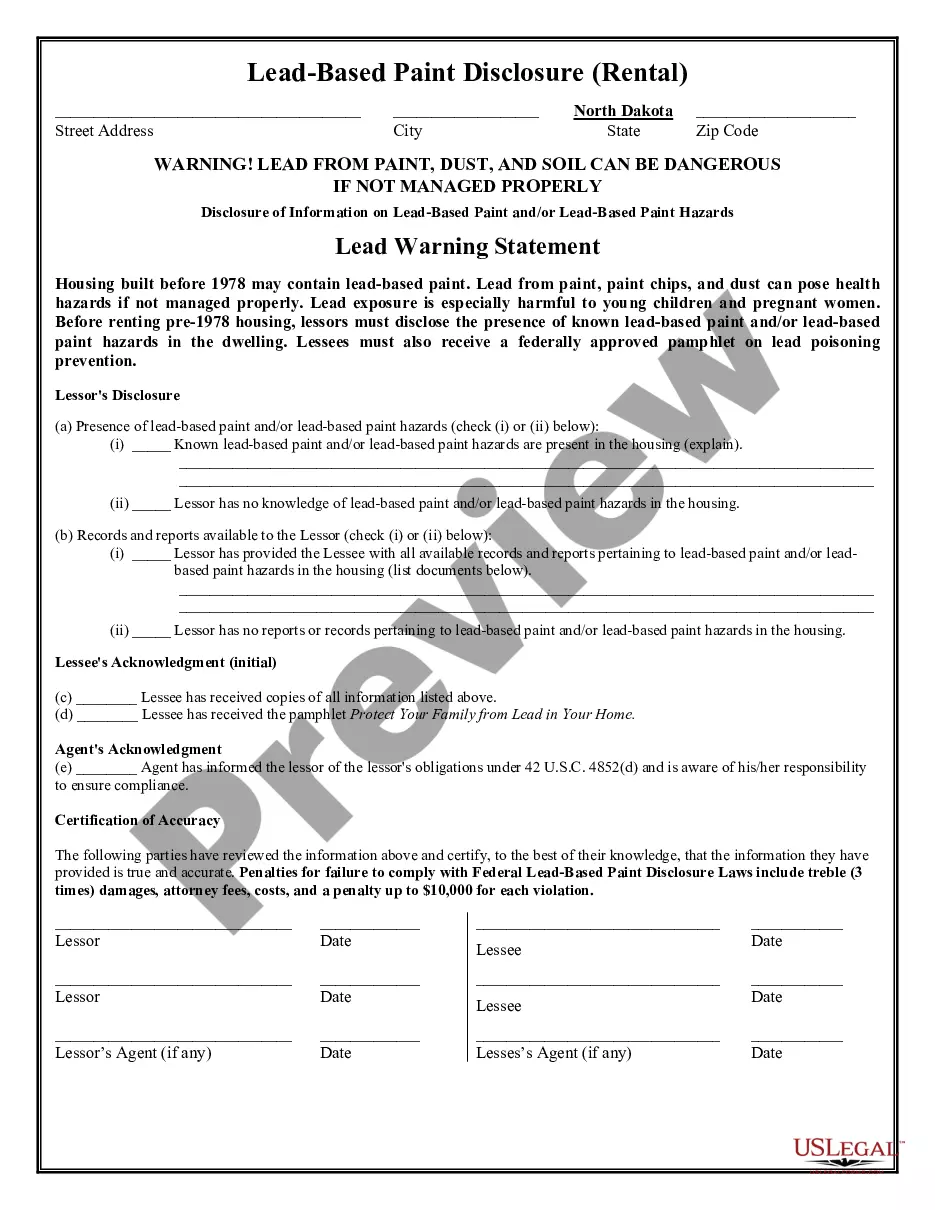

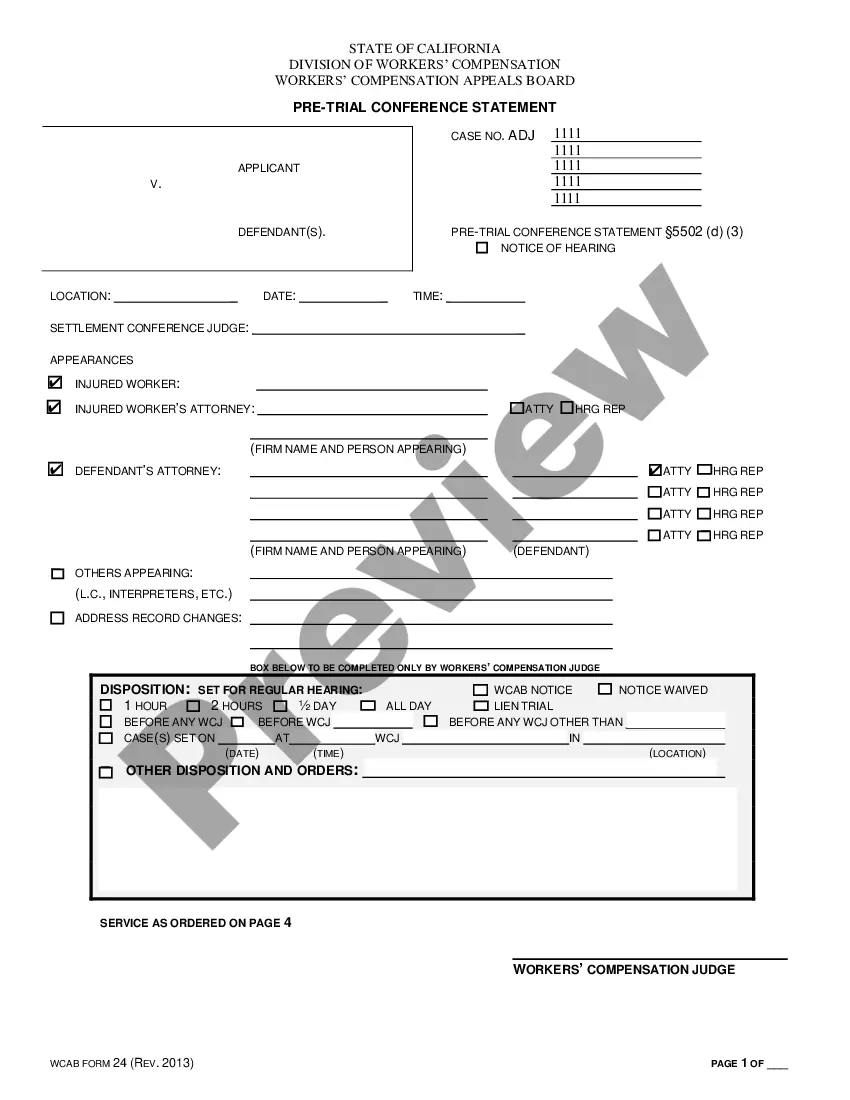

Selecting the appropriate legal document format can be a challenge. Of course, there are numerous templates accessible online, but how do you obtain the legal document you need? Use the US Legal Forms website. The service provides a vast array of templates, such as the Oregon Self-Employed Seamstress Services Agreement, that you can utilize for business and personal purposes. All of the documents are verified by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click on the Download button to acquire the Oregon Self-Employed Seamstress Services Agreement. Use your account to access the legal documents you have purchased previously. Navigate to the My documents section of your account and obtain another copy of the document you need.

If you are a new user of US Legal Forms, here are straightforward instructions you should follow: First, ensure you have chosen the correct document for your city/county. You can view the document using the Preview button and review the document overview to confirm it is suitable for you. If the document does not fulfill your requirements, utilize the Search area to find the correct document. Once you are certain that the document is appropriate, click the Purchase now button to obtain the document. Select the pricing plan you need and enter the required information. Create your account and complete the purchase using your PayPal account or Visa or Mastercard. Choose the file format and download the legal document format to your device. Complete, modify, print, and sign the acquired Oregon Self-Employed Seamstress Services Agreement. US Legal Forms is the largest collection of legal documents where you can find various document templates. Use the service to download professionally crafted paperwork that meets state requirements.

US Legal Forms is the largest collection of legal documents where you can find various document templates.

- Selecting the appropriate legal document format can be a challenge.

- Of course, there are numerous templates accessible online.

- If you are already registered, Log In to your account.

- Use your account to access the legal documents you have purchased previously.

- If you are a new user of US Legal Forms, here are straightforward instructions you should follow.

- Complete, modify, print, and sign the acquired Oregon Self-Employed Seamstress Services Agreement.

Form popularity

FAQ

Yes, contract workers are typically classified as self-employed individuals. This means they operate their own businesses and are responsible for their own taxes, benefits, and expenses. If you are providing services under an Oregon Self-Employed Seamstress Services Contract, you are essentially running your own business. This classification gives you the flexibility to set your own hours and choose your clients.

Yes, registering your business as an independent contractor is important for legal and tax purposes. In Oregon, you may need to obtain a business license, especially if you plan to operate under a specific business name. This step helps you formally establish your Oregon Self-Employed Seamstress Services Contract and ensures compliance with local regulations. Additionally, registering can enhance your credibility with clients.

In Oregon, the amount of work you can do without a contractor license varies depending on the type of services offered. For many self-employed individuals, including seamstresses, there may be no specific license required for freelance work. However, having an Oregon Self-Employed Seamstress Services Contract will help ensure that your business operations are compliant, regardless of licensing requirements.

Labor laws generally do not apply to 1099 independent workers in the same way they do for employees. Independent contractors have more freedom in how they operate their businesses. However, having an Oregon Self-Employed Seamstress Services Contract can provide guidelines that help maintain compliance with applicable regulations and clarify the working relationship.

Legal requirements for independent contractors include obtaining necessary licenses, reporting income accurately, and paying self-employment taxes. In Oregon, it is crucial to have a clear agreement, such as an Oregon Self-Employed Seamstress Services Contract, that outlines the scope of work and payment terms. This contract serves as documentation of your independent status and protects your rights.

Certain workers, like independent contractors and some specific job categories, may be exempt from Oregon's minimum wage laws. However, independent contractors must still adhere to the terms outlined in their contracts. If you are a self-employed seamstress, it is essential to understand your rights and responsibilities, which can be detailed in your Oregon Self-Employed Seamstress Services Contract.

Yes, self-employed individuals should have a contract. A contract, like the Oregon Self-Employed Seamstress Services Contract, outlines the terms of the work, payment, and expectations. This protects both you and your client, providing a clear framework for your services and helping to prevent misunderstandings.

No, a 1099 independent contractor is not considered an employee. Instead, these contractors operate as self-employed individuals, which gives them more flexibility but also means they are responsible for their own taxes. When you create an Oregon Self-Employed Seamstress Services Contract, you establish the independent nature of your work relationship, ensuring clarity for both parties.

To establish yourself as an independent contractor, begin by defining the services you offer and how you will market them. Create an Oregon Self-Employed Seamstress Services Contract that outlines your terms, which helps clarify your business relationship with clients. Additionally, register your business where necessary, obtain the appropriate licenses, and consider consulting resources like uslegalforms to ensure compliance with all legal requirements. This proactive approach sets a solid foundation for your self-employment journey.

The 4-hour rule in Oregon refers to the stipulation that independent contractors must work more than four hours in a single day to be classified as such for certain benefits. If you work fewer than four hours, you may be considered an employee under specific conditions. This rule is crucial for self-employed individuals, as it affects tax obligations and eligibility for benefits. Always consider documenting your hours in an Oregon Self-Employed Seamstress Services Contract to avoid misunderstandings.