Oregon Sample Letter for Notice of Credit Limit - Conversion to C.O.D. Status

Category:

State:

Multi-State

Control #:

US-0394LR

Format:

Word;

Rich Text

Instant download

Description

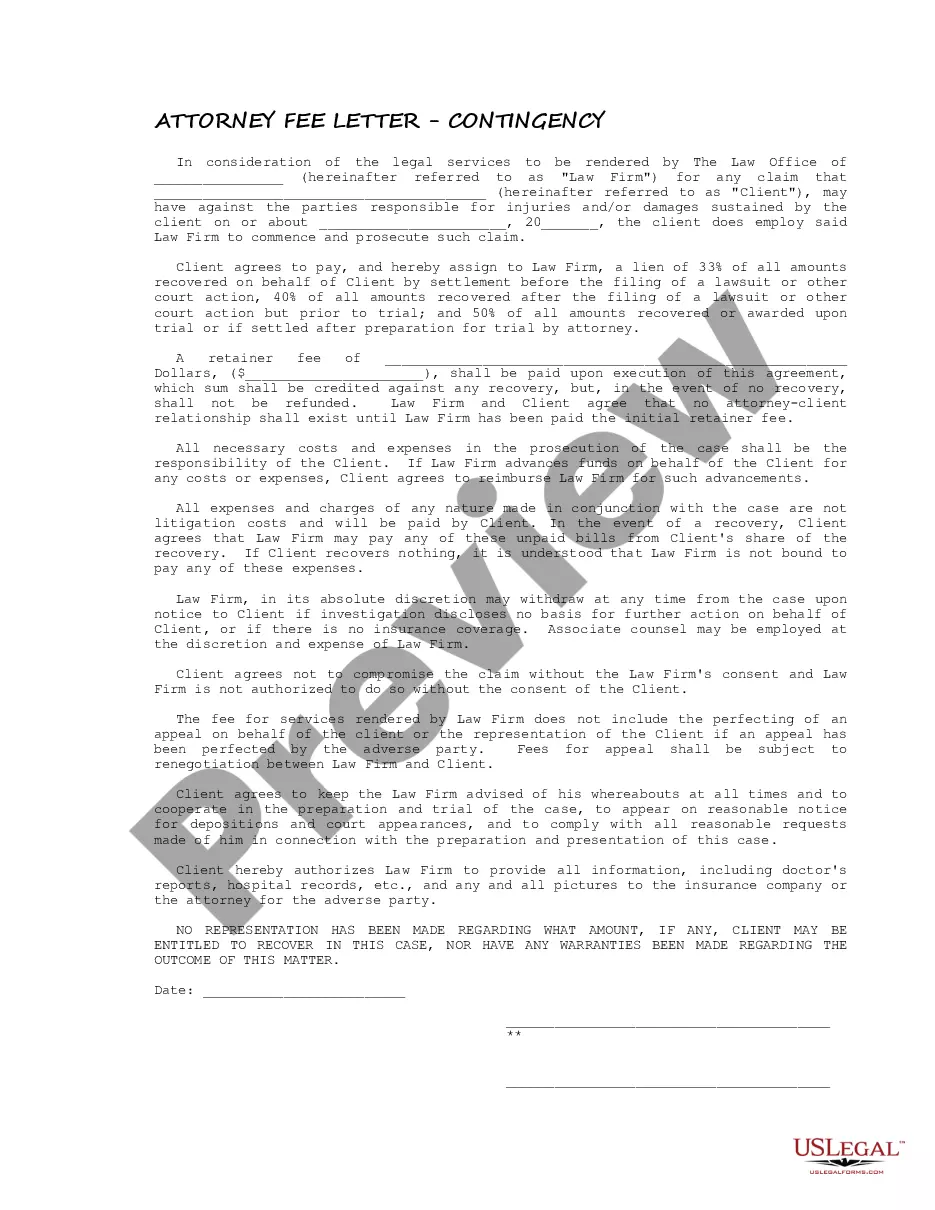

Sample Letter for Notice of Credit Limit - Conversion to C.O.D. Status

How to fill out Sample Letter For Notice Of Credit Limit - Conversion To C.O.D. Status?

You might spend hours online trying to find the legal document template that meets both state and federal requirements you need.

US Legal Forms offers a vast array of legal forms that are reviewed by professionals.

You can download or print the Oregon Sample Letter for Notice of Credit Limit - Conversion to C.O.D. Status from our service.

If available, utilize the Preview button to view the document template as well.

- If you already possess a US Legal Forms account, you may Log In and then click the Download button.

- Subsequently, you can fill out, modify, print, or sign the Oregon Sample Letter for Notice of Credit Limit - Conversion to C.O.D. Status.

- Every legal document template you purchase is yours permanently.

- To obtain another copy of a purchased form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your area/town of preference.

- Review the document outline to make certain you have chosen the appropriate form.