Oregon General Form of Inter Vivos Irrevocable Trust Agreement

Description

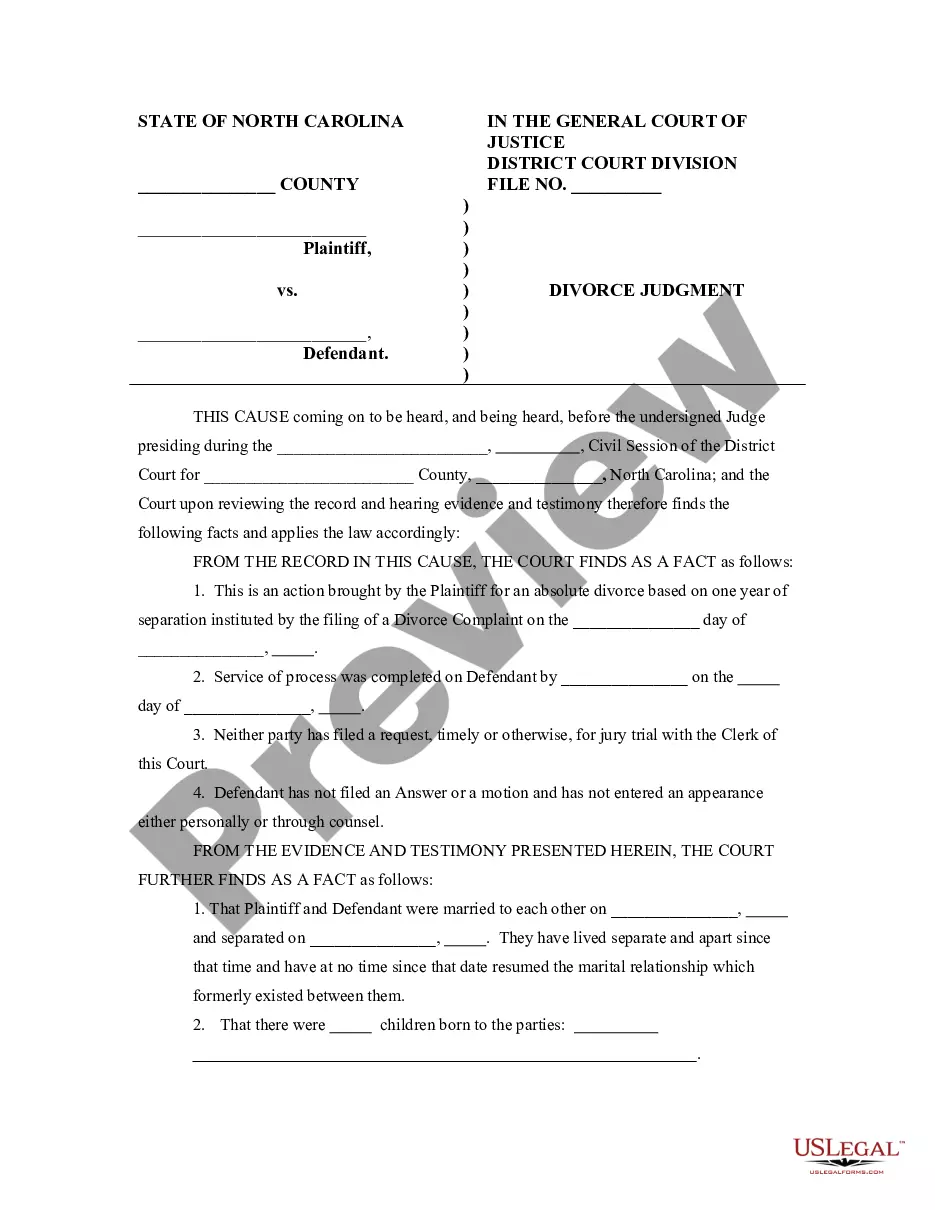

How to fill out General Form Of Inter Vivos Irrevocable Trust Agreement?

It is feasible to spend hours online trying to locate the legal document template that meets the state and federal standards you require.

US Legal Forms offers a vast array of legal forms that can be evaluated by professionals.

You can download or print the Oregon General Form of Inter Vivos Irrevocable Trust Agreement through my assistance.

If available, utilize the Review button to browse through the document template as well.

- If you already have a US Legal Forms account, you can Log In and click the Obtain button.

- Afterward, you can complete, edit, print, or sign the Oregon General Form of Inter Vivos Irrevocable Trust Agreement.

- Every legal document template you obtain is yours permanently.

- To request another copy of any purchased form, visit the My documents tab and click the appropriate button.

- If you are accessing the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have chosen the correct document template for the county/town of your choice.

- Review the form details to ensure you have selected the right one.

Form popularity

FAQ

Amending a trust in Oregon can be complex, especially for irrevocable trusts. Generally, changes require either the consent of all beneficiaries or a court order. Utilizing the Oregon General Form of Inter Vivos Irrevocable Trust Agreement can help streamline this process, as it may include provisions that facilitate amendments. It’s advisable to seek expert legal help when considering amendments to ensure compliance with Oregon law.

Yes, an irrevocable trust can absolutely be inter vivos, meaning it is created during your lifetime. The Oregon General Form of Inter Vivos Irrevocable Trust Agreement serves as an effective tool in estate planning, transferring assets, and achieving tax benefits. By establishing an inter vivos irrevocable trust, you can maintain control over your assets while ensuring they are distributed according to your wishes.

An irrevocable trust typically cannot be altered or terminated at any time due to its inherent nature. Nevertheless, certain exceptions exist, allowing for alterations under specific situations. For those using the Oregon General Form of Inter Vivos Irrevocable Trust Agreement, being aware of these exceptions can be crucial in managing your estate effectively. Always consider consulting a legal professional for guidance on your trust.

Yes, there are legal pathways to change an irrevocable trust in Oregon, but they often require beneficiary consent or a court order. Sometimes, trust provisions might include specific methods for modification or termination. The Oregon General Form of Inter Vivos Irrevocable Trust Agreement may also contain clauses that facilitate certain changes under acceptable conditions, making it vital to understand its structure when planning.

In general, an irrevocable trust cannot be changed without the consent of all beneficiaries. However, Oregon law allows for certain modifications under specific circumstances. The Oregon General Form of Inter Vivos Irrevocable Trust Agreement is designed to address these legal nuances, ensuring your trust remains effective while adhering to state guidelines. Consulting with a legal expert can clarify your options.

The two types of inter vivos trusts are revocable and irrevocable trusts. A revocable trust allows you to retain control during your lifetime, enabling changes as needed. On the other hand, an irrevocable trust, such as the Oregon General Form of Inter Vivos Irrevocable Trust Agreement, cannot be modified once established. Understanding these distinctions helps you choose the right option for your estate planning needs.

One of the biggest mistakes parents make is not clearly defining the terms of the trust. When establishing an Oregon General Form of Inter Vivos Irrevocable Trust Agreement, it is essential to outline how and when assets will be distributed to beneficiaries. Failing to communicate these terms can lead to confusion and conflict among family members. By taking the time to set clear guidelines, you can create a trust that effectively supports your children's future.

You can write your own trust in Oregon, but it's crucial to ensure that it meets all legal requirements. Using an Oregon General Form of Inter Vivos Irrevocable Trust Agreement can simplify this process, guiding you through necessary provisions. However, consulting with a legal professional is advisable to ensure that your trust is valid and aligns with your intentions. A properly drafted trust can prevent disputes and ensure your assets are distributed as you wish.

Yes, you can create a trust in your own name. An Oregon General Form of Inter Vivos Irrevocable Trust Agreement allows you to establish a trust where you are the grantor, meaning you provide the assets. This setup can help you maintain control over your assets while ensuring they are managed according to your wishes. It's an effective way to protect your estate and provide for your beneficiaries.

In Oregon, the threshold for inheritance tax is determined by the relationship to the deceased. Generally, spouses and children can inherit a substantial amount without incurring taxes, while other relatives and non-relatives have lower exemptions. Establishing an irrevocable trust using the Oregon General Form of Inter Vivos Irrevocable Trust Agreement can protect your assets from inheritance tax, making it important to consider this form of estate planning. Consulting a tax advisor is advisable to understand your specific situation.