Oregon Option For the Sale and Purchase of Real Estate - Residential Home

Description

How to fill out Option For The Sale And Purchase Of Real Estate - Residential Home?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a wide range of legal document templates available for download or printing.

By using the platform, you will find thousands of forms for business and personal purposes, sorted by categories, states, or keywords.

You can access the latest documents such as the Oregon Option for the Sale and Purchase of Real Estate - Residential Home within minutes.

If the form does not meet your needs, utilize the Search box at the top of the screen to find one that does.

Once you are satisfied with the form, confirm your selection by clicking the Acquire now button. Then, choose your pricing plan and provide your information to register for an account.

- If you already have an account, sign in to download the Oregon Option for the Sale and Purchase of Real Estate - Residential Home from the US Legal Forms library.

- The Download button will appear on each form you view.

- You can access all previously downloaded forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are some simple steps to help you start.

- Ensure you have selected the correct form for your locality.

- Click the Review button to check the form's details.

Form popularity

FAQ

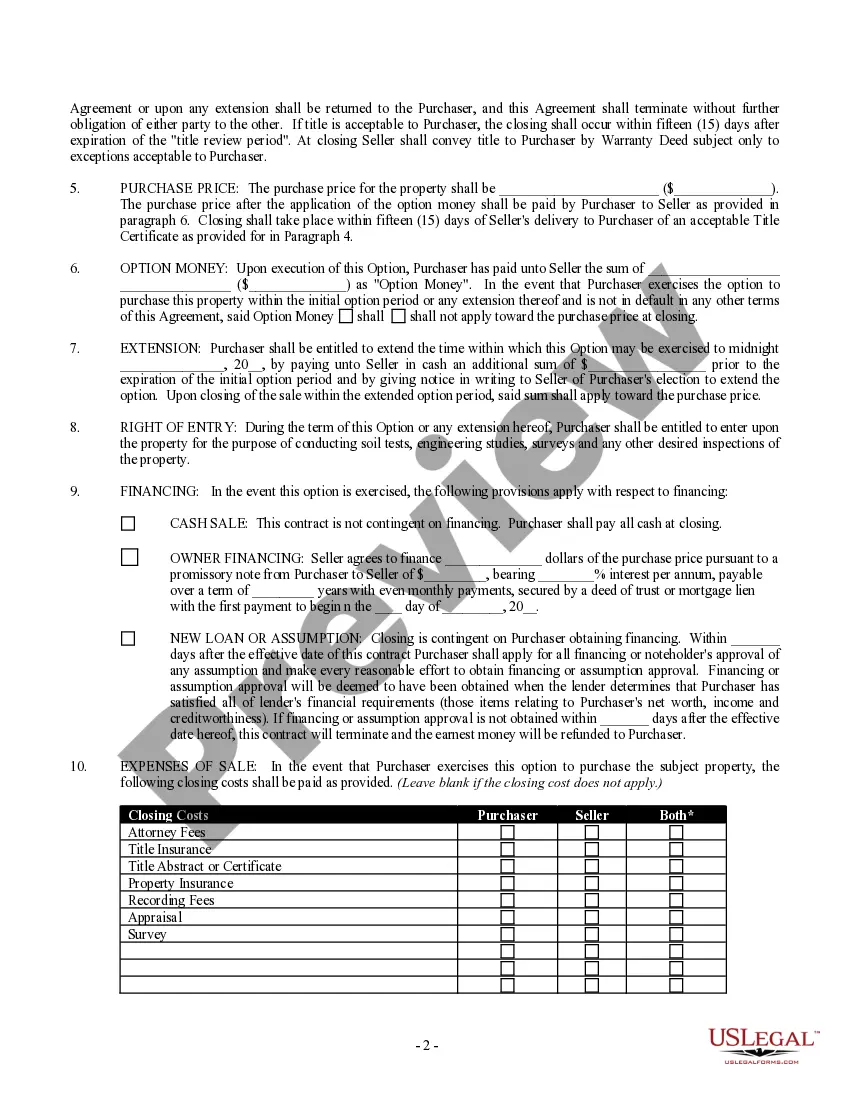

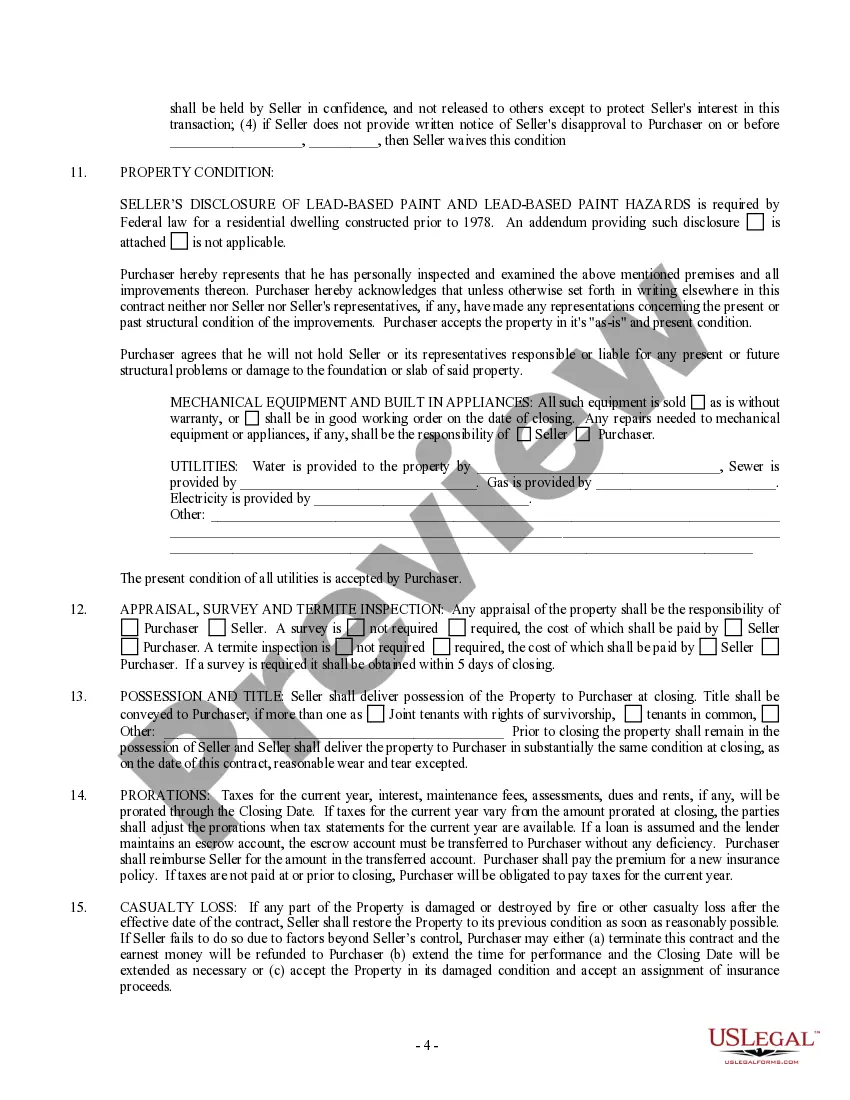

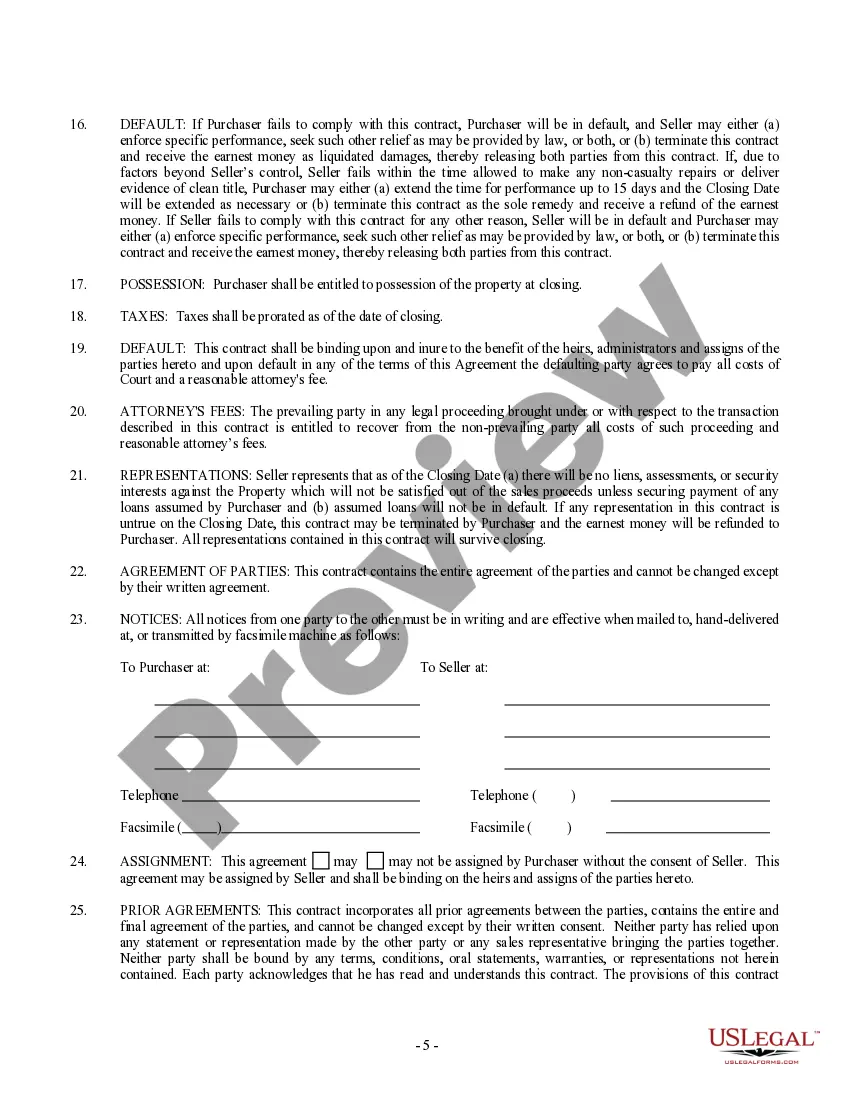

The basics: What is an option contract in real estate? In the simplest terms, a real-estate option contract is a uniquely designed agreement that's strictly between the seller and the buyer. In this agreement, a seller offers an option to the buyer to purchase property at a fixed price within a limited time frame.

Oregon doesn't have a general sales or use/transaction tax.

Oregon's property tax system is primarily a rate-based system calculated on the Tax Assessed value of a property. There is a constitutional limit on tax assessed value increases. This means that property taxes are not reassessed when a home sells.

With the option-to-purchase route, the buyer pays the seller money for the exclusive right to purchase the property within a specified term (often six months to a year). The buyer and seller might agree to a purchase price at that time, or the buyer can agree to pay market value at the time their option is exercised.

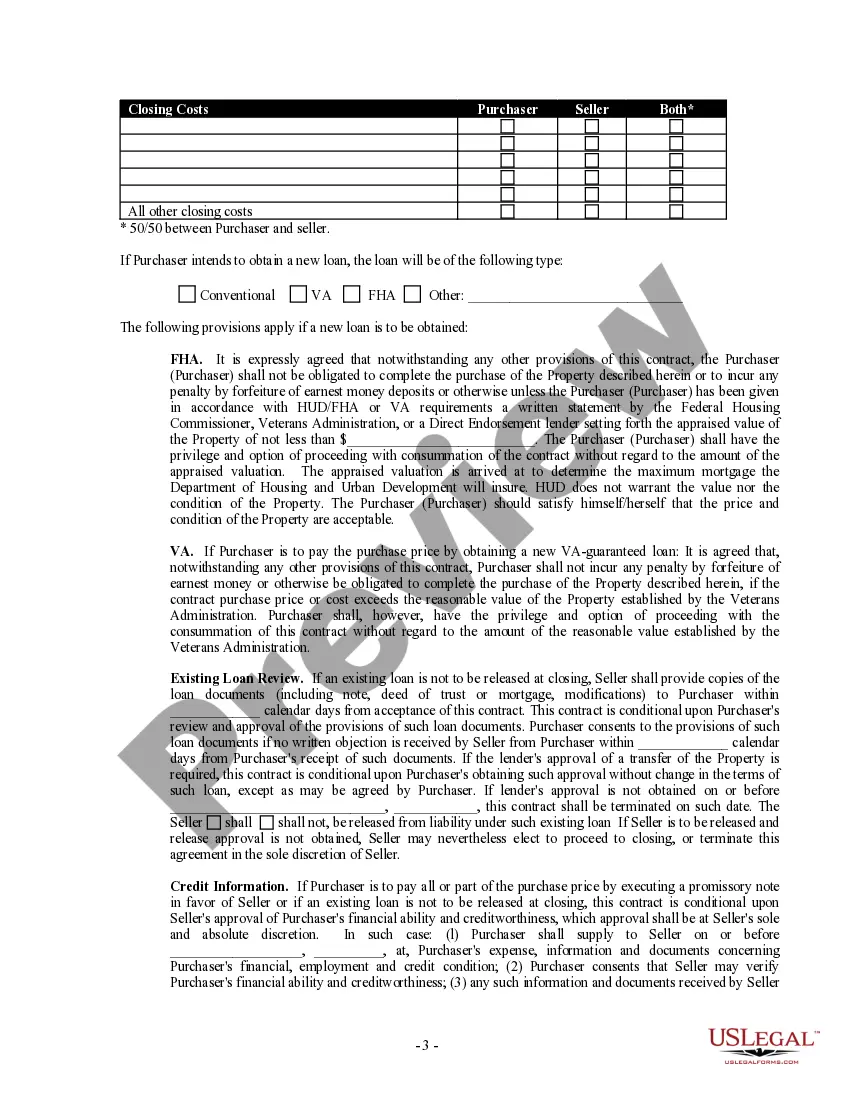

There is no city, county, or state property transfer tax in the state of Oregon with the exception of Washington County. Washington County assesses a tax of $1 per thousand. The standard practice is to split this tax 50/50 between the buyer and seller.

List FSBO and sell to a buyer without an agent: Pay no commission. List FSBO and sell to a represented buyer: Cover the buyer's agent commission. List with a traditional agent and sell to a represented buyer: Cover both agents' commissions.

An option to purchase is an agreement that gives a potential buyer (optionee) the right, but not the obligation, to buy property in the future. The optionee must decide by a certain time whether to exercise the option and thereafter by bound under the contract to purchase.

Stamp Duty Land Tax (SDLT) is a tax paid by the buyer of a UK residential property. The stamp duty rate ranges from 2% to 12% of the purchase price, depending upon the value of the property bought, the purchase date and whether you are a first time buyer or multiple home owner.

Washington is one of only seven states in the country that do not charge income tax. Oregon, on the other hand, does charge its resident's income tax. Oregon however does not charge a sales tax on purchased goods, while Washington has a sales tax as high as 10%.

Flipping (also called wholesale real estate investing) is a type of real estate investment strategy in which an investor purchases a property not to use, but with the intention of selling it for a profit.