Delaware Amendment To Certificate of Limited Partnership

Description

How to fill out Delaware Amendment To Certificate Of Limited Partnership?

Preparing official documents can be a significant anxiety if you lack accessible fillable templates. With the US Legal Forms online library of formal records, you can be assured in the blanks you discover, as all of them adhere to federal and state laws and are verified by our specialists.

So if you require to fill out the Delaware Amendment To Certificate of Limited Partnership, our service is the ideal location to obtain it.

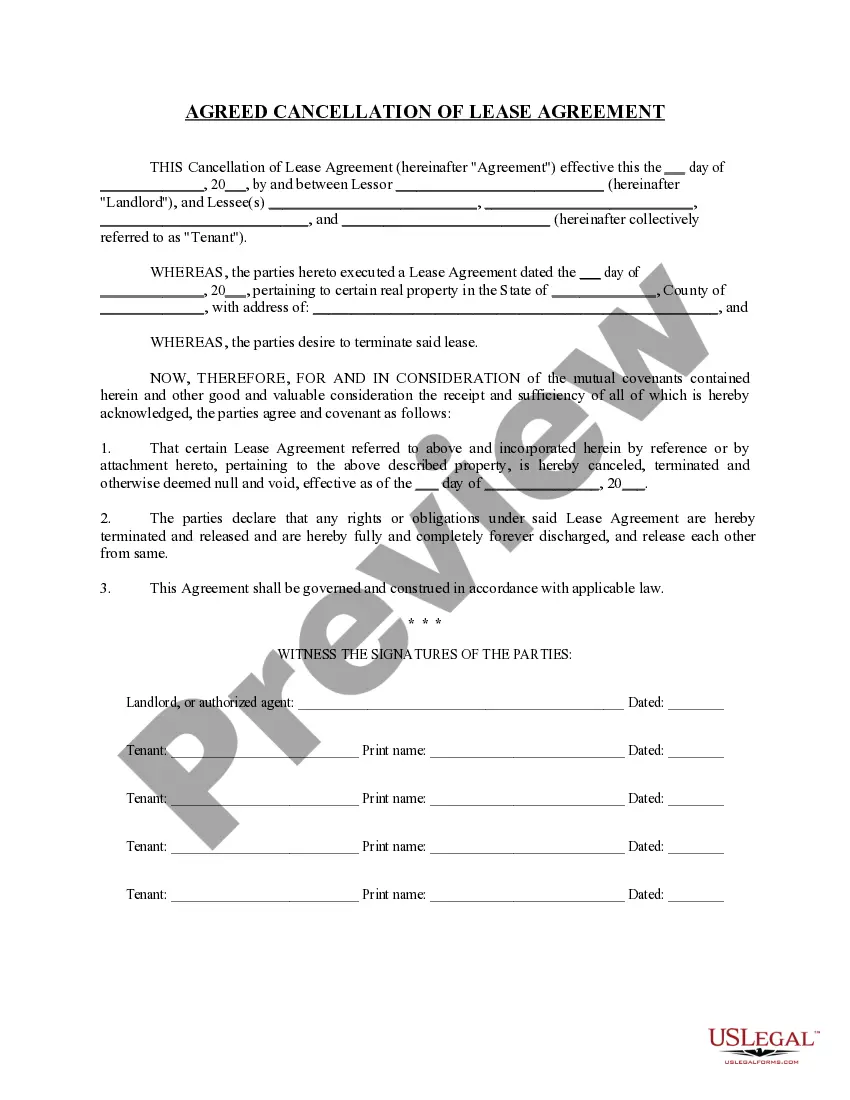

Here's a brief guideline for you: Document compliance verification. You should thoroughly review the content of the form you wish to obtain and ensure it meets your requirements and adheres to your state regulations. Previewing your document and evaluating its general description will assist you in doing just that.

- Acquiring your Delaware Amendment To Certificate of Limited Partnership from our collection is as easy as one-two-three.

- Previously authorized users with a valid subscription merely need to Log In and click the Download button once they find the suitable template.

- Afterwards, if desired, users can retrieve the same blank from the My documents tab of their profile.

- However, even if you are unfamiliar with our service, registering with a valid subscription will only take a few minutes.

Form popularity

FAQ

A certificate of limited partnership in Delaware is a foundational document that establishes the existence of a limited partnership. This document outlines essential details such as the partnership's name, registered agent, and members' contributions. When filing a Delaware Amendment To Certificate of Limited Partnership, you may need to update this certificate to reflect changes in the partnership's structure or operations.

Yes, limited partnerships are registered in Delaware, which is known for its business-friendly laws. Many businesses choose Delaware due to its efficient registration process and favorable legal environment. When you register a limited partnership, keep in mind the importance of the Delaware Amendment To Certificate of Limited Partnership to maintain compliance.

The Delaware Revised Uniform Limited Partnership Act provides the legal framework governing limited partnerships in Delaware. This act streamlines formation, management, and operation processes for such entities. Understanding this act is crucial, especially when you plan on submitting a Delaware Amendment To Certificate of Limited Partnership, as it outlines your rights and obligations.

Changing the registered agent of your LLC in Delaware involves submitting a Certificate of Change of Registered Agent to the Delaware Secretary of State. It's important to also notify your current registered agent and ensure compliance with their exit procedures. Using ulegalforms can simplify this process, providing you with the necessary documents and guidance to complete the Delaware Amendment To Certificate of Limited Partnership with ease.

Notifying the IRS of an LLC ownership change requires you to fill out specific tax forms that reflect the new ownership structure. When you file your next tax return, include the updated information or submit Form 8822-B to report the change. This ensures that the IRS records align with your updated Delaware Amendment To Certificate of Limited Partnership.

To change LLC ownership in Delaware, you typically start by amending your Certificate of Limited Partnership. This Delaware Amendment To Certificate of Limited Partnership outlines the changes in ownership and must be filed with the state. After you submit the amendment, ensure you update your internal records and communicate these changes to all stakeholders involved.

Yes, you can change the LLC ownership percentage through a Delaware Amendment To Certificate of Limited Partnership. This process involves updating your partnership agreement to reflect the new ownership structure. It is essential to ensure that all members agree to these changes, as this agreement plays a crucial role in maintaining transparency and legality.

The DGCL 242 Amendment pertains to the Delaware General Corporation Law and involves the process of amending a corporation's certificate of incorporation. This amendment is significant for corporations seeking to change their structure or governance. Knowing this is valuable when executing a Delaware Amendment To Certificate of Limited Partnership, as it ensures compliance with state laws and promotes better organizational management.

To dissolve a Delaware limited partnership, you must follow specific procedures set forth in the Delaware Revised Uniform Limited Partnership Act. Typically, you must file a Certificate of Cancellation with the Delaware Secretary of State. For those navigating the process, the uslegalforms platform offers resources and forms to facilitate your Delaware Amendment To Certificate of Limited Partnership or dissolution effectively.

Section 245 of the Delaware Corporation law outlines the procedures for amending a company's certificate to create different classes of stock. This section provides flexibility for corporations to adjust their capital structure. This knowledge is beneficial when considering a Delaware Amendment To Certificate of Limited Partnership, as it guides how changes might affect the partnership's financial arrangements.