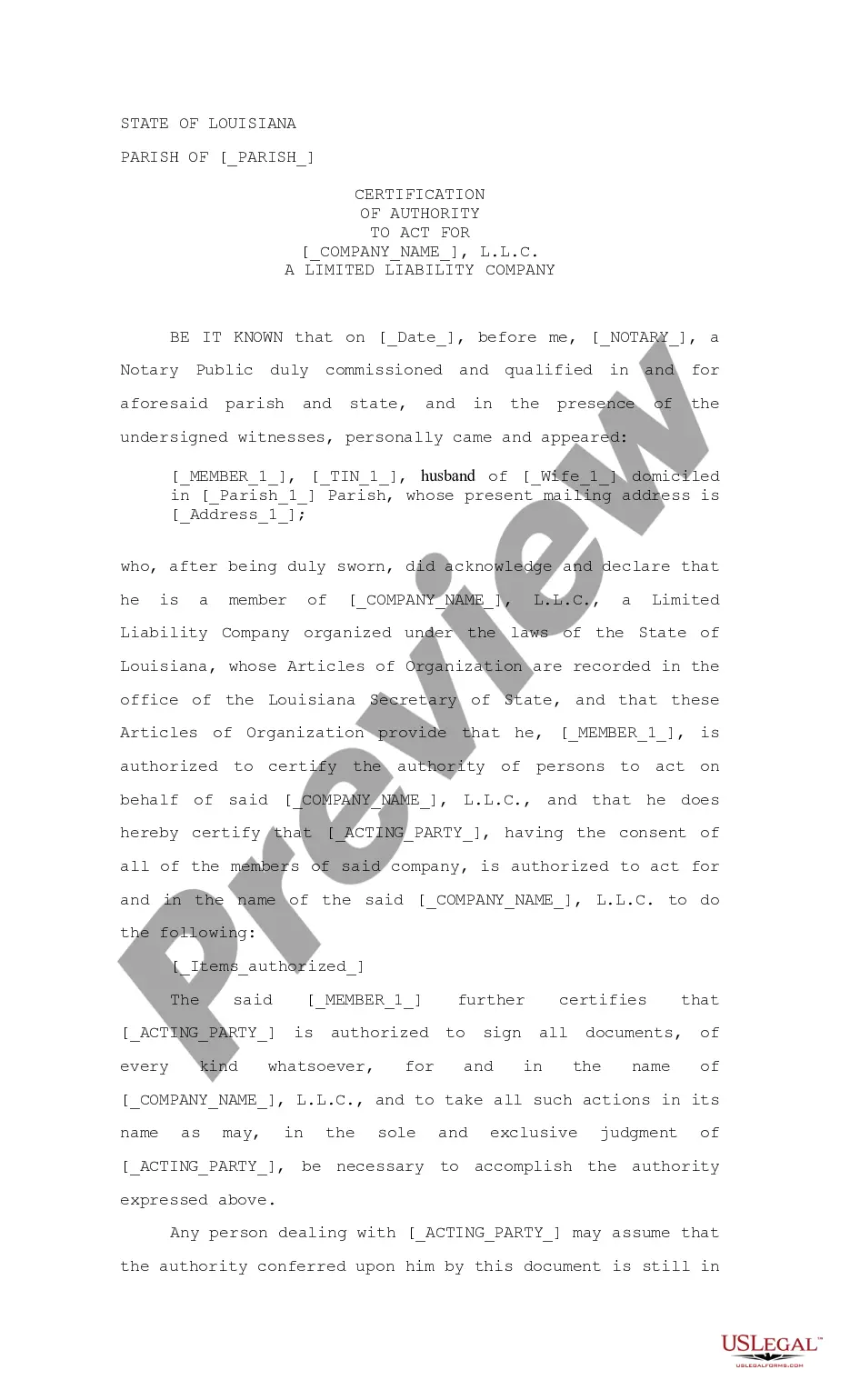

Louisiana Certification of Authority to Act for a Limited Liability Company LLC

Description

How to fill out Louisiana Certification Of Authority To Act For A Limited Liability Company LLC?

You are invited to the most extensive legal document library, US Legal Forms.

Here, you can discover any template, including Louisiana Certification of Authority to Act for a Limited Liability Company (LLC) forms and download them (as many as you desire). Prepare official papers in a few hours instead of days or weeks, without paying a fortune to an attorney.

Obtain your state-specific template in just a few clicks and feel assured knowing it was created by our licensed attorneys.

If the template suits your requirements, click Buy Now. To create an account, select a pricing plan. Utilize a credit card or PayPal account to register. Download the document in the format you need (Word or PDF). Print the document and complete it with your or your business’s information. After you’ve filled out the Louisiana Certification of Authority to Act for a Limited Liability Company LLC, send it to your attorney for validation. It’s an extra step but crucial for ensuring you’re fully protected. Join US Legal Forms now and gain access to a vast array of reusable templates.

- If you’re already a registered user, simply Log In to your account and click Download next to the Louisiana Certification of Authority to Act for a Limited Liability Company LLC you want.

- As US Legal Forms is internet-based, you'll typically have access to your downloaded documents, regardless of the device you're using.

- View them within the My documents section.

- If you do not possess an account yet, what are you waiting for.

- Follow our instructions below to get started.

- If this is a state-specific template, verify its validity in the state where you reside.

- Review the description (if available) to see if it’s the correct template.

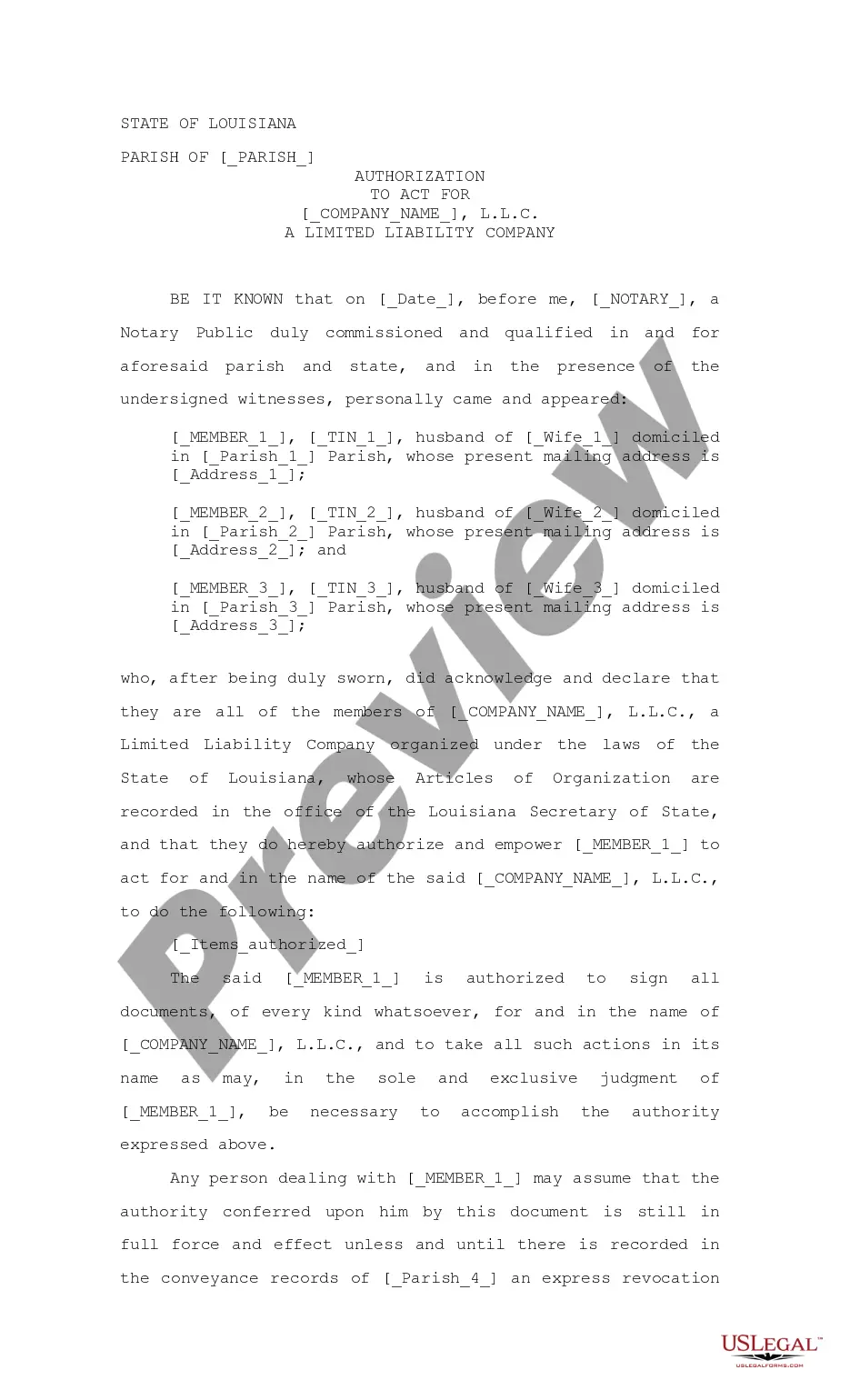

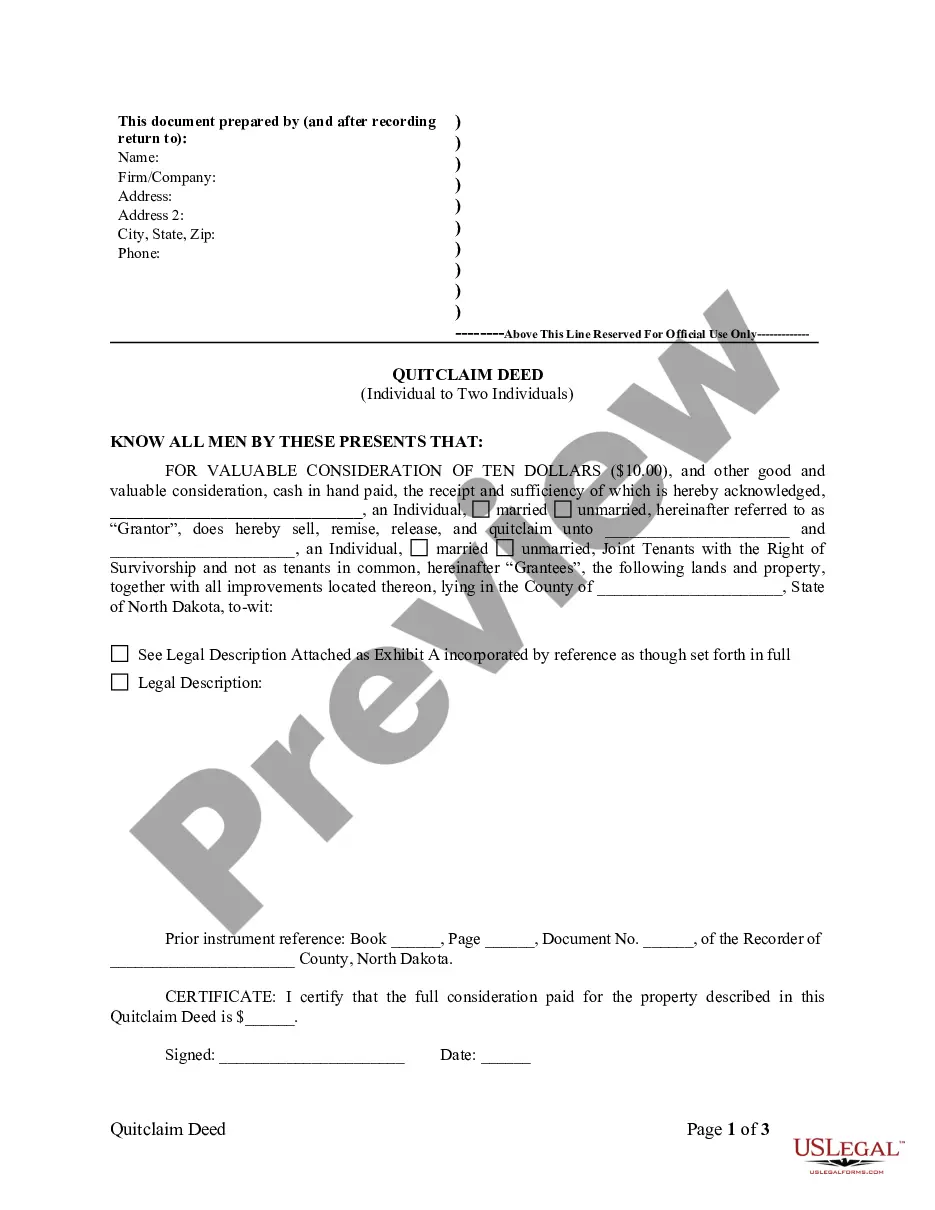

- Explore more details with the Preview feature.

Form popularity

FAQ

How do I add or delete someone from my company? You may add or delete a registered agent by filing the Change of Registered Office or Agent form. You may add or delete a manager/member or officer/director by filing either the Notice of Change of Member/Manager form or the Notice of Change of Officer/Director form.

A California Certificate of Status (Good Standing Certificate) is a one-page document provided by the California Secretary of State that serves as conclusive proof that your California corporation, LLC, or registered partnership is in existence, in good standing (or in some cases suspended), and if in good standing

Who Should Form an LLC? Any person starting a business, or currently running a business as a sole proprietor, should consider forming an LLC. This is especially true if you're concerned with limiting your personal legal liability as much as possible. LLCs can be used to own and run almost any type of business.

Business Name. Your LLC must have a name that is unique and is not the same or confusingly similar to another business. Registered Agent. Operating Agreement. Articles of Organization. Business Licenses and Permits. Statement of Information Form. Tax Forms.

You can file online at Louisiana's geauxBIZ website or you can complete the application for registration of trade name form. The application will ask for your new DBA name and information about your business, such as: Section 2: Applicant's state of incorporation (if applicable) Section 5: Type of business.

Once your business remains compliant with the state, you can request a Louisiana certificate of good standing from the Secretary of State. This can be done online or by submitting a written request by mail or by fax.

If you need to verify that all outstanding tax liabilities for a Louisiana Corporation or Louisiana LLC have been paid then you need a Louisiana Tax Status Compliance Certificate.

Choose a name for your LLC. File Articles of Organization. Choose a registered agent. Decide on member vs. manager management. Create an LLC operating agreement. Comply with other tax and regulatory requirements. File annual reports. Out of state LLC registration.

Once a business entity or registration is properly formed, incorporated, organized or registered on record with this office, it is not required to purchase or receive a certificate of status to be considered valid.Care should be taken to know the items needed for your business to remain up to date with yearly reports.