Oregon Employee Evaluation Form for Accountant

Description

How to fill out Employee Evaluation Form For Accountant?

Locating the appropriate legal document template might be quite a challenge. Obviously, there are numerous templates available online, but how can you identify the legal form you need.

Utilize the US Legal Forms website. The service provides thousands of templates, such as the Oregon Employee Evaluation Form for Accountant, which can be utilized for both business and personal purposes.

All of the forms are reviewed by experts and comply with federal and state regulations.

If the form does not satisfy your requirements, utilize the Search field to find the correct form. Once you are certain that the form is appropriate, click on the Purchase now button to acquire the form. Choose the pricing plan you require and enter the necessary information. Create your account and pay for your order using your PayPal account or credit card. Select the document format and download the legal document template onto your system. Finally, complete, modify, print, and sign the received Oregon Employee Evaluation Form for Accountant. US Legal Forms is the largest repository of legal forms where you can find a variety of document templates. Use the service to download professionally-crafted documents that adhere to state requirements.

- If you are already registered, Log In to your account and click on the Download button to save the Oregon Employee Evaluation Form for Accountant.

- Use your account to search for the legal forms you have acquired previously.

- Navigate to the My documents section of your account to obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions to follow.

- First, ensure you have selected the correct form for your area/state.

- You can view the form using the Review option and read the form details to confirm it is the right one for you.

Form popularity

FAQ

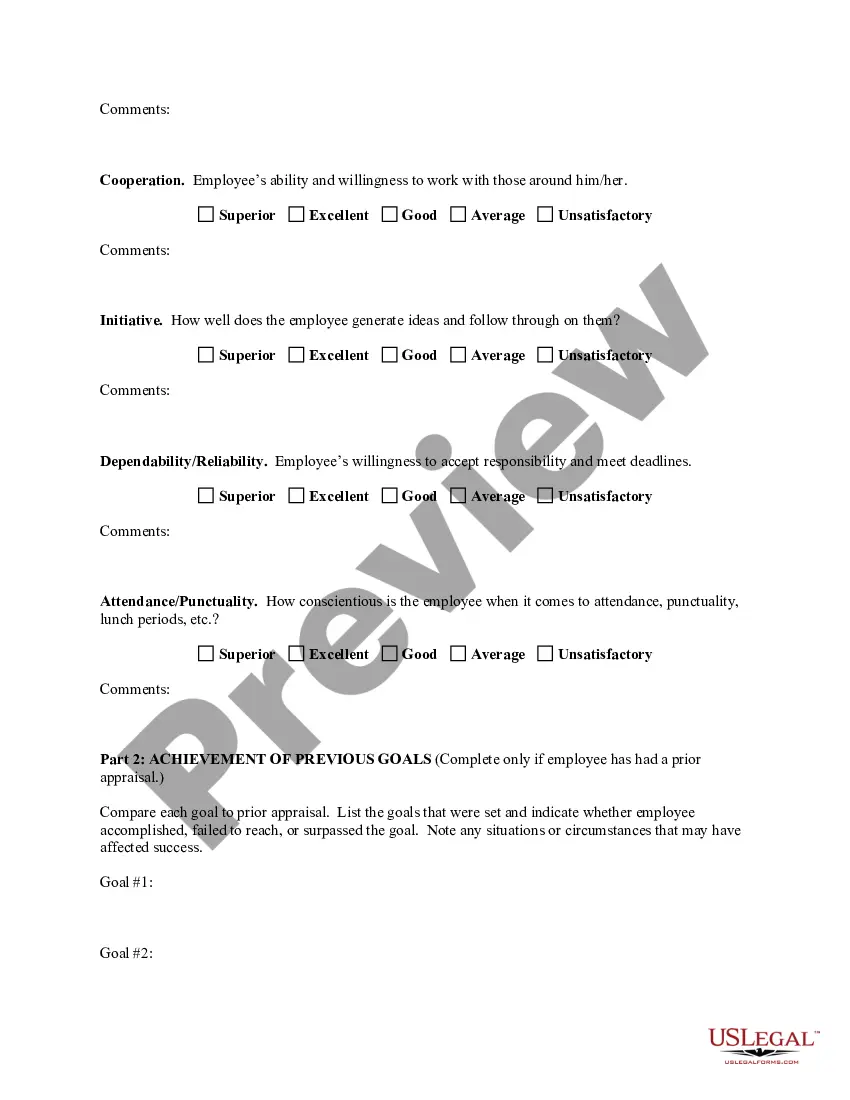

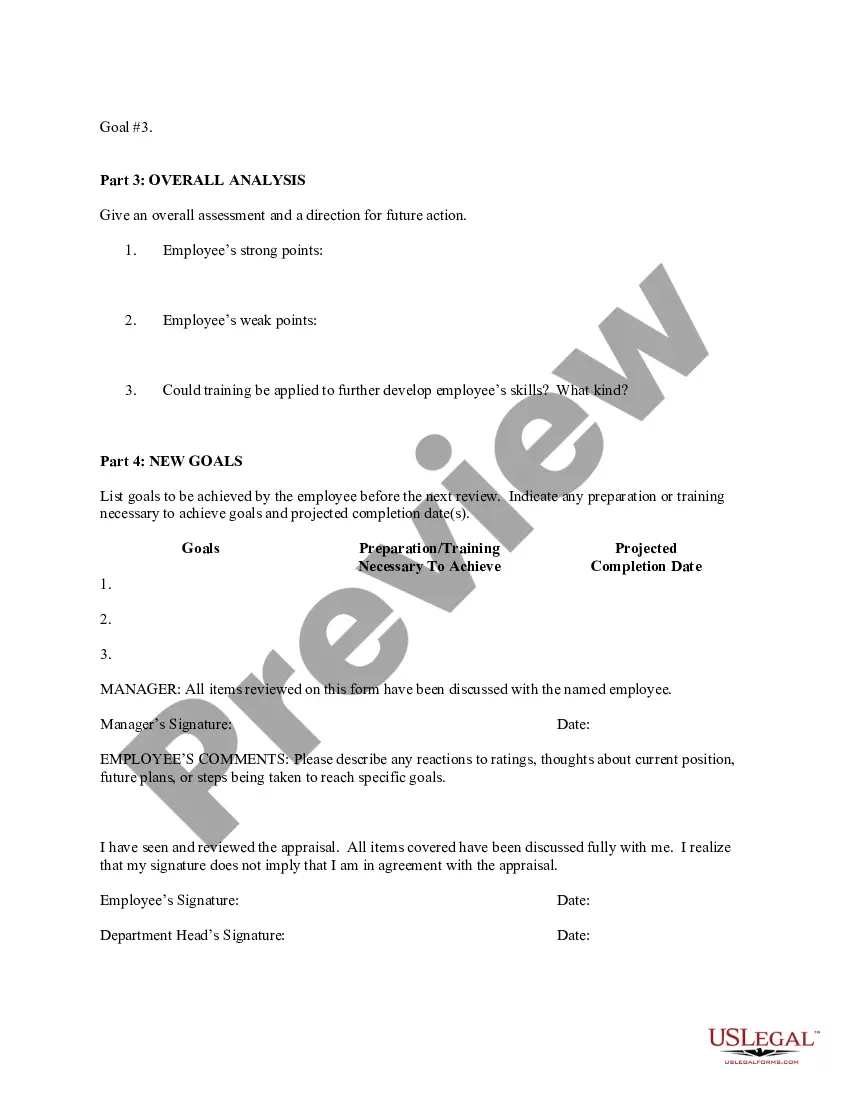

To complete the Oregon Employee Evaluation Form for Accountant, first gather all necessary information about the employee’s performance and contributions. You will need to evaluate their skills, competencies, and adherence to company standards. Be honest and constructive in your feedback, as this form serves both as an evaluation tool and a guide for future development. Ensure that you follow any specific company guidelines while filling out the form.

Choose a quarterly report filing method:Oregon Payroll Reporting System (OPRS) electronic filing.Combined Payroll Tax Reports Form OQ.Interactive voice response system, call 503-378-3981. Use only to report quarters with no payroll or no hours worked.

Form 132 is filed with Form OQ on a quarterly basis. Oregon Combined Quarterly Report- Form OQUse this form to determine how much tax is due each quarter for state unemployment insurance, withholding, Tri-Met & Lane Transit excise taxes, and the Workers' Benefit Fund.

Download forms from the Oregon Department of Revenue website . Order forms by calling 1-800-356-4222. Contact your regional Oregon Department of Revenue office.

Definitions as they pertain to Oregon Employment Department Law. An employer is subject to unemployment insurance taxes when the employer pays wages of $1,000 or more in a calendar quarter, or employs one or more individuals in any part of 18 separate weeks during any calendar year.

Requirements and penalties Required 1099s are the 1099-G, 1099-K, 1099-NEC, 1099-MISC, 1099-R, and W-2G. Other 1099s, including 1099-DIV and 1099-INT, are not required.

Qualifications for EUC:Your base year wages must equal or exceed 40 times your weekly benefit amount. (If your claim pays 26 weeks of benefits, you have met this qualification.) Your most recent claim must have tired regular benefits or be expired.

Forms OR-40, OR-40-P and OR-40-N can be found at or you can contact us to order it.

To file the Form WR electronically, as required under ORS 316.202 and ORS 314.360, you must do so using Department of Revenue's system, Revenue Online by going to this link: .

State Forms Download forms from the Oregon Department of Revenue website . Order forms by calling 1-800-356-4222.