Oregon Renunciation of Legacy in Favor of Other Family Members

Description

How to fill out Renunciation Of Legacy In Favor Of Other Family Members?

If you wish to full, download, or print out authorized document themes, use US Legal Forms, the greatest assortment of authorized types, that can be found on-line. Make use of the site`s simple and convenient research to discover the files you require. Different themes for enterprise and individual purposes are categorized by types and says, or keywords. Use US Legal Forms to discover the Oregon Renunciation of Legacy in Favor of Other Family Members in just a handful of clicks.

In case you are already a US Legal Forms buyer, log in for your accounts and click on the Down load switch to find the Oregon Renunciation of Legacy in Favor of Other Family Members. Also you can entry types you previously acquired from the My Forms tab of your accounts.

Should you use US Legal Forms initially, follow the instructions listed below:

- Step 1. Ensure you have chosen the form for that correct town/region.

- Step 2. Take advantage of the Review option to check out the form`s content. Don`t forget to learn the information.

- Step 3. In case you are not satisfied with all the develop, use the Look for industry at the top of the display screen to locate other versions from the authorized develop web template.

- Step 4. When you have located the form you require, click the Acquire now switch. Pick the prices plan you like and put your references to sign up on an accounts.

- Step 5. Approach the deal. You can utilize your Мisa or Ьastercard or PayPal accounts to finish the deal.

- Step 6. Choose the structure from the authorized develop and download it on your gadget.

- Step 7. Complete, edit and print out or indicator the Oregon Renunciation of Legacy in Favor of Other Family Members.

Every single authorized document web template you acquire is your own property for a long time. You might have acces to every develop you acquired within your acccount. Click the My Forms area and decide on a develop to print out or download once again.

Contend and download, and print out the Oregon Renunciation of Legacy in Favor of Other Family Members with US Legal Forms. There are thousands of specialist and status-certain types you may use for your personal enterprise or individual requirements.

Form popularity

FAQ

If you refuse to accept an inheritance, you will not be responsible for inheritance taxes, but you'll have no say in who receives the assets in your place. The bequest passes either to the contingent beneficiary listed in the will or, if that person died without a will, ing to your state's laws of intestacy.

Who Gets What in Oregon? If you die with:here's what happens:spouse and at least one descendant from you and someone other than that spousespouse inherits 1/2 of your intestate property descendants inherit everything elseparents but no spouse or descendantsparents inherit everything4 more rows

?Legacy? is likewise a gift by will, especially of personal property and often of money, the beneficiary of a legacy being known as a ?legatee.? And, of course, devises, bequests and legacies may all be equally described as ?testamentary gifts.?

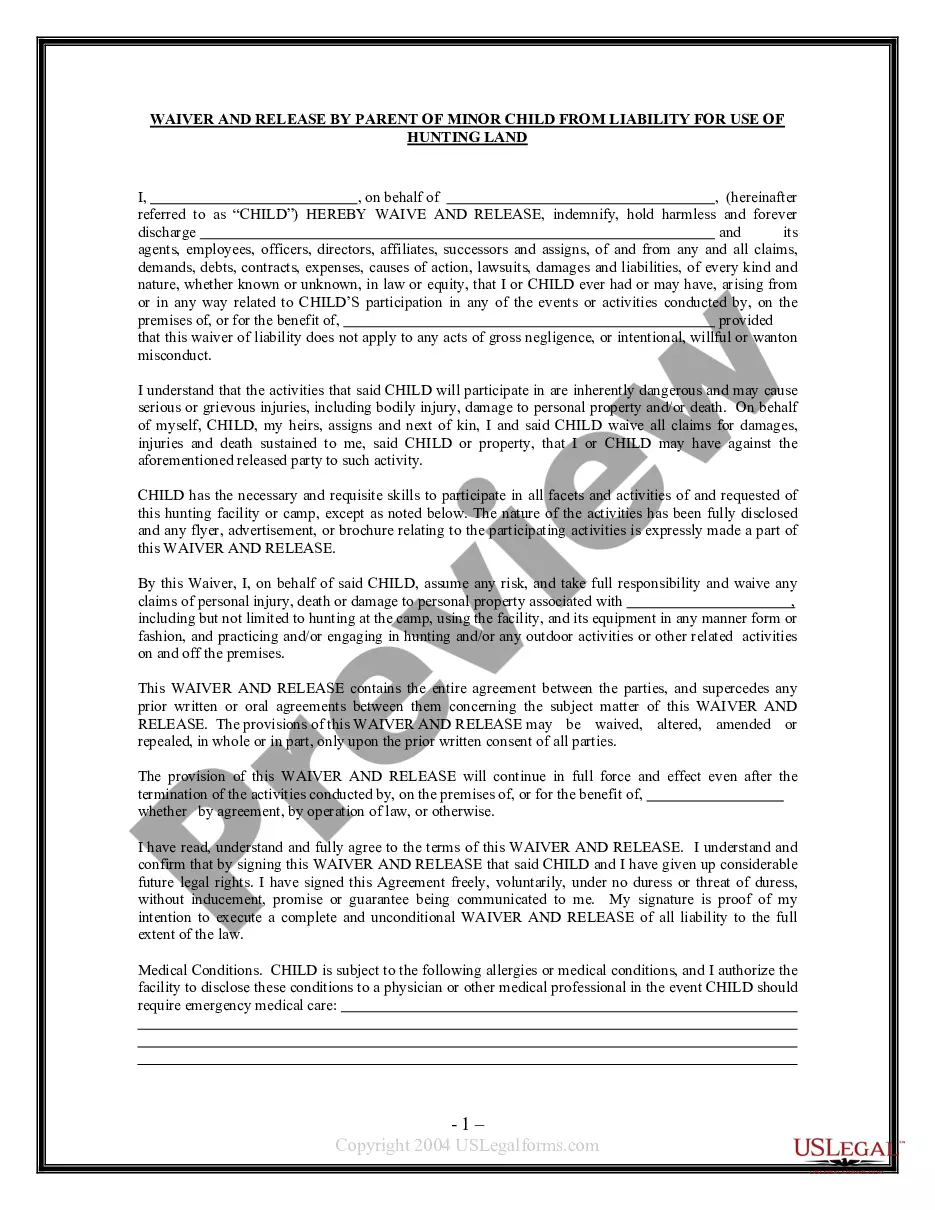

In order to disclaim an inheritance, you will need to write a Disclaimer, which states that you are disclaiming your inheritance in writing. Within your Disclaimer, you will need to explain what is being disclaimed, whether it is only part of your inheritance or all of it, as well as sign the document to make it legal.

If you have recently received an inheritance, you may be able to redirect all or part of that inheritance to other people. This can be achieved through a Deed of Variation. You can redirect your inheritance to anyone you want.

You can sign over your inheritance to another party, or refuse it entirely. However, you do not get to choose that party.

Unfortunately, beneficiaries often make major financial mistakes that could have been avoided when they inherited money. Mistake #1: Not following a realistic plan. ... Mistake #2: Spending Money Too Quickly. ... Mistake #3: Making Emotional Decisions when receiving an inheritance.

To avoid subjecting the assets to creditors in case the primary beneficiary is involved in a lawsuit or bankruptcy proceeding. To benefit another family member?for example, a college-age grandchild who could use an inherited car.