Oregon Stock Option and Award Plan

Description

How to fill out Stock Option And Award Plan?

Are you currently in a situation where you frequently require documents for business or specialized purposes.

There are numerous legitimate document templates accessible online, but finding reliable ones is challenging.

US Legal Forms offers thousands of template documents, like the Oregon Stock Option and Award Plan, designed to comply with state and federal regulations.

Select a convenient file format and download your copy.

Access all the document templates you have purchased in the My documents list. You can obtain another copy of the Oregon Stock Option and Award Plan anytime, if needed. Just click the necessary form to download or print the template.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Oregon Stock Option and Award Plan template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is appropriate for your city/county.

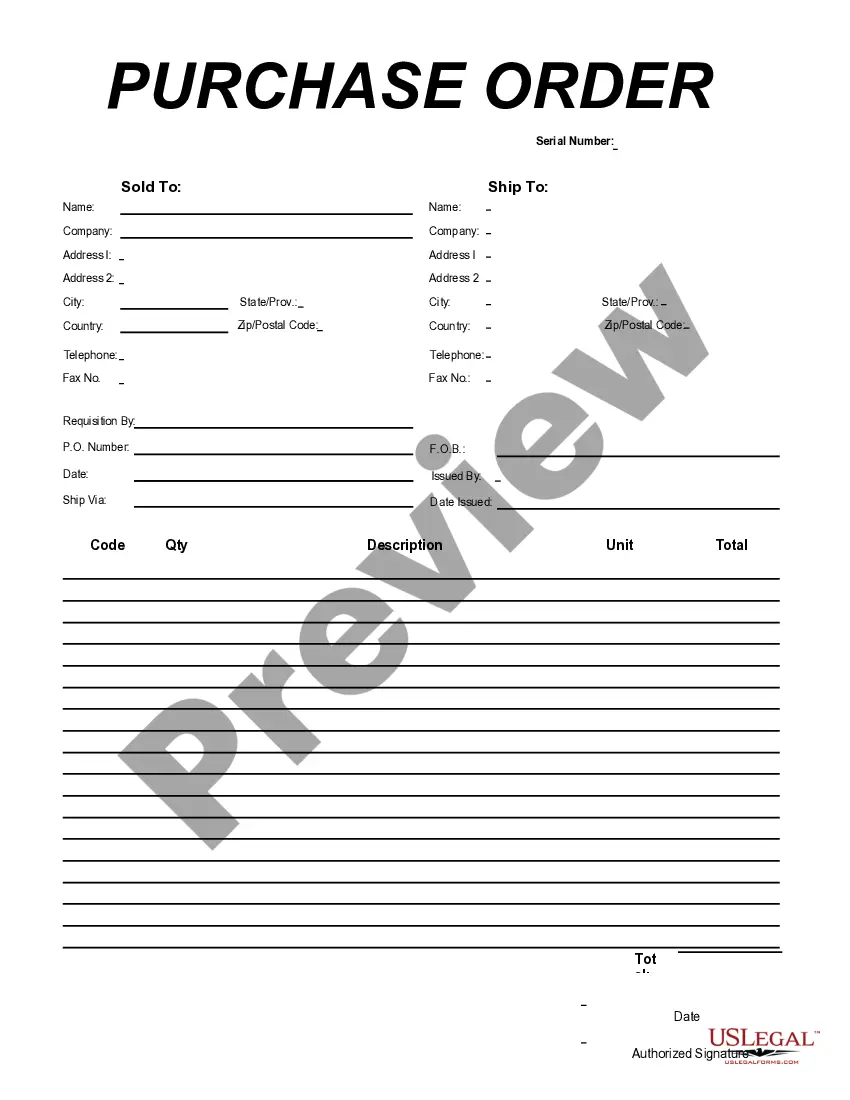

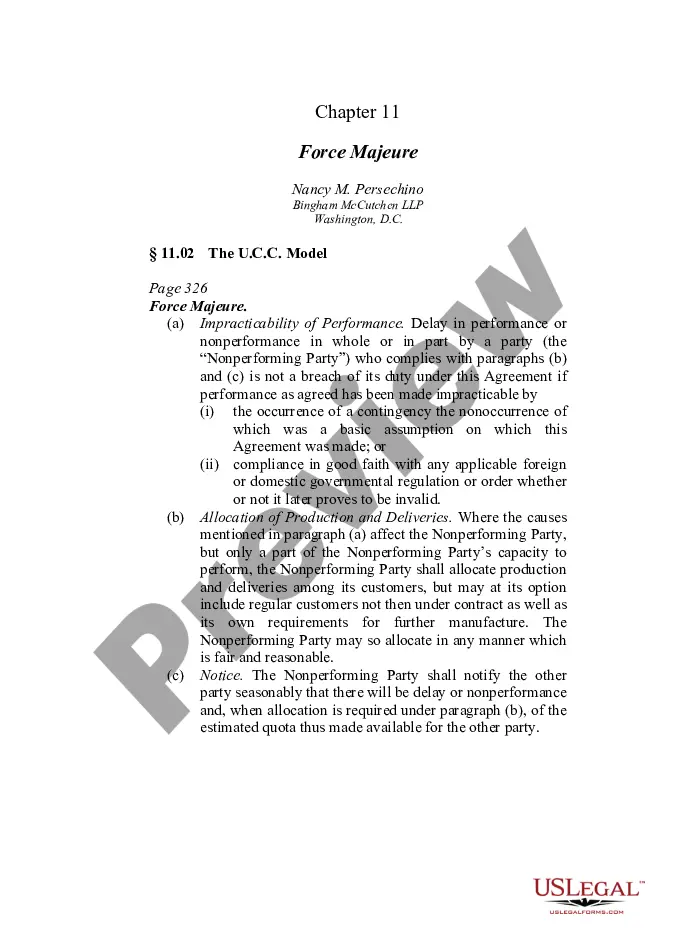

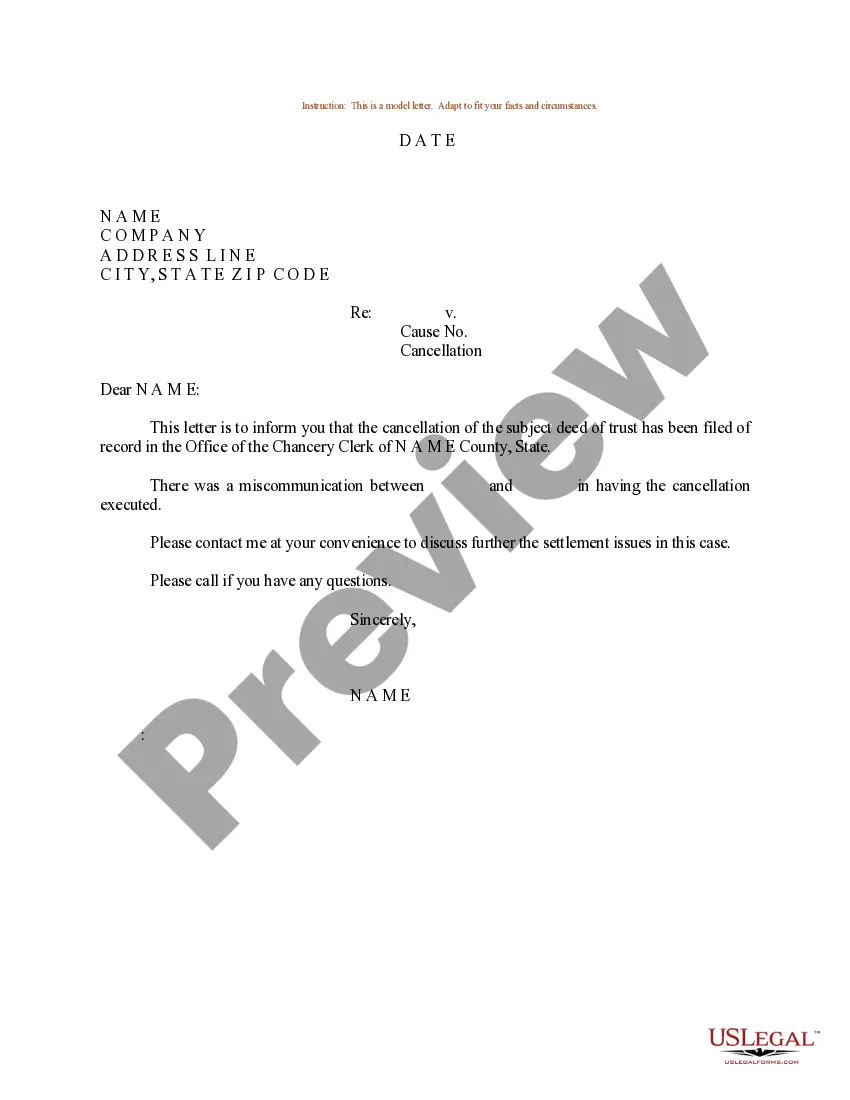

- Use the Preview feature to review the form.

- Check the description to confirm you have selected the correct document.

- If the form isn’t what you’re looking for, use the Search area to find the template that meets your needs.

- When you find the correct form, simply click Get now.

- Choose the pricing plan you prefer, fill in the required information to create your account, and complete the purchase using your PayPal or credit card.

Form popularity

FAQ

Stock Awards means any rights granted by the Company to Executive with respect to the common stock of the Company, including, without limitation, stock options, stock appreciation rights, restricted stock, stock bonuses and restricted stock units. Sample 2.

For example, a stock option is for 100 shares of the underlying stock. Assume a trader buys one call option contract on ABC stock with a strike price of $25. He pays $150 for the option. On the option's expiration date, ABC stock shares are selling for $35.

With a stock award, you receive the company's stocks as compensation. Depending on the type of stock, you may have to wait for a certain period before you can fully own it. A stock option, on the other hand, only gives you the right to buy the company's stocks in the future at a certain price.

Stock options are commonly used to attract prospective employees and to retain current employees. The incentive of stock options to a prospective employee is the possibility of owning stock of the company at a discounted rate compared to buying the stock on the open market.

Your ESPP will have set offering and purchase periods, while a stock option grant has a set term in which you can exercise the options after they vest. The purchase price of stock under a tax-qualified Section 423 ESPP is typically discounted in some way from the market price at purchase.

Stock options are a form of compensation. Companies can grant them to employees, contractors, consultants and investors. These options, which are contracts, give an employee the right to buy, or exercise, a set number of shares of the company stock at a preset price, also known as the grant price.

Equity Awards means all options to purchase shares of Company common stock, as well as all other stock-based awards granted to the Executive, including, but not limited to, stock bonus awards, restricted stock, restricted stock units and stock appreciation rights.

An incentive stock option (ISO) is a corporate benefit that gives an employee the right to buy shares of company stock at a discounted price with the added benefit of possible tax breaks on the profit. The profit on qualified ISOs is usually taxed at the capital gains rate, not the higher rate for ordinary income.