Oregon Certificate of Unanimous Consent of Directors and Shareholders to Sign and Deliver a Promissory Note

Description

How to fill out Certificate Of Unanimous Consent Of Directors And Shareholders To Sign And Deliver A Promissory Note?

Have you been in a place in which you will need papers for possibly organization or specific purposes virtually every day? There are a variety of lawful record layouts available on the net, but discovering versions you can rely is not simple. US Legal Forms provides a huge number of form layouts, just like the Oregon Certificate of Unanimous Consent of Directors and Shareholders to Sign and Deliver a Promissory Note, that happen to be created to satisfy federal and state demands.

When you are presently knowledgeable about US Legal Forms internet site and possess a merchant account, just log in. Afterward, it is possible to obtain the Oregon Certificate of Unanimous Consent of Directors and Shareholders to Sign and Deliver a Promissory Note format.

Unless you have an account and need to begin to use US Legal Forms, adopt these measures:

- Discover the form you will need and ensure it is for that correct city/region.

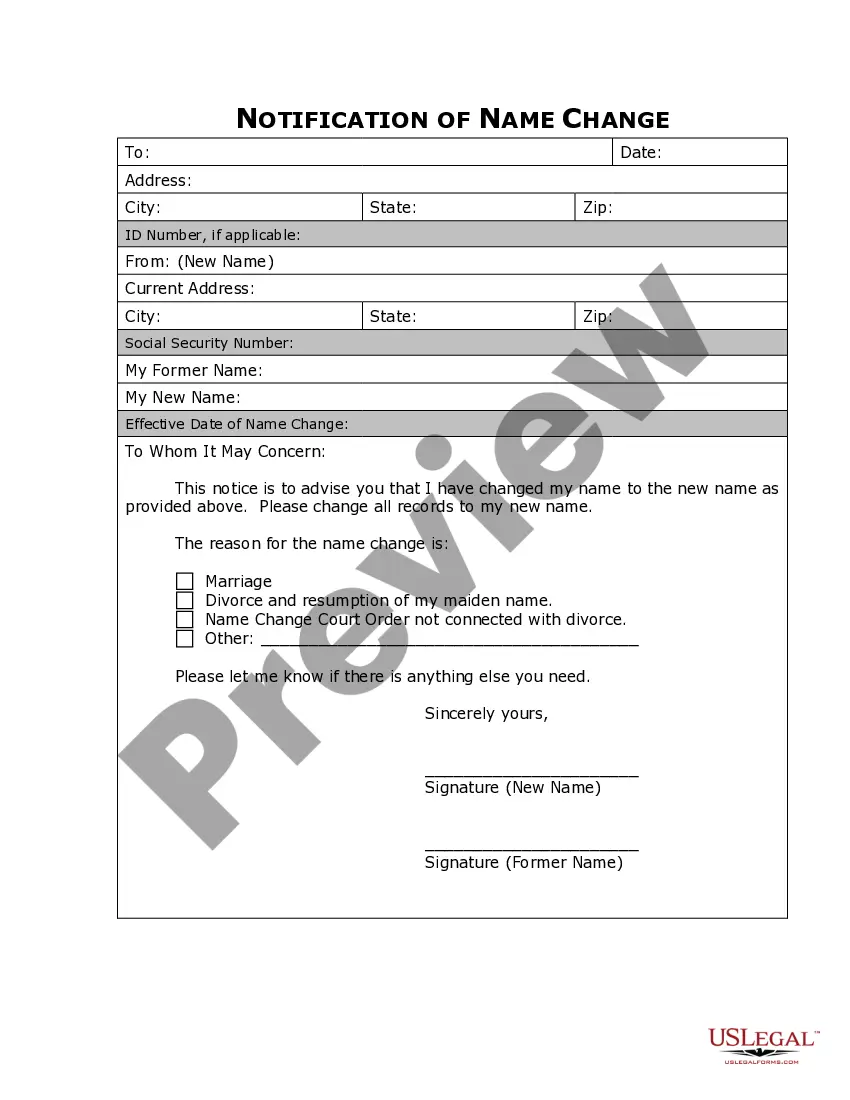

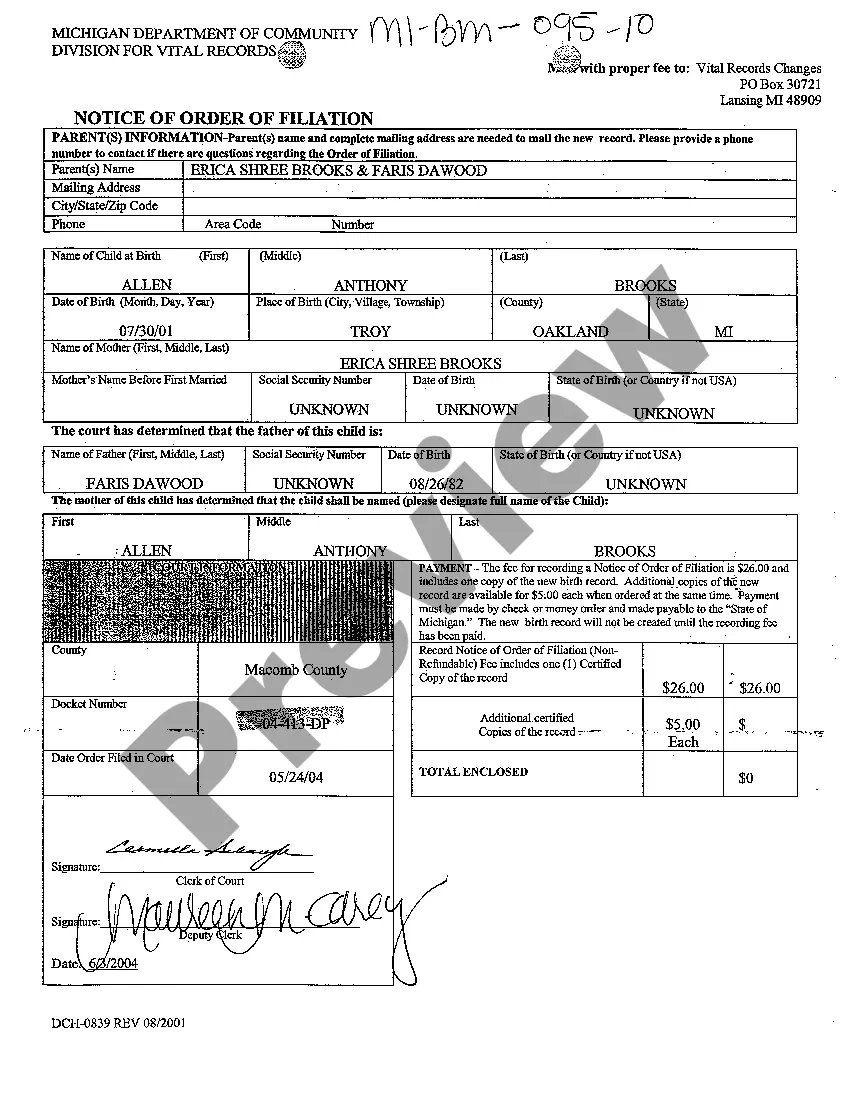

- Take advantage of the Preview switch to examine the form.

- See the explanation to ensure that you have selected the appropriate form.

- When the form is not what you`re trying to find, use the Research industry to obtain the form that meets your needs and demands.

- Once you discover the correct form, click on Acquire now.

- Pick the costs strategy you would like, submit the necessary information and facts to generate your money, and purchase your order utilizing your PayPal or credit card.

- Decide on a handy data file structure and obtain your duplicate.

Get all the record layouts you may have bought in the My Forms food selection. You may get a more duplicate of Oregon Certificate of Unanimous Consent of Directors and Shareholders to Sign and Deliver a Promissory Note anytime, if possible. Just go through the needed form to obtain or print the record format.

Use US Legal Forms, the most extensive selection of lawful kinds, to save some time and avoid blunders. The assistance provides appropriately produced lawful record layouts which you can use for a selection of purposes. Generate a merchant account on US Legal Forms and start creating your life easier.

Form popularity

FAQ

A limited liability company (LLC) offers liability protection and tax advantages, among other benefits for small businesses. LLC formation in Oregon is easy. Just follow these six steps, and you'll be on your way. Ready to start your business? Plans start at $0 + filing fees.

Benefits of a Corporation The Oregon Business Corporation Act includes laws and regulations for corporations doing business in the state of Oregon. By forming a corporation, the owner's personal assets aren't at risk for legal or financial issues relating to the business.

Corporate bylaws are legally required in Oregon. § 60.061, corporate bylaws shall be adopted by the incorporators or the corporation's board of directors. Bylaws are usually adopted by your corporation's directors at their first board meeting.

Benefits of starting an Oregon LLC: Protect your personal assets from your business liability and debts. Simple to create, manage, regulate, administer and stay in compliance. Easily file your taxes and discover potential advantages for tax treatment. Low cost to file ($100)

Shareholder action by written consent refers to corporate shareholders' right to act by written consent instead of a meeting. This type of consent avoids some of the negative characteristics of shareholder meetings.

The Oregon Limited Liability Company Act allows companies to enjoy the taxation that partnerships do as well as the personal liability that corporations enjoy.

A limited liability company (LLC for short) is the United States-specific form of a private limited company. It is a business structure that can combine the pass-through taxation of a partnership or sole proprietorship with the limited liability of a corporation.