Oregon Educator Agreement - Self-Employed Independent Contractor

Description

How to fill out Educator Agreement - Self-Employed Independent Contractor?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal document templates that you can download or print. By using the website, you can access numerous forms for business and personal purposes, categorized by groups, states, or keywords. You can find the latest versions of forms like the Oregon Educator Agreement - Self-Employed Independent Contractor in just seconds.

If you already have a subscription, Log In and download the Oregon Educator Agreement - Self-Employed Independent Contractor from the US Legal Forms library. The Download option will appear on each form you view. You have access to all previously obtained forms in the My documents section of your account.

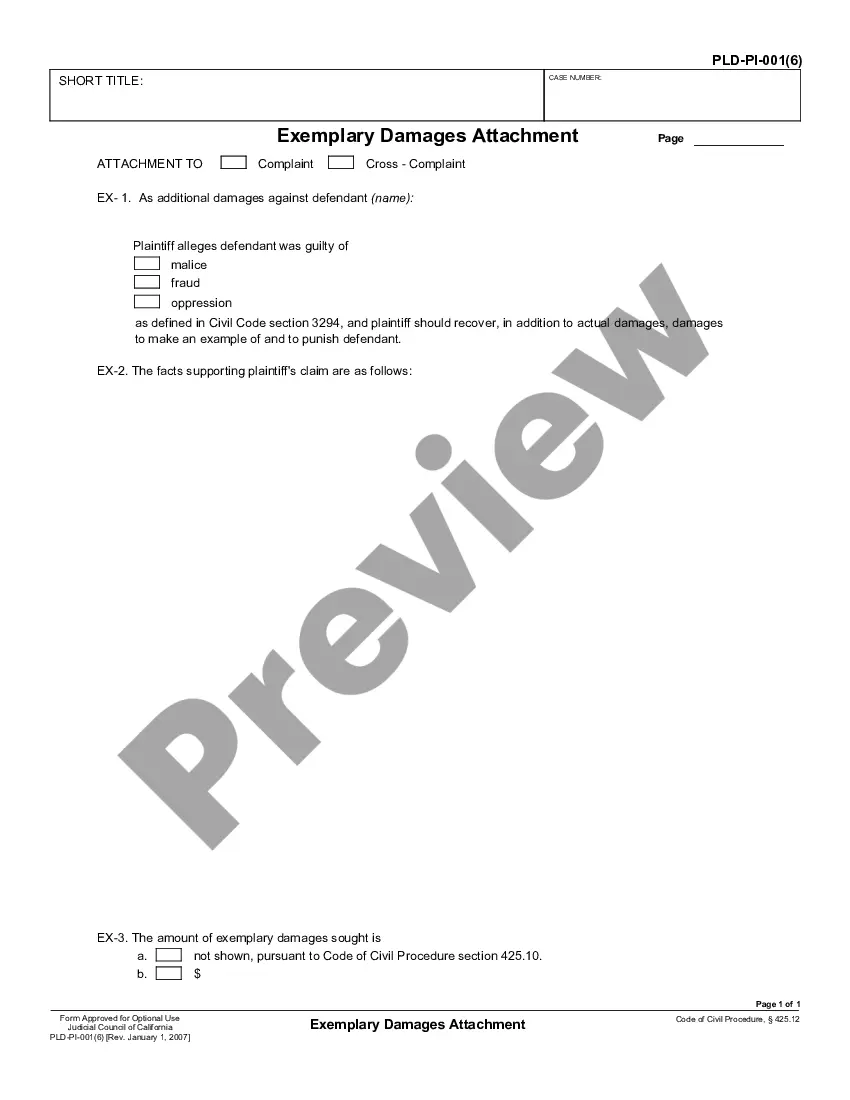

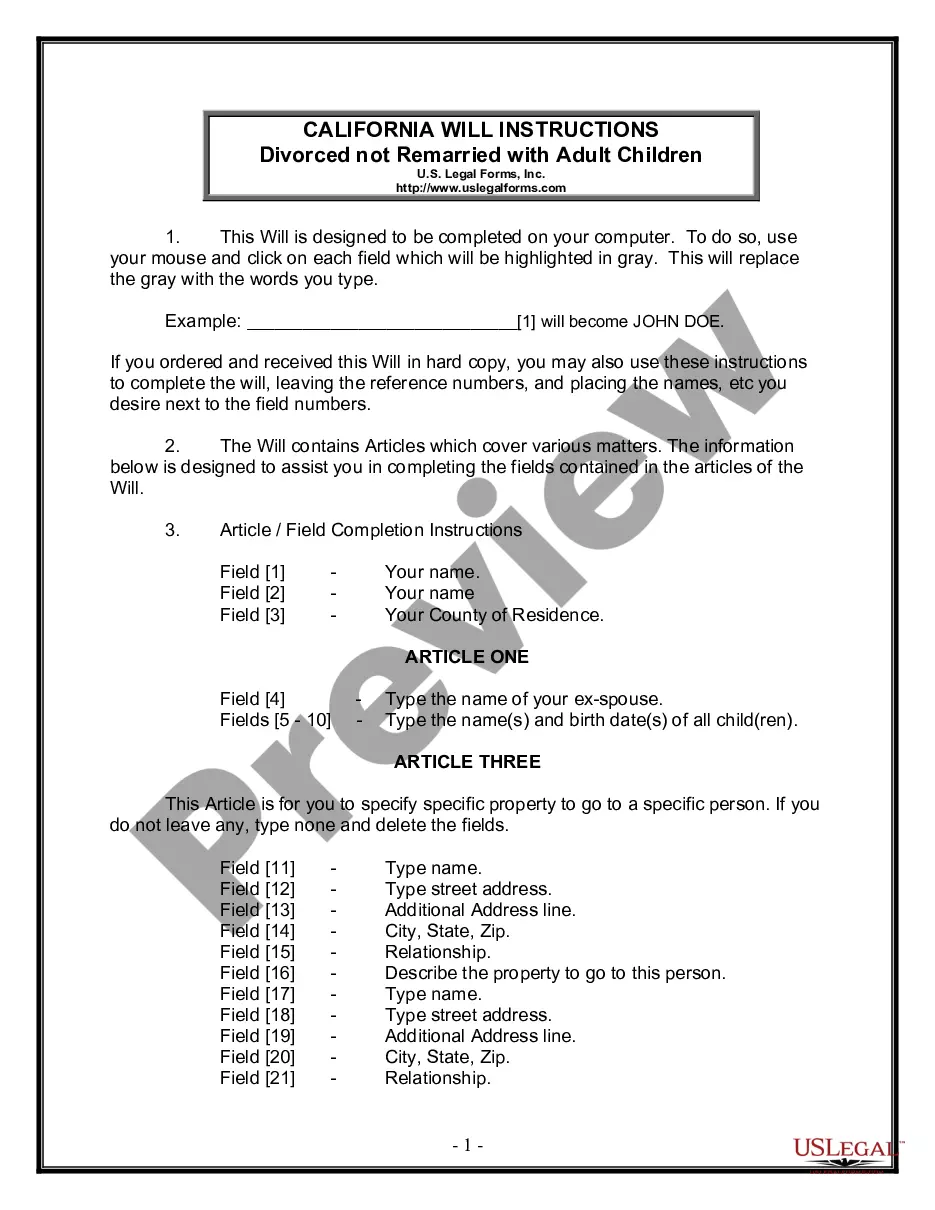

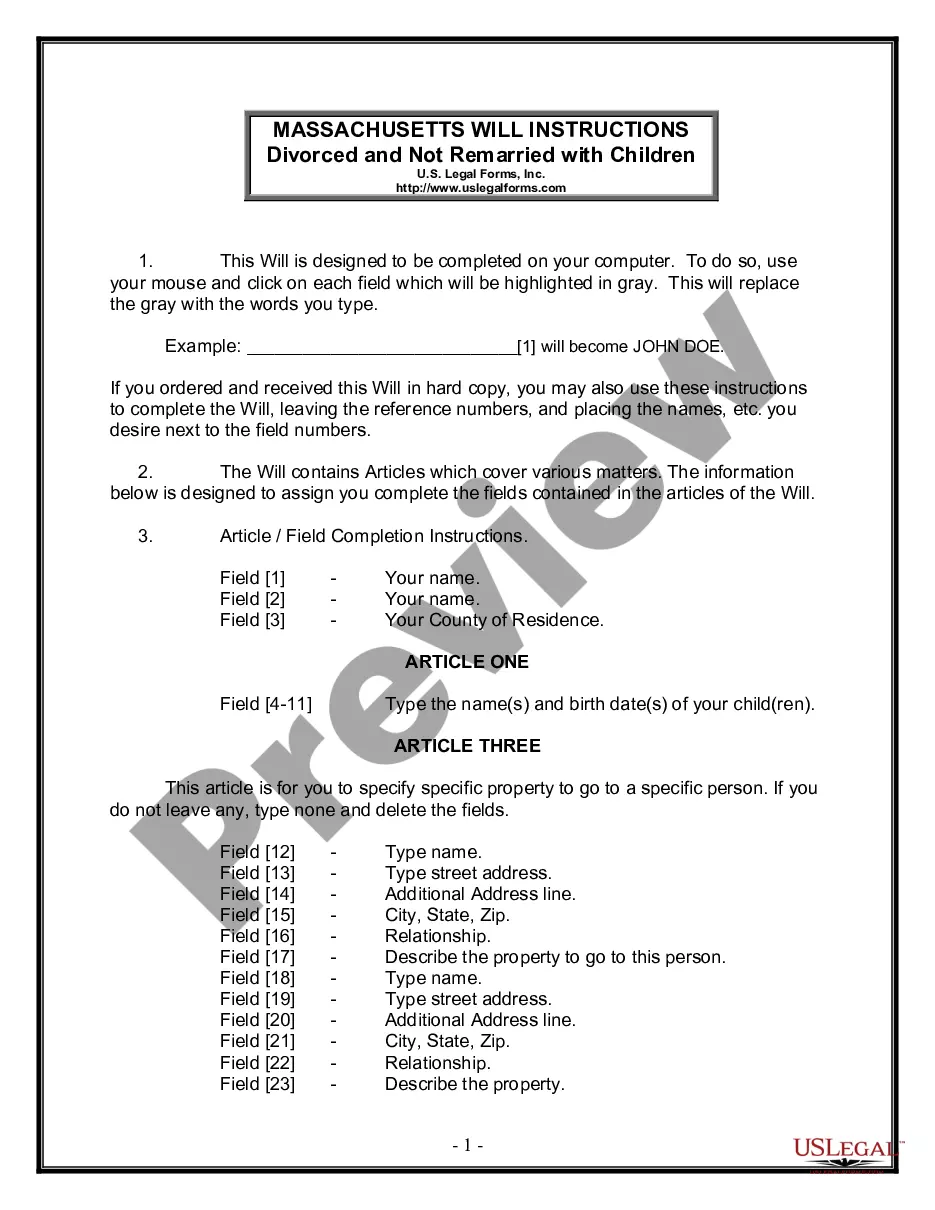

If you wish to use US Legal Forms for the first time, here are simple instructions to help you get started: Make sure you have selected the correct form for your city/state. Click on the Preview option to review the content of the form. Read the form description to ensure that you have chosen the right form. If the form does not meet your needs, utilize the Search field at the top of the screen to find one that does. When you are satisfied with the form, confirm your choice by clicking on the Buy now button. Then, select the pricing plan you prefer and provide your details to register for an account. Process the payment. Use your credit card or PayPal account to complete the transaction. Choose the format and download the form to your device. Make edits. Fill out, modify, and print and sign the acquired Oregon Educator Agreement - Self-Employed Independent Contractor. Every template you added to your account has no expiration date and is yours permanently. So, if you wish to download or print another version, simply go to the My documents section and click on the form you want.

- Access the Oregon Educator Agreement - Self-Employed Independent Contractor with US Legal Forms, one of the most extensive libraries of legal document templates.

- Utilize a vast collection of professional and state-specific templates that fulfill your business or personal needs and requirements.

Form popularity

FAQ

To fill out an Oregon Educator Agreement - Self-Employed Independent Contractor, start by gathering all necessary information about both parties, including names and addresses. Clearly outline the scope of work, payment terms, and deadlines to ensure mutual understanding. Use straightforward language to describe expectations, responsibilities, and any relevant legal requirements. Utilizing a platform like USLegalForms can simplify this process, providing templates specifically designed for Oregon educator agreements, which guarantees compliance and clarity.

Independent contractors must follow specific legal requirements to ensure compliance. In Oregon, it is essential to have a clear agreement, like the Oregon Educator Agreement - Self-Employed Independent Contractor, that outlines your role and responsibilities. Additionally, you must manage your own taxes and maintain necessary business licenses where applicable.

Yes, an independent contractor is considered self-employed. When you enter into an Oregon Educator Agreement - Self-Employed Independent Contractor, you operate your own business, allowing you to set your rates and choose your clients. This status brings both benefits and responsibilities, particularly regarding taxes and benefits.

Labor laws do not apply to 1099 independent workers in the same way they do to employees. The protections provided under Oregon's labor laws typically pertain to employees, not independent contractors like those under an Oregon Educator Agreement - Self-Employed Independent Contractor. However, understanding your rights and responsibilities is crucial to protecting your interests.

Certain groups are exempt from Oregon's minimum wage laws, including some independent contractors. Under the Oregon Educator Agreement - Self-Employed Independent Contractor, you may not fall under minimum wage requirements, as your earnings depend on your contract terms. It's essential to clarify these details in your agreement to avoid misunderstandings.

Yes, a 1099 employee is often referred to as contract labor. This designation means they work independently and are responsible for their own taxes. When you enter into an Oregon Educator Agreement - Self-Employed Independent Contractor, you align your work as an independent contractor rather than a traditional employee. Understanding your status helps you navigate tax responsibilities effectively.

The basic independent contractor agreement includes essential elements such as the parties’ details, scope of work, payment terms, and project duration. It should also address confidentiality and liability issues. For those new to contracting, templates like the Oregon Educator Agreement - Self-Employed Independent Contractor from uslegalforms provide a solid foundation, making it easy to create a comprehensive document.

In Oregon, an independent contractor typically works for themselves and has control over how they perform their tasks. They are not subject to the same level of control that employers have over their employees. To be classified correctly, it's crucial to understand the criteria set by the state, which can be outlined in the Oregon Educator Agreement - Self-Employed Independent Contractor.

Creating an independent contractor agreement involves outlining the specific terms of work between the contractor and the hiring entity. Begin by defining the scope of work, payment terms, and deadlines. Additionally, utilize resources like uslegalforms to access templates for the Oregon Educator Agreement - Self-Employed Independent Contractor. These templates can streamline the process, ensuring compliance and clarity.

Typically, the business or organization engaging the independent contractor drafts the independent contractor agreement. However, both parties should review the document to ensure it meets their needs and complies with Oregon state laws. You may consider using templates available on platforms like uslegalforms, which specialize in comprehensive agreements, including the Oregon Educator Agreement - Self-Employed Independent Contractor.