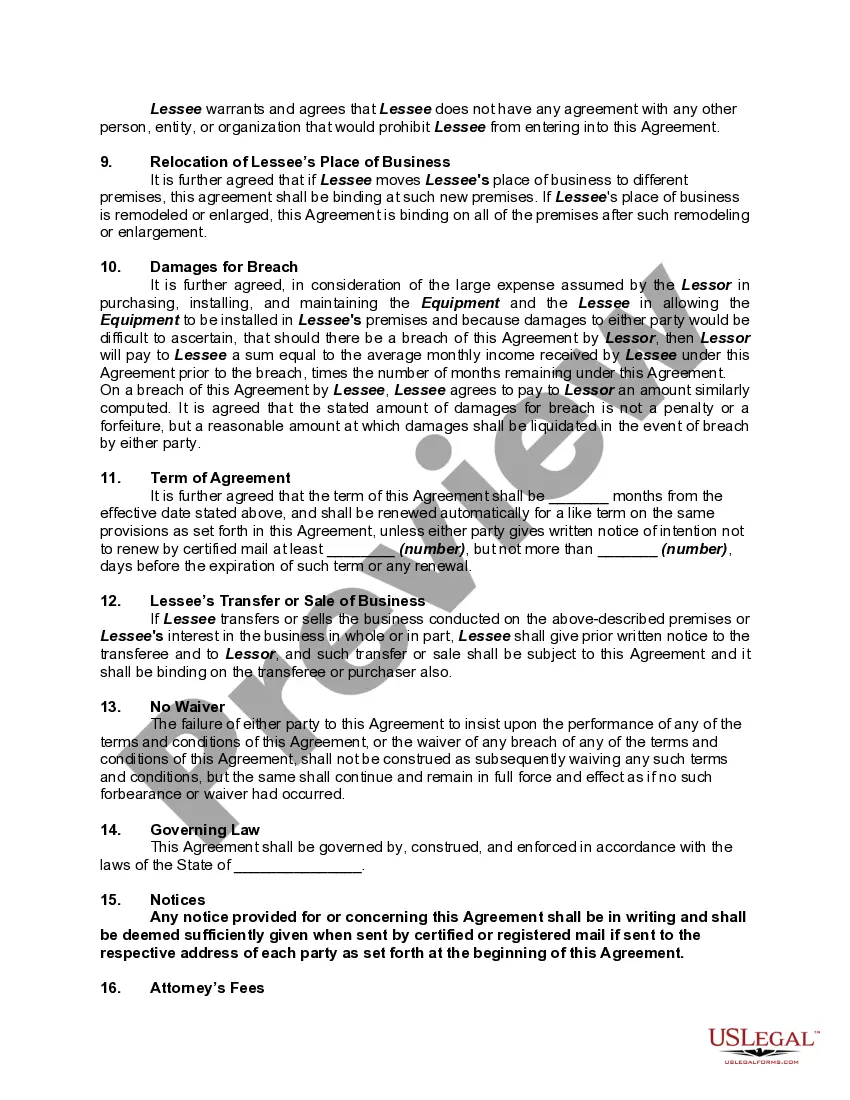

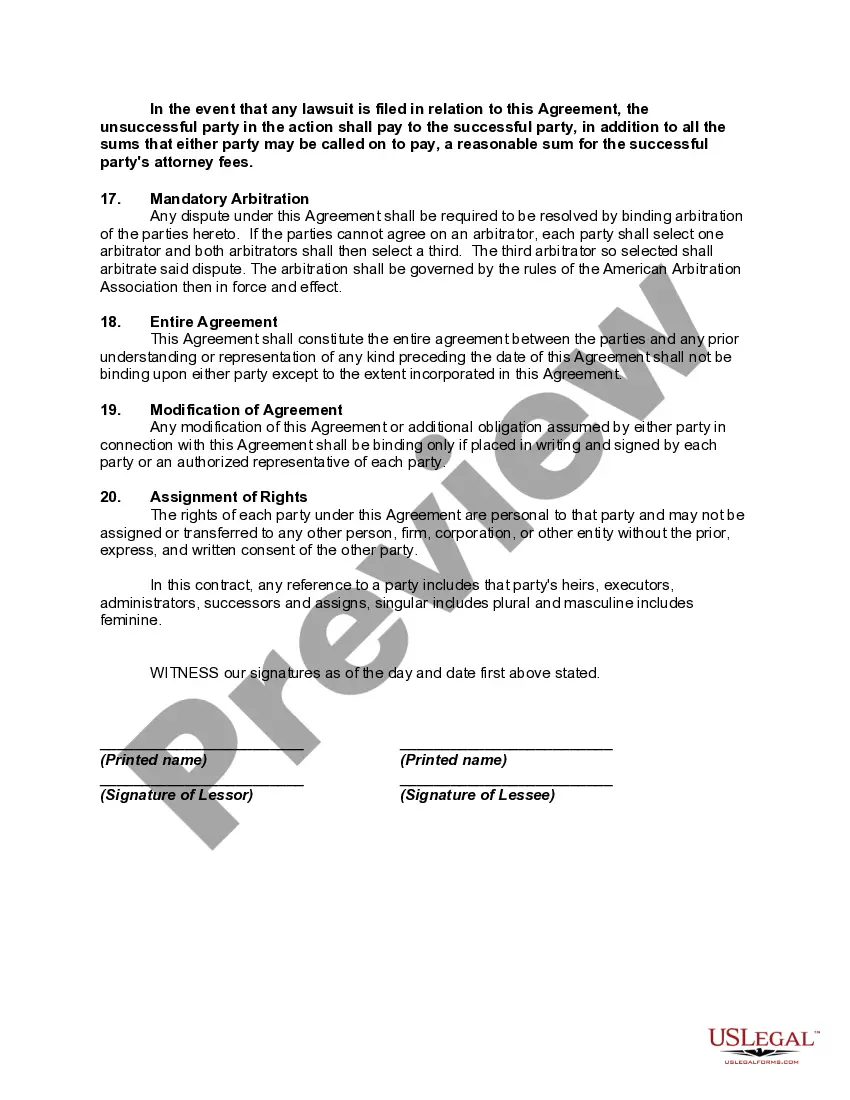

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Oregon Lease of Game or Entertainment Device

Description

How to fill out Lease Of Game Or Entertainment Device?

US Legal Forms - one of the most extensive repositories of valid forms in the United States - offers a variety of legal document templates that you can download or create.

By utilizing the website, you will access numerous forms for business and personal use, sorted by categories, states, or keywords.

You can find the latest versions of forms such as the Oregon Lease of Game or Entertainment Device within moments.

Read the form description to confirm that you have chosen the right document.

If the form does not meet your needs, utilize the Search field at the top of the screen to find one that does.

- If you already have a subscription, Log In to download the Oregon Lease of Game or Entertainment Device from your US Legal Forms collection.

- The Get option will be visible on every form you review.

- You have access to all previously obtained forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these straightforward steps to begin.

- Make sure you have selected the correct form for your city/state.

- Use the Preview option to check the contents of the form.

Form popularity

FAQ

Starting a lottery business as an individual involves navigating legal requirements, which can vary by state. In Oregon, engaging with the Oregon Lease of Game or Entertainment Device can provide a structured way to enter the gaming market. However, it is essential to comply with state laws and regulations to ensure proper authorization. For those considering this venture, resources like uslegalforms can guide you through the necessary steps.

The Oregon Lottery generates substantial revenue annually, contributing significantly to public programs and state funding. Most of this income comes from various games, including those enabled by the Oregon Lease of Game or Entertainment Device. This framework not only supports the lottery's financial goals but also provides valuable resources for community initiatives. Thus, the Oregon Lottery plays a vital role in funding education, parks, and other state projects.

Lottery sellers typically receive a commission for each ticket sold, as well as bonuses for meeting certain sales targets. These earnings can increase significantly through an Oregon Lease of Game or Entertainment Device, where sellers can offer more games and attract a diverse customer base. This model supports growth in earnings and reduces the risk of fluctuating income from pure lottery ticket sales. Therefore, understanding this potential can motivate sellers to excel in their performance.

The earnings of Oregon lottery retailers can vary depending on location and sales volume, but they typically earn a percentage of ticket sales. By partnering with the Oregon Lottery through an Oregon Lease of Game or Entertainment Device, retailers can boost their income through gaming and lottery sales. Additionally, staying informed about promotional offers and community events can enhance earnings. Overall, the potential for revenue is significant for those engaged in this business.

To start a lottery business in Oregon, you need to obtain an Oregon Lease of Game or Entertainment Device. This process includes applying for the necessary licenses, following state regulations, and ensuring that you have a secure location for your operations. You will also want to understand the market and create a solid business plan. Consider using resources like US Legal Forms to navigate the legal requirements efficiently.

Amusement tax refers to the tax applied to revenues generated from entertainment activities, including gaming operations. It typically includes fees from activities such as operating amusement devices. If you’re involved with the Oregon Lease of Game or Entertainment Device, understanding amusement tax is vital for proper financial management and compliance.

Oregon is known for having no sales tax on most products, including electronics. This absence of sales tax makes it an attractive state for businesses and consumers alike. For those interested in the Oregon Lease of Game or Entertainment Device, this allows more flexibility in investment without the burden of sales tax on electronics.

Filing Oregon WR online involves submitting required payroll tax information through the state's online portal. Accurate reporting is essential to avoid compliance issues. Utilizing tools available through platforms like USLegalForms can simplify the process of filing for those managing the Oregon Lease of Game or Entertainment Device.

The equipment tax in Oregon applies to tangible personal property used in business operations, including gaming devices. Businesses that lease equipment, like those involved with the Oregon Lease of Game or Entertainment Device, must account for this tax in their financial planning. Proper management of the equipment tax helps maintain smooth business operations.

The amusement device tax is a levy imposed on businesses that operate amusement devices in Oregon, such as arcade games and rides. This tax varies depending on the device's classification and usage. If your business involves the Oregon Lease of Game or Entertainment Device, it's crucial to stay informed about this tax to avoid penalties and ensure compliance.