Oregon Expense Account Form

Description

How to fill out Expense Account Form?

Are you presently in the location where you need documents for either corporate or personal use almost every day.

There are numerous legal document templates accessible online, but finding reliable ones isn't simple.

US Legal Forms offers a vast array of document templates, such as the Oregon Expense Account Form, that are created to comply with state and national regulations.

Once you identify the correct template, click on Purchase now.

Select the payment plan you desire, complete the necessary information to create your account, and finalize your order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Oregon Expense Account Form template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

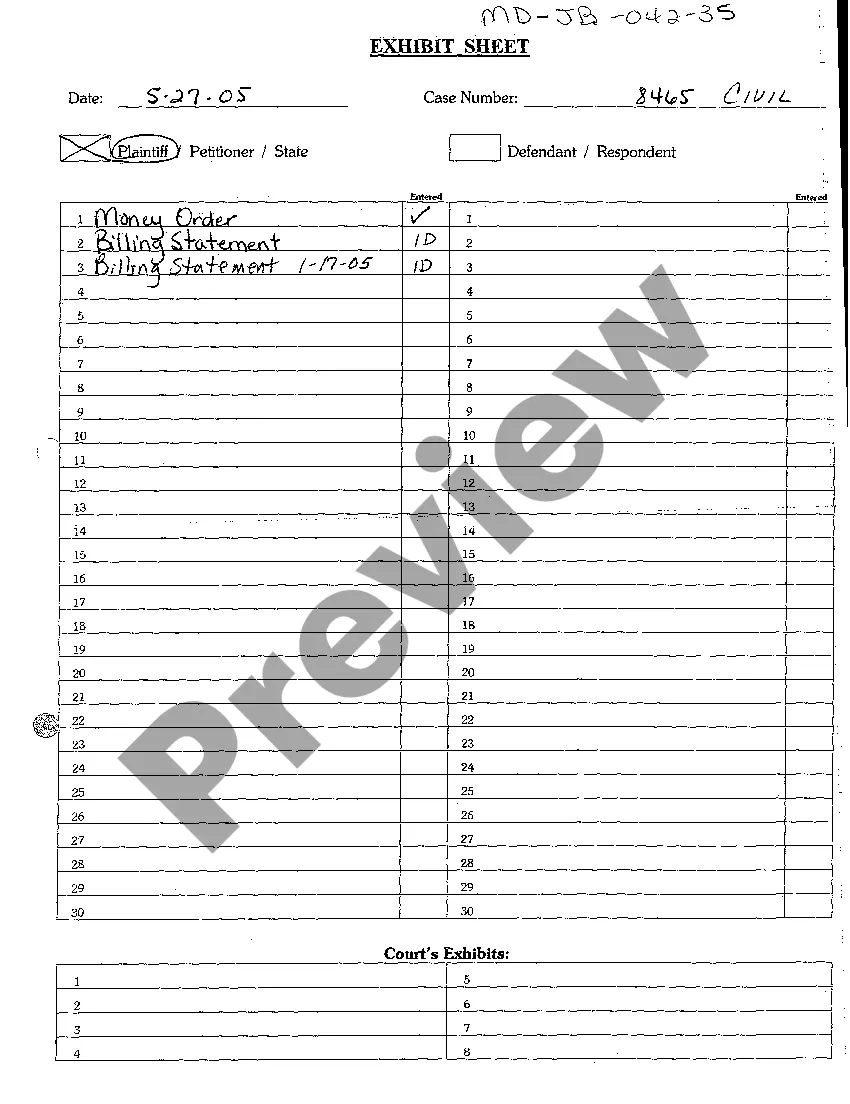

- Find the template you need and ensure it is for the correct city/state.

- Use the Preview button to review the document.

- Check the description to confirm that you have selected the right template.

- If the template isn’t what you’re looking for, utilize the Search feature to locate the document that fulfills your needs and requirements.

Form popularity

FAQ

Your federal tax liability amount is found on Form 1040 (line 63), Form 1040A (line 39), and Form 1040EZ (line 12). If you need your state liability, look for the line that says total tax on your state return.

115. Taxability of Meal Per Diem. Meal allowances paid in connection with overnight travel status are nontaxable to the employee.

The official answer is 17.341% of 2020 state income taxes paid. Taxpayers can find their 2020 tax liability on line 22 of their 2020 Form OR. Oregonians get a kicker rebate when the state's revenue exceeds by 2% or more what state forecasters projected far ahead of time.

You can deduct Healthcare professionals, including medical doctors, dentists, physical therapists, and psychologists. Medical examinations, X-rays, laboratory fees, diagnos- tic tests, and other services. Hospital care and nursing help. Ambulance service and other travel costs.

If you or your spouse turned 66 by the end of 2021 and have qualifying medical and/or dental expenses, you may qualify for the special Oregon medical subtraction. See IRS Publication 502 for types of qualifying medical and dental expenses.

You can deduct Healthcare professionals, including medical doctors, dentists, physical therapists, and psychologists. Medical examinations, X-rays, laboratory fees, diagnos- tic tests, and other services. Hospital care and nursing help. Ambulance service and other travel costs.

Visit to get tax forms, check the status of your refund, or make tax payments; call 800-356-4222 toll-free from an Oregon prefix (English or Spanish); 503-378-4988 in Salem and outside Oregon; or email questions.dor@oregon.gov.

The IRS allows you to deduct unreimbursed payments for preventative care, treatment, surgeries, dental and vision care, visits to psychologists and psychiatrists, prescription medications, appliances such as glasses, contacts, false teeth and hearing aids, and expenses that you pay to travel for qualified medical care.

Special Oregon medical subtraction code 351. You or your spouse turned age 66 by the end of the tax year; 2022 Your federal AGI isn't more than $200,000 ($100,000 if your filing status is single or married filing separately); and 2022 You or your spouse have qualifying medical or dental expenses.

Medical costs are deductible only after they exceed 7.5% of your Adjusted Gross Income (AGI). So, if your AGI is $50,000, the first $3,750 ($50,000 x 0.075) of unreimbursed medical expenses doesn't count.