Oregon Contract with Independent Contractor to Perform Advertising Services to a Financial Services Business

Description

How to fill out Contract With Independent Contractor To Perform Advertising Services To A Financial Services Business?

If you desire to be thorough, secure, or print legal document templates, utilize US Legal Forms, the largest collection of legal documents available online.

Take advantage of the site’s straightforward and user-friendly search to obtain the documents you require.

Various templates for business and personal needs are categorized by categories and claims or keywords.

Step 4. Once you have found the form you require, click on the Get now button. Choose the pricing plan you prefer and enter your information to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Utilize US Legal Forms to obtain the Oregon Contract with Independent Contractor to Perform Advertising Services for a Financial Services Business in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click on the Obtain button to get the Oregon Contract with Independent Contractor to Perform Advertising Services for a Financial Services Business.

- You can also access forms you previously obtained from the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct state/region.

- Step 2. Utilize the Review feature to examine the form’s details. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of your legal form template.

Form popularity

FAQ

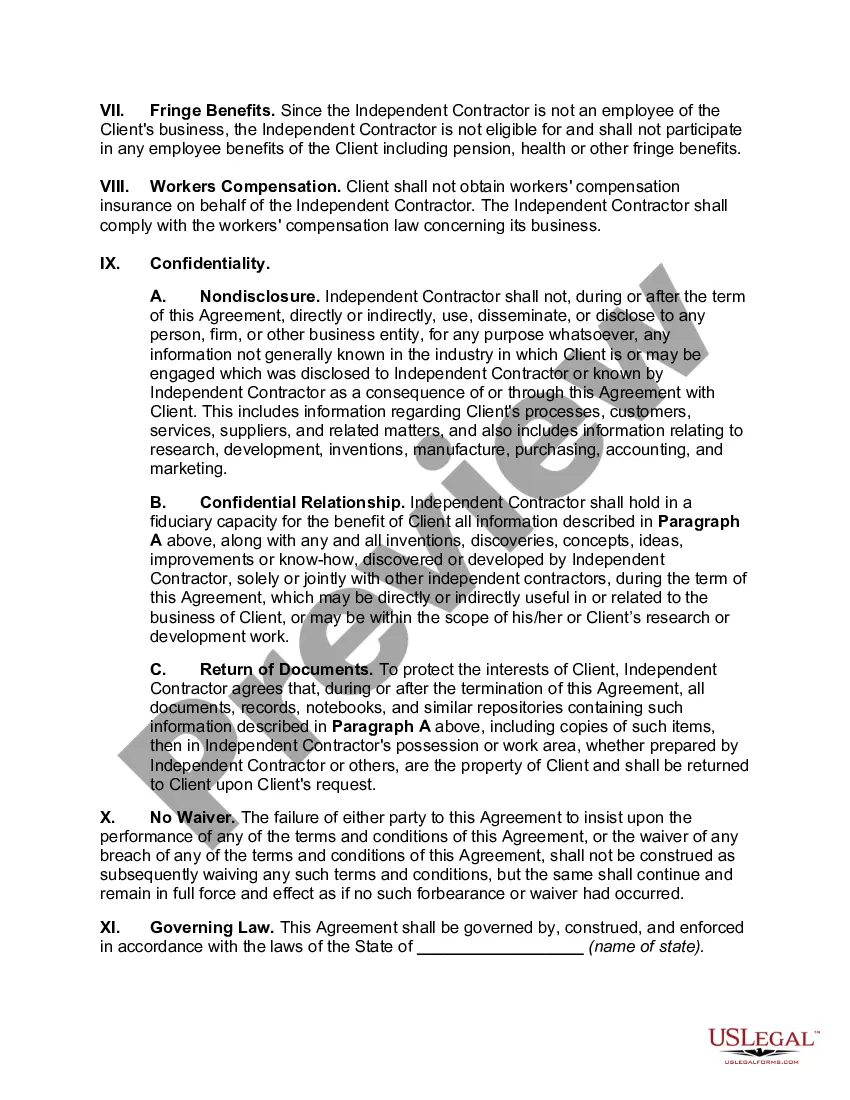

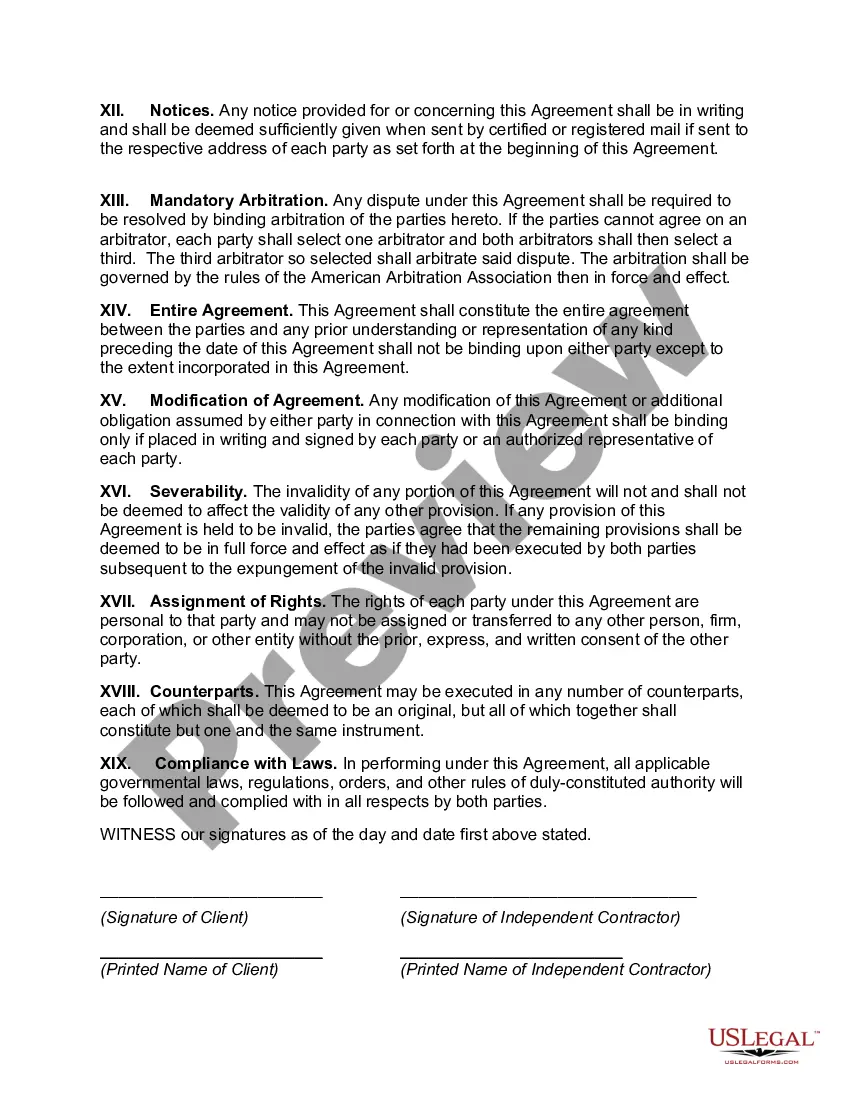

In Oregon, independent contractors are not considered employees of businesses and are not subject to employment laws, rules or protections provided to actual employees.

The threshold for performing certain work without a contractor license increased from $500 to $1,000. To qualify for the exemption, a contractor must perform work that is casual, minor or inconsequential. This means that the work cannot: Be structural in nature.

File an unemployment claim 200bUse the Contact Us form or visit unemployment.oregon.gov. Looking for work? WorkSource Oregon can help you find a job, training and other free resources. 200b200b200b200b200bWe have helped more than 1500 Oregonians receiving unemployment insurance (UI) benefits successfully start their own business.

What is an independent contractor? Under Oregon law, an independent contractor must be: free from direction and control over the means and manner of providing the services, subject only to the right to specify the desired results; is customarily engaged in an independently established business; and.

Independent contractors are not covered by workers' compensation insurance. They are not entitled to receive benefits if they are injured on the job. 5. Independent contractors cannot use the wages they earn to qualify for unemployment insurance benefits when they are unemployed.

Independent contractors are not covered by workers' compensation insurance. They are not entitled to receive benefits if they are injured on the job. 5. Independent contractors cannot use the wages they earn to qualify for unemployment insurance benefits when they are unemployed.

Do independent contractors qualify for unemployment insurance? Yes, with the passing of the CARES Act, independent contractors, gig workers, and self-employed individuals are eligible for unemployment insurance if they are unable to work due to COVID-19.

Every independent contractor is a business owner. You run a business even if you are your only employee and you don't have a company name. There are significant differences, however, between a business that's just you as an independent contractor and running a company with employees and a registered name.

Who Needs a Contractors License? The Oregon Construction Contractors Board states specifically that anyone who works for compensation in any construction activity involving improvements to real property needs a license. Common construction roles include: Roofing.

No, Oregon does not issue an independent contractor license. Although various trades and professional occupations may have licensure requirements, merely holding such a license does not make anyone into an independent contractor.