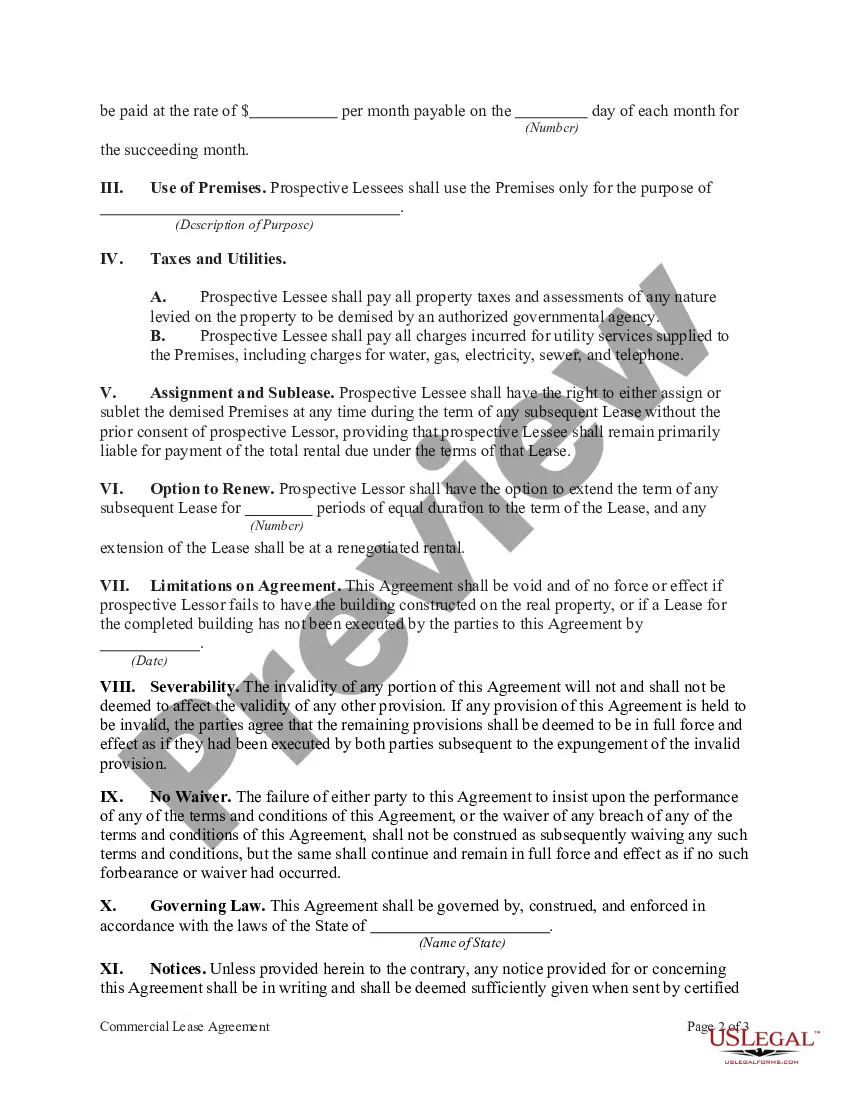

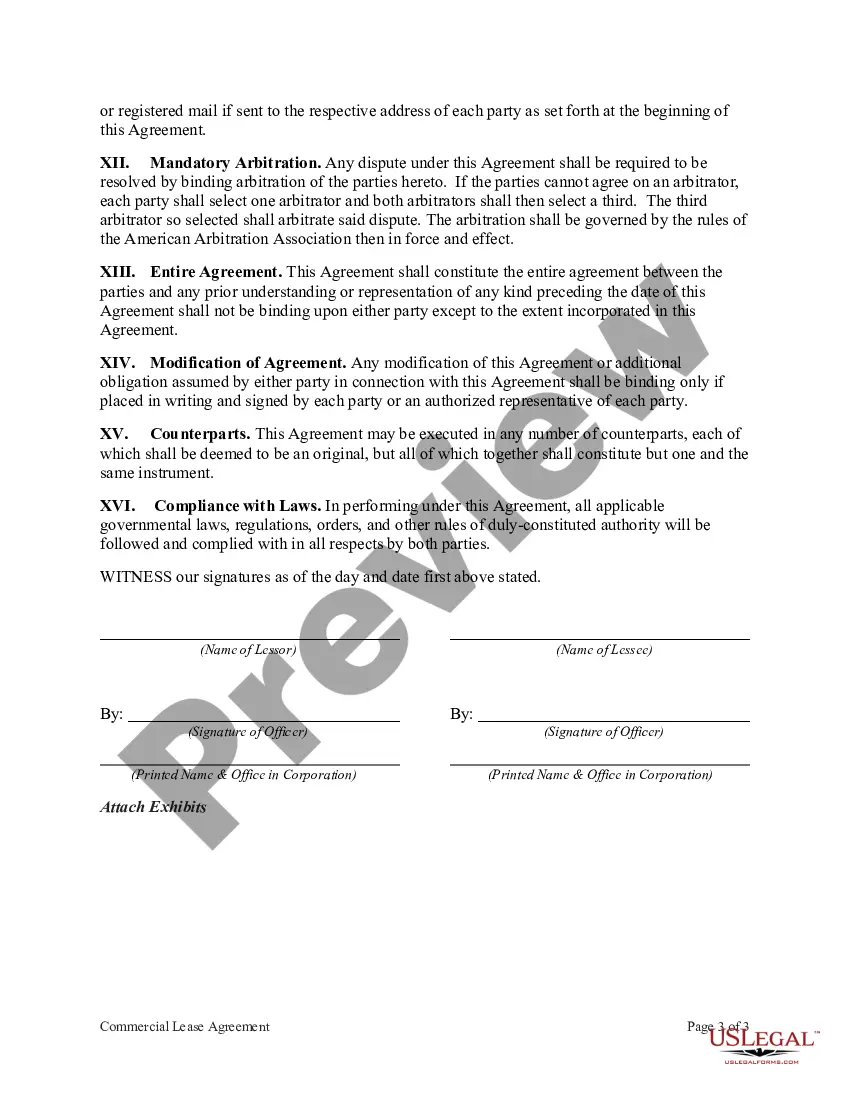

Oregon Commercial Lease Agreement for Building to be Erected by Lessor

Description

How to fill out Commercial Lease Agreement For Building To Be Erected By Lessor?

You can spend hours online searching for the legal document template that fulfills the federal and state requirements you need.

US Legal Forms offers a vast selection of legal forms that can be reviewed by professionals.

You can easily download or print the Oregon Commercial Lease Agreement for Building to be Erected by Lessor from the service.

Review the form details to ensure you have picked the right one. If available, use the Preview button to examine the document template as well.

- If you already have a US Legal Forms account, you can Log In and then click the Acquire button.

- Afterward, you can complete, modify, print, or sign the Oregon Commercial Lease Agreement for Building to be Erected by Lessor.

- Every legal document template you obtain is yours indefinitely.

- To get another copy of any purchased form, visit the My documents tab and then click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for the state/city of your choice.

Form popularity

FAQ

Here are 10 key financial commercial lease clauses that you should keep a close eye on throughout your lease term.Rent And Default.Rent Increase Steps/Percentages.Profit-Sharing Or Revenue-Based Rent.Options.Operating Expenses.Rent Incentives And Reimbursements.Janitorial Services.Electricity.More items...?

At a minimum, the lease agreement should include the property address , amount of rent , and duration of the lease with an effective start date. It should also include any other costs that the tenant and landlord will be responsible for. Leases need to be signed by both the landlord and the tenant.

A lease is automatically void when it is against the law, such as a lease for an illegal purpose. In other circumstances, like fraud or duress, a lease can be declared void at the request of one party but not the other.

The responsibilities of landlord and tenant will be clearly set out in the lease. Normally commercial landlords are responsible for any structural repairs such as foundations, flooring, roof and exterior walls, and tenants are responsible for non-structural repairs such as air conditioning or plumbing.

Your landlord is responsible for any aspects of health and safety written in the lease (eg in communal areas). You must take reasonable steps to make sure your landlord fulfils these responsibilities. If you get into a dispute with your landlord, you need to keep paying rent - otherwise you may be evicted.

3 Types of Commercial Real Estate LeasesGross Lease/Full Service Lease. In a gross lease, the tenant's rent covers all property operating expenses.Net Lease. The net lease is a highly adjustable commercial real estate lease.Modified Gross Lease/Modified Net Lease.

Commercial leases are legally binding contracts between landlords and commercial tenants. They give tenants the right to use the premises in a particular way for a set period for an agreed rent. Your lease will establish your rights and responsibilities as a tenant, as well as those of your landlord.

Specifically, the tenant pays the base rent, property but also taxes, insurance, utilities, and maintenance. This even includes standard property repairs associated with the commercial space being occupied.

Landlords are normally responsible for any structural repairs needed to maintain commercial properties. This includes exterior walls, foundations, flooring structure and the roof.

A Triple Net Lease (NNN Lease) is the most common type of lease in commercial buildings. In a NNN lease, the rent does not include operating expenses. Operating expenses include utilities, maintenance, property taxes, insurance and property management.