Oregon Hourly Employee Evaluation

Description

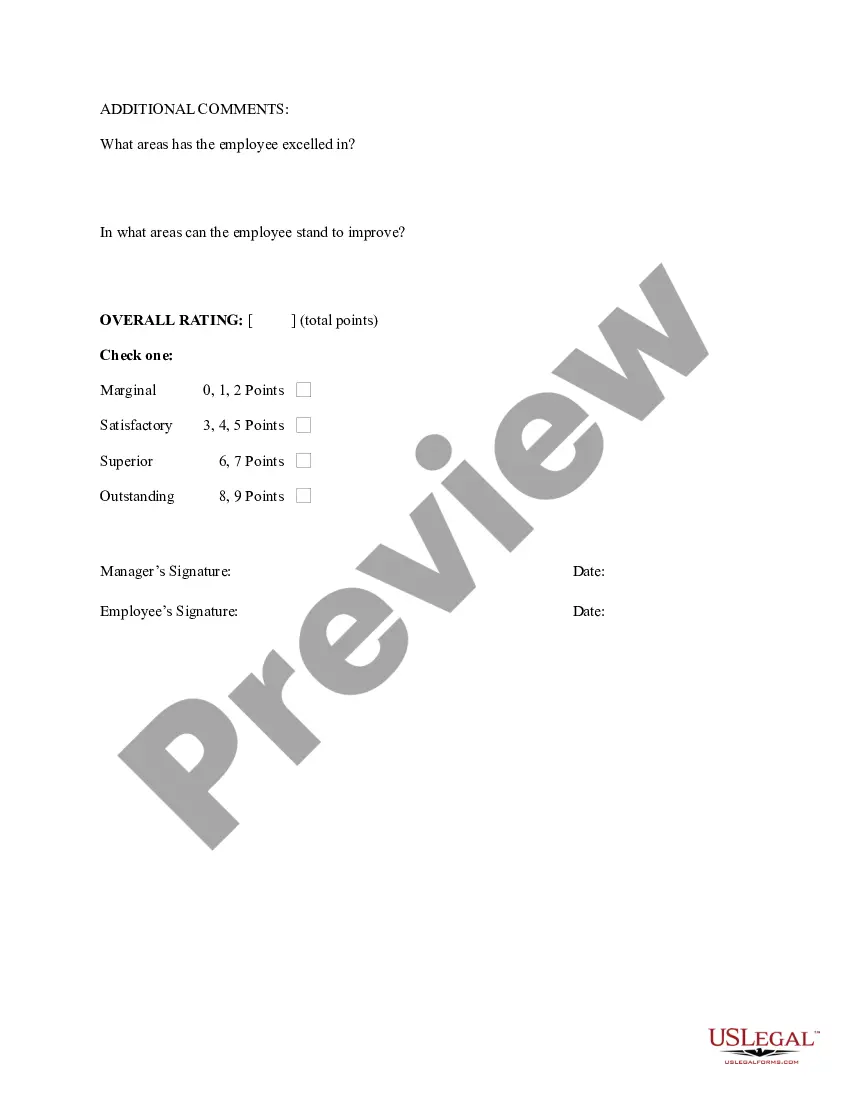

How to fill out Hourly Employee Evaluation?

If you need to finish, acquire, or print valid document templates, utilize US Legal Forms, the largest assortment of valid forms available online.

Employ the site`s straightforward and efficient search to find the documents you require. Various templates for corporate and personal purposes are organized by categories and suggestions, or keywords.

Utilize US Legal Forms to locate the Oregon Hourly Employee Assessment in just a few clicks.

Every legal document format you purchase is yours for a prolonged period. You will have access to every form you saved in your account.

Select the My documents section and choose a form to print or download again. Complete and obtain, and print the Oregon Hourly Employee Assessment with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to receive the Oregon Hourly Employee Assessment.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview function to view the form`s details. Remember to check the outline.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other templates in the legal form format.

- Step 4. Once you have found the form you want, click the Get now button. Choose the payment plan you prefer and provide your information to create an account.

- Step 5. Complete the purchase. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Oregon Hourly Employee Assessment.

Form popularity

FAQ

The 2022 Workers Benefit Fund (WBF) assessment rate is 2.2 cents per hour.

The law prohibits employers from inquiring about job applicants' salary history. Do not discourage employees from discussing compensation with one another. The law protects employees who want to discuss their compensation with one another.

With the new additions to Oregon law, this issue is clear. It is unlawful to discriminate or retaliate because the employee has: Inquired about, discussed or disclosed in any manner the wages of the employee or of another employee. HB 2007.

In 2021, this assessment is 2.2 cents per hour worked. Employers and employees split the cost. Employers report and pay the WBF assessment directly to the state with other state payroll taxes.

Currently, there is one state, Oregon, with full state predictive scheduling regulations that apply to every city. Additionally, Vermont and New Hampshire have specific regulations in place around flexible working hours for employees.

The Oregon Department of Consumer and Business Services has announced that the Workers' Benefit Fund (WBF) assessment is 2.2 cents per hour worked in 2022, unchanged from 2021. The 2.2 cents-per-hour rate is the employer and worker rate combined.

In fact, employees' right to discuss their salary is protected by law. While employers may restrict workers from discussing their salary in front of customers or during work, they cannot prohibit employees from talking about pay on their own time.

No, only if you've agreed to keep your salary secret in your employment contract. While your salary is your personal information, the Privacy Act doesn't require you to keep it confidential.

The Workers' Benefit Fund (WBF) assessment funds return-to-work programs, provides increased benefits over time for workers who are permanently and totally disabled, and gives benefits to families of workers who die from workplace injuries or diseases. In 2021, this assessment is 2.2 cents per hour worked.