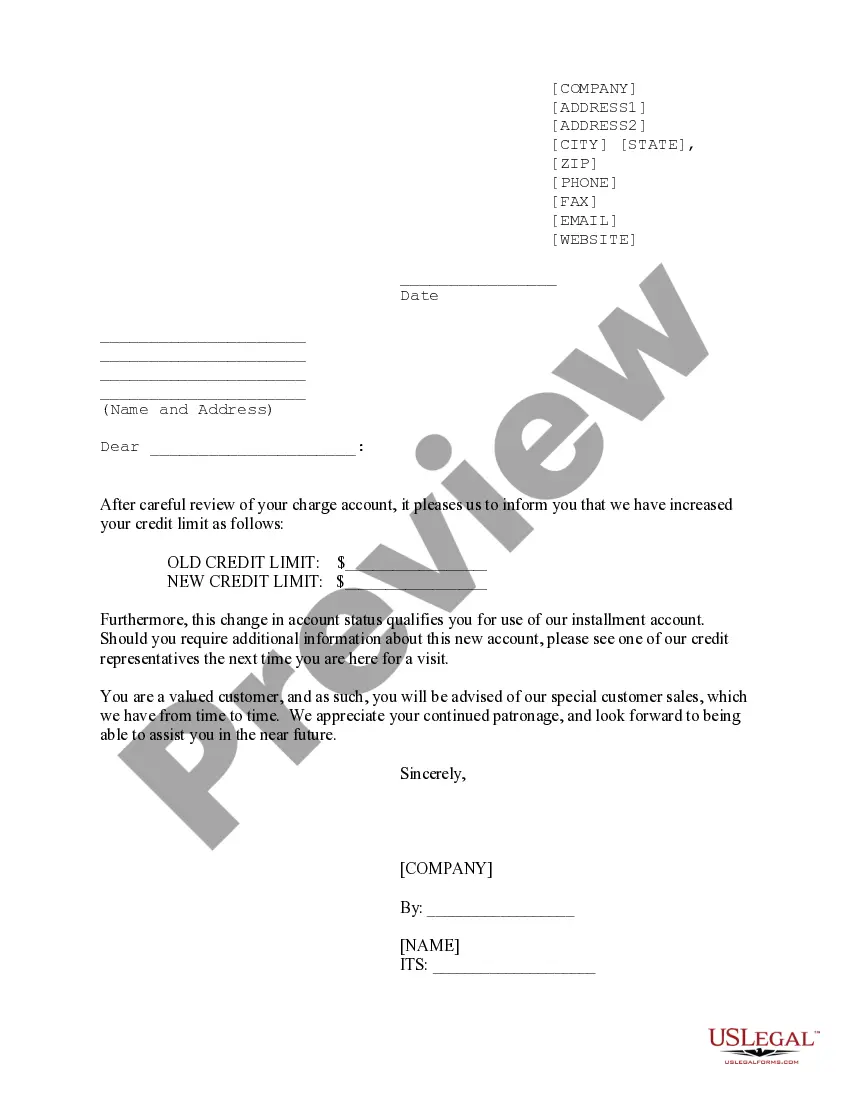

Oregon Sample Letter for Notice of Charge Account Credit Limit Raise

Description

How to fill out Sample Letter For Notice Of Charge Account Credit Limit Raise?

If you desire to complete, fetch, or create sanctioned document templates, employ US Legal Forms, the largest assembly of legal forms, accessible on the web.

Leverage the site’s uncomplicated and straightforward search to locate the documents you require.

Various templates for businesses and specific purposes are organized by categories and claims, or search terms.

Step 4. Once you have identified the form you need, click the Buy now button. Choose the payment plan you prefer and enter your details to register for your account.

Step 5. Process the purchase. You can use your credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to find the Oregon Sample Letter for Notice of Charge Account Credit Limit Increase in just a few clicks.

- If you are currently a US Legal Forms user, Log In to your account and then click the Download button to locate the Oregon Sample Letter for Notice of Charge Account Credit Limit Increase.

- You can also retrieve forms you previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps outlined below.

- Step 1. Ensure you have chosen the form for the appropriate city/region.

- Step 2. Make use of the Review option to assess the form’s content. Remember to read the description.

- Step 3. If you are unsatisfied with the form, utilize the Search field at the top of the screen to discover other versions of the legal form template.

Form popularity

FAQ

Options for getting a higher credit limitMake a request online. Many credit card issuers allow their cardholders to ask for a credit limit increase online.Call your card issuer.Look for automatic increases.Apply for a new card.

Increasing your credit limit, also known as a credit access line, won't necessarily hurt your credit score. In fact, you might improve your credit score. How you utilize the credit access line after the increase is one of the multiple factors that can impact your score.

I am writing to request an increase of $5,000.00 in my credit limit with Doe. My current limit is insufficient to cover my monthly purchases at your firm. As you know, my credit history with you is spotless. I have always made payments on time, so I do not anticipate problems handling the increased limit.

If you have a Capital One® credit card, requesting a credit limit increase will not result in a hard inquiry. You might want to consider asking your issuer about their procedure before requesting a credit limit increase.

Although a credit limit increase is generally good for your credit, requesting one could temporarily ding your score. That's because credit card issuers will sometimes perform a hard pull on your credit to verify you meet their standards for the higher limit.

At the same time, you don't want to ask for too much or seem too confident. For example, don't insist the rep double your credit limit. Instead, ask for 10 to 25% more up to $250 for every $1,000 in credit you already have. If you have excellent or even good credit, you may be able to ask for more.

Respected Sir/Madam, I like to state that my name is (Name) and, I hold a (name of credit card) credit card with your bank having credit card number (credit card number). I am writing this letter to ask you to kindly increase the limit of my credit card.

Increasing your credit limit can lower credit utilization, potentially boosting your credit score. A credit score is an important metric lenders use to determine a borrower's ability to repay. A higher credit limit can also be an efficient way to make large purchases and provide a source of emergency funds.

The wrong time to ask for a credit limit increaseNew credit applications trigger a new credit penalty, which may hurt your credit, especially if the length of your credit history is short. If you're making less money, your spending power has decreased, so the issuer has no reason to extend more credit to you.

Respected Sir/ Madam, My name is (Name) and I do hold a cash credit limit in your branch i.e. (Branch Name) bearing account number (Account number). I look forward to your kind and quick support. In case of any queries, you may contact me at (Contact number).