Oregon Letter to Creditors Notifying Them of Identity Theft of Minor for New Accounts

Description

How to fill out Letter To Creditors Notifying Them Of Identity Theft Of Minor For New Accounts?

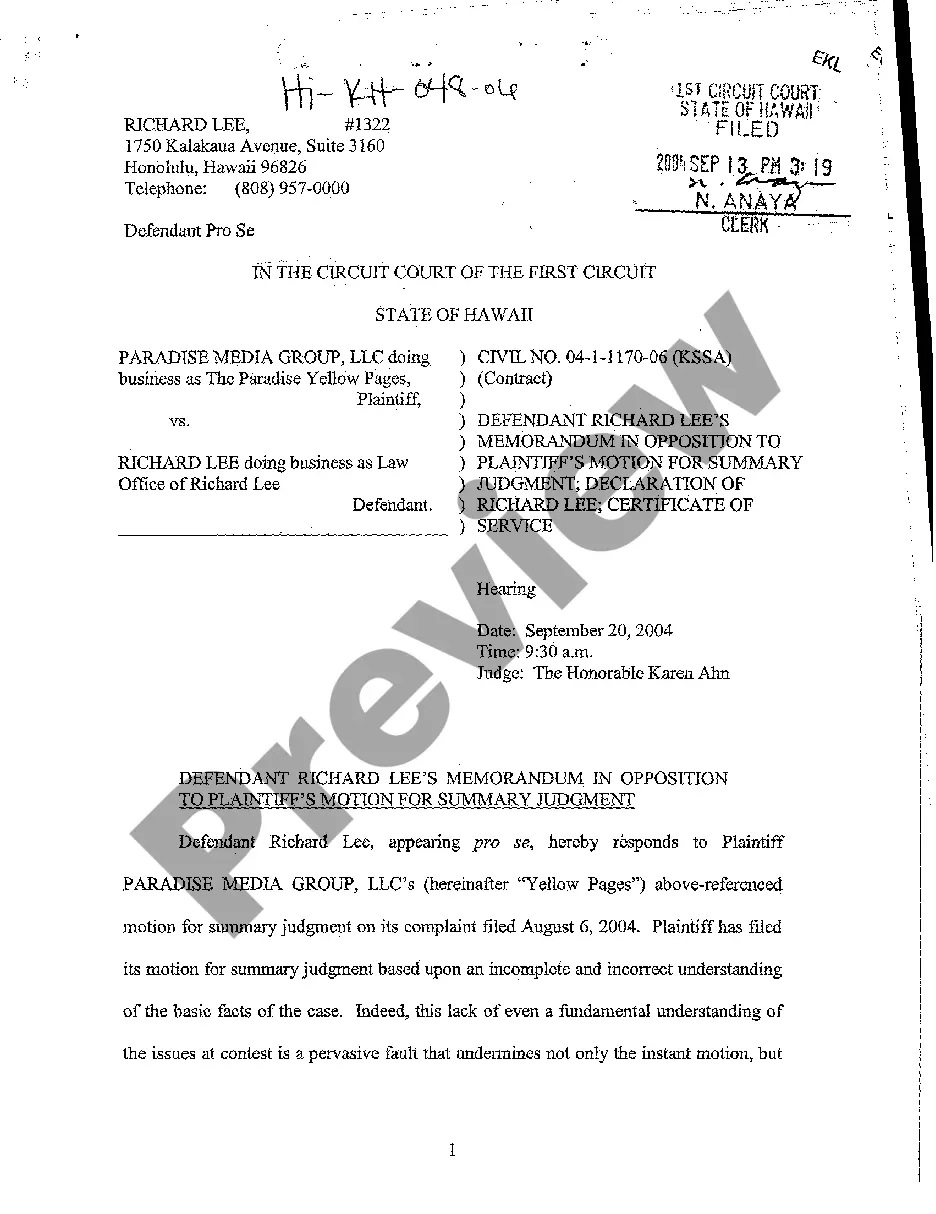

Discovering the right legal file template can be a have difficulties. Needless to say, there are plenty of layouts available on the net, but how would you get the legal form you will need? Take advantage of the US Legal Forms web site. The assistance offers 1000s of layouts, for example the Oregon Letter to Creditors Notifying Them of Identity Theft of Minor for New Accounts, that can be used for organization and personal demands. Every one of the forms are checked out by experts and meet state and federal requirements.

When you are already signed up, log in to your accounts and then click the Obtain option to have the Oregon Letter to Creditors Notifying Them of Identity Theft of Minor for New Accounts. Make use of accounts to check with the legal forms you may have purchased formerly. Proceed to the My Forms tab of your accounts and acquire one more backup in the file you will need.

When you are a new user of US Legal Forms, listed below are basic directions so that you can stick to:

- Initial, make certain you have chosen the correct form for your town/state. You can look over the shape making use of the Preview option and browse the shape information to guarantee it will be the right one for you.

- In case the form is not going to meet your needs, make use of the Seach field to get the correct form.

- Once you are certain that the shape is acceptable, go through the Purchase now option to have the form.

- Select the pricing plan you need and enter the needed information. Create your accounts and buy an order utilizing your PayPal accounts or charge card.

- Pick the submit file format and download the legal file template to your device.

- Complete, edit and produce and signal the received Oregon Letter to Creditors Notifying Them of Identity Theft of Minor for New Accounts.

US Legal Forms may be the biggest local library of legal forms in which you can discover different file layouts. Take advantage of the company to download expertly-created documents that stick to state requirements.

Form popularity

FAQ

Conduct regular credit checks to verify whether someone has applied for credit using your personal information and if so, advise the credit grantor immediately. Investigate and register for credit related alerts offered by credit bureaus. Check your bank statements regularly.

How To Know If Someone Is Using Your Identity Errors on your credit report. Suspicious transactions on your bank statements. Your health insurance benefits are used up. Your tax return is rejected. You're locked out of your online accounts. You start to receive more spam. Missing or unexpected physical mail.

File a report with your local police department. Place a fraud alert on your credit report. ... Consumer Reporting Agencies (CRA's) Close the accounts that you know or believe have been tampered with or opened fraudulently. ... Report the theft to the Federal Trade Commission. ... File a police report.

What signs should I look out for? You have lost or have important documents stolen, such as your passport or driving licence. Mail from your bank or utility provider doesn't arrive. Items that you don't recognise appear on your bank or credit card statement.

Regularly check your credit report and bank statements. Check for the warning signs of identity theft ? such as strange charges on your bank statement or accounts you don't recognize. An identity theft protection service like Aura can monitor your credit and statements for you and alert you to any signs of fraud.

Check your credit reports regularly The three major credit reporting bureaus give consumers access to free credit reports weekly, accessible by using AnnualCreditReport.com. Check to be sure that accounts are being reported properly and watch for signs of fraud, like accounts you don't recognize.