Oregon Social Worker Agreement - Self-Employed Independent Contractor

Description

How to fill out Social Worker Agreement - Self-Employed Independent Contractor?

You can devote hours on the web searching for the legal document template that meets the state and federal requirements you require.

US Legal Forms offers a vast collection of legal templates that have been reviewed by experts.

It is straightforward to obtain or print the Oregon Social Worker Agreement - Self-Employed Independent Contractor from our service.

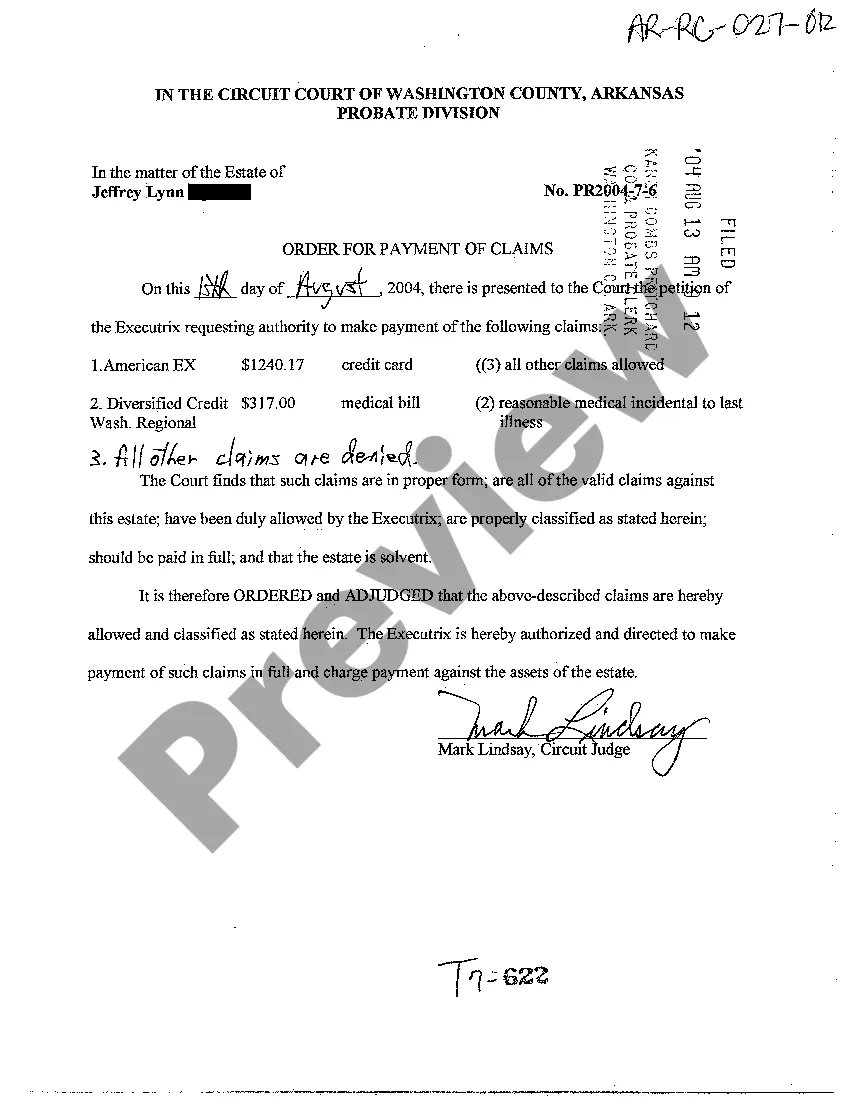

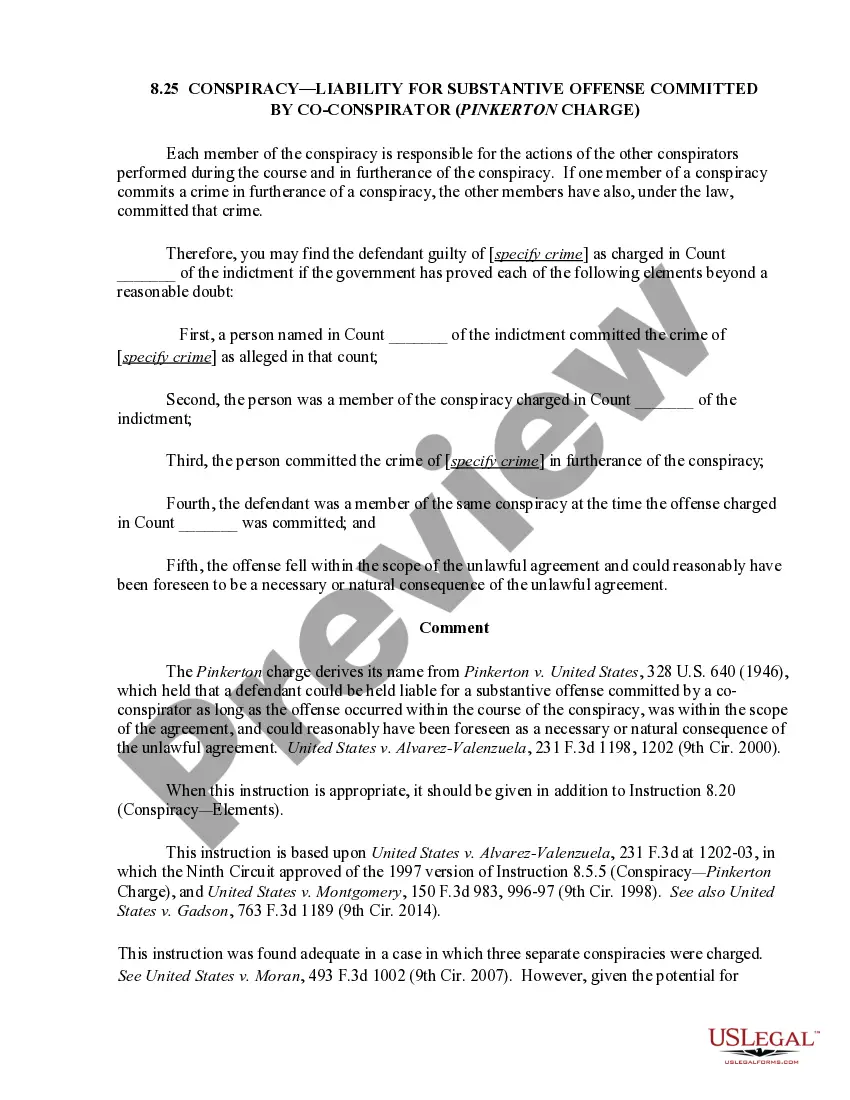

If available, use the Preview option to review the document template as well.

- If you already possess a US Legal Forms account, you can Log In and select the Download option.

- Then, you can complete, modify, print, or sign the Oregon Social Worker Agreement - Self-Employed Independent Contractor.

- Every legal document template you obtain is yours indefinitely.

- To obtain another copy of any acquired form, navigate to the My documents section and select the corresponding option.

- If this is your first time using the US Legal Forms website, follow the simple guidelines outlined below.

- First, ensure you have selected the correct document template for the area/city you choose.

- Review the form description to confirm that you have picked the right form.

Form popularity

FAQ

To write an independent contractor agreement, begin with a clear title and outline all relevant details. Be sure to include the names of both parties, the scope of work pertaining to the Oregon Social Worker Agreement - Self-Employed Independent Contractor, payment terms, and schedules. Finally, incorporate clauses regarding confidentiality, termination, and dispute resolution to protect both parties and ensure a smooth collaboration.

Filling out an independent contractor agreement requires clarity and detail. Start by including your personal information, the services you will provide, and the payment terms associated with the Oregon Social Worker Agreement - Self-Employed Independent Contractor. Make sure to define the duration of the agreement and any specific terms that will govern your working relationship, ensuring both parties understand their obligations.

Independent contractors typically fill out various documents, including tax forms, contracts, and invoices. For those entering into a relationship under the Oregon Social Worker Agreement - Self-Employed Independent Contractor, a well-defined contract outlining services, payment terms, and responsibilities is essential. Keeping meticulous records and ensuring all paperwork is completed accurately can facilitate smooth operations and compliance.

Yes, labor laws do apply to 1099 independent workers in Oregon, but the regulations vary compared to traditional employees. While independent contractors, like those working under the Oregon Social Worker Agreement - Self-Employed Independent Contractor, have more flexibility, they may not be entitled to the same benefits as full-time employees. It's important to understand these rights and responsibilities to ensure compliance and protection.

To fill out the declaration of independent contractor status form, begin by providing your personal information, including your name, address, and contact details. Specify the nature of your work and the services you will provide under the Oregon Social Worker Agreement - Self-Employed Independent Contractor. Make sure to review the form thoroughly for accuracy, and submit it according to your specific state requirements.

Yes, independent contractors are classified as self-employed individuals. When you work under an Oregon Social Worker Agreement - Self-Employed Independent Contractor, you operate your own business rather than working for an employer. This status gives you autonomy over your work but also requires you to manage your taxes and benefits independently.

To protect yourself as an independent contractor in Oregon, consider formalizing your work agreements through contracts like the Oregon Social Worker Agreement - Self-Employed Independent Contractor. Clearly outline your services, payment terms, and responsibilities to avoid misunderstandings. Additionally, you might want to explore insurance options to cover potential risks in your line of work, and using resources from uslegalforms can aid you in drafting these agreements.

The main difference between an independent contractor and an employee in Oregon lies in the level of control and flexibility. Independent contractors, such as those operating under an Oregon Social Worker Agreement - Self-Employed Independent Contractor, have more freedom in how they complete their work. Employees typically have set hours, job duties, and benefits provided by an employer, while independent contractors have greater autonomy over their business practices.

In Oregon, 1099 employees, classified as independent contractors, generally do not qualify for traditional unemployment benefits. However, if you are an independent contractor under the Oregon Social Worker Agreement - Self-Employed Independent Contractor, you may be eligible for specific programs if you lose work due to a qualifying reason. Utilizing platforms like uslegalforms can help you understand your rights and options related to unemployment benefits.

When employing an independent contractor, such as in the case of an Oregon Social Worker Agreement - Self-Employed Independent Contractor, you will need several essential documents. First, ensure you have a signed contract outlining the terms of your agreement, including services to be performed, payment details, and timelines. You should also collect a W-9 form from the contractor for tax purposes and maintain records of any payments made throughout the agreement. By utilizing USLegalForms, you can streamline this process and access professionally drafted templates specific to your needs.