Oregon Notice of Annual Report of Employee Benefits Plans

Description

How to fill out Notice Of Annual Report Of Employee Benefits Plans?

Are you currently in the situation where you require documents for both business or personal purposes every time.

There are numerous legitimate document templates available online, but finding reliable ones is not easy.

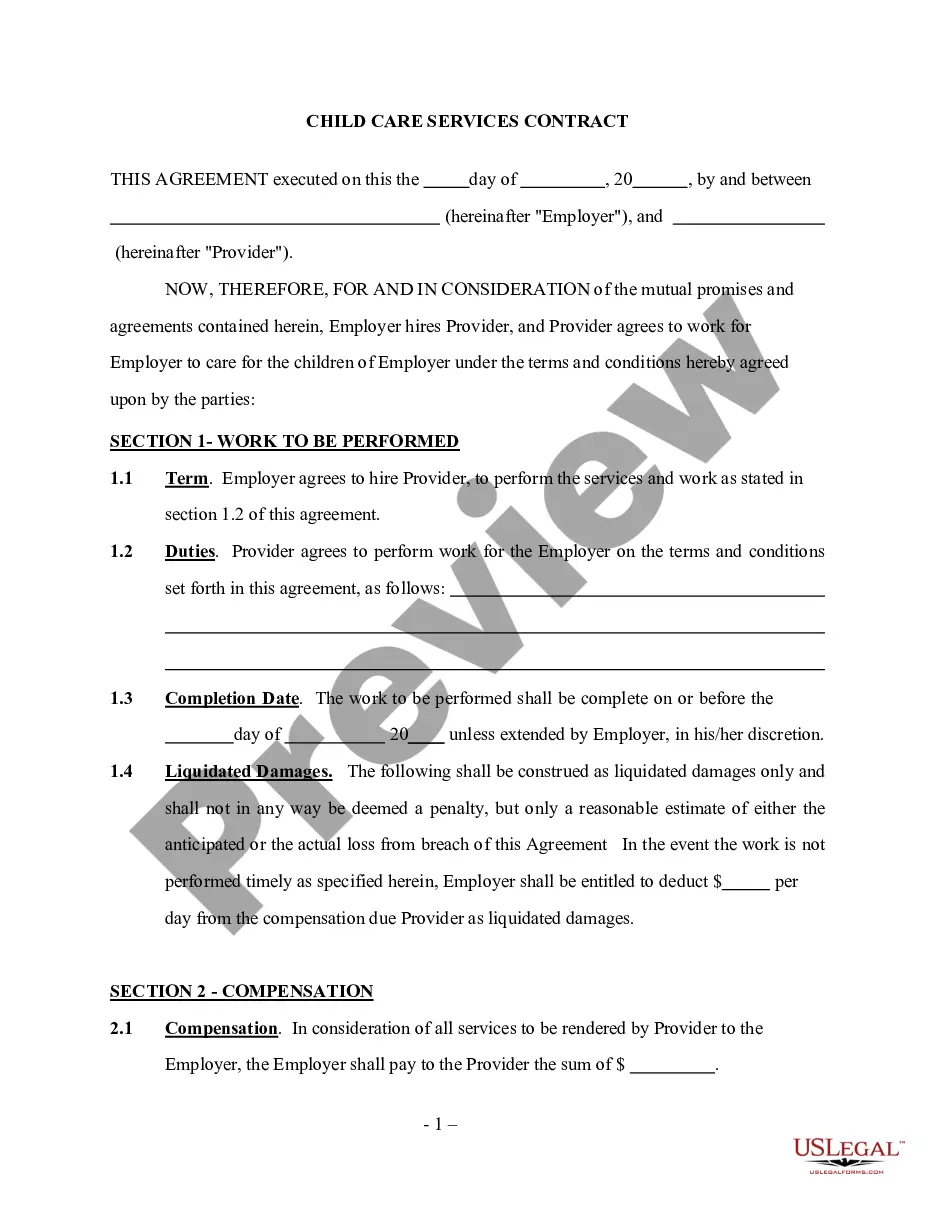

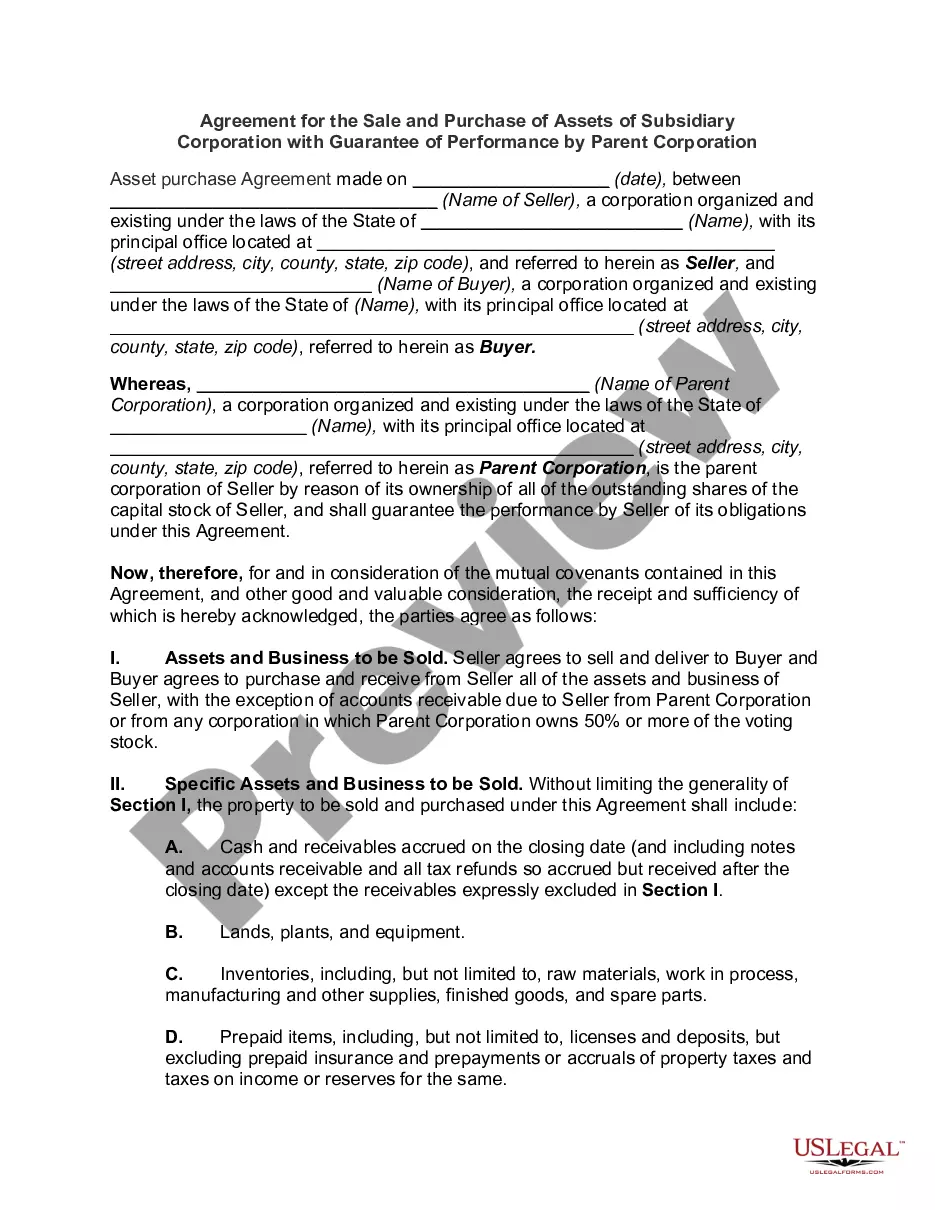

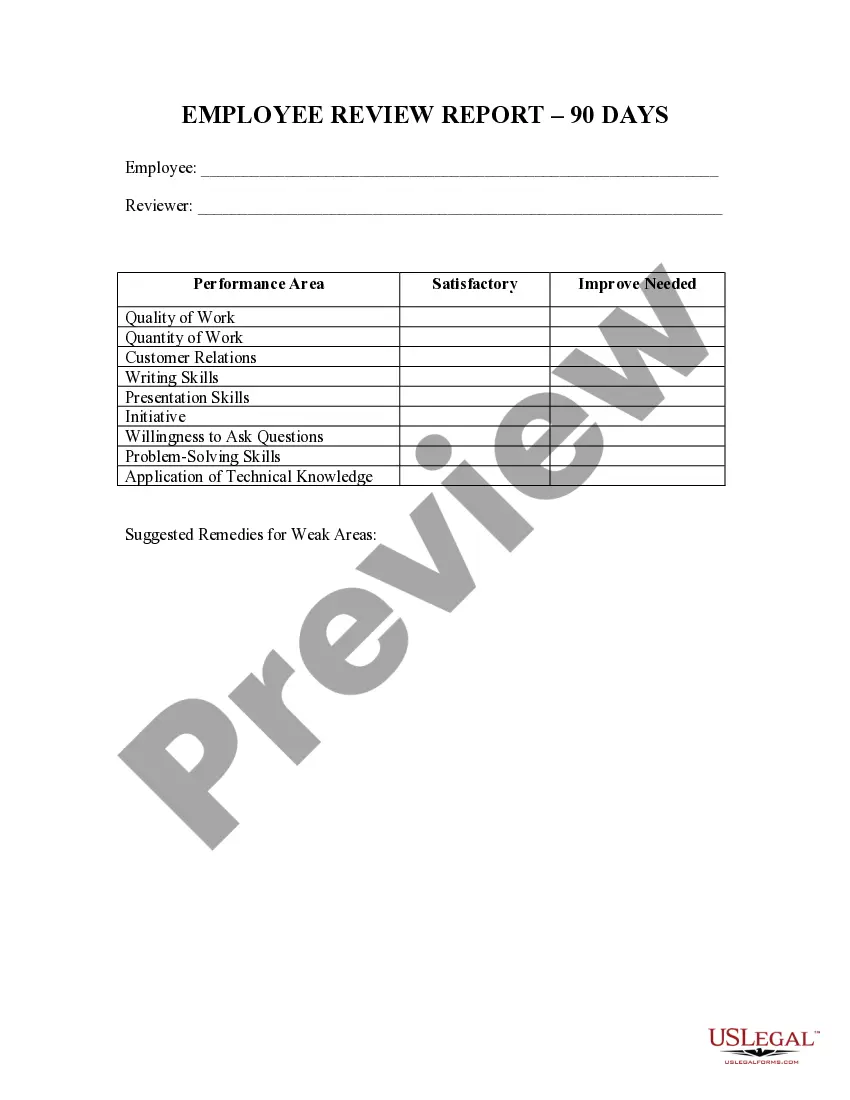

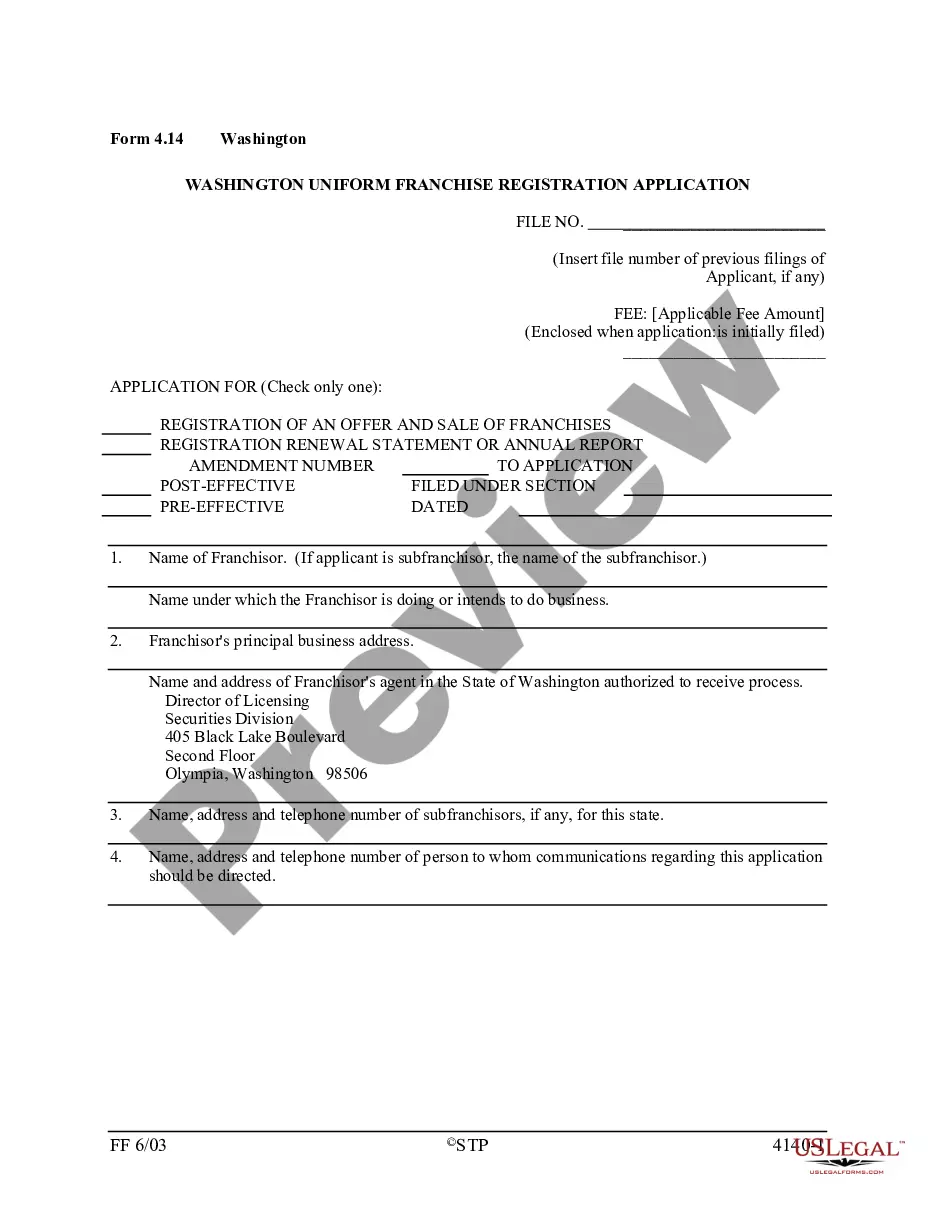

US Legal Forms provides thousands of document templates, such as the Oregon Notice of Annual Report of Employee Benefits Plans, that are designed to meet state and federal standards.

Once you find the correct form, click Purchase now.

Choose the payment plan you want, enter the necessary details to create your account, and purchase your order using your PayPal or Visa or MasterCard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Oregon Notice of Annual Report of Employee Benefits Plans template.

- If you don't have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/county.

- Utilize the Preview button to review the form.

- Read the description to confirm you have selected the right document.

- If the form is not what you are looking for, use the Lookup field to find the form that meets your needs and specifications.

Form popularity

FAQ

To apply for a Business Identification Number (BIN) in Oregon, complete the required application form through the Oregon Department of Revenue website. This step is crucial for businesses, especially when preparing the Oregon Notice of Annual Report of Employee Benefits Plans. The application can often be completed online, simplifying the process for your organization.

Choose a quarterly report filing method:Oregon Payroll Reporting System (OPRS) electronic filing.Combined Payroll Tax Reports Form OQ.Interactive voice response system, call 503-378-3981. Use only to report quarters with no payroll or no hours worked.

Please provide your telephone number and email address when submitting your PUA application and weekly certifications. Next, select Choose File to upload your document. When you are ready to submit your document, select the Upload button.

Requirements and penalties Required 1099s are the 1099-G, 1099-K, 1099-NEC, 1099-MISC, 1099-R, and W-2G. Other 1099s, including 1099-DIV and 1099-INT, are not required.

File Form OR-WR on Revenue Online at . Mail your Form OR-WR separately from your 2018 4th quarter Form OQ and 4th quarter statewide transit tax form. If you amend Form OR-WR, you will also need to amend Form OQ and 4th quarter statewide transit tax form. Make a copy for your records.

Choose a quarterly report filing method:Oregon Payroll Reporting System (OPRS) electronic filing.Combined Payroll Tax Reports Form OQ.Interactive voice response system, call 503-378-3981. Use only to report quarters with no payroll or no hours worked.

Form 132 is filed with Form OQ on a quarterly basis. Oregon Combined Quarterly Report- Form OQUse this form to determine how much tax is due each quarter for state unemployment insurance, withholding, Tri-Met & Lane Transit excise taxes, and the Workers' Benefit Fund.

To file the Form WR electronically, as required under ORS 316.202 and ORS 314.360, you must do so using Department of Revenue's system, Revenue Online by going to this link: .

What is a 1099G? 1099G is a tax form sent to people who have received unemployment insurance benefits. You use it when you are filing federal and state income taxes to the Internal Revenue Service (IRS) and Oregon Department of Revenue. Sign up to receive email updates!

Definitions as they pertain to Oregon Employment Department Law. An employer is subject to unemployment insurance taxes when the employer pays wages of $1,000 or more in a calendar quarter, or employs one or more individuals in any part of 18 separate weeks during any calendar year.