An agreement modifying a loan agreement and mortgage should be signed by both parties to the transaction and recorded in the office of the register of deeds and mortgages where the original mortgage was recorded. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Oregon Agreement to Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Mortgage

Description

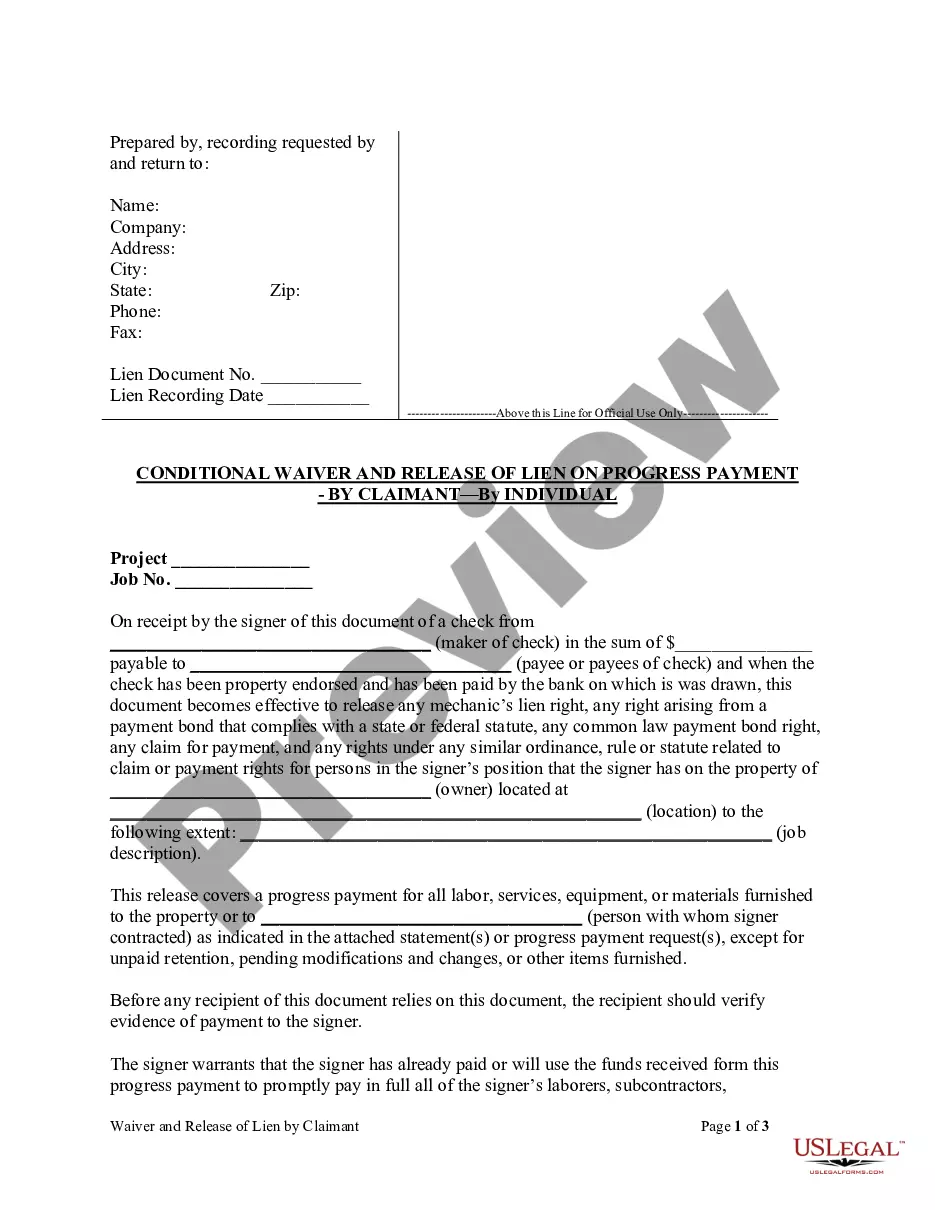

How to fill out Agreement To Modify Interest Rate, Maturity Date, And Payment Schedule Of Promissory Note Secured By A Mortgage?

US Legal Forms - among the biggest libraries of authorized types in the United States - gives an array of authorized document web templates it is possible to obtain or produce. Using the internet site, you can get a large number of types for organization and personal uses, categorized by types, claims, or keywords and phrases.You can get the most up-to-date versions of types much like the Oregon Agreement to Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Mortgage in seconds.

If you currently have a membership, log in and obtain Oregon Agreement to Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Mortgage from your US Legal Forms library. The Down load switch can look on each form you see. You gain access to all previously delivered electronically types within the My Forms tab of the bank account.

In order to use US Legal Forms for the first time, here are easy instructions to help you get started off:

- Make sure you have selected the proper form for your area/state. Click on the Review switch to analyze the form`s information. See the form information to ensure that you have chosen the right form.

- When the form does not match your needs, use the Research area towards the top of the screen to find the one that does.

- Should you be happy with the form, validate your selection by clicking the Buy now switch. Then, choose the prices prepare you favor and supply your accreditations to sign up for an bank account.

- Approach the transaction. Make use of charge card or PayPal bank account to accomplish the transaction.

- Pick the file format and obtain the form on your own product.

- Make alterations. Complete, modify and produce and indicator the delivered electronically Oregon Agreement to Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Mortgage.

Each template you included in your account does not have an expiry day and is also your own property forever. So, in order to obtain or produce yet another copy, just visit the My Forms area and click on about the form you want.

Gain access to the Oregon Agreement to Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Mortgage with US Legal Forms, probably the most substantial library of authorized document web templates. Use a large number of professional and express-particular web templates that satisfy your company or personal demands and needs.

Form popularity

FAQ

A Loan Agreement, also known as a term loan, demand loan, or a loan contract, is a contract that documents a financial agreement between two parties, where one is the lender and the other is the borrower. This contract specifies the amount of the loan, any interest charges, the repayment plan, and payment dates.

A promissory note is a formal contract As a legally binding document, borrowers must abide by the terms they agree to when they sign. If they fail to do so, the lender has a legally legitimate written record that proves the debt exists and the borrower has agreed to repay the loan.

A loan agreement is made between the creditor (the lender) and the borrower (the debtor), although it is generally prepared by the lender's legal counsel in order to ensure the legal enforceability of the contract.

A loan covenant (a promise) is an agreement stipulating the terms and conditions of loan policies between a borrower and a lender.

Although it is legally enforceable, a promissory note is less formal than a loan agreement and is suitable where smaller sums of money are involved. However, its terms - which can include a specific date of repayment, interest rate and repayment schedule - are more certain than those of an IOU.

A promissory note is a written and signed promise to repay a sum of money in exchange for a loan or other financing. A promissory note typically contains all the terms involved, such as the principal debt amount, interest rate, maturity date, payment schedule, the date and place of issuance, and the issuer's signature.

In Oregon, promissory notes require the signature of both the lender and the sender for the contract to be valid. Without both signatures, the deal is not legal. If one of the parties voids the agreement, the matter cannot be taken to court for judgment. The case will be thrown out.

Loan maturity date refers to the date on which a borrower's final loan payment is due. Once that payment is made and all repayment terms have been met, the promissory note that is a record of the original debt is retired.