Oregon Employee Notice to Correct IRCA Compliance

Description

How to fill out Employee Notice To Correct IRCA Compliance?

Locating the appropriate legal document template can be challenging. Clearly, there are numerous templates accessible online, but how do you identify the legal form you require.

Utilize the US Legal Forms website. This service offers thousands of templates, such as the Oregon Employee Notice to Correct IRCA Compliance, which can serve both business and personal needs.

All forms are reviewed by experts and comply with state and federal regulations.

If the form does not fulfill your needs, use the Search section to locate the right form. Once you are certain that the form is correct, click on the Get it now button to acquire the form. Select the pricing plan you desire and enter the necessary details. Create your account and complete your order using your PayPal account or credit card. Choose the file format and download the legal document template to your device. Complete, edit, print, and sign the downloaded Oregon Employee Notice to Correct IRCA Compliance. US Legal Forms is the largest repository of legal forms offering a variety of document templates. Utilize this service to download professionally crafted papers that comply with state regulations.

- If you are currently registered, Log In to your account and select the Download option to obtain the Oregon Employee Notice to Correct IRCA Compliance.

- Use your account to search through the legal forms you have bought previously.

- Visit the My documents section of your account and retrieve another copy of the document you require.

- If you are a new user of US Legal Forms, here are simple steps to follow.

- Firstly, ensure you have selected the correct form for your city/state.

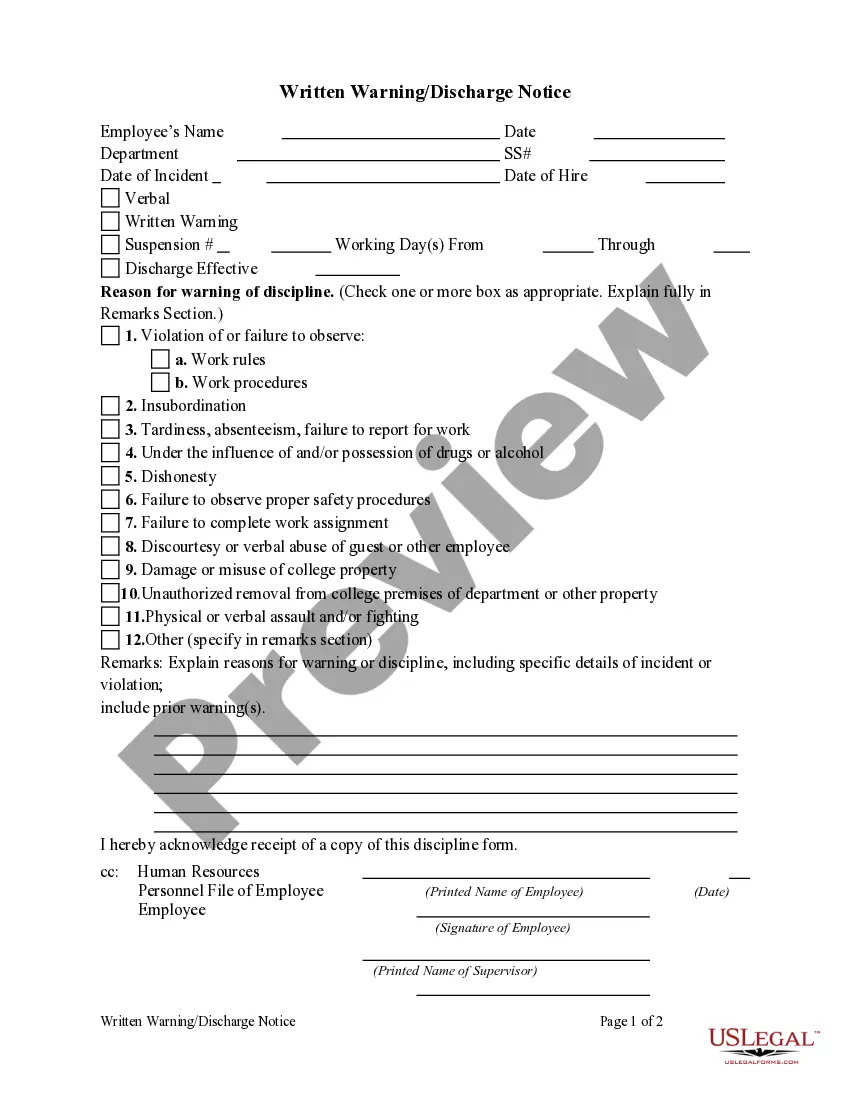

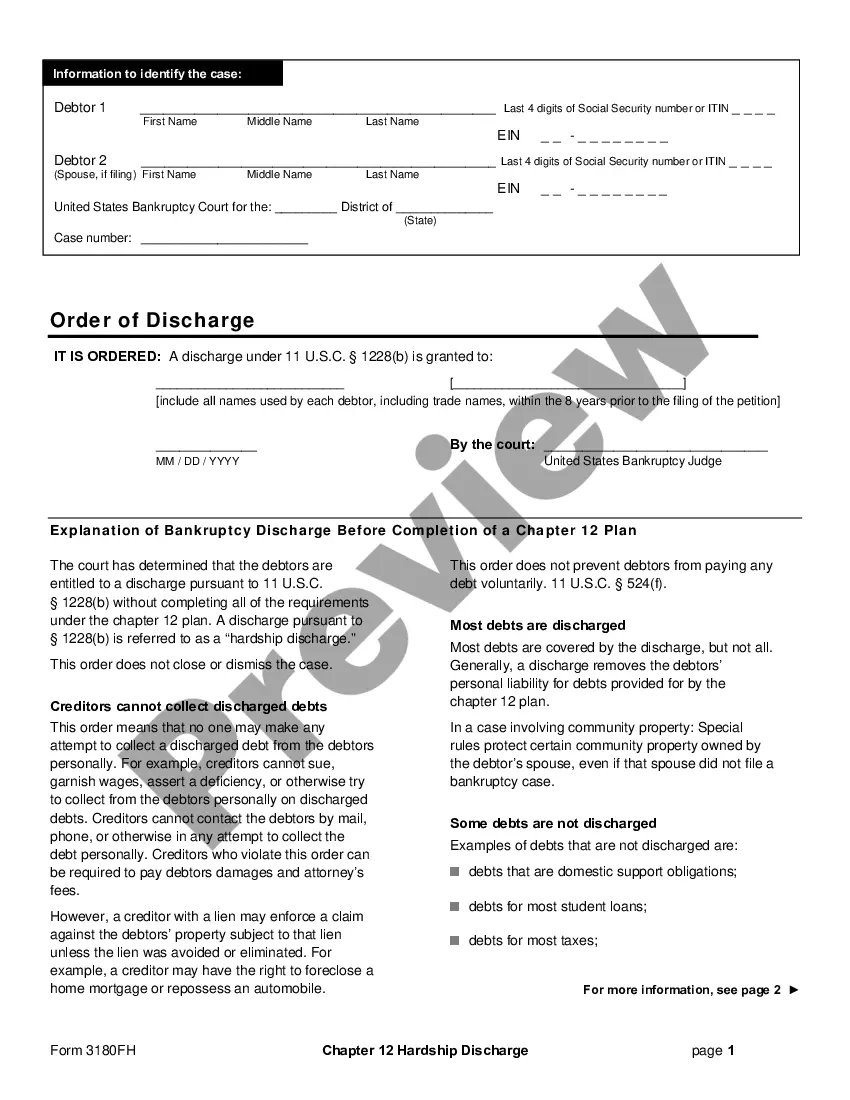

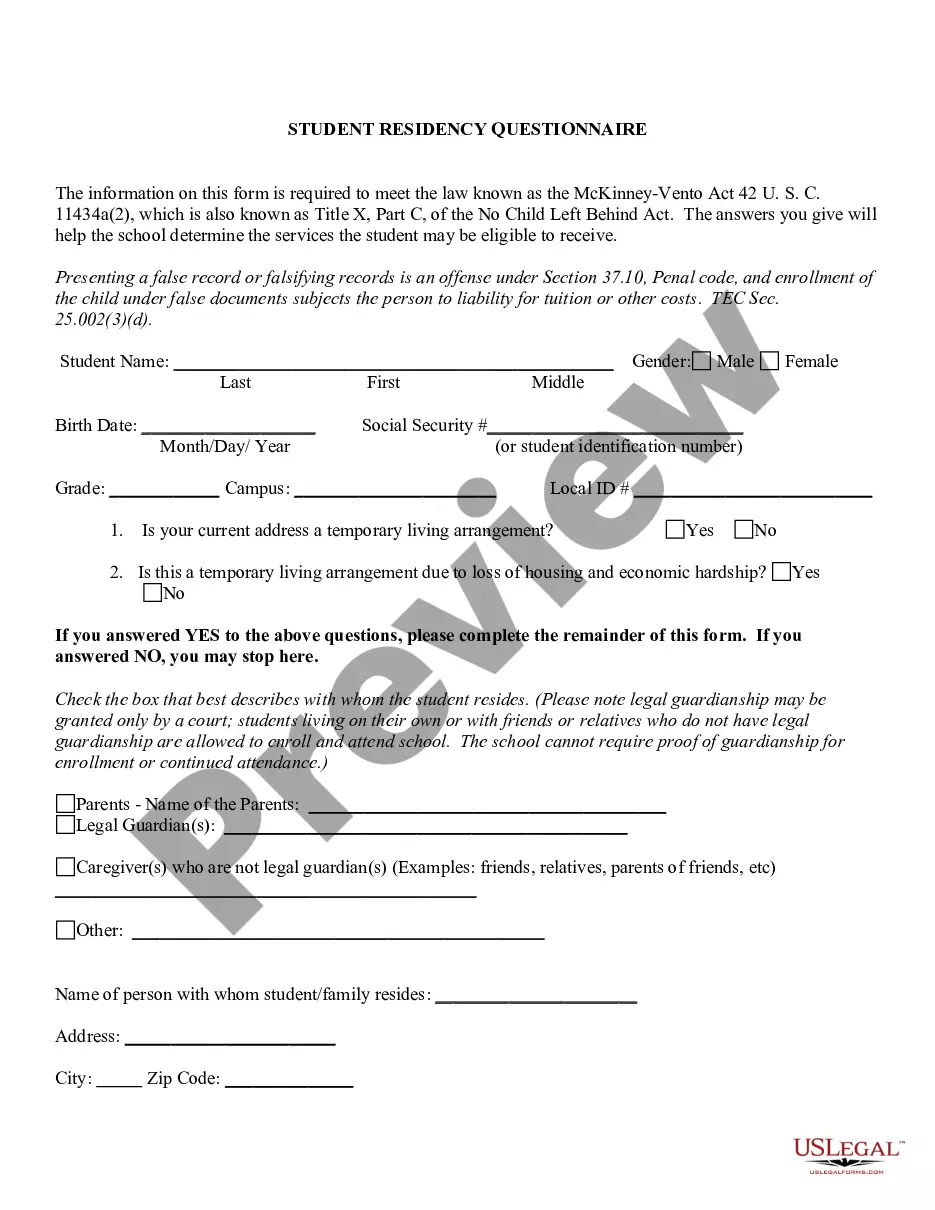

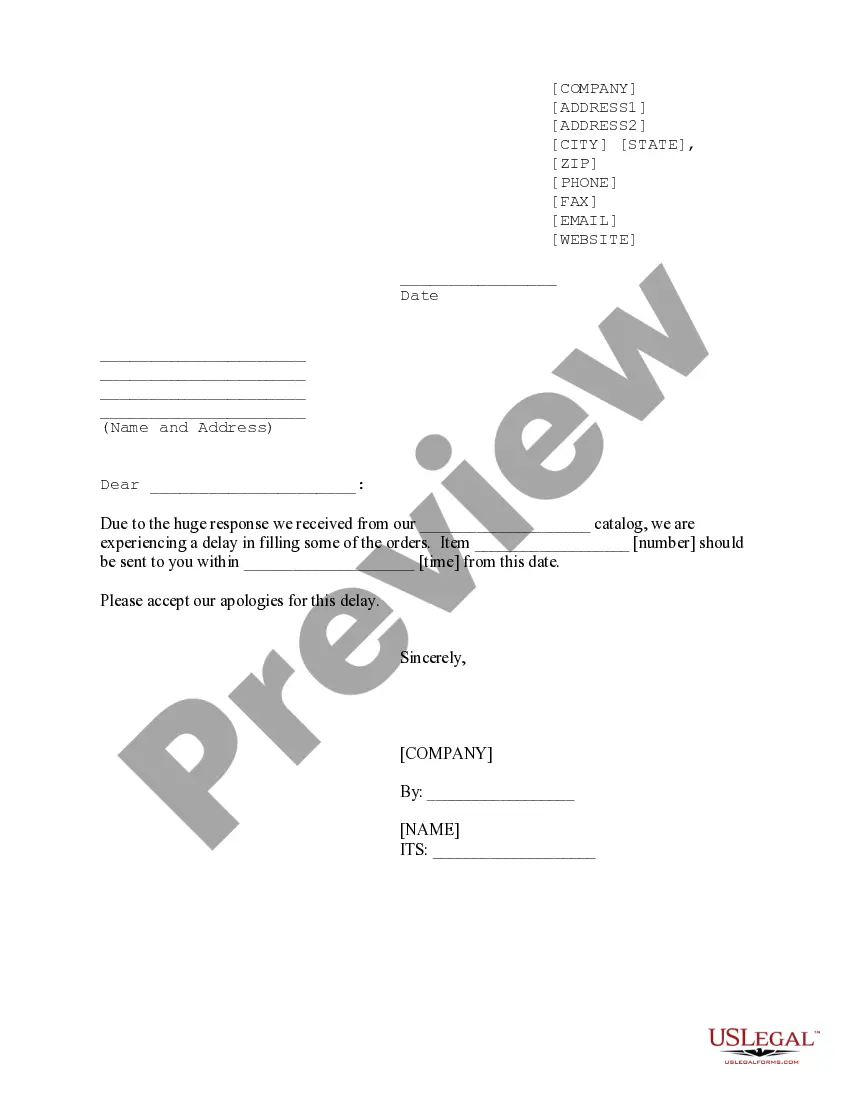

- You can review the form using the Preview feature and examine the form summary to confirm it is suitable for you.

Form popularity

FAQ

Yes, employer compliance with the Immigration Reform and Control Act (IRCA) requires that employers verify the employment eligibility of all newly hired employees. This means they must complete Form I-9 for each employee, ensuring that they are legally able to work in the United States. Staying informed about Oregon Employee Notice to Correct IRCA Compliance can help you understand the significance of this requirement.

Employers must have a completed Form I-9, Employment Eligibility Verification, on file for each person on their payroll (or otherwise receiving remuneration) who is required to complete the form. Employers must also keep completed Forms I-9 for a certain amount of time after their employees stop working for them.

The Immigration Reform and Control Act (IRCA) of 1986 requires all U.S. employers, regardless of size, to complete a Form I-9 upon hiring a new employee to work in the United States.

The Immigration Reform and Control Act (IRCA) of 1986 requires all U.S. employers, regardless of size, to complete a Form I-9 upon hiring a new employee to work in the United States.

To correct multiple errors in one section, you may redo the section on a new Form I-9 and attach it to the old form. You can also complete a new Form I-9 if it contains major errors (such as entire sections that were left blank or you completed Section 2 based on unacceptable documents).

Failing to timely complete an I-9 for employee or doing a really bad job of it can result in fines of $110 to over $1000 per employee for the first infraction. These fines impact large and small business alike.

Failing to timely complete an I-9 for employee or doing a really bad job of it can result in fines of $110 to over $1000 per employee for the first infraction. These fines impact large and small business alike.

Employers must: Have a completed Form I-9 on file for each person on their payroll who is required to complete the form; Retain and store Forms I-9 for three years after the date of hire, or for one year after employment is terminated, whichever is later; and.

All U.S. employers must properly complete Form I-9 for each individual they hire for employment in the United States. This includes citizens and noncitizens. Both employees and employers (or authorized representatives of the employer) must complete the form.

The Immigration Reform and Control Act (IRCA) of 1986 requires all U.S. employers, regardless of size, to complete a Form I-9 upon hiring a new employee to work in the United States.