Oregon Sample Performance Review for Nonexempt Employees

Description

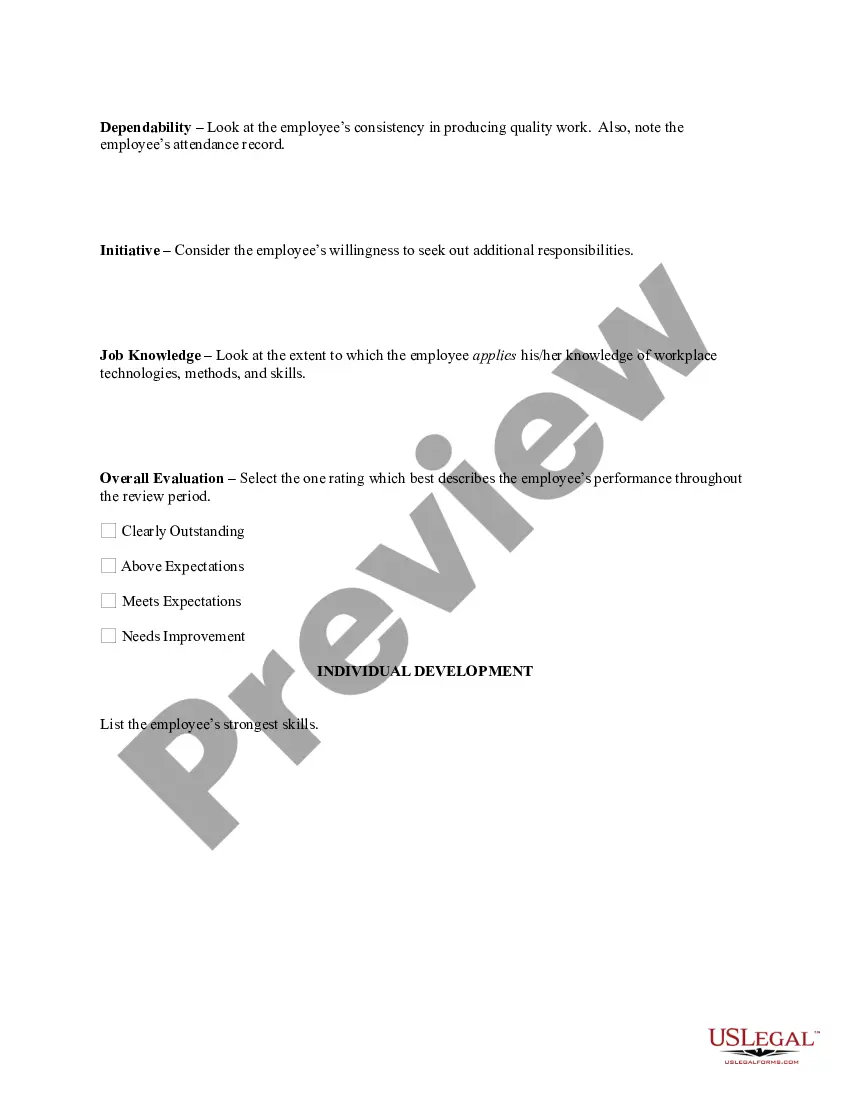

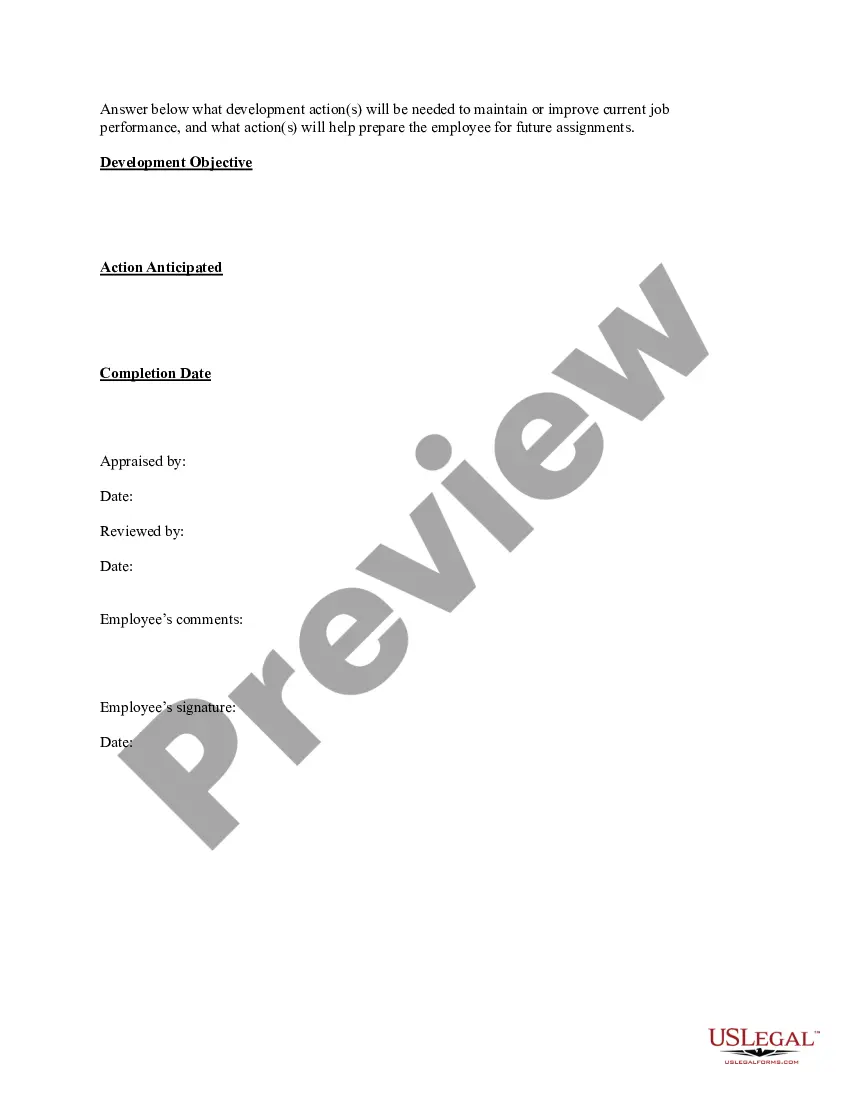

How to fill out Sample Performance Review For Nonexempt Employees?

Are you currently in a situation where you require documents for either business or personal purposes every day.

There are many legal document templates accessible online, but locating ones you can rely on is challenging.

US Legal Forms provides a vast array of template forms, including the Oregon Sample Performance Review for Nonexempt Employees, which are designed to comply with federal and state regulations.

Select a convenient file format and download your copy.

Access all of the document templates you have purchased in the My documents menu. You can obtain a duplicate of the Oregon Sample Performance Review for Nonexempt Employees at any time, as needed. Simply follow the required form to download or print the document template.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Once logged in, you will be able to download the Oregon Sample Performance Review for Nonexempt Employees template.

- If you do not possess an account and wish to start using US Legal Forms, follow these steps.

- Select the form you require and ensure it is for the correct city/region.

- Utilize the Preview button to review the form.

- Review the description to confirm that you have selected the appropriate form.

- If the form does not meet your needs, utilize the Search feature to find the form that suits you and your requirements.

- When you find the correct form, click Get now.

- Choose the pricing plan you desire, fill in the necessary details to create your account, and complete the payment using your PayPal or credit card.

Form popularity

FAQ

An employer is required to pay accrued vacation to an employee upon separation from employment if its policy or contract requires it. OR Bureau of Labor and Industries FAQs.

The work period is 8½ hours, with two work segments of four hours or more, therefore, the employee should receive one rest break at approximately AM, and another at approximately PM. An employee who works a work shift longer than 10 hours is entitled to a third rest break.

Nonexempt: An individual who is not exempt from the overtime provisions of the FLSA and is therefore entitled to overtime pay for all hours worked beyond 40 in a workweek (as well as any state overtime provisions). Nonexempt employees may be paid on a salary, hourly or other basis.

If you are a non-exempt employee, your employer must pay you at least the federal minimum wage (currently $7.25 per hour in Texas and under federal law) and must pay you overtime pay at a rate of at least one and a half times your hourly pay rate for all hours worked over 40 in each workweek.

Oregon employers are not required to offer any vacation days to employees. However, when an employer does provide vacation as part of its employment contract, the final paycheck should include payment for the unused vacation an employee is entitled to receive.

Examples of non-exempt employees include contractors, freelancers, interns, servers, retail associates and similar jobs. Even if non-exempt employees earn more than the federal minimum wage, they still take direction from supervisors and do not have administrative or executive positions.

If you have a policy, employment contract or a practice of doing so, you're required to pay accrued PTO to every employee who leaves the company. That means, you can't arbitrarily pay banked PTO to salaried employees and not to hourly employees; the practice and policy must equally apply to all employees.

Employers with employees who voluntarily leave can withhold accrued vacation pay if: The employer provided the employee with a written notice about PTO payout conditions. The employee has worked for the employer for less than one year. The employee gave the employer less than five days notice.

In Oregon, PTO and sick leave do not have to be paid out upon employee termination. However, providing PTO is optional, while providing sick leave is required. If you combine the policies, it may be difficult to keep track of which days are used for what, and how much to roll over each year.

Salary level test. Employees who are paid less than $23,600 per year ($455 per week) are nonexempt. (Employees who earn more than $100,000 per year are almost certainly exempt.)