Oregon Renunciation of Legacy to give Effect to Intent of Testator

Description

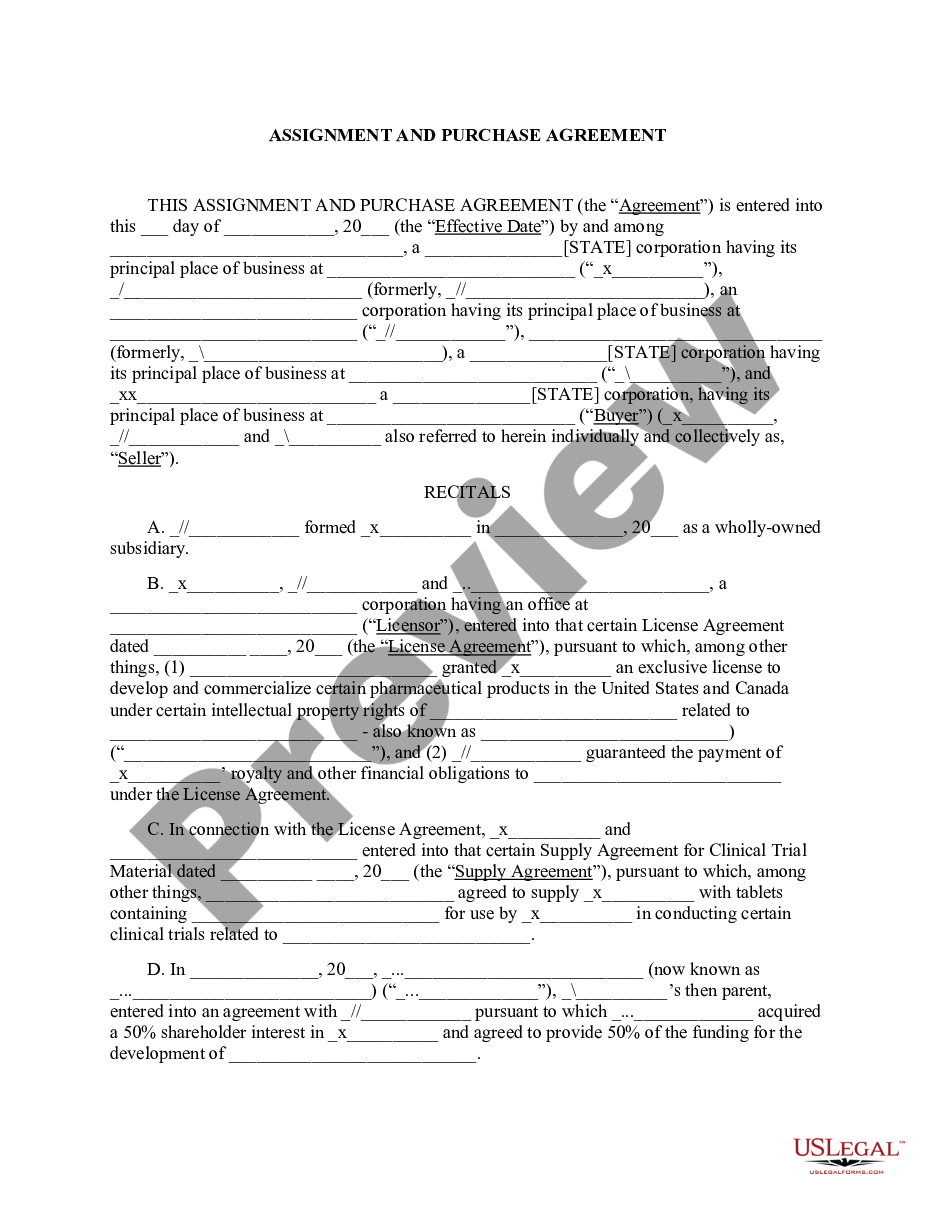

How to fill out Renunciation Of Legacy To Give Effect To Intent Of Testator?

You are able to spend several hours on the web looking for the authorized papers format which fits the state and federal specifications you will need. US Legal Forms provides 1000s of authorized types that happen to be examined by professionals. You can easily down load or print out the Oregon Renunciation of Legacy to give Effect to Intent of Testator from our assistance.

If you already have a US Legal Forms bank account, you can log in and click on the Down load option. Afterward, you can comprehensive, modify, print out, or indication the Oregon Renunciation of Legacy to give Effect to Intent of Testator. Each authorized papers format you buy is the one you have for a long time. To get yet another backup of the bought develop, check out the My Forms tab and click on the related option.

Should you use the US Legal Forms site initially, stick to the basic instructions under:

- Very first, make sure that you have chosen the correct papers format for that area/town of your liking. Browse the develop outline to make sure you have picked the right develop. If readily available, take advantage of the Review option to check with the papers format as well.

- If you wish to discover yet another version in the develop, take advantage of the Research industry to get the format that meets your requirements and specifications.

- After you have discovered the format you would like, click on Purchase now to move forward.

- Find the costs program you would like, key in your credentials, and register for an account on US Legal Forms.

- Comprehensive the transaction. You may use your charge card or PayPal bank account to pay for the authorized develop.

- Find the formatting in the papers and down load it in your system.

- Make adjustments in your papers if needed. You are able to comprehensive, modify and indication and print out Oregon Renunciation of Legacy to give Effect to Intent of Testator.

Down load and print out 1000s of papers themes while using US Legal Forms site, which provides the largest selection of authorized types. Use skilled and state-specific themes to tackle your business or personal demands.

Form popularity

FAQ

Children in Oregon Inheritance Law If you die intestate in Oregon, your children will get an ?intestate share? of the property. The size of the share depends on how many children you have, whether their parent is your surviving spouse and whether you have any children from a prior relationship.

In Oregon, if a person dies without a will, their assets are distributed ing to the state's laws of intestate succession. Under these laws, the deceased person's assets are distributed to their surviving spouse and children, or to their next closest relatives if they have no spouse or children.

Under Oregon law, an estate must go through a full probate unless the value of the real property is $200,000 or less and the value of all other property (like bank accounts, investment accounts, cars, manufactured homes that are not part of the land, other tangible personal property ? everything except land) is $75,000 ...

Probate can be started immediately after death and takes a minimum of four months. If the estate includes property that takes a while to sell, or if there are complicated tax or other matters, probate can last much longer. A small estate proceeding cannot be filed until 30 days after death and is complete upon filing.

When a person dies intestate, it means they left no legal will. If there is no will to go by, a state probate court will determine how the person's estate will be distributed. Courts generally establish a hierarchy, with spouses and other close relatives being first in line to receive the assets.

If you own property jointly with someone else, and this ownership includes the "right of survivorship," then the surviving owner automatically owns the property when the other owner dies. This is called a "survivorship estate" in Oregon.

Under Oregon inheritance laws, If you have a spouse but no descendants (children, grandchildren), your spouse will inherit everything. If you have children but no spouse, your children will inherit everything. If you have a spouse and descendants (with that spouse), your spouse inherits everything.

?Per Stirpes? means that the beneficiary with the closest familial relationship to the decedent will receive an equal share of the decedent's assets.