A corporation is an artificial person that is created by governmental action. The corporation exists in the eyes of the law as a person, separate and distinct from the persons who own the corporation (i.e., the stockholders). This means that the property of the corporation is not owned by the stockholders, but by the corporation. Debts of the corporation are debts of this artificial person, and not of the persons running the corporation or owning shares of stock in it. The shareholders cannot normally be sued as to corporate liabilities. However, in this guaranty, the stockholders of a corporation are personally guaranteeing the debt of the corporation in which they own shares.

Oregon Continuing Guaranty of Business Indebtedness By Corporate Stockholders

Category:

State:

Multi-State

Control #:

US-01108BG

Format:

Word;

Rich Text

Instant download

Description

How to fill out Continuing Guaranty Of Business Indebtedness By Corporate Stockholders?

It is feasible to spend hours online searching for the legal document template that complies with the federal and state stipulations you require.

US Legal Forms offers a multitude of legal forms that can be assessed by experts.

You can download or print the Oregon Continuing Guaranty of Business Indebtedness By Corporate Stockholders from the services.

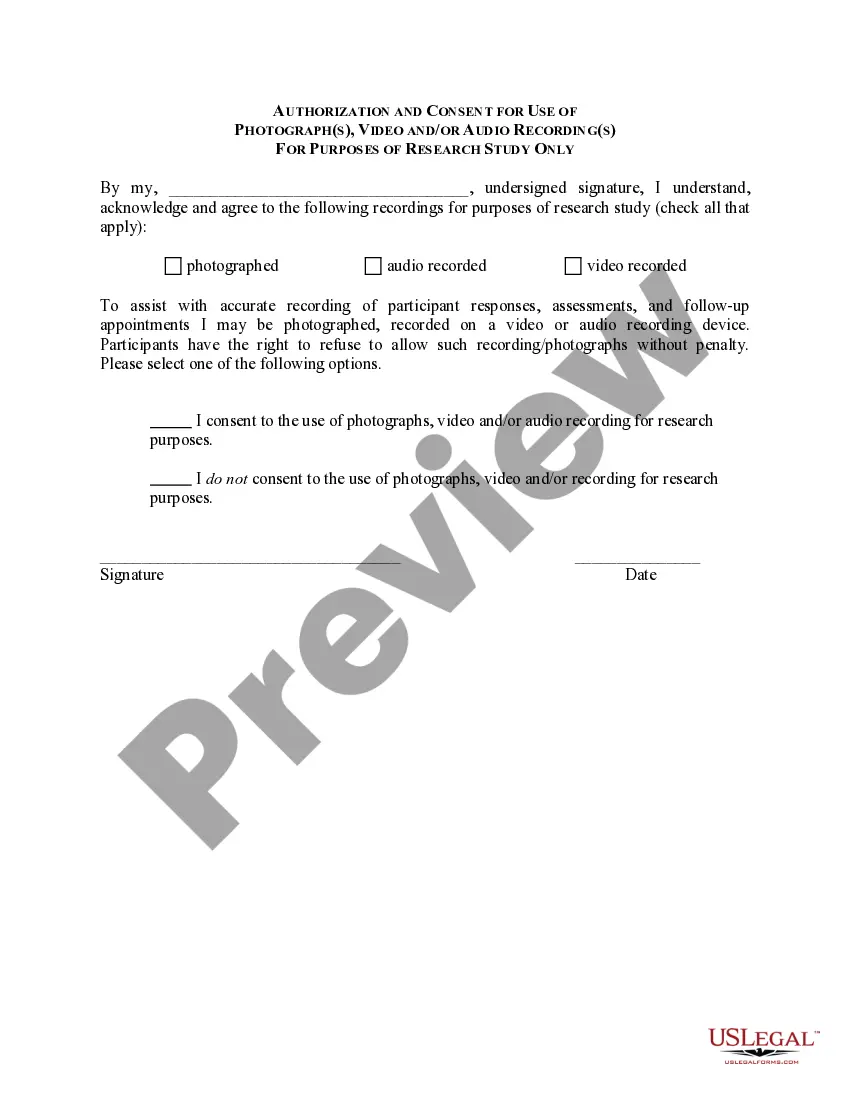

If available, use the Review option to view the document template simultaneously.

- If you have a US Legal Forms account, you can Log In and then click the Download option.

- After that, you can complete, modify, print, or sign the Oregon Continuing Guaranty of Business Indebtedness By Corporate Stockholders.

- Each legal document template you purchase is yours permanently.

- To obtain an additional copy of any purchased form, navigate to the My documents tab and click the corresponding option.

- If you're using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document format for your state/area of interest.

- Review the form description to confirm you’ve chosen the appropriate form.