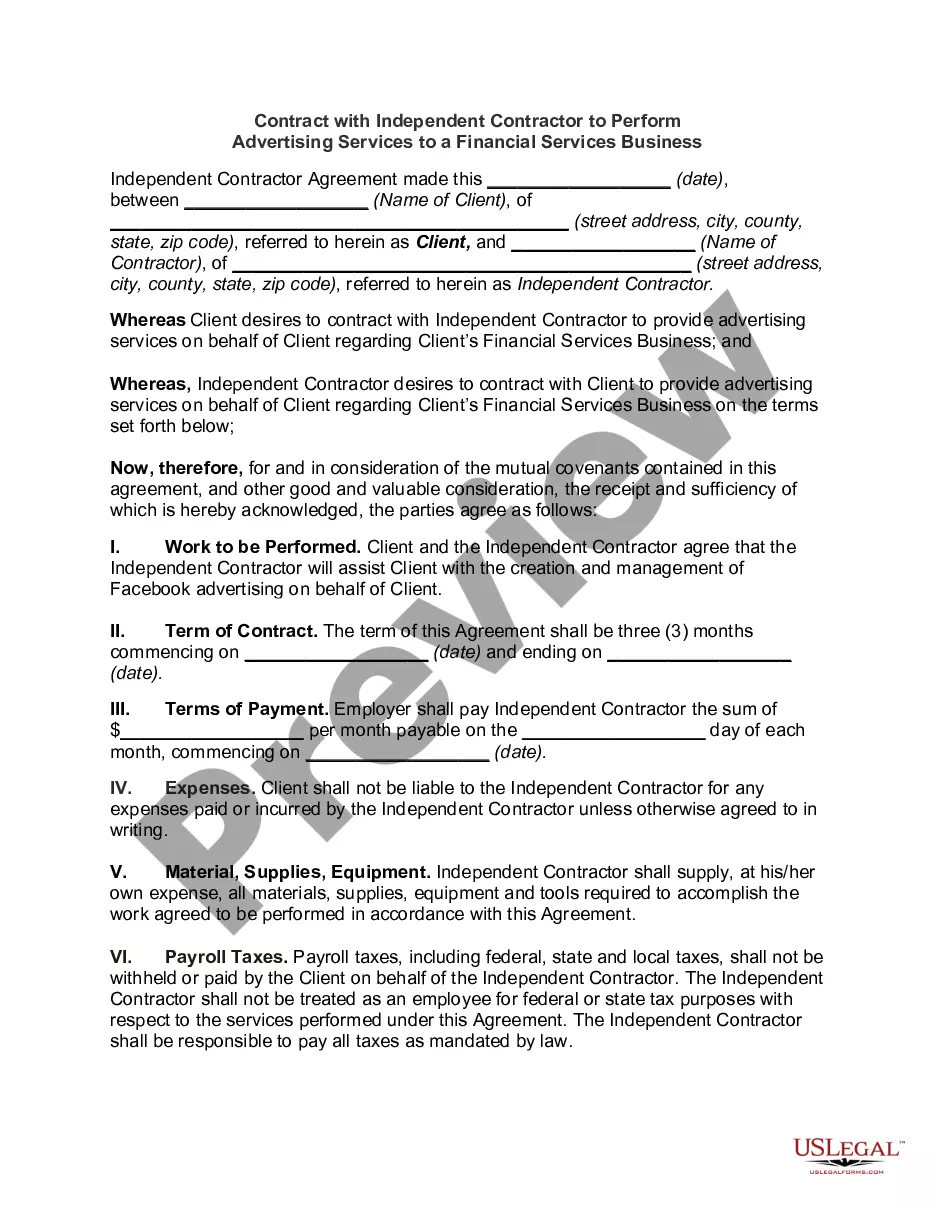

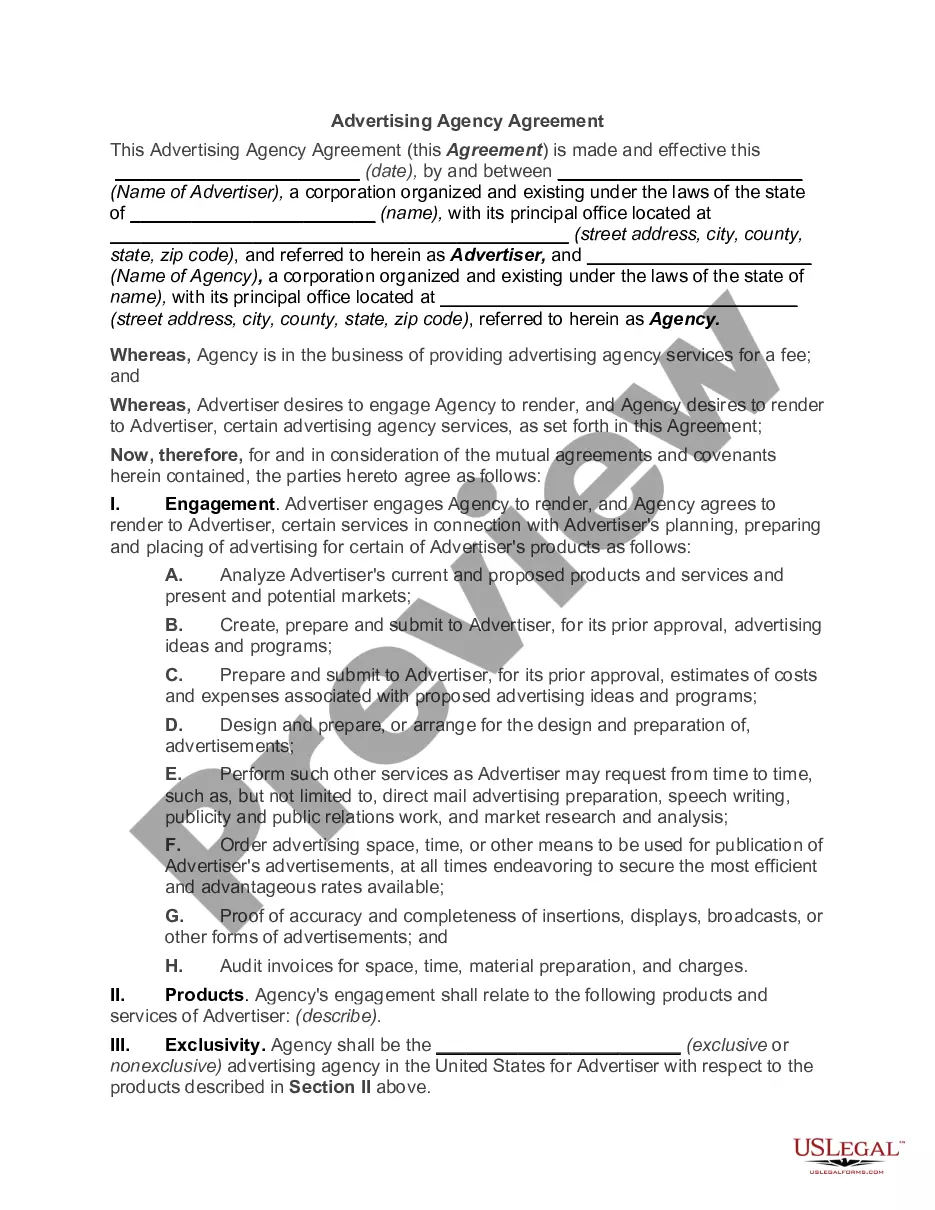

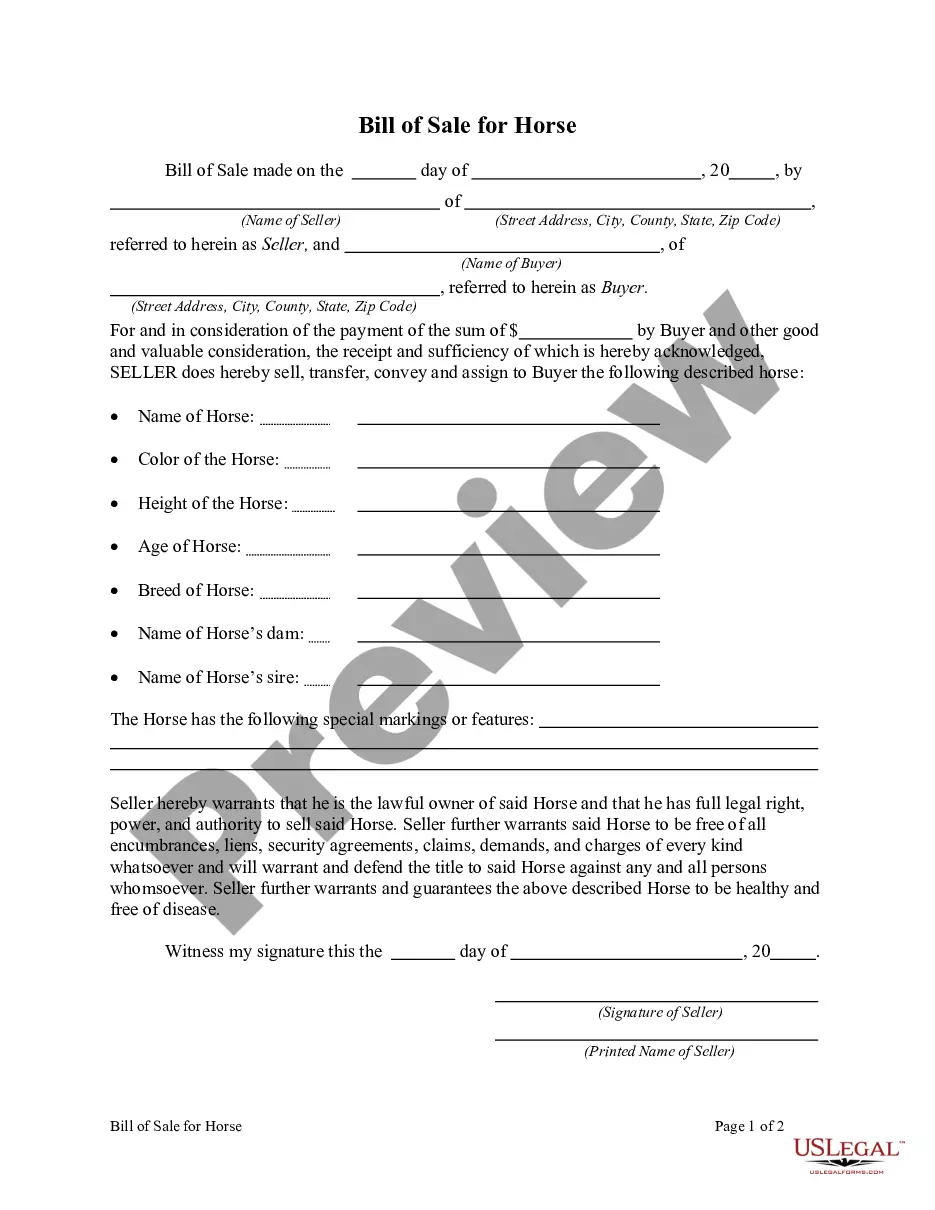

Oregon Advertising Executive Agreement - Self-Employed Independent Contractor

Description

How to fill out Advertising Executive Agreement - Self-Employed Independent Contractor?

Choosing the best legitimate papers format could be a have difficulties. Needless to say, there are plenty of web templates available online, but how would you get the legitimate form you need? Use the US Legal Forms internet site. The service delivers 1000s of web templates, including the Oregon Advertising Executive Agreement - Self-Employed Independent Contractor, which can be used for organization and personal requires. Every one of the forms are inspected by specialists and meet up with federal and state requirements.

Should you be currently authorized, log in to the account and click on the Download option to get the Oregon Advertising Executive Agreement - Self-Employed Independent Contractor. Make use of account to check with the legitimate forms you might have ordered in the past. Proceed to the My Forms tab of the account and have another copy of your papers you need.

Should you be a fresh customer of US Legal Forms, listed here are basic guidelines so that you can follow:

- Initially, make certain you have chosen the correct form to your area/county. It is possible to look through the shape while using Preview option and study the shape outline to ensure this is the right one for you.

- In case the form will not meet up with your requirements, use the Seach field to find the proper form.

- Once you are certain that the shape is suitable, click the Buy now option to get the form.

- Opt for the rates program you would like and type in the required details. Design your account and pay for the transaction with your PayPal account or Visa or Mastercard.

- Select the data file format and down load the legitimate papers format to the system.

- Full, change and print and sign the acquired Oregon Advertising Executive Agreement - Self-Employed Independent Contractor.

US Legal Forms may be the largest local library of legitimate forms for which you can find various papers web templates. Use the service to down load appropriately-made paperwork that follow express requirements.

Form popularity

FAQ

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

No, Oregon does not issue an independent contractor license. Although various trades and professional occupations may have licensure requirements, merely holding such a license does not make anyone into an independent contractor.

Generally, Oregon law requires anyone who works for compensation in any construction activity involving improvements to real property to be licensed. Learn more200b. Licensing steps: 1.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

What is an independent contractor? Under Oregon law, an independent contractor must be: free from direction and control over the means and manner of providing the services, subject only to the right to specify the desired results; is customarily engaged in an independently established business; and.

1099. Every independent contractor is a business owner. You run a business even if you are your only employee and you don't have a company name. There are significant differences, however, between a business that's just you as an independent contractor and running a company with employees and a registered name.

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

The IRS says that someone is self-employed if they meet one of these conditions:Someone who carries on a trade or business as a sole proprietor or independent contractor,A member of a partnership that carries on a trade or business, or.Someone who is otherwise in business for themselves, including part-time business.

The threshold for performing certain work without a contractor license increased from $500 to $1,000. To qualify for the exemption, a contractor must perform work that is casual, minor or inconsequential. This means that the work cannot: Be structural in nature.