Oregon Job Description Worksheet

Description

How to fill out Job Description Worksheet?

Are you in a location where you need documents for either professional or personal purposes almost every day.

There are numerous legal document templates accessible online, but locating versions you can trust is not simple.

US Legal Forms provides thousands of form templates, such as the Oregon Job Description Worksheet, that are designed to meet state and federal standards.

Once you locate the correct form, click on Get now.

Select the pricing plan you want, fill in the required details to create your account, and finalize your order with PayPal or credit card. Choose a convenient file format and download your copy. You can find all the document templates you have purchased in the My documents section. You can acquire another copy of the Oregon Job Description Worksheet at any time if needed. Click on the necessary form to download or print the template. Leverage US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors. The service provides professionally crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and begin making your life easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Oregon Job Description Worksheet template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and verify it is for the correct state/area.

- Utilize the Preview button to review the document.

- Check the details to ensure you have selected the appropriate form.

- If the form is not what you are looking for, use the Search area to find the document that suits your needs.

Form popularity

FAQ

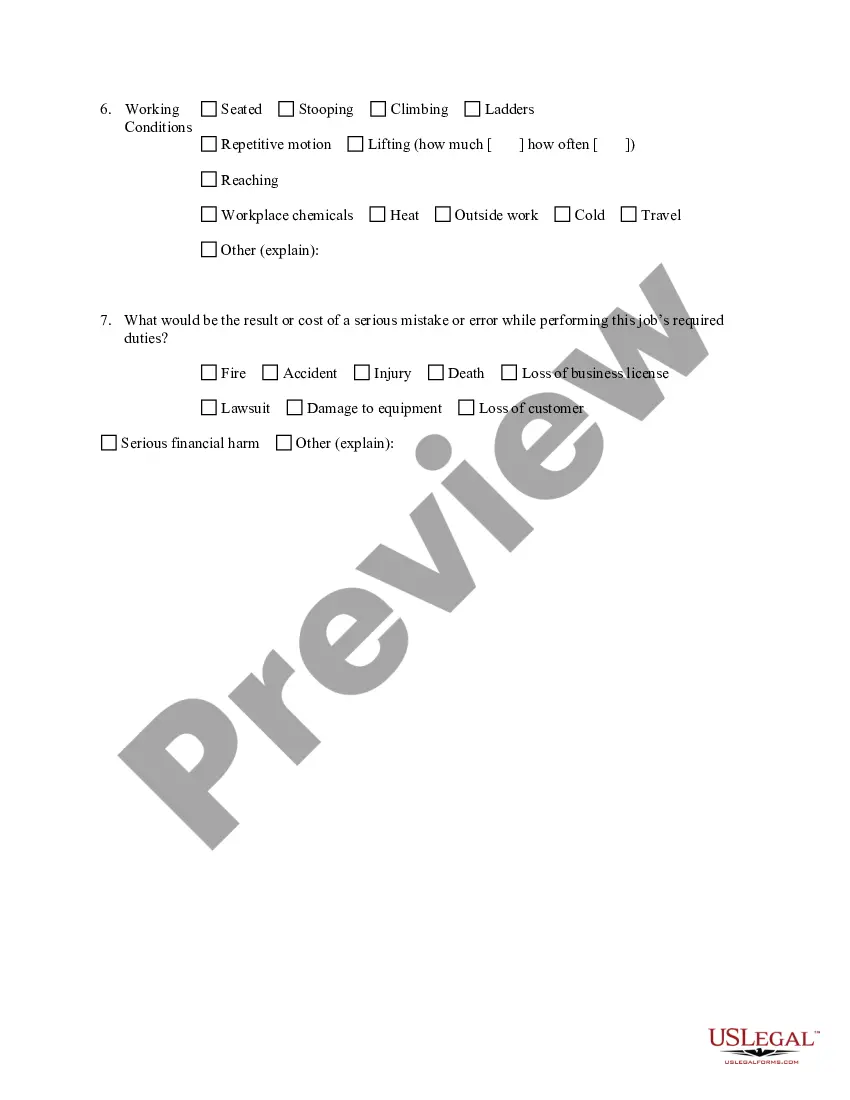

The format of a job description (JD) typically includes sections such as job title, summary, responsibilities, qualifications, and company culture. This structured approach helps applicants easily grasp the role and its expectations. Utilizing the Oregon Job Description Worksheet allows you to create a standardized JD that aligns with best practices.

A single filer with no children should claim a maximum of 1 allowance, while a married couple with one source of income should file a joint return with 2 allowances. You can also claim your children as dependents if you support them financially and they're not past the age of 19.

By placing a 0 on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period.

A: An allowance represents a portion of your income that is exempt from tax. On your Oregon tax return, this portion can take the form of a credit against tax, a deduction, or a subtraction. The more allowances you claim on Form OR-W-4, the less tax your employer will withhold.

The most common types of employment forms to complete are:W-4 form (or W-9 for contractors)I-9 Employment Eligibility Verification form.State Tax Withholding form.Direct Deposit form.E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.

How to Fill Out The Personal Allowances Worksheet (W-4 Worksheet) for 2019. As you may know, Form W-4 is used to determine your withholding allowances based on your unique situation so that your employer can withhold the correct federal income tax from your pay.

Required Employment Forms in OregonSigned Job Offer Letter.W2 Tax Form.I-9 Form and Supporting Documents.Direct Deposit Authorization Form (Template)Federal W-4 Form.Employee Personal Data Form (Template)Company Worker's Compensation Insurance Policy Forms.Company Health Insurance Policy Forms.More items...?

Form 132 is filed with Form OQ on a quarterly basis. Oregon Combined Quarterly Report- Form OQUse this form to determine how much tax is due each quarter for state unemployment insurance, withholding, Tri-Met & Lane Transit excise taxes, and the Workers' Benefit Fund.

A single person who lives alone and has only one job should place a 1 in part A and B on the worksheet giving them a total of 2 allowances. A married couple with no children, and both having jobs should claim one allowance each. You can use the Two Earners/Multiple Jobs worksheet on page 2 to help you calculate this.

Q: What is a withholding allowance? A: An allowance represents a portion of your income that is exempt from tax. On your Oregon tax return, this portion can take the form of a credit against tax, a deduction, or a subtraction. The more allowances you claim on Form OR-W-4, the less tax your employer will withhold.