US Legal Forms - one of many greatest libraries of legal types in the States - delivers a wide array of legal file templates you are able to acquire or print out. Making use of the site, you can find a large number of types for organization and person uses, categorized by types, states, or keywords and phrases.You can get the most recent models of types much like the Oregon Agreement Between Widow and Heirs as to Division of Estate in seconds.

If you already have a registration, log in and acquire Oregon Agreement Between Widow and Heirs as to Division of Estate from the US Legal Forms catalogue. The Acquire option can look on every kind you look at. You have access to all earlier downloaded types within the My Forms tab of the bank account.

If you would like use US Legal Forms initially, listed here are straightforward directions to obtain started off:

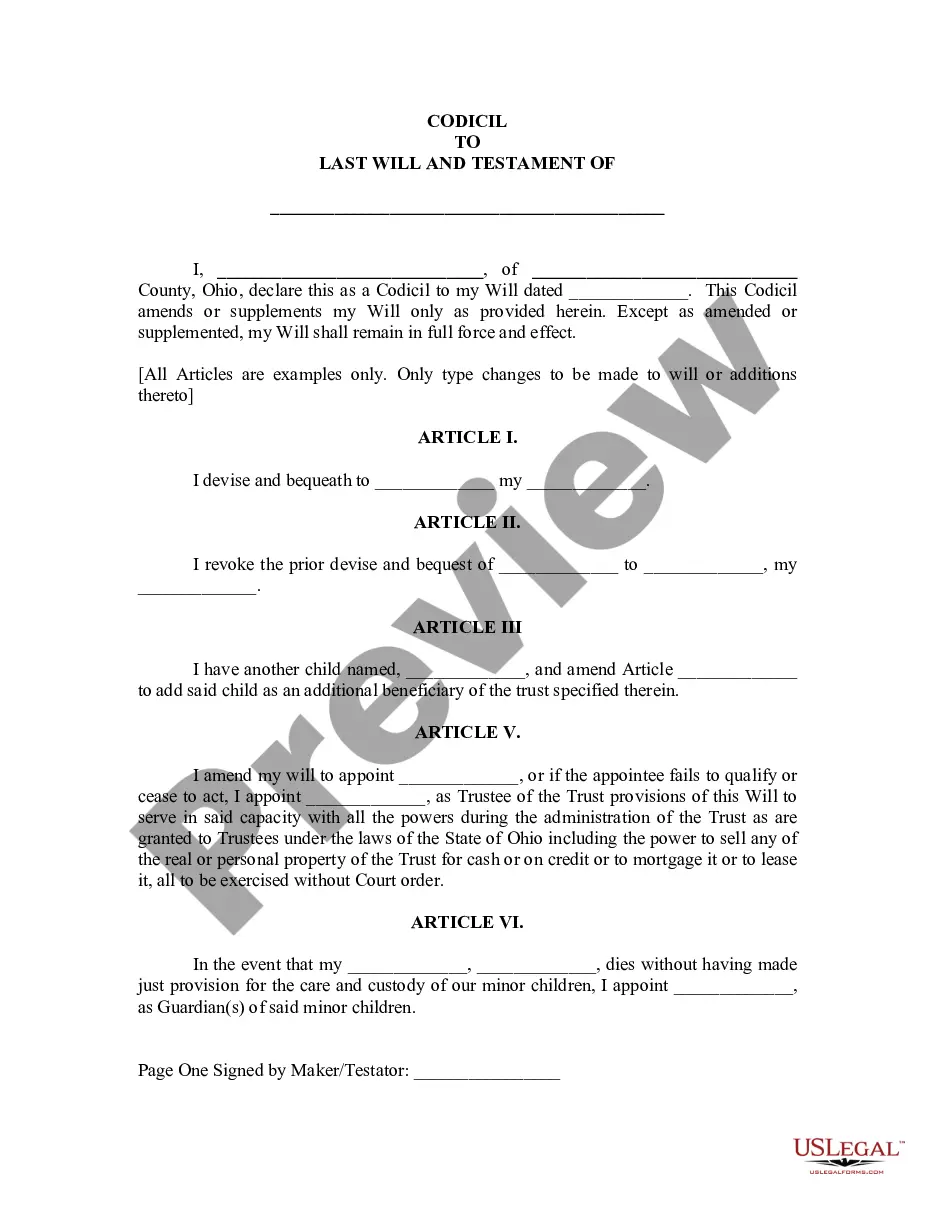

- Be sure to have chosen the right kind for your city/county. Click the Preview option to check the form`s information. Look at the kind outline to actually have selected the appropriate kind.

- In case the kind does not fit your requirements, take advantage of the Look for industry near the top of the screen to get the the one that does.

- When you are satisfied with the shape, affirm your choice by simply clicking the Purchase now option. Then, pick the costs strategy you prefer and provide your credentials to sign up for an bank account.

- Process the transaction. Use your charge card or PayPal bank account to accomplish the transaction.

- Find the formatting and acquire the shape on the device.

- Make modifications. Complete, change and print out and indicator the downloaded Oregon Agreement Between Widow and Heirs as to Division of Estate.

Every single template you added to your money does not have an expiry day and is also your own permanently. So, if you would like acquire or print out an additional backup, just go to the My Forms portion and click in the kind you need.

Gain access to the Oregon Agreement Between Widow and Heirs as to Division of Estate with US Legal Forms, by far the most considerable catalogue of legal file templates. Use a large number of expert and state-specific templates that meet up with your business or person requires and requirements.