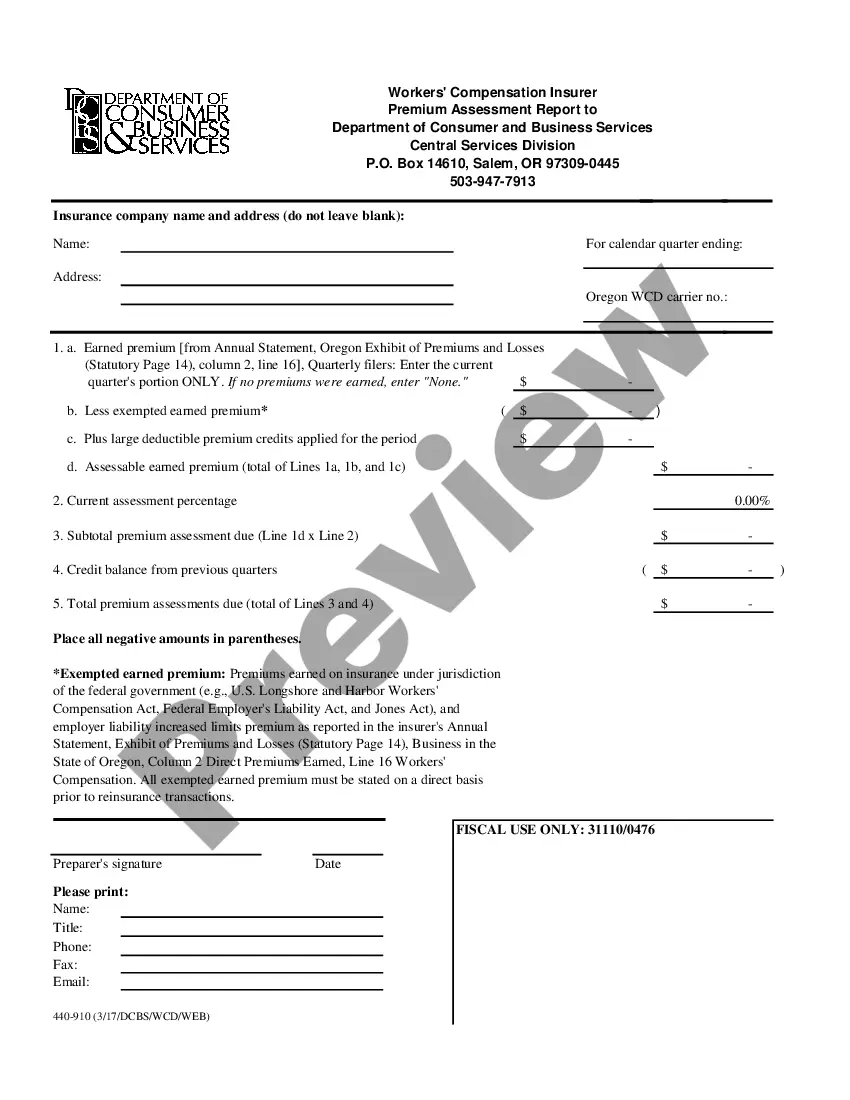

The Oregon Workers' Compensation Insurer Premium Assessment Report to DUBS Business Administration Division, Fiscal Services Section is an annual report that provides the Department of Consumer and Business Services (DUBS) with information on employers’ workers' compensation insurance premiums. The report is used to assess the amount of money each employer owes to the State of Oregon. There are two types of reports: the Insurer Premium Assessment Report and the Insurer Premium Assessment Supplement. The Insurer Premium Assessment Report is the main form and includes all the information necessary for the assessment. The Insurer Premium Assessment Supplement provides additional information to be used in the assessment.

Oregon Workers' Compensation Insurer Premium Assessment Report to DCBS Business Administration Division, Fiscal Services Section

Description

How to fill out Oregon Workers' Compensation Insurer Premium Assessment Report To DCBS Business Administration Division, Fiscal Services Section?

Preparing legal paperwork can be a real stress unless you have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be certain in the blanks you obtain, as all of them correspond with federal and state regulations and are checked by our specialists. So if you need to prepare Oregon Workers' Compensation Insurer Premium Assessment Report to DCBS Business Administration Division, Fiscal Services Section, our service is the perfect place to download it.

Obtaining your Oregon Workers' Compensation Insurer Premium Assessment Report to DCBS Business Administration Division, Fiscal Services Section from our catalog is as easy as ABC. Previously authorized users with a valid subscription need only log in and click the Download button after they find the proper template. Afterwards, if they need to, users can get the same blank from the My Forms tab of their profile. However, even if you are new to our service, registering with a valid subscription will take only a few minutes. Here’s a quick instruction for you:

- Document compliance check. You should attentively examine the content of the form you want and ensure whether it suits your needs and meets your state law regulations. Previewing your document and reviewing its general description will help you do just that.

- Alternative search (optional). Should there be any inconsistencies, browse the library through the Search tab on the top of the page until you find an appropriate blank, and click Buy Now when you see the one you need.

- Account registration and form purchase. Sign up for an account with US Legal Forms. After account verification, log in and choose your preferred subscription plan. Make a payment to proceed (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your Oregon Workers' Compensation Insurer Premium Assessment Report to DCBS Business Administration Division, Fiscal Services Section and click Download to save it on your device. Print it to fill out your papers manually, or use a multi-featured online editor to prepare an electronic copy faster and more efficiently.

Haven’t you tried US Legal Forms yet? Sign up for our service now to get any official document quickly and easily any time you need to, and keep your paperwork in order!

Form popularity

FAQ

Adopting and administering uniform statewide building codes. Providing building code and rule interpretation. Assisting local government building departments and facilitating dispute resolution. Enforcing license, code, and permit requirements.

The 2022 Workers Benefit Fund (WBF) assessment rate is 2.2 cents per hour.

To electronically pay the WBF assessment and state payroll taxes (quarterly or annually), use the Oregon Department of Revenue's website Revenue Online. You can make ACH debit payments for the WBF assessment through this system with a Revenue Online account. Log in to Revenue Online at . gov/dor.

Oregon Workers' Compensation Rates In 2021, Oregon employers will pay an average of $1.00 per $100 of payroll for workers' compensation. Workers' comp rates will vary between insurance companies. Rates are set by individual class code or industry and advised by the NCCI, a national rate-making organization.

The Workers' Benefit Fund (WBF) assessment funds return-to-work programs, provides increased benefits over time for workers who are permanently and totally disabled, and gives benefits to families of workers who die from workplace injuries or diseases.

The Oregon Department of Consumer and Business Services announced that the Workers' Benefit Fund (WBF) assessment is 2.2 cents per hour worked in 2023, unchanged from 2022. The 2.2 cents-per-hour rate is the employer and worker rate combined.

In 2023, this assessment is 2.2 cents per hour worked. Employers and employees split the cost. Employers report and pay the WBF assessment directly to the state with other state payroll taxes.

Background. If you are an Oregon employer and carry workers' compensation insurance, you must pay a payroll tax called the Workers' Benefit Fund (WBF) Assessment for each employee covered under workers' comp. The purpose of the tax is to help fund programs in Oregon to help injured workers and their families.