Oregon Self-Employed Lifeguard Services Contract

Description

How to fill out Self-Employed Lifeguard Services Contract?

You can utilize your time on the web searching for the sanctioned document formats that comply with federal and state requirements you necessitate.

US Legal Forms provides thousands of sanctioned forms that have been vetted by professionals.

You can acquire or print the Oregon Self-Employed Lifeguard Services Agreement from our assistance.

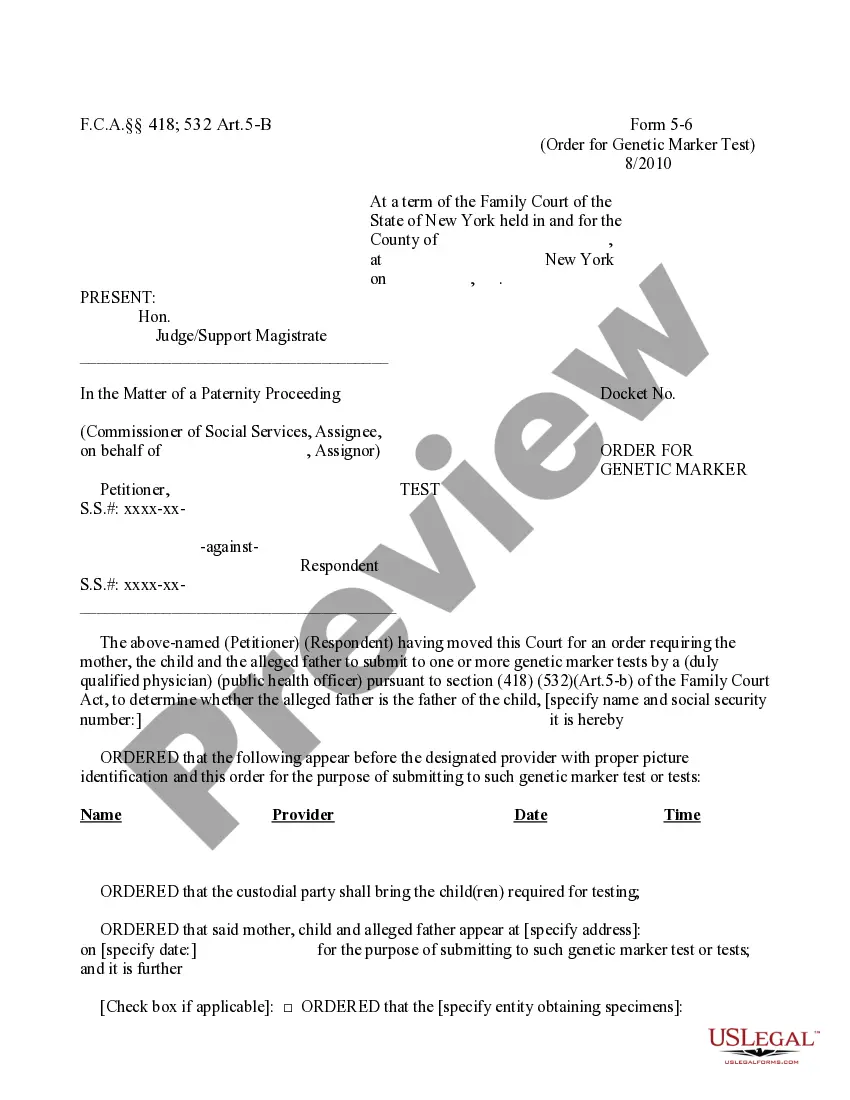

If available, utilize the Preview button to examine the document format as well.

- If you already possess a US Legal Forms account, you can Log In and click on the Download button.

- Then, you can complete, modify, print, or sign the Oregon Self-Employed Lifeguard Services Agreement.

- Every sanctioned document format you obtain is yours permanently.

- To retrieve an additional copy of a purchased form, head to the My documents tab and click the appropriate button.

- If you are visiting the US Legal Forms site for the first time, follow the simple guidelines listed below.

- First, ensure you have selected the correct document format for the region/area you choose.

- Review the form description to confirm you have chosen the right one.

Form popularity

FAQ

No, Oregon does not issue an independent contractor license. Although various trades and professional occupations may have licensure requirements, merely holding such a license does not make anyone into an independent contractor.

File an unemployment claim 200bUse the Contact Us form or visit unemployment.oregon.gov. Looking for work? WorkSource Oregon can help you find a job, training and other free resources. 200b200b200b200b200bWe have helped more than 1500 Oregonians receiving unemployment insurance (UI) benefits successfully start their own business.

The threshold for performing certain work without a contractor license increased from $500 to $1,000. To qualify for the exemption, a contractor must perform work that is casual, minor or inconsequential. This means that the work cannot: Be structural in nature.

What is an independent contractor? Under Oregon law, an independent contractor must be: free from direction and control over the means and manner of providing the services, subject only to the right to specify the desired results; is customarily engaged in an independently established business; and.

Make sure you really qualify as an independent contractor. Choose a business name (and register it, if necessary). Get a tax registration certificate (and a vocational license, if required for your profession). Pay estimated taxes (advance payments of your income and self-employment taxes).

Independent contractors cannot use the wages they earn to qualify for unemployment insurance benefits when they are unemployed. 6. Independent contractors are generally not eligible for other employment benefits, such as health insurance and pension plans.

Companies that need to be licensed include commercial and residential contractors, subcontractors, developers, locksmiths, home energy analysts, landscapers, and many others. There are several types of Oregon contractor licenses which the state calls endorsements for contractors to choose from.

Follow these steps on how to become an independent contractor:Identify your business structure.Choose and register your business name.Get business licenses and permit.Get a business number and find your taxation requirements.Get insurance for your business.Establish the requirements for your workplace safety.More items...?

How Do You Become Self-Employed?Think of a Name for Your Self-Employed Business. Consider what services you will offer, and then pick a name that describes what you do.Choose a Self-Employed Business Structure and Get a Proper License.Open a Business Bank Account.Advertise Your Independent Contractor Services.

Every independent contractor is a business owner. You run a business even if you are your only employee and you don't have a company name. There are significant differences, however, between a business that's just you as an independent contractor and running a company with employees and a registered name.