Oregon Tutoring Agreement - Self-Employed Independent Contractor

Description

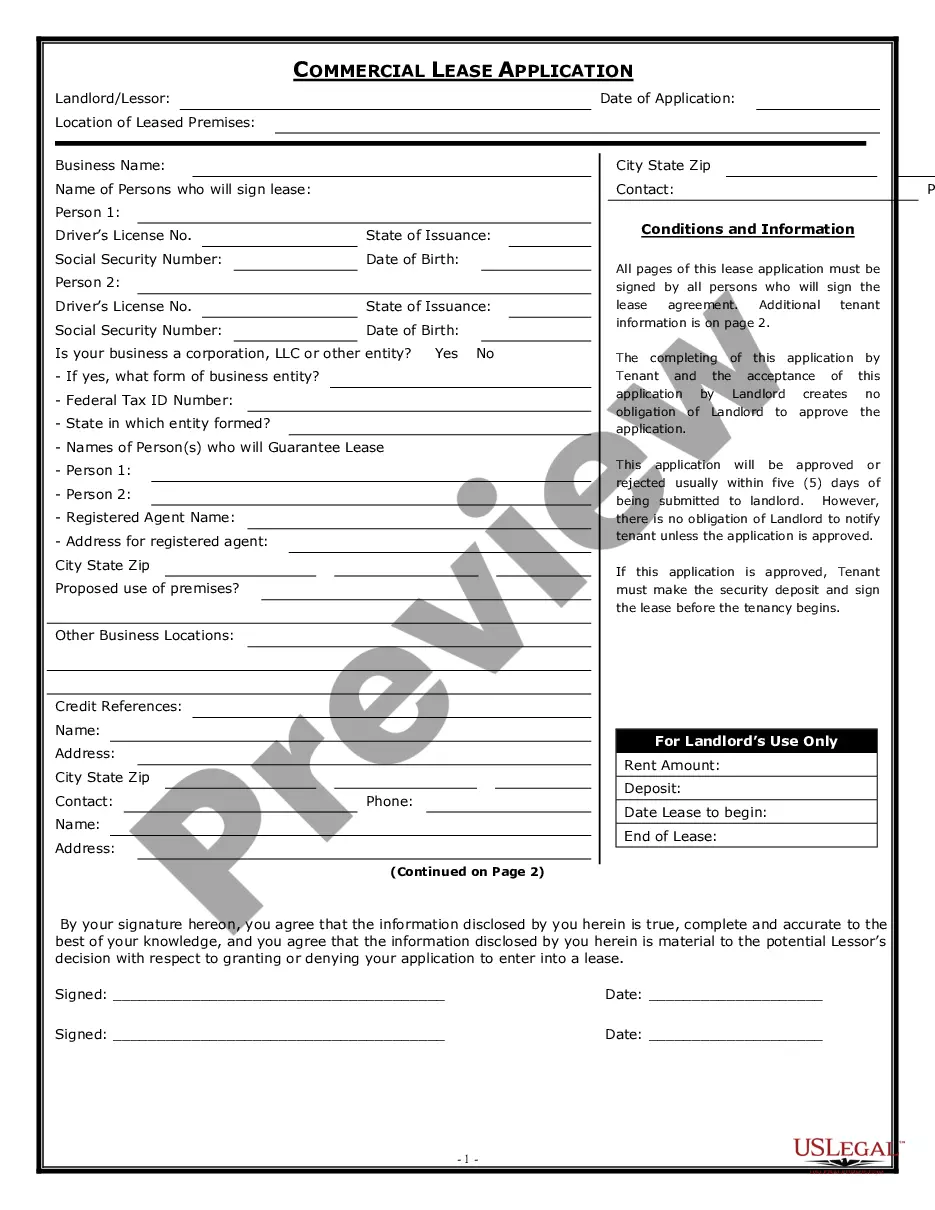

How to fill out Tutoring Agreement - Self-Employed Independent Contractor?

If you need to thorough, acquire, or create legal document templates, utilize US Legal Forms, the largest selection of legal forms, which are accessible online.

Take advantage of the site’s straightforward and convenient search to find the documents you require. A range of templates for commercial and personal purposes are organized by categories and states, or keywords.

Use US Legal Forms to locate the Oregon Tutoring Agreement - Self-Employed Independent Contractor within a few clicks.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

Step 6. Select the format of the legal form and download it to your device. Step 7. Complete, modify, and print or sign the Oregon Tutoring Agreement - Self-Employed Independent Contractor. Each legal document template you purchase is yours permanently. You will have access to every form you downloaded in your account. Click on the My documents section and select a form to print or download again. Stay competitive and obtain and print the Oregon Tutoring Agreement - Self-Employed Independent Contractor with US Legal Forms. There are thousands of professional and state-specific forms you can utilize for your business or personal needs.

- If you are already a US Legal Forms customer, Log In to your account and click the Obtain button to get the Oregon Tutoring Agreement - Self-Employed Independent Contractor.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, refer to the instructions below.

- Step 1. Make sure you have chosen the form for the correct city/state.

- Step 2. Use the Review option to examine the form’s content. Don’t forget to check the description.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have located the form you need, click the Buy now button. Choose the pricing plan you prefer and enter your details to register for an account.

Form popularity

FAQ

Tutoring is indeed classified as self-employment. As a tutor, you operate independently from schools or organizations, allowing you to determine your rates and schedules. An Oregon Tutoring Agreement can assist in outlining the specifics of your tutoring services, ensuring that both you and your clients are aligned. This formal approach not only protects you but also establishes professionalism in your business.

Yes, tutoring is generally considered self-employed work. Tutors often establish their own schedules and client lists, and they are responsible for their income and expenses. By utilizing an Oregon Tutoring Agreement, tutors can formalize their self-employed status, which allows for clear communication with clients regarding terms and conditions. This helps build trust and enhances professional relationships.

Being self-employed means running your own business and having the freedom to control how you work. Typically, this includes people who offer services and manage their business activities independently. If you’re a tutor with an Oregon Tutoring Agreement in place, you qualify as self-employed. This agreement clarifies your working status and ensures all parties understand their responsibilities.

As a self-employed independent contractor, you can often write off certain expenses related to tutoring on your taxes. This includes costs for materials, marketing, and even a portion of your home office if you work from home. To maximize your tax benefits, consider using an Oregon Tutoring Agreement to document your business dealings. This helps in keeping track of income and expenses efficiently.

Yes, a private tutor typically operates as a self-employed individual. They usually manage their hours, rates, and clients, which distinguishes them from employees within a school or organization. By creating an Oregon Tutoring Agreement, private tutors can outline their roles and obligations clearly. This formalizes their status as independent contractors, offering legal protection in their business dealings.

Tutors often fall under the category of independent contractors rather than traditional employees. This classification allows for greater flexibility in scheduling and client selection. Many tutors establish Oregon Tutoring Agreements to formalize their working relationship with clients, ensuring clarity regarding services and payments. Being a self-employed independent contractor gives tutors the freedom to set their terms while providing valuable educational support.

Creating an independent contractor agreement involves specifying the services offered, payment details, and the timeline for completion. You can enhance your contract by including terms related to confidentiality and termination. The Oregon Tutoring Agreement - Self-Employed Independent Contractor template available on uslegalforms can simplify this process. By using our platform, you can easily customize your agreement to suit your unique tutoring needs.

The new federal rule clarifies the classification of independent contractors, emphasizing the need for clear criteria in determining employment status. Under this rule, the distinction focuses on the level of control and independence in the working relationship. For those engaged in tutoring, having an Oregon Tutoring Agreement - Self-Employed Independent Contractor is vital to ensure compliance with federal guidelines. Staying informed about these regulations can protect your business and maintain lawful operations.

In Oregon, an independent contractor is someone who provides services under a contract and operates independently from the hiring entity. This means they have flexibility in managing their own workload and business practices. The Oregon Tutoring Agreement - Self-Employed Independent Contractor must affirm that you control how and when you work, distinguishing you from an employee. Understanding these qualifications can help freelancers and businesses uphold their rights.

An independent contractor agreement is a legal document that outlines the terms between a client and a self-employed individual. This Oregon Tutoring Agreement - Self-Employed Independent Contractor clarifies the scope of services, payment terms, and deadlines. It protects both parties by ensuring clear understanding and expectations about their working relationship. Utilizing a well-crafted agreement helps avoid potential misunderstandings down the line.