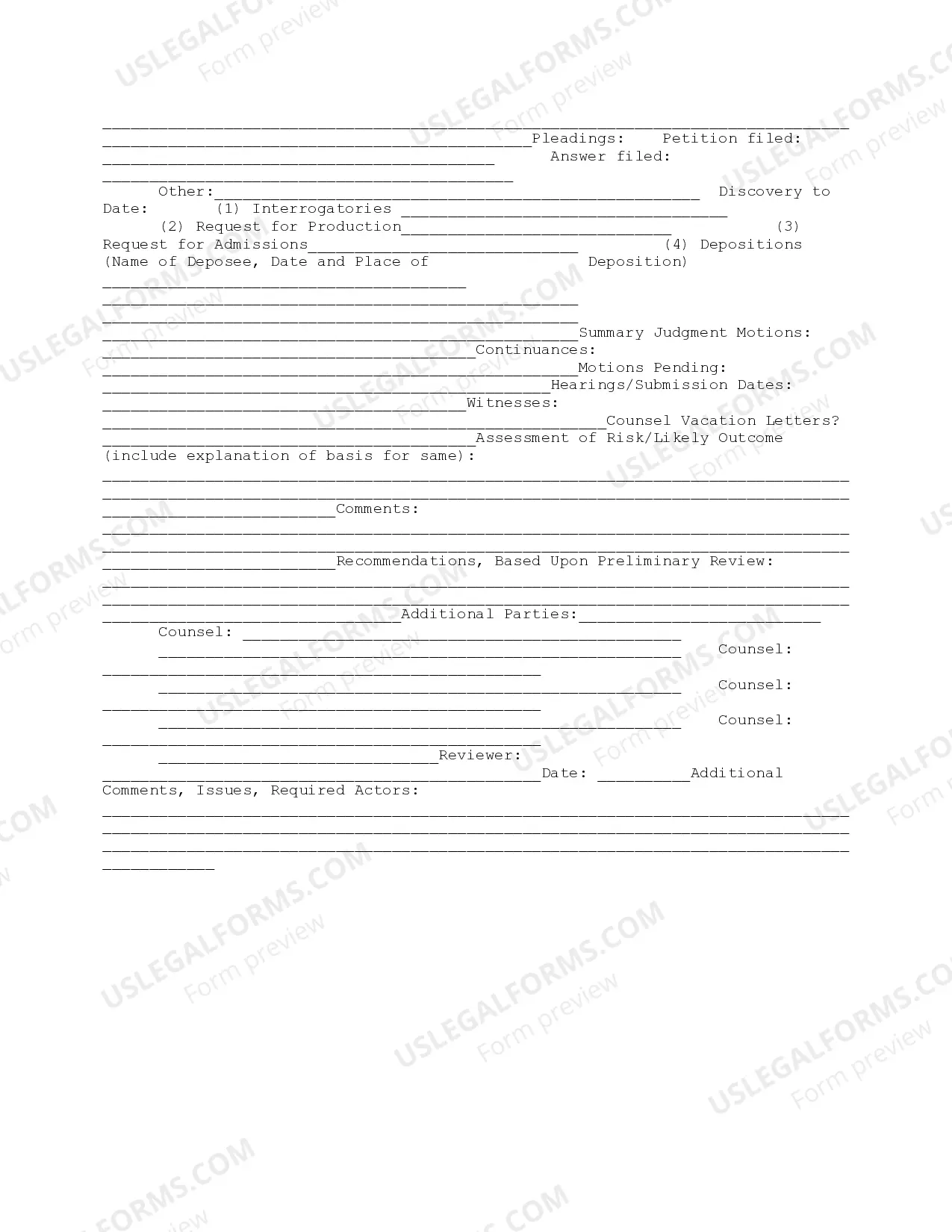

This due diligence form is a workform to be prepared for each pending or threatened claim or investigation brought against the company in business transactions.

Oregon Litigation Workform

Description

How to fill out Litigation Workform?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a range of legal template options you can obtain or print.

By using the site, you can access numerous templates for business and personal use, organized by types, states, or keywords. You can acquire the latest versions of templates such as the Oregon Litigation Workform in just a few moments.

If you hold a membership, sign in and obtain the Oregon Litigation Workform from the US Legal Forms library. The Download button will appear on each form you examine. You can access all previously saved templates in the My documents section of your account.

Process the payment. Use your credit card or PayPal account to complete the transaction.

Choose the format and download the form to your device. Make modifications. Fill out, edit, and print and sign the downloaded Oregon Litigation Workform. Each template you add to your account has no expiration date and belongs to you indefinitely. Therefore, to obtain or print another copy, simply visit the My documents section and click on the form you need. Access the Oregon Litigation Workform with US Legal Forms, one of the most extensive libraries of legal template options. Utilize a multitude of professional and state-specific templates that cater to your business or personal requirements.

- Ensure you have chosen the correct form for your city/state.

- Click on the Preview button to review the content of the form.

- Check the form details to make sure you have selected the correct form.

- If the form does not meet your requirements, use the Search bar at the top of the page to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Get now button.

- Then, select the pricing plan you wish and provide your information to create your account.

Form popularity

FAQ

You can pick up Oregon tax forms at various locations, including local tax offices, public libraries, and some government buildings. Additionally, many forms are available online through the Oregon Department of Revenue's website. Utilizing the Oregon Litigation Workform can simplify the process if you are preparing for any tax-related disputes. It’s important to have the right forms on hand to ensure compliance and accuracy.

Anyone earning income in Oregon may need to file a tax return, especially if your income exceeds the state's filing thresholds. Additionally, if you owe taxes or qualify for tax credits, filing a return is essential. Understanding your filing obligations helps prevent future tax issues. The Oregon Litigation Workform serves as a valuable resource should you encounter legal challenges related to your tax situation.

Yes, you typically need to file the Oregon Form or WR if you have had state taxes withheld throughout the year. This form allows you to reconcile the withholding amounts with your total tax due. Failing to file can result in penalties and additional charges. For more guidance on this, using the Oregon Litigation Workform can simplify your experience and ensure you comply with all requirements.

Whether you should exempt yourself from withholding depends on your individual tax situation. If you believe you will not owe any taxes at the end of the year, opting for exemption may be beneficial. However, if you underestimate your tax liability, you could face a tax surprise in April. Consulting the Oregon Litigation Workform can offer insights into your specific circumstances and help you make an informed decision.

The Oregon tax form or WR (withholding reconciliation) is used to report the amount of state tax withheld from your paycheck throughout the year. This form is essential for reconciling the taxes withheld with your actual tax liability. Ensuring that you file this form correctly is crucial to avoid any tax issues. If you have questions or need assistance, the Oregon Litigation Workform can provide guidance in related legal matters.

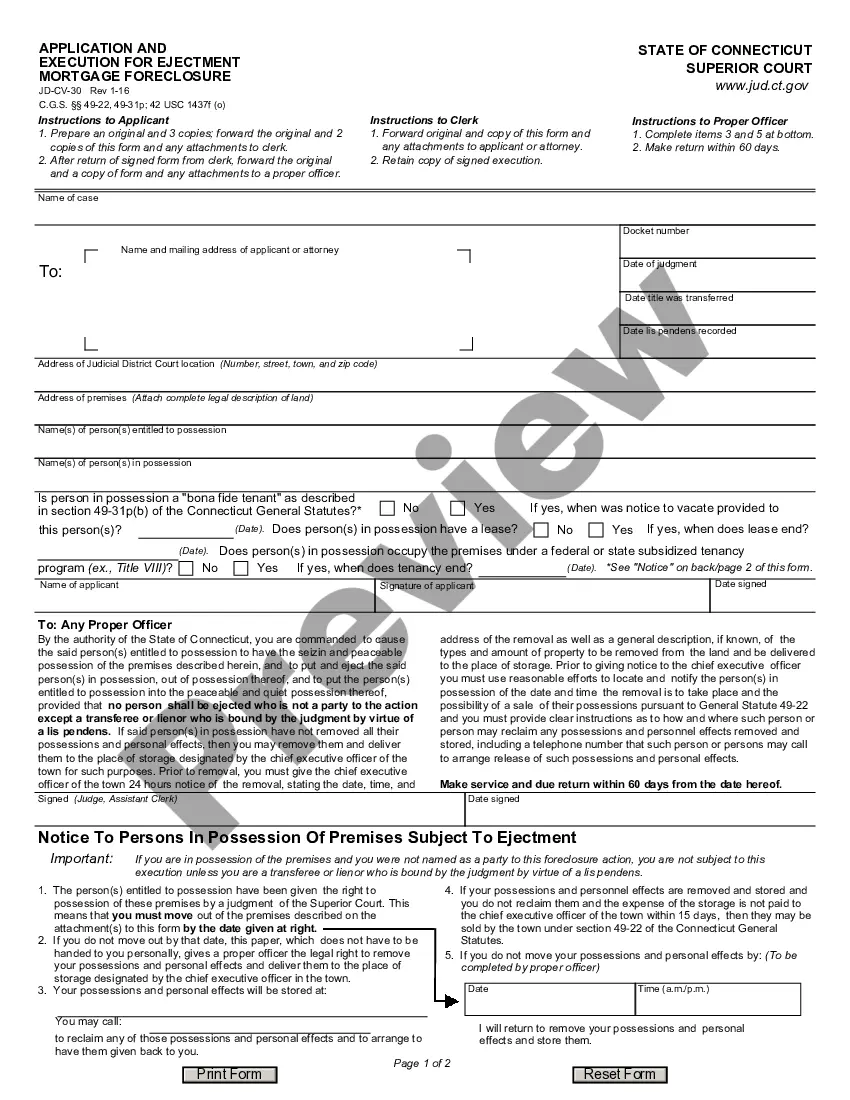

Filing a lawsuit in Oregon involves several key steps. First, you must determine the appropriate court for your case based on the amount and nature of your claim. After that, you should prepare the necessary documents, including the Oregon Litigation Workform if applicable, and file them with the court. It's also wise to familiarize yourself with Oregon's court rules to ensure compliance throughout the process.

The Oregon Form or W 4 is a tax document that helps you determine the amount of state income tax withholding from your paycheck. It allows you to specify your filing status and any additional withholding you desire. Ensuring you fill out this form accurately is vital for managing your taxes effectively. Additionally, using the Oregon Litigation Workform can help you navigate any legal proceedings related to tax issues.