Oregon Structure Erection Contractor Agreement - Self-Employed

Description

How to fill out Structure Erection Contractor Agreement - Self-Employed?

Locating the suitable legal document template can be a challenge. Naturally, there are numerous templates accessible online, but how do you acquire the legal form you require? Utilize the US Legal Forms website. The platform offers thousands of templates, such as the Oregon Structure Erection Contractor Agreement - Self-Employed, which you can utilize for both business and personal purposes. All documents are verified by experts and comply with state and federal regulations.

If you are already a member, Log In to your account and hit the Download button to obtain the Oregon Structure Erection Contractor Agreement - Self-Employed. Use your account to browse through the legal documents you have acquired previously. Navigate to the My documents section of your account and retrieve another copy of the document you need.

If you are a new user of US Legal Forms, here are simple guidelines you should follow: First, ensure you have selected the correct form for your state/region. You can review the document using the Review button and examine the document details to confirm it is suitable for you. If the form does not meet your needs, use the Search field to find the correct document. Once you are certain that the form is accurate, click on the Acquire now button to obtain the form. Choose the pricing plan you want and enter the necessary information. Create your account and complete the transaction using your PayPal account or credit card. Select the file format and download the legal document template to your device. Fill out, modify, print, and sign the received Oregon Structure Erection Contractor Agreement - Self-Employed.

Take advantage of US Legal Forms to simplify the process of obtaining the legal documents you need.

- US Legal Forms is the largest repository of legal documents where you can find numerous paper templates.

- Utilize the service to download well-crafted files that adhere to state requirements.

- Ensure you have the right form before making a purchase.

- Leverage the review and search options to find the most appropriate document.

- Complete the necessary fields for account creation and payment.

- Download, edit, and finalize your legal documents with ease.

Form popularity

FAQ

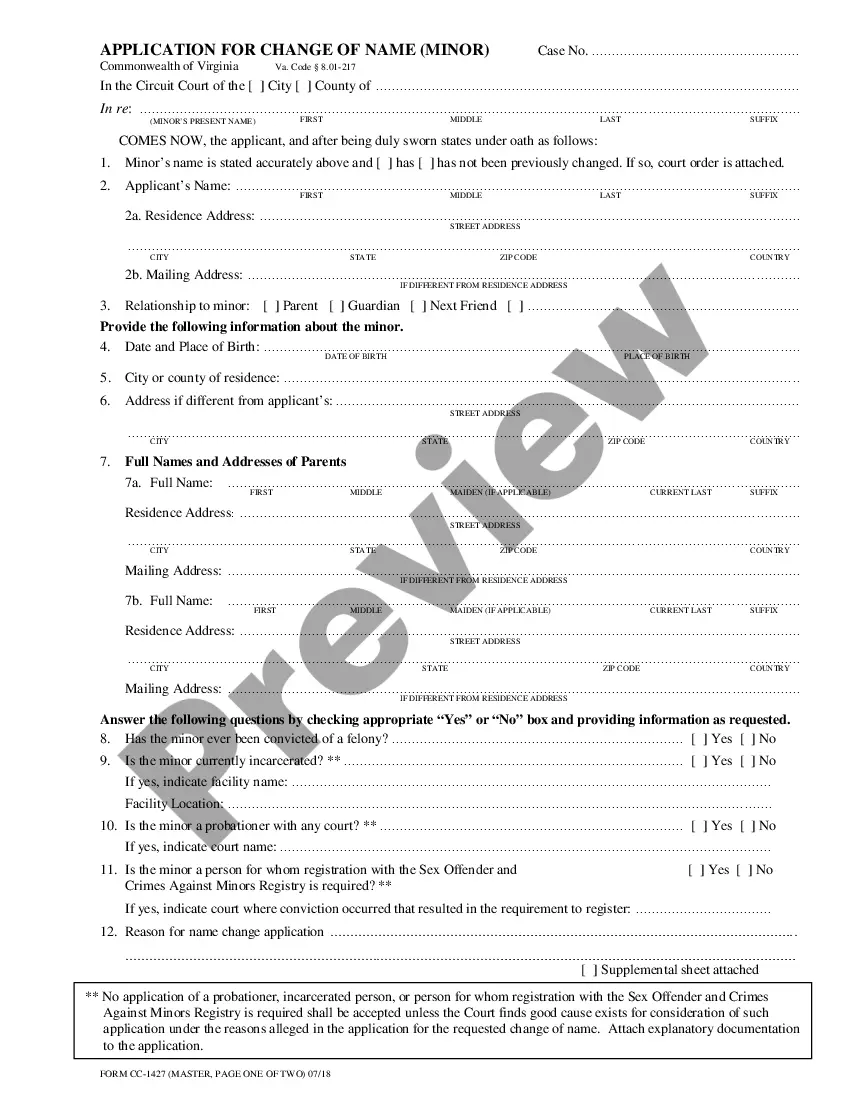

To effectively fill out an independent contractor agreement, begin by accurately entering all parties' information at the top of the document. Outline the details of the work you will perform, including payment amounts and timelines. Remember to sign and date the agreement to make it legally binding. Utilizing resources like uslegalforms can simplify this process by providing templates specifically designed for an Oregon Structure Erection Contractor Agreement - Self-Employed.

When writing an independent contractor agreement, start with a title that reflects the nature of the contract, such as Oregon Structure Erection Contractor Agreement - Self-Employed. Include sections for project description, payment terms, deadlines, and termination conditions. Make sure to use clear language to define the rights and responsibilities of both parties. This clarity enhances understanding and avoids potential conflicts.

Filling out an independent contractor form involves several key steps. Start by providing your personal information, including your name and address. Next, clearly detail the services you will offer and the payment terms. For an Oregon Structure Erection Contractor Agreement - Self-Employed, it's essential to be thorough and precise to avoid disputes later on.

An independent contractor agreement in Oregon is a legal document that defines the terms of engagement between a client and a self-employed individual. This agreement outlines payment terms, work scope, deadlines, and other important aspects of the working relationship. It is vital for those engaging with an Oregon Structure Erection Contractor Agreement - Self-Employed to ensure compliance with state laws. Having this agreement also safeguards your interests and clarifies expectations.

Yes, you can have a contract when you are self-employed. In fact, an Oregon Structure Erection Contractor Agreement - Self-Employed is a crucial document for outlining your working relationship with clients. Having a clear agreement protects your rights and defines your responsibilities. It helps establish expectations for both parties involved.

Projects that do not require a license from the CCB include gutter cleaning, power & pressure washing, debris clean up (yard or construction site), and handyman work on projects with a contract value of $1,000 or less.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

(18) Working without a construction permit in violation of ORS 701.098, $1,000 for the first offense; $2,000 and suspension of CCB license for three (3) months for the second offense; $5,000 and permanent revocation of CCB license for the third and subsequent offenses.

The threshold for performing certain work without a contractor license increased from $500 to $1,000. To qualify for the exemption, a contractor must perform work that is casual, minor or inconsequential. This means that the work cannot: Be structural in nature.

A payment schedule should contain all of the information you need to plan out anticipated and actual payments:The name of the contractor or vendor.Description of the work or materials.Amount of the payment due.Due date for the payment.Actual amount paid.Actual payment date.Payment method.Notes.07-Dec-2020